Price Matters

“Those who cannot remember the past are condemned to repeat it.”

— George Santayana

AI stocks have been all the rage this year and have reminded several of us “riper” generations of the dotcom bubble, which saw its peak over 23 years ago. We have a look at an interesting chart in the COTD section today, which was in itself enough to give the title to today’s Quotedian.

Looking for a truly experienced investment team? Look no further.

Contact us at ahuwiler@npb-bank.ch

But the importance of price discussed in the COTD section is not the only one we should discuss today. As later this (European) afternoon, we will also witness the release of the Consumer Price Inflation (CPI) number in the US.

Ad nauseam I have repeated in this space that CPI is one of the worst numbers to measure inflation, due to a) it severe lag in some items and b) the constant revisions by the BLS (Bureau of Labor Statistics).

Anyway, a pick-up in inflation is expected to the tune of 0.6% month-on-month for headline inflation, and a 0.2% increase for core inflation.

This may prove to be not a high enough expectation by our dear economist friends. According to the Federal Reserve Bank of Cleveland inflation nowcasting model, supposedly not as lagged as the BLS statistic, CPI could be reported at nearly 0.8% and core CPI at 0.38%, nearly double the estimate:

This could be a metaphoric stick in the wheels of stock and bond markets:

Ok, time to have a (brief) review of yesterday’s market action:

It looks like yesterday’s equity session was further under the sign of risk reduction ahead of today’s CPI print, as most major indices on both sides of the Atlantic retreated. The tech stock-heavy Nasdaq saw the biggest decline amongst the majors, down one percent on the day. It is to be deducted then that tech stocks were also mainly responsible for the half a percentage point retreat in the S&P 500

Only three out of eleven sectors were up on the day, with the biggest gainer, you probably have already sniffed it out on the graph above, being Energy (+2.3%).

Let’s stay with that latter sector for a moment, as it has also the honor to be the first ‘trade’ idea we follow on our new trade blotter (see towards the bottom of the mail, but please note this is still the beta phase).

Notice how the energy sector, on a global level in our aReS chart below, has crept back up to the top position and is establishing itself up there:

But let’s go back to yesterday’s session and put in the context of our recent “lines in the sand” chart:

4,532 and 4,343 remain the respective lines to the up- and the downside to be observed for a breakout and new intermediate trend direction.

Similarly, the Nasdaq seems also to be in a waiting position for the next big move:

Asian stock markets are trading largely softer this morning, but really nothing sizeable enough to write home about.

European index futures are in the red, about an hour before cash markets open, which could be on the back of the template provided by Wall Street, or, by the headline which you find in the next section, which hit markets after the closing bell yesterday …

This news ‘leak’ hitting the market less than 48 hours before the ECB meets in Frankfurt is probably very little of a coincidence, but rather seems an act of forward guidance …

Whilst economists as a collective are not expecting a rate hike,

the comment is enough to make German short-term rates jump this morning:

In the US, yields have been tightly range bound over the past five or six sessions, probably awaiting today’s CPI and next week’s FOMC meeting. Here’s the chart of the 10-year yield:

The yield curve in the US remains of course inverted, and whilst a bear steepener seems to becoming consensus, this chart is worth noting. It shows that yesterday we broke the record (since at least 1962) for the longest streak of trading days with an inverted yield curve using the 10-Year Treasury Note and the 3-Month Treasury Bill:

Little to note on FX markets, with maybe the exception of the ECB-comment-induced jump in the Euro versus the US Dollar, but which is already on the path to being completely unwound:

In commodity markets, the focus remains on crude oil, where the WTI for example seems on its way back to the 2022 October/November highs at $94:

One of the main catalysts for this oil squeeze is of course politics. Many called me crazy a few months ago,

when I suggested that Saudia Arabia would mingle with the US election via the oil price, but here we (probably) go:

According to Bloomberg: "Global oil markets face a supply shortfall of more than 3 million barrels a day next quarter — potentially the biggest deficit in more than a decade — as Saudi Arabia extends its production cuts."

Last but not least, here’s another oil that has been outperforming strongly - olive oil!

That’s all folks - probably checking back in tomorrow to analyze the hubris left by CPI number … stay tuned!

André

The fine folks at Research Affiliates had an interesting piece out earlier this month, which you can download here.

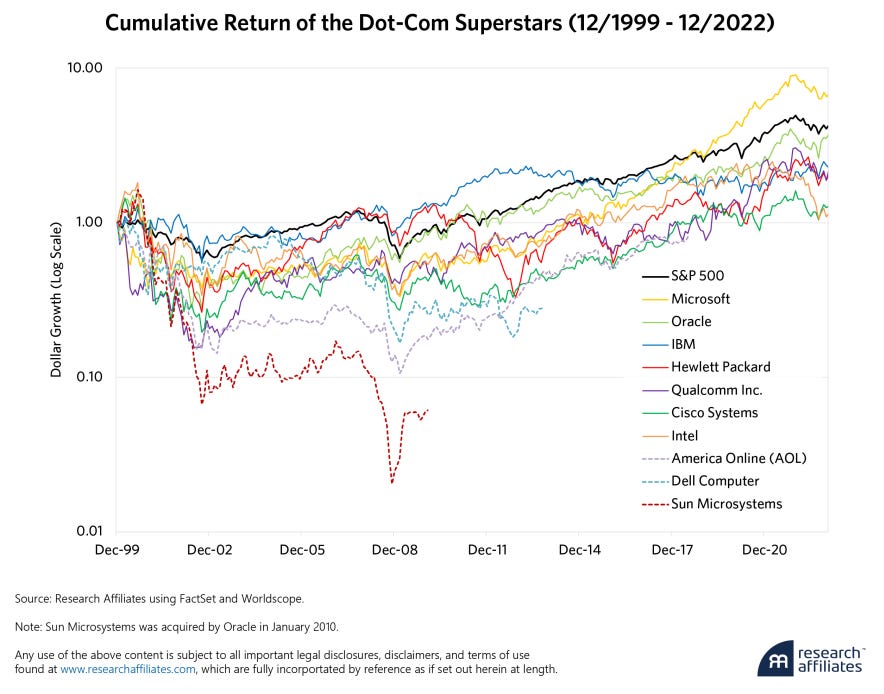

But in short, when assets get priced to perfection and beyond, as was the case in late 1999, and early 2000 for the largest dot-com stocks, those stocks have to deliver on growth, otherwise their valuations eventually start to deflate.

In that context, the following chart is super-interesting and sobering.

It shows the performance of the 10 largest dot-com-related companies from December 1999 through December of last year:

It stands out, that;

Not one company beat the market (S&P 500) by the time of the next bully cycle peak in 2007

Only one company, Microsoft, has managed to beat the S&P 500 by 2022

All other underperformed the index

Apple and Amazon are not on the list because they did not make the top 10 in 1999, each struggling with its own problems (and Apple with a near-death experience)

Today’s COTD is NOT a recommendation to sell/short Nvidia et al, but rather a stark reminder, that eventually, price matters …

Beta-Test Phase

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance