QE II

The Quotedian - Vol V, Issue 124

“I have to be seen to be believed.”

— Queen Elizabeth II

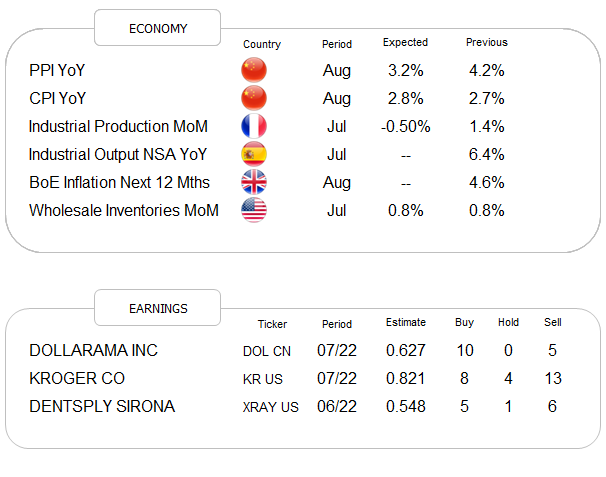

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

No, today’s title does not refer to one of those central bankers’ efforts of Quantitative Easing of yesteryear, but is rather in honour of Her Majestý Queen Elizabeth who yesterday went into well-deserved retirement. The following continues to be my all-time favourite pictures of the Queen when she got surprised by her husband disguised as a royal guard:

But let’s get down to business …

Starting to prepare today’s Quotedian yesterday, the original title was going to be Aspirational, in reference to the ECB’s growth forecast for this year during yesterday's post-rate hike press release.

@MacroAlf had the following Tweet right after the ECB announcement yesterday at 14:15 CET (highlight mine):

As a matter of fact, Delusional might have been the even better choice, but I was already nasty to the ECB yesterday, hence decided to give them a break today. But just in case:

And then there’s this…. the 75 basis points was actually not the real story of yesterday’s ECB activity, but rather their commitment to keeping excess liquidity huge for longer and will pay the European banking system handsomely on that excess liquidity. In order words, unlike the Fed’s Balance Sheet, the ECB will not reign in excess liquidity anytime soon:

The Euro (currency) is holding up for now, even a bit higher than the pre-ECB meeting as I type, but basically, it’s on its way to the slaughterhouse.

Anyway, stocks faced a seesaw session yesterday, with equity indices slipping between negative and positive territory. Bulls finally gained the upper hand, in what very much felt like a continuation of the previous day’s short squeeze. Here’s the intraday chart of the S&P 500, with the squeeze in the last 15 minutes of the session highlighted:

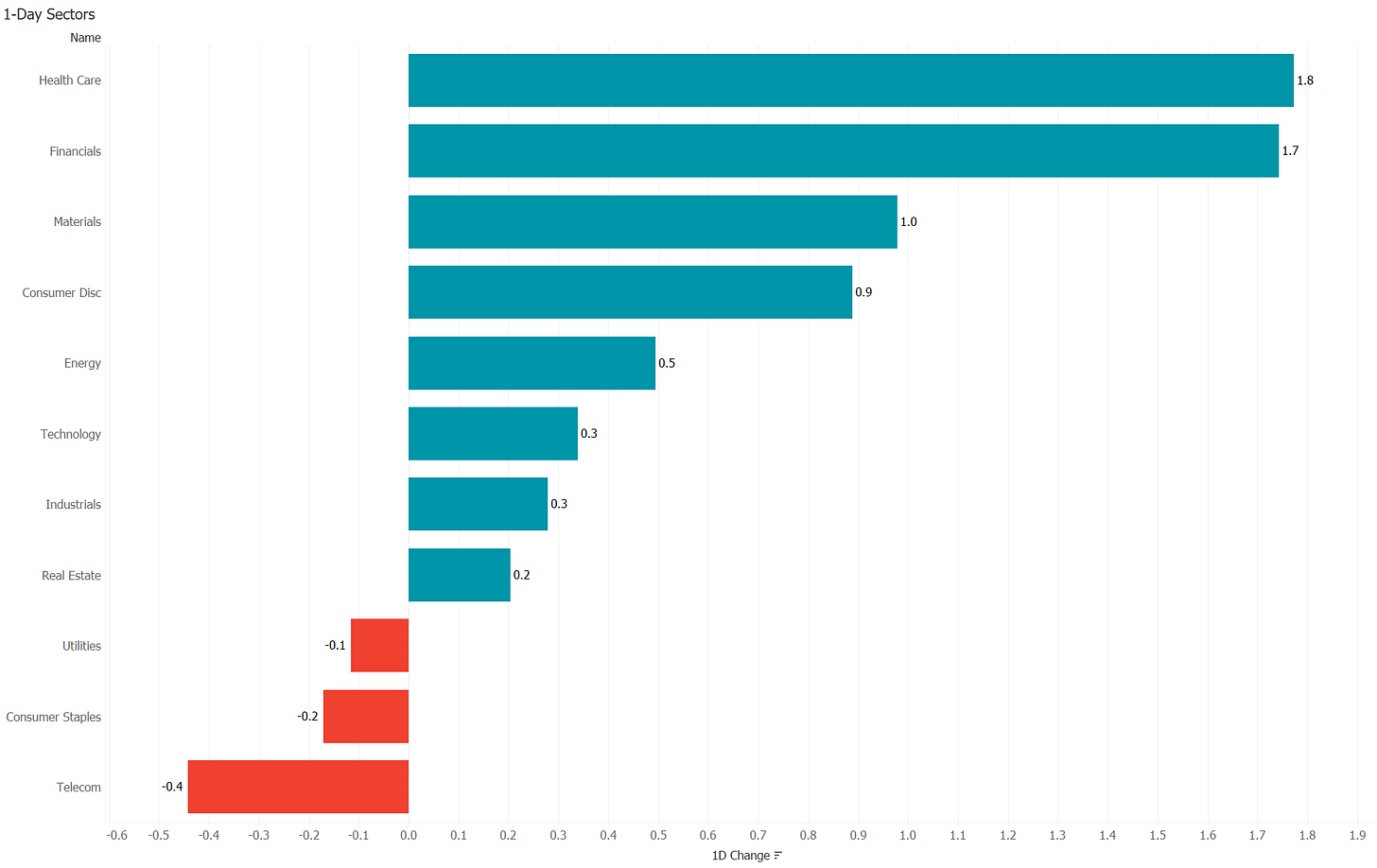

Eight out of eleven sectors ended up on the day, whilst advancers outpaced decliners by about three-to-one:

The weekly on Thursdays updated bull and bear survey by the AAII (American Association of Individual Investors) showed once again an increase in bears and decrease in bulls and is closing in on April and June lows, which were low enough for at least short-term bounces:

However, this ‘expressed’ negativeness still stands in contrast to the actual allocation to stocks, which is lower but still above average:

Asian markets are rallying across the board this early Friday morning, with a special mention going to Chinese (+1.4%) and Hong Kong (+2.6%) stocks, up strongly as some bargain hunting seems to be setting in on these recently underperforming indices.

In fixed income markets, a lot of focus of course on European yields, where German rates as a proxy jumped after the ECB ‘record’ rate hike:

Unsurprisingly, the jump in yields was larger at the short end of the curve

leading to further yield curve flattening:

Inversion is still 35 bp away, but given the ECB’s promise (or threat?) to continue hiking, this could happen rather sooner than later. What we need to keep an eye on during this hiking process is of course the reaction of ‘peripheral Europe’, which we can probably best proxy via the BTP (Italy) to Bund (Germany) spread:

Elevated, but no particular reaction to yesterday’s hike, hence: So far, so good!

As usual, I am running out of time, so let me finish with a chart on currencies and a promise:

Chart: EURUSD —> some kind of upside correction unfolding, though I remain suspicious

Promise: The weekly round-up Quotedian on Sunday (and there’s the promise - it will be published on Sunday) will contain a ton of information and charts. Make sure to tune in - it will make for a fun read!

Have a great weekend!

André

CHART OF THE DAY

Over the past few weeks, we had established the secular lines in the sand via our ‘inverted traffic light’ chart on the S&P 500 (top chart). Another possible way to look at the longer-term chart is shown in the bottom chart, where a squeeze seems to be taking place. An advantage of the second chart would be that the signal is triggered slightly earlier than on the first chart. Let’s stay tuned … ;-)

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance