Schmutzli

Volume V, Issue 179

"Finance is often poetically just; it punishes the reckless with special fervor."

— Roger Lowenstein

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Many Western European countries celebrate today their particular “Father Christmas” feast in the form of St. Nicholas day. In Switzerland, St. Nicholas is called Samichlaus and he has an interesting sidekick called Schmutzli, name-giver to today’s Quotedian. As I learnt it, Samichlaus is the cool dude who gives out gingerbread and small presents to those children who had behaved well throughout the year, whilst Schmutzli (known as Père Fouettard in the French-speaking part of the country or Knecht Ruprecht in Germany) literally gave you stick if you had misbehaved.

Markets met Schmutzli yesterday …

Whilst European markets had still held up, just about, US markets got some stick after a second pipping hot economic data following Friday’s NFP, in the form of a 56.5 ISM Service Index reading (versus 53.5 expected and 54.4 previously reported) sent close to 95% of the S&P 500 index members lower on the day.

The best, or better said, least bad sector performance came from utilities, at a negative reading of -0.6%:

The daily chart of the S&P 500 seems to be too easy to be true, with stocks reverting exactly where they should have, though admittedly setting up a bull trap with two previous consecutive closes above the 200-day moving average:

Now, before we all start running around panicky like headless chickens, the current uptrend is still valid as indicated by the shaded area on the graph above. A break of 3,900 (-2%) would sound an alarm bell, with only a break below 3,720 (-7%), justifying a full risk-off mode. Whilst seasonality is in favour of higher prices, I would not rule out a visit down to that lower, major support level before Santa comes to town.

Another not-so-bullish observation, I was going to make in Sunday’s edition, but which fell victim to a lack of time, is the non-confirmation signal given by something called the Dow Theory. In that, the Dow Jones Industrial and the Dow Jones Transportation indices have to confirm their respective moves (breaks) higher or lower.

For example, last week the DJ Industrial index moved above its previous recovery high, suggesting a possible new uptrend:

However, this was not confirmed by the DJ Transportation index, raising a yellow flag:

Anyway, moving on to this morning’s session so far, Asian equity deliver quite a mixed picture, torn between the negative template provided by Wall Street and continued hopes for an accelerated China reopening. The RBA in Australia hiked interest rates as expected to 3.10% and gave the typical “probably still higher but depends on path” speech. European index futures are small negative, whilst their US counterparts trade flat as I type.

Just before we move to fixed-income market observations, a quick addendum to Sunday’s issue, where I had omitted providing the usual weekly Top 25 performing stocks in Europe and the US. Hereby corrected:

Yields on Monday reacted ‘correctly’ by rising on the back of the strong ISM reading, unlike on Friday, where they dropped after the better-than-expected NFP data. For now, they have rebounded quite precisely where they had to according to our support zone on the daily chart:

The yield curve continues to signal what has become the most expected recession ever by record inversion (10y-2y):

And also, the Fed’s favourite yield curve recession gauge (10y-3m) we have discussed on several occasions in the past is giving an unequivocal signal:

Remember, this one (10y-3m) has so far a perfect track record, with no false signals.

And in case you wondered, the yield curve is also inverted in Europe (proxied via German yields):

In FX markets, I tripped over the following seasonality chart on the US Dollar yesterday:

According to the above, the US Dollar index should weaken into year-end. However, quite the contrary has been occurring over the past two sessions at least.

But it is noteworthy that the DXY remains below its 200-day moving average. And the same is true for the EUR/USD:

In any case, watching the path of the US Dollar over the next few sessions may provide some clues on other asset classes.

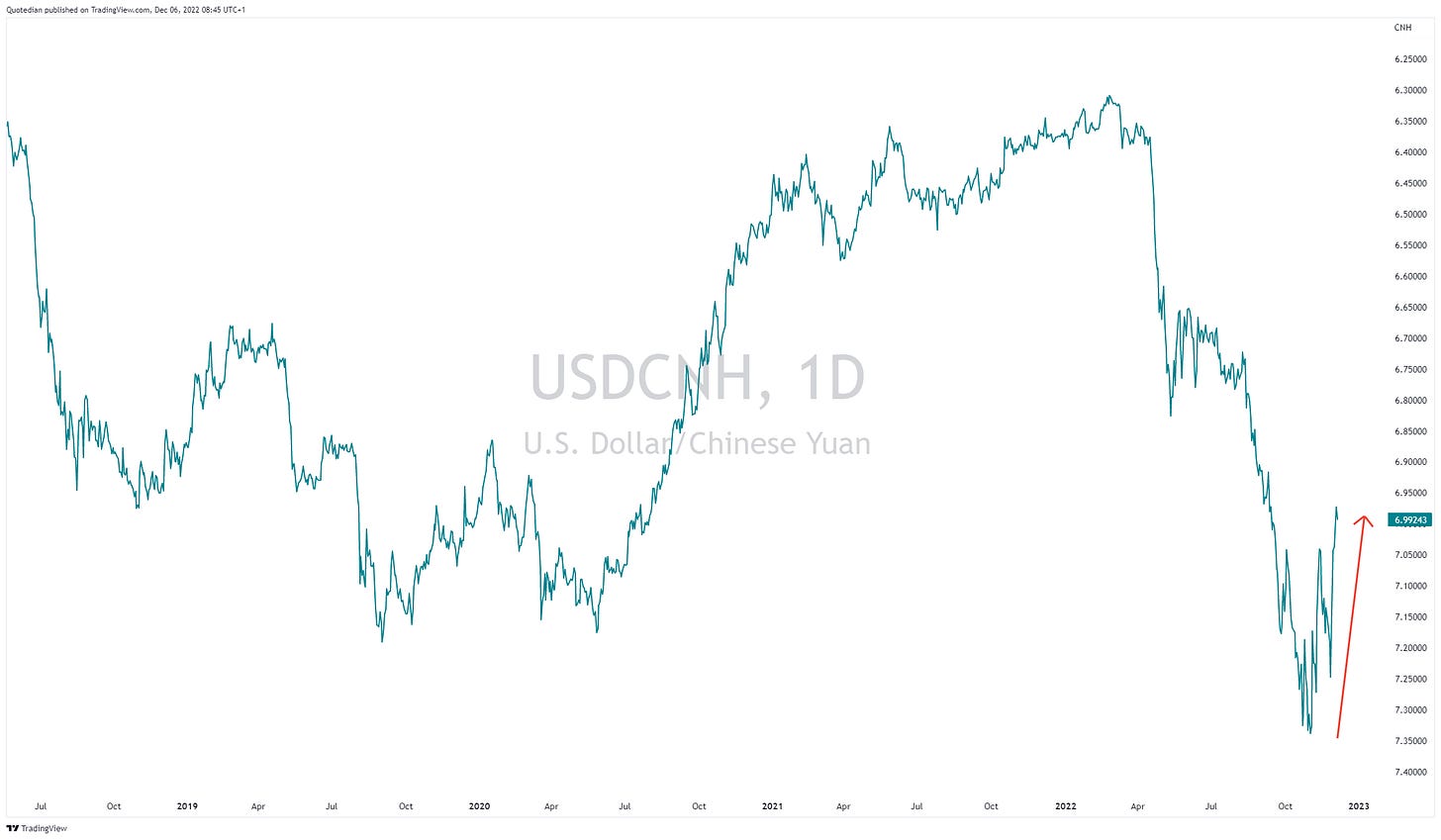

The Chinese Yuan has been recovering versus the US Dollar since reopening hopes have flamed up:

And its apparently also pulling the Vietnamese Dong along (USD/VND, inverted):

Two interesting forecasts on Bitcoin yesterday. Standard Chartered expects a drop to $5,000, whilst venture capitalist Tim Draper expects $250,000 …

Let me try to chart that:

All I can say:

In commodities, just a quick observation on crude, which dropped some 3% yesterday, despite, or maybe partially amid the price cap imposed on Russian oil. Of course, the strong ISM reading and hence implied continued hawkish Fed stance on rate pushed black gold lower too:

Back at key support for the WTI!

Anyhow, time to hit the Send button.

Have a great (turnaround?) Tuesday!

André

CHART OF THE DAY

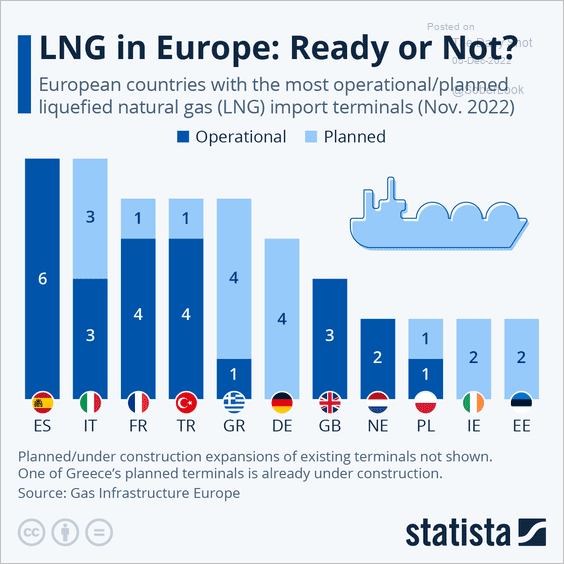

Ready or not (click here for another great song). Only a united Europe is somewhat ready …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance