Size Doesn't Matter

The Quotedian - Vol VII, Issue 14 | Powered by NPB Neue Privat Bank AG

“Great things are done by a series of small things brought together.”

— Vincent van Gogh

Unfortunately I will not be able to keep the promised published schedule of Sunday/Monday next week, as I am travelling with limited access to the tools necessary.

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Contact us at ahuwiler@npb-bank.ch

However, to fill that void, here’s a very brief, small in size Quotedian, with only a few charts and comments per asset class. This should serve you as a bridge to the next release due next Wednesday or Thursday, which will be full of end-of-month goodies!

Equity markets are within a key reflection point in there correction … just as it seemed a new down leg to key support is getting underway, we got some good earnings from tech giants last night, which for now is lifting markets again.

On the very short-term, a move above 5,086 (green arrow) would improve chances that the entire correction is already over, whilst a move below 4,966 would increase the probability of a full correction down to our defined target zone between 4,800 and 4,700:

Futures currently indicate that the break to the upside is more likely, but let’s wait for today’s closing bell before committing to any side.

Chinese stocks are trying their to break the upper end of their downtrend channel again. n-th time lucky?

Our sector model continues to prefer cyclicals (energy, industrials, materials), which is confirmed by Bloomberg’s RRG (Relative Rotation Graph):

It has been a big earnings week on Wall Street, which shows up in the 5-day performance heatmap:

Here are the top 25 performing US stocks year-to-date and their 5-day “fortunes”:

And here is the same table for European markets:

In bonds, our yield target (>5%) for the US 10-year treasury is moving into sight:

Similarly, is the Bund moving towards the 3%-handle:

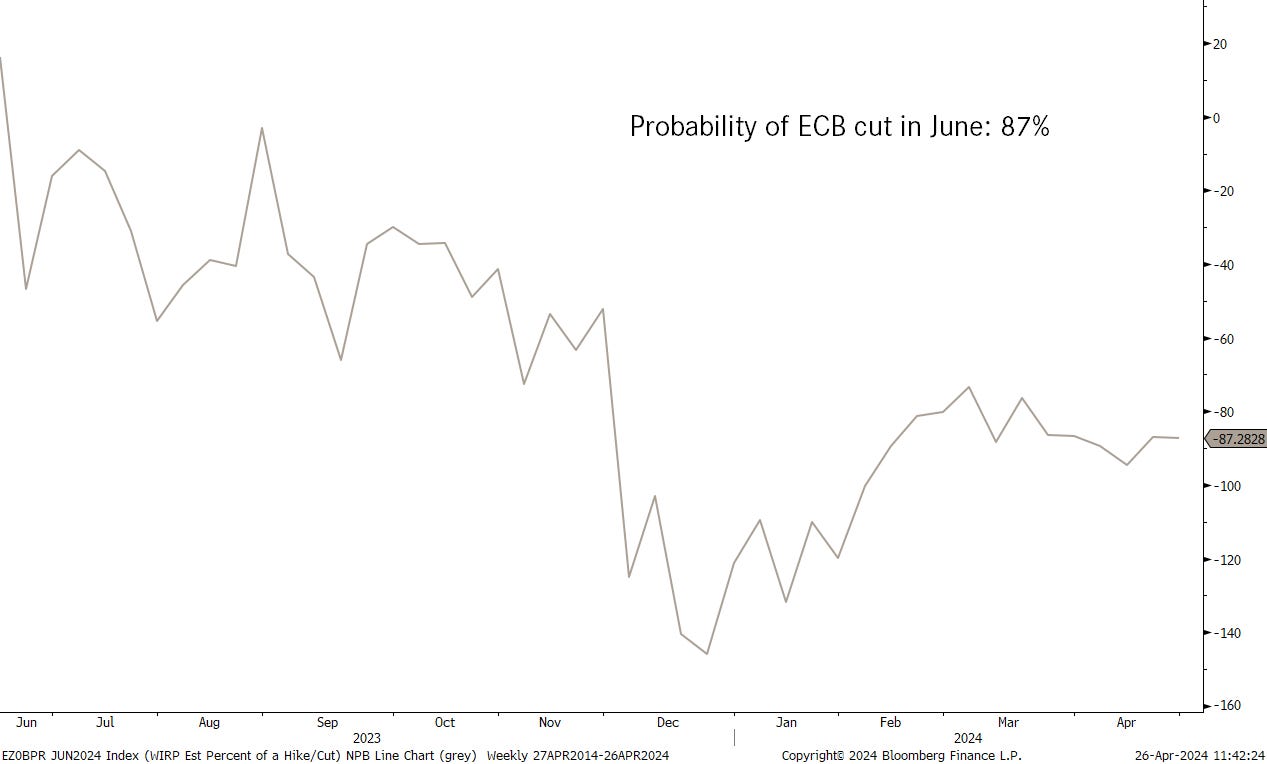

And still, the ECB recently all but insisted on a cut in June, and market participants seem to believe them:

Will Lagarde pull of a reverse Trichet (2007)?

In currency markets, the Bank of Japan (BoJ) has left interest rates unchanged at their monetary policy this morning, leaving the Yen to the lions:

Here’s the daily chart of the Yen’s demise:

Against most other G-10 currencies, the Greenback actually has been losing ground over the past few sessions:

In commodities, is the Gold correction already over?

Gold stocks certainly think so this morning:

Crude oil (Brent) is continuing to move in an uptrend channel:

And that’s it already!

Have a great weekend,

André

No comment needed.

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance