Snoozefest

Volume V, Issue 175

"My partner, Charlie, says that there's only three ways that a smart person can go broke: liquor, ladies and leverage."

— Warren Buffett

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

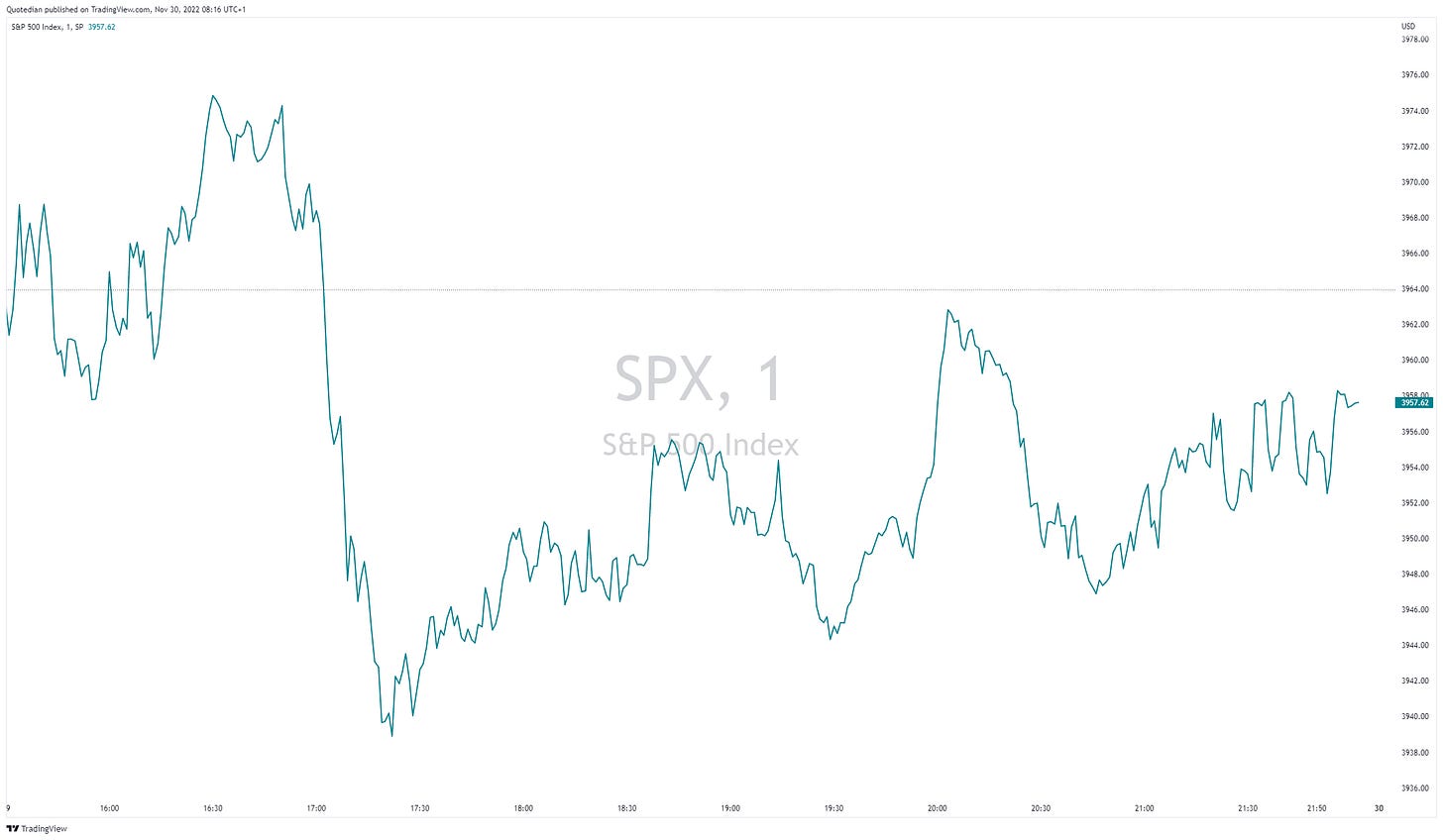

It took me nearly an hour to come up with today’s sleazy title for The Quotedian, which is either a sign of how boring market action was yesterday or of how distracted I have been - or both.

Indeed a lot of focus this week seems to be on today’s speech by Fed Boss Powell at the Brooking Institution in Washington later this evening (19:30 CET). Expectations are high as the Fed will then move into a self-imposed blackout period ahead of the December 14th FOMC meeting. As already discussed yesterday, expectations are for a lot of hawkishness, as financial conditions have eased a lot since the last hike, and the market expects that Powell will try and avoid repeating the dovish talk mistake made back in July. Now, we of course know, that if expectations are as lopsided as they are for this event, all the surprise lies on the other side … let’s see.

In conclusion, let’s keep it rather short today - there may be a lot to discuss tomorrow.

Starting with equities, even though I do not have access to the exact index data, it is likely that the 2% drop in Apple’s share price made up all of the index’s 0.2% loss on the day.

The drop came after a report by a respected analyst (an oxymoron, I know) read that ‘issues’ at one of the Foxconn plants could curtail iPhone production by as much as 15 to 20 million pieces …

Otherwise, the session was an absolute bore

with slightly more stocks up (279) than down (221) and sector performance accordingly also split about halfway:

Some random equity observations …

This chart was making the rounds on Fintwit yesterday - let’s hope that history neither repeats nor rhymes ;-)

Also, there is something afoul between oil stocks (XLE ETF, green line) and the oil price (WTI, blue line):

Last but not least as a good segue into Asian equity markets, which are mostly printing green this morning, believe it or not, the Indian equity market just broke out to new all-time highs:

Moving into fixed income markets for a brief moment, rates moved a tad higher yesterday, especially at the longer end of the curve, leading to some tightening:

Again, it will be interesting to observe how bond traders will react to today’s Powell speech.

On the currency side, the US Dollar continues its bounce from the 200-day moving average:

Being in the currency section and being such a quiet day yesterday, this is probably a good moment to dump all the cryptp/FTX memes I have collected over the past few days on you. It also fits loosely with today’s ‘Quote of the Day’ Without further ado or comment:

Ok, sorry for that, done now 😋

Of course, is it not only the day of Powell’s speech today but also the last day of the month, which means we are in for our monthly review festival tomorrow. So, make sure to check back in early tomorrow morning!

Have a great St. Andrew’s day!

André…

CHART OF THE DAY

The other theory for yesterday’s Snoozefest on financial markets could of course well be that USA played Iran (1:0) two hours before market close and maybe everybody left early for that. Average Value At Time (AVAT) comparison would suggest just that:

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

Happy St. Andrew's day!!!!!