Snoozer

The Quotedian - Volume V, Issue 131

"Life is too important to be taken seriously."

— Oscar Wilde

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s post will make up for a shorter letter, as yesterday’s session was quite the snoozer. But let’s dive right in!

Starting with equities, the intraday chart of the S&P 500 is probably the best way to tell yesterday’s story:

I count (and still wonder why I bothered to do so) twelve crosses above and below the zero line before stocks finally got a lift in the last hour of trading. The ratio of stocks advancing versus stocks declining was at 3:1 tilted pretty positive, also reflected in sector performance (US), with 8 out of 11 up on the day:

Accordingly, the S&P 500 heatmap gave a mixed to a positive picture of the day:

Little else memorable really from yesterday’s session.

This morning Asian stocks are mostly following Wall Street’s lead of a late rally, with most markets up between half and a full percentage point. Similarly, index futures in Western markets point to a flat to a higher opening of cash markets.

Indecision throughout most of yesterday’s equity session probably stemmed from investors’ uncertainty about what to make of tomorrow’s 75 basis points hike decision by the FOMC. Why 75 bp? Well, because you decided so! Here’s the outcome of our poll last Friday:

Participation was once again frighteningly low with less than 10% of list members casting their vote. Once again, to make it more fun I would encourage you to participate - voting is anonymous to all, even me.

Anyway, yesterday’s late equity rally came despite bond yields hitting new highs ahead of tomorrow’s Fed decision. Here’s the daily chart of the US 10-year Treasury yield, briefly trading above 3.50% and on the verge of breaking higher:

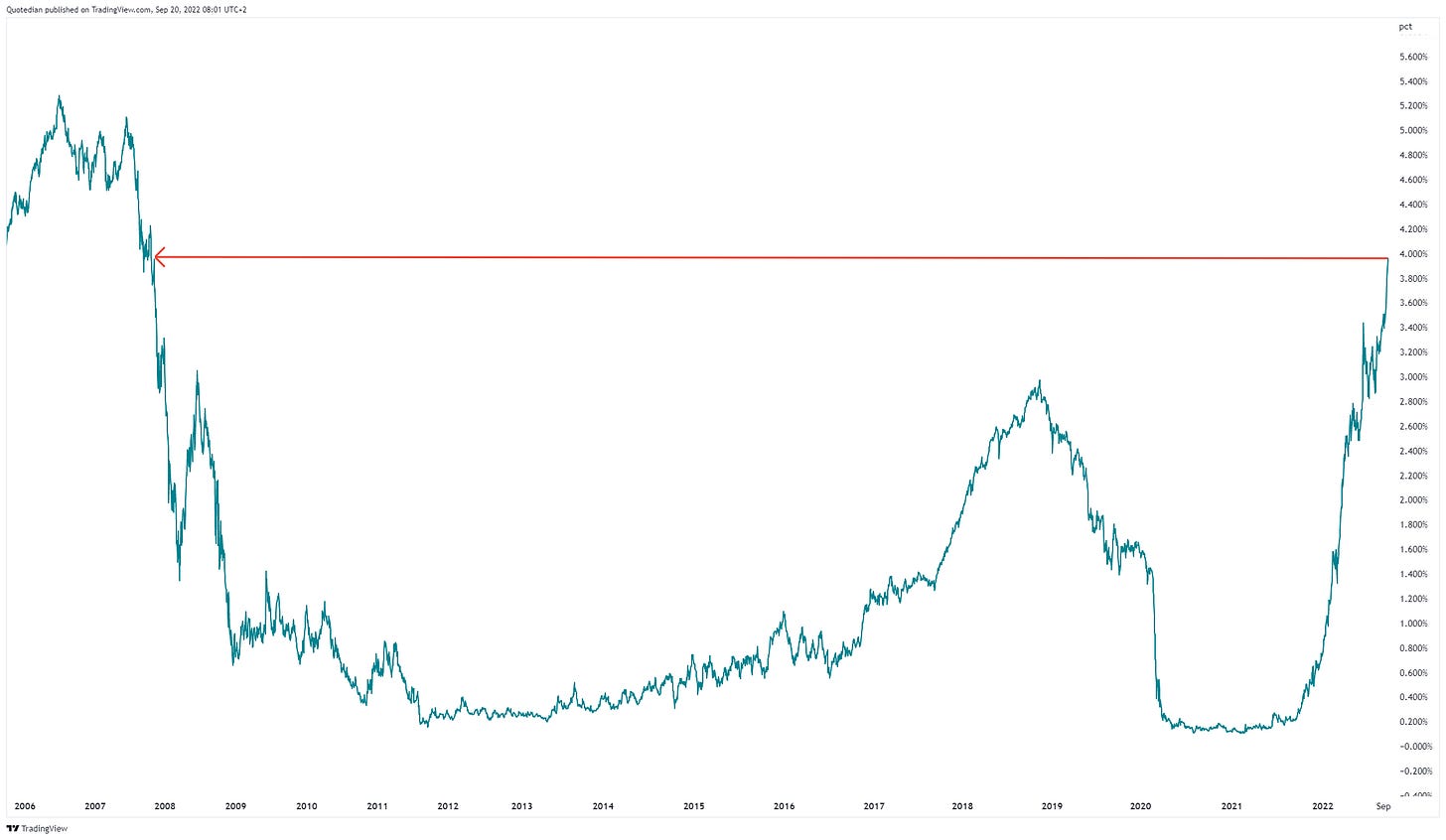

But the real “star” was the short-end of the curve, with 2-year yields hitting their highest level in 15(!) years at nearly four percent:

Let me make that point to you here again. For an asset allocator, having a 4% p.a. yield for a 2-year duration is becoming a true alternative compared to an equity yield of 1.7% p.a. (S%P 500) with a duration anywhere between 7-10 years…

In Europe, rates as proxied via German bond yields, are continuing to fly too. Here’s the German 2-year Bund yield:

Whilst rates in Europe (green line) at the 2-year level of the term structure of course continue to be less than half of their US cousins (blue line) since the rally started they have increased however substantially more in %-terms, just to give some perspective:

Nevertheless, the Euro/US Dollar rate continues to be under pressure (nice segue into the currency space, eh?), probably better explained by growth prospects than interest rate differential:

I have often highlighted the Japanese Yen weakness in the past, and the speed of its sell-off remains mind-boggling, despite the pause over the past week or so since the BoJ sniffed out FX rates. But a currency being ‘devalued’ at such a pace, normally leads to other things breaking too, and looking at Asian currencies versus the US Dollar since the beginning of the year indeed shows it is not only the JPY:

Also is it not only the USD, as over the past month Asian currencies also have weakened versus the Euro (quite the feat!):

The sell-off in the Taiwanese versus the US Dollar is acceleration:

As is the sell-off in the Chinese Renminbi (maybe more importantly so):

Overall, the valuation of the US Dollar is of course getting very stretched, but measures of Purchasing Power Parity (as shown in the chart below) are only a good indication of ballpark and do not serve as a market timing tool:

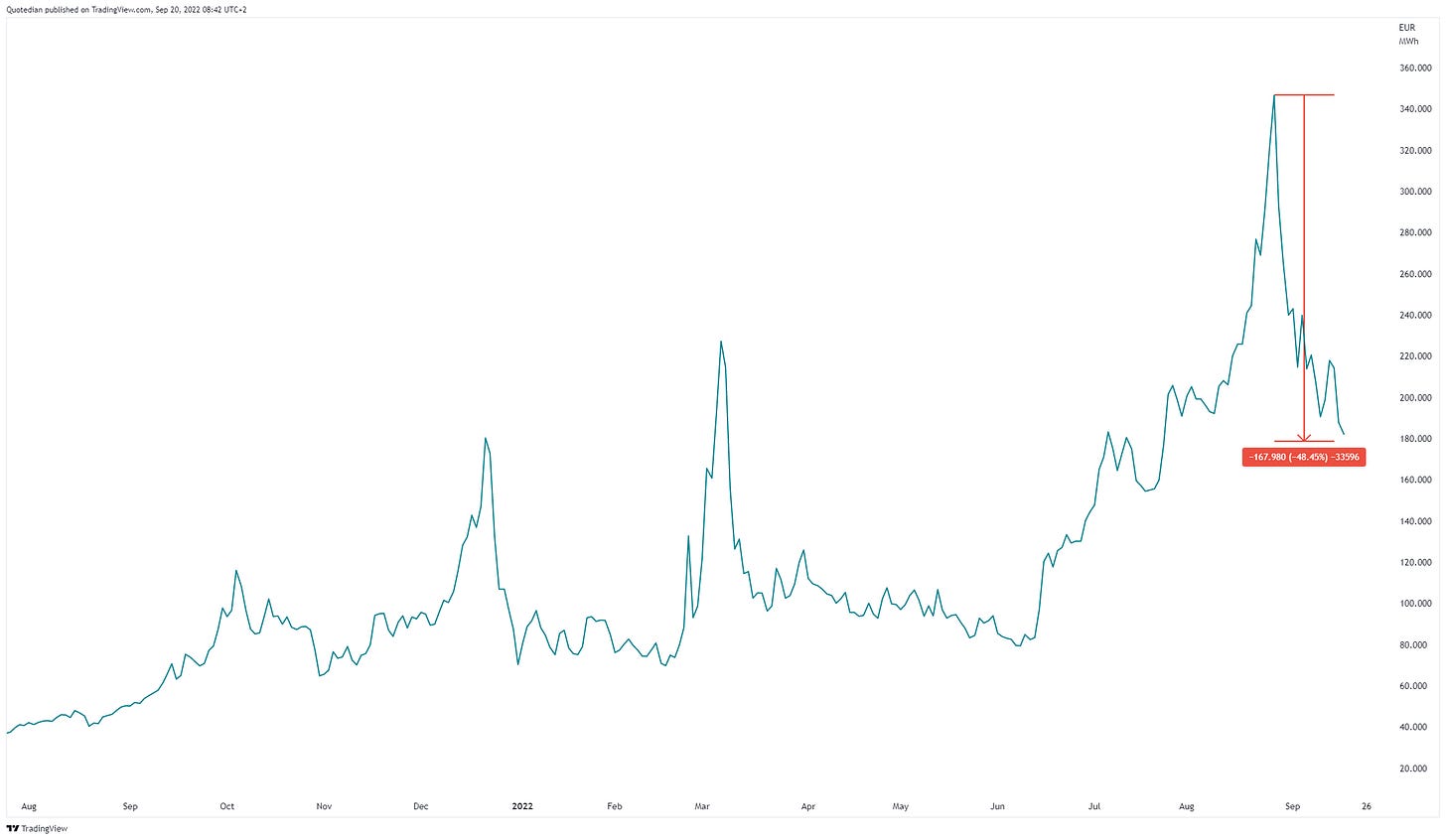

Little to write home from the commodity space (in relative terms), though may be worth mentioning that some of the speculation in European Natural Gas prices is starting to disappear:

Have a great Tuesday!

André

CHART OF THE DAY

Is Roger’s retirement announcement a hint to future interest rate policy?

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance