"Marriage is the triumph of imagination over intelligence. Second marriage is the triumph of hope over experience."

— Oscar Wilde

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

It was a confusing week. First, we had Powell on Wednesday telling the world that rates would stay higher for longer, but all the world wanted to hear was that a slower pace in hiking (FFS!) may lay ahead. Equity and bonds rallied their backsides off and the Dollar plunged.

Or maybe the market believed when Powell pronounced what can only go down in history books as ‘famous last words’:

“I do continue to believe that there is a path to a soft, or a soft-ish landing”

Then, on Friday, non-farm payroll numbers came in well ahead of expectations (263k vs 200k) and the month-on-month comparison of average hourly earnings was double the expectations (0.6% vs. 0.3%).

IMHO, the stock market correctly corrected (🤪) as did bonds. But by the end of the session, equities had recovered all losses

and bond yields were even lower than at the end of the previous session, hitting there lowest level since September of this year:

But, of course, there is a message in there and as our leitmotif is “Looking for the forest? Listen to the trees!” let’s do just that today, reviewing what has been going on and not fighting what price is telling us.

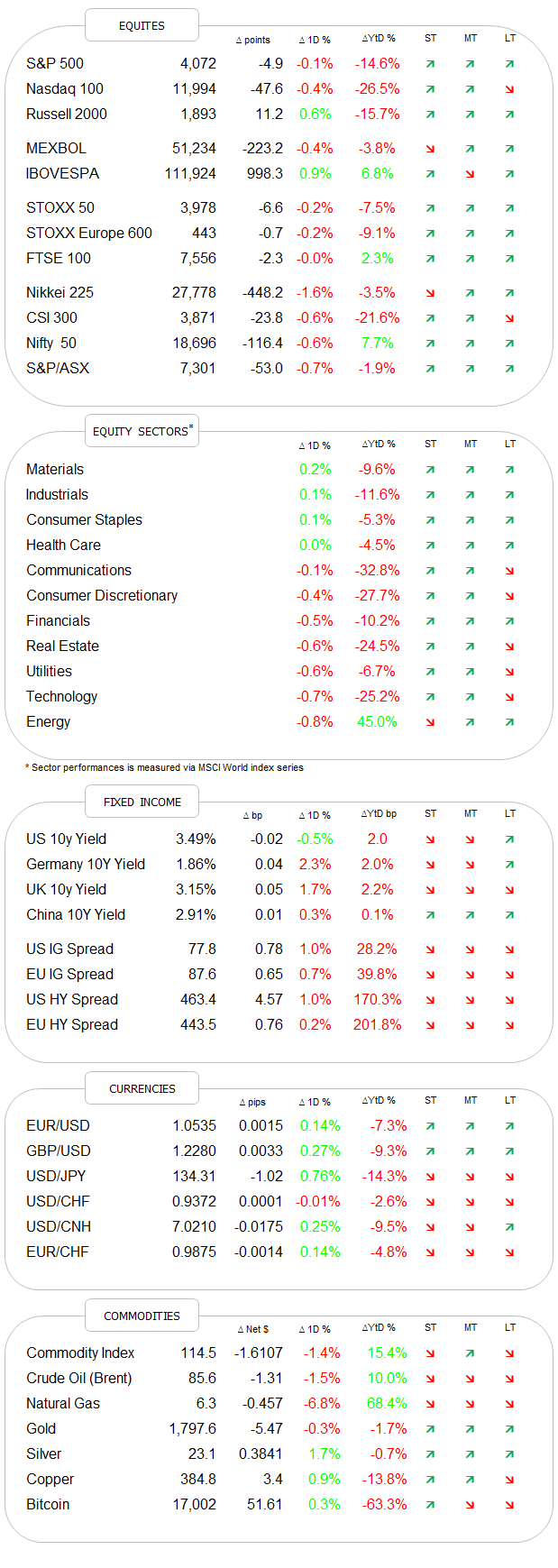

Starting with equities, it was overall not a bad week for global benchmark indices:

Whilst THE global equity benchmark, the S&P 500 was up ‘only’ slightly more than a percent on the week, it achieved an important feat by closing above its 200-day moving average for the first time in over six months:

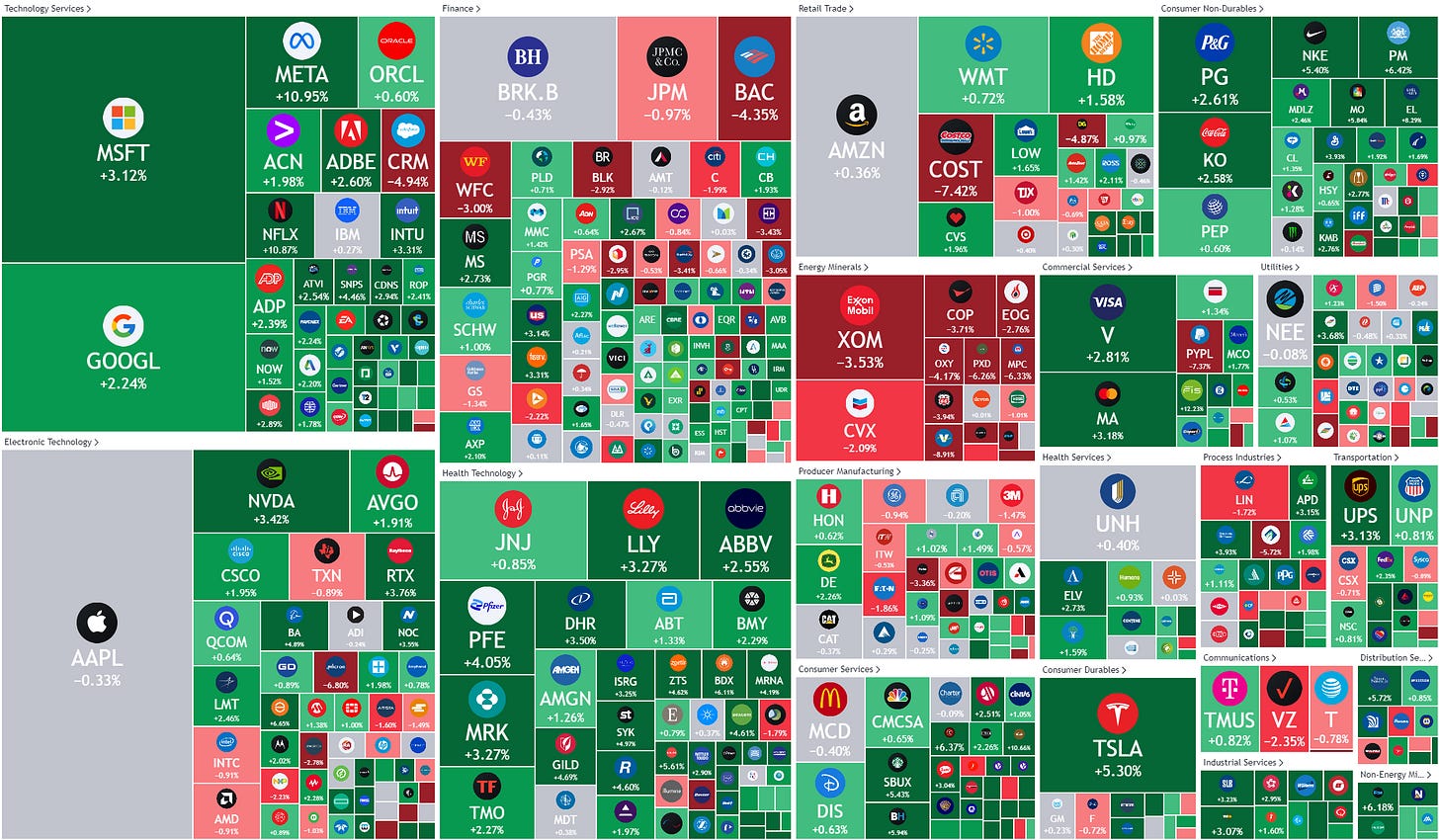

While for now it is still being rejected at the upper trendline from the bear cycle, a break higher seems imminent. Supportive for a break higher is the relatively good breadth figure. For example, there’s quite a lot of green on the 5-day performance heat map:

But maybe even more instructive is the ratio of the S&P 500 Equal-Weight (SPW) to the S&P 500 Cap-Weight (SPX) index:

The rising line means participation is broad.

Two of the best performing markets last week were Hong Kong and Mainland China. This is then also reflected in the Chinese tech sector, where for example the KraneShares CSI China Internet ETF is up 65% from its end of October lows:

Though for buy-the-top investors, the drawdown is still more than 70% …

These are some of the top holdings in that fund:

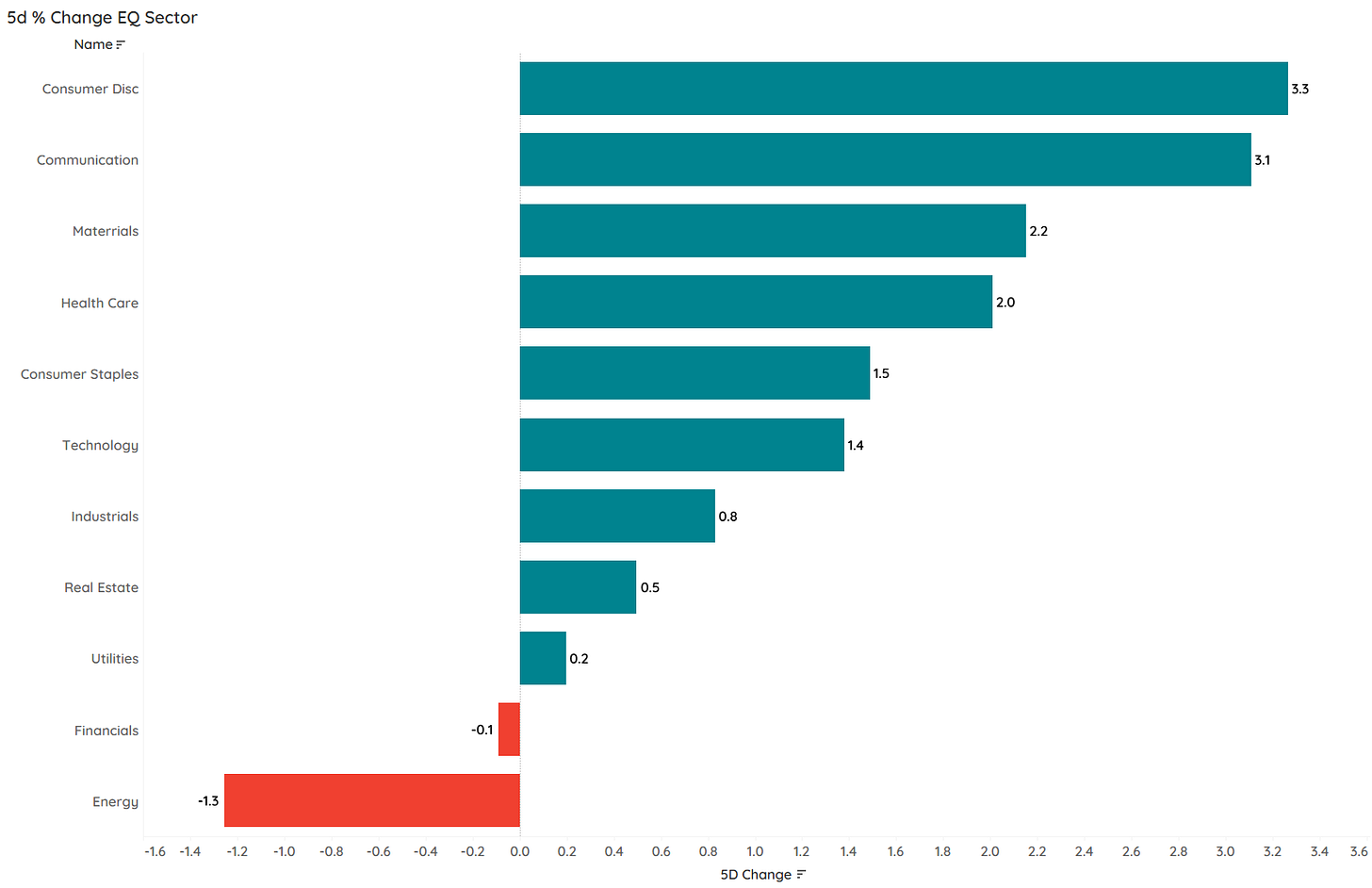

In terms of sector performance, at MSCI World level, it was a decent week for most sectors. Given the drop in yields, the hardest beaten long duration sectors did best, whilst Energy stocks saw some profit taking:

Interestingly enough, and as a point for the bulls, volatility (VIX) is dropping to levels where we are reminded that we should “buy protection when we can, not when we have to” …

Moving into fixed-income, if you hold bonds, you were likely to have had (finally) a very good week:

Asian high yield has done fantastically well, but the road to (full) recovery is looooong:

In the US, the 10-year Treasury yield, with its monster move on Friday has fallen right to the lower end of our defined support zone:

Their German equivalent (as proxy for European rates), is also right on key support:

Credit spreads continue to contract:

On the currency side, it was largely a good week for non-USD currencies:

The US Dollar Index now trades firmly below its 200-day moving average,

whilst the EUR/USD cross trades firmly above:

Even the USD/JPY is giving it an attempt:

Finally, and apologies for pressing on so fast, in the commodity space, it was definitely a good week for the metals, be it industrial or precious:

Silver is leading the way for Gold higher:

Needing to hit the send button, we will be back on Tuesday with more observations.

Have a great Sudnay!

André

CHART OF THE DAY

According to this chart, equities will have their best year in the 4-year presidential cycle next year.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

Good morning all.

What is the community opinion on gap between the Euribor rates and the countries rates?