Spy vs. Spy

The Quotedian - Vol VI, Issue 21 | Powered by Neue Privat Bank AG

“An economist is someone who sees something that works in practice and wonders if it would work in theory”

— Ronald Reagan

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

**Housekeeping**

First of all, apologies for missing out on last week’s Quotedian. The truth is that a) I did not feel inspired at all and b) you weren’t paying attention anyway ;-)

But here’s the good news: The Quotedian, in order to live up to its wordplay name is returning to a (nearly) daily publishing schedule. As I am getting tied up with more mundane issues in my new assignment(s), I realize it is ever more important for me to stay abreast with market happenings by writing these mostly useless lines. So, you are still in good time to unsubscribe, but if you don’t, make sure to hit that ‘LIKE’ button every day!

I swear by (insert your favourite deity here), that today’s title has nothing to do at all with Chinese balloons, ex-US Presidents taking homework to Mar-A-Lago or even this week’s Pentagon Gate.

Much more, today’s title refers to the internal war going on between bulls and bears in the stock market. Over the past two weeks, both have lost, as witnessed in the chart of the S&P 500:

A lot of excitement for bulls and bears, but little net progress… Technically speaking (aka evidence), ‘things’ are starting to look quite bullish, as we will see further down. Fundamentally, (aka emotions), ‘things’ continue to look quite bearish (earnings recession, debt ceiling, no Fed-Pivot, etc…)

This stalemate is also somewhat reflected in NPB Neue Privat Bank’s Q2 outlook, which I will post on LinkedIn and our Webpage tomorrow - and of course I will also send you a courtesy link in Tuesday’s Quotedian.

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

Starting with stocks, here are the performance statistics of some of the most important equity benchmarks around the globe:

WOW!! Not bearish!!

It’s actually not much of a surprise seeing the bear running away in pain, once we realize that positioning of speculators has been quite bearish (which is a contrarian bullish signal). Here is for example the positioning of speculators as per CFTC data:

Outside the GFC, such extreme short positioning has not been a sign of an impending market top.

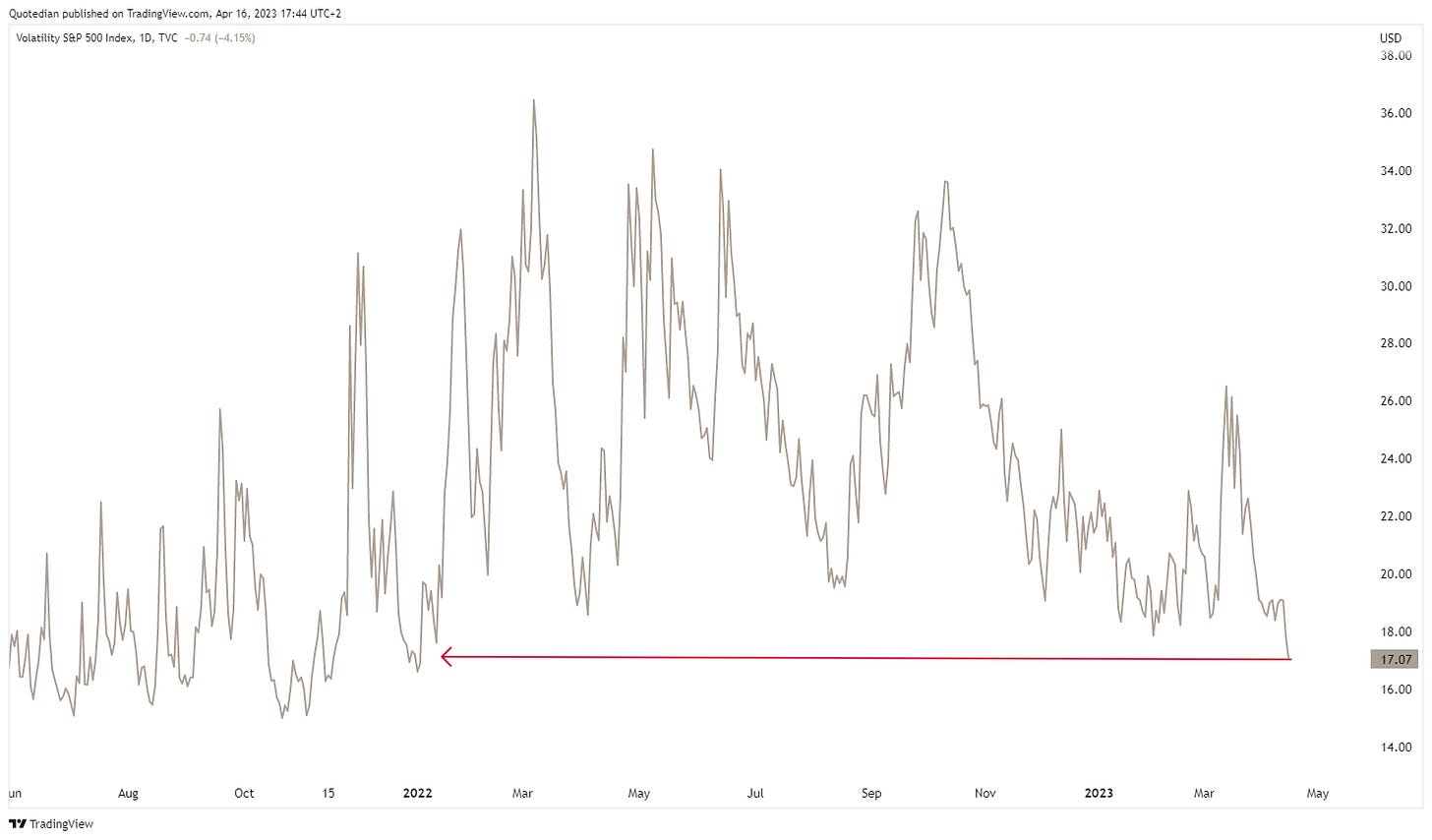

The bears may find some “chicken soup for the soul” in the S&P 500 Volatility Index (VIX), which hit its lowest level since early 2022,

or the Equity Risk Premium (S&P 500) being at its lowest level since the GFC:

…BUT…

nothing is more honest than price, and here is what price is telling us for the S&P 500:

Unless this is the mother of all bull traps, this is NOT bearish…

The pivot level (dotted line) on the NASDAQ 100 is holding up well:

But now, let’s have a look at ‘hopeless’ Europe. Here’s the STOXX 600 index:

Not bearish.

Or the narrower STOXX 50:

A few points away from a multi-year high…

Here’s the chart of the DAX index, the equity benchmark of that country that is soooo overexposed to Russian assets:

Less than three percent away from new all-time high. Let me sum up that chart with the following GIF:

Let’s turn to equity sector performance now, where the weekly statistic reveals that cyclical sectors took the lead this week:

Of course, there were also bank earnings out on Friday, with both JPMorgan and Citigroup reporting stellar returns. Apart from not being bearish, this will for sure lead to more political debate in the US (too big to fail profiting from the not too big to fail regional banks?) and in Switzerland (WTF was Credit Suisse doing anyway?). Here’s JPMorgan’s chart:

This is probably also a good moment to review the top performing stocks in the US and Europe and their weekly fortunes. Here’s the US table first:

Despite Friday’s jump in banking stocks, last month’s banking crisis has taken too much of a toll to allow any financial stock to make the top 25. However, hated META and beloved NVDA continue to occupy the top spots.

Here’s the same stat for the European market:

The performance of Defense stocks continues to stand out, as does the performance of emerging market telecom service provider Millicom. Here’s the chart on the latter:

There seems to be more upside to be had here if the break is indeed confirmed.

Let’s move into fixed-income markets. Here’s the weekly performance table:

A mixed week, where tightening credit spreads, related to the equity market rally, seem to have been largely offset by increasing rates.

The US 10-year yield is saying hello to its 200-day moving average from below, making up for an intriguing chart:

Is the chart on the 2-year treasury giving us a hint of the direction to come?

Bond volatility is coming back down fast, but continues to be high in recent historic terms:

This relaxation in treasury volatility (above) stands somewhat at odds with the US 5-year CDS spread, which is super-low, but at a multi-decade high:

Debt ceiling crisis anyone?

Finally, across the Atlantic, German yields are on the rise again:

This stands at odds of course with the complacency (or outright bullishness) witnessed on European equity markets.

On the currency front, the US Dollar continues to lose feathers against most other major currencies:

This of course as the narrative around the greenback losing its global reserve currency status gets louder by the day. For example, the Brazilian Real (and stock market) gained strongly, perhaps on the back of the announced plans to ditch the USD as trade currency when dealing with China:

Or is the Dollar weakness also related to the country’s rising CDS spread?

Despite the setback on Friday, the EUR is breaking higher versus the USD:

Finally, here’s the performance of the major commodity sub-sectors:

and there the five-day performance of some of the most prominent commodity futures:

Gold had a sell-off on Friday, but overall the chart remains constructive:

As I posted on LinkedIn a few days ago, the yellow metal is about to make a 5,000 year high….

Connected or not, Bitcoin seems to be coming out of crypto-winter crypto ice age:

Let’s call it a day here. As indicated higher up, the daily Quotedian is returning - of course in abbreviated form, but the increased cadence will allow us to stay better connected. Looking forward to writing you on Tuesday!

Best,

André

CHART OF THE DAY

For the diecast bears amongst you, here’s the last straw I can offer you to clutch onto:

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance