“Life is like riding a bicycle. To keep your balance, you must keep moving.”

— Albert Einstein

DASHBOARD

CALENDAR

CROSS-ASSET DELIBARATIONS

I remember (many) years when it started already in June being difficult to write anything of interest in this fine daily document, as the Summer Doldrums set in early. This lack of excitement in financial markets tended to drag on until the point in time when I left for a holiday - after which of course all hell broke loose…

Anyway, no hint of boredom coming this year, as cross-asset macro moves are plentiful - in my view a direct consequence of Central Banks finally abandoning centre court and giving up on their shameful market manipulation of the past decade(s). A golden time full of opportunities for deity market participants as you are.

On with market observations of the past hours …

The market is a dog (macro hound?) with many tails, each wagging with different strengths at different times. Early in yesterday’s session, it was clearly the currency tail wagging strongest, as the EUR/USD dropped below key support, sending European equity markets lower:

It seemed only yesterday that we highlighted such a possibility as Germany reported their first trade deficit in over 30 years (oh, it was only yesterday…). As mentioned, European stocks fell into a tailspin over recession fears, sending European indices about two percent lower:

Clearly, European are on a stairway to heaven in an elevator to hell …

EU gravity then also pulled US stocks lower at their opening, however, once the closing bell rang on the old continent, bargain hunters appeared in the US market, deciding that the slump in bond yields and energy prices were enough for an at least short-term market rally:

This leaves the daily chart of the S&P 500 in a substantially less precarious position compared to the European chart further above:

But, be not fooled, for now, the rebound is not much more than a technical bounce (sucker’s rally), with the most down-beaten assets recovering most, as indicated for example by sector performance

or even factor performance:

Asian stocks are not buying into the US rally though, with most regional indices down around one percent as I type on this early Wednesday morning. European equity futures are indicating a higher opening, though it may be though to hold onto any gains, especially with US futures flashing small red already again.

In fixed income (bond) markets, yields retreated strongly on recession fears on both sides of the Atlantic and are rapidly approaching our correction targets we identified a few sessions ago:

As a matter of fact, in the case of the US yield curve, we saw a third inversion in short time of the classic 2-10 year spread recession indicator:

In terms of credit spreads (i.e. credit risk), the iShares High Yield ETF (HYG) has stopped its recent freefall, but is also failing to meaningful recover. The verdict remains pending:

Interestingly, but probably not surprisingly, European credit spreads continue to widen, whilst US spreads have halted their ascension. You can observe this in the chart below, but I will try to improve that image in one of the upcoming letters:

Moving into currencies, we already had a glimpse at the ‘crashing’ EUR/USD chart, but from yesterday’s session it is also interesting to observe that the US Dollar was strong versus everything, bar the most traditional safe havens (CHF and JPY):

Fast track into Commodities then, where recession fears are rapidly leading to strong reversals in recent trends. A few examples …

Oil ‘crashed’ over eight percent yesterday, with the WTI closing below the $100-mark for the first time since April, but still above its key longer-term moving average:

The price of copper is screaming economic slowdown:

And even the Ags (Wheat, Soybeans, Lean Hogs, etc.) which are all famously running out of, are taking a nosedive, as illustrated below via the Invesco Agricultural ETF:

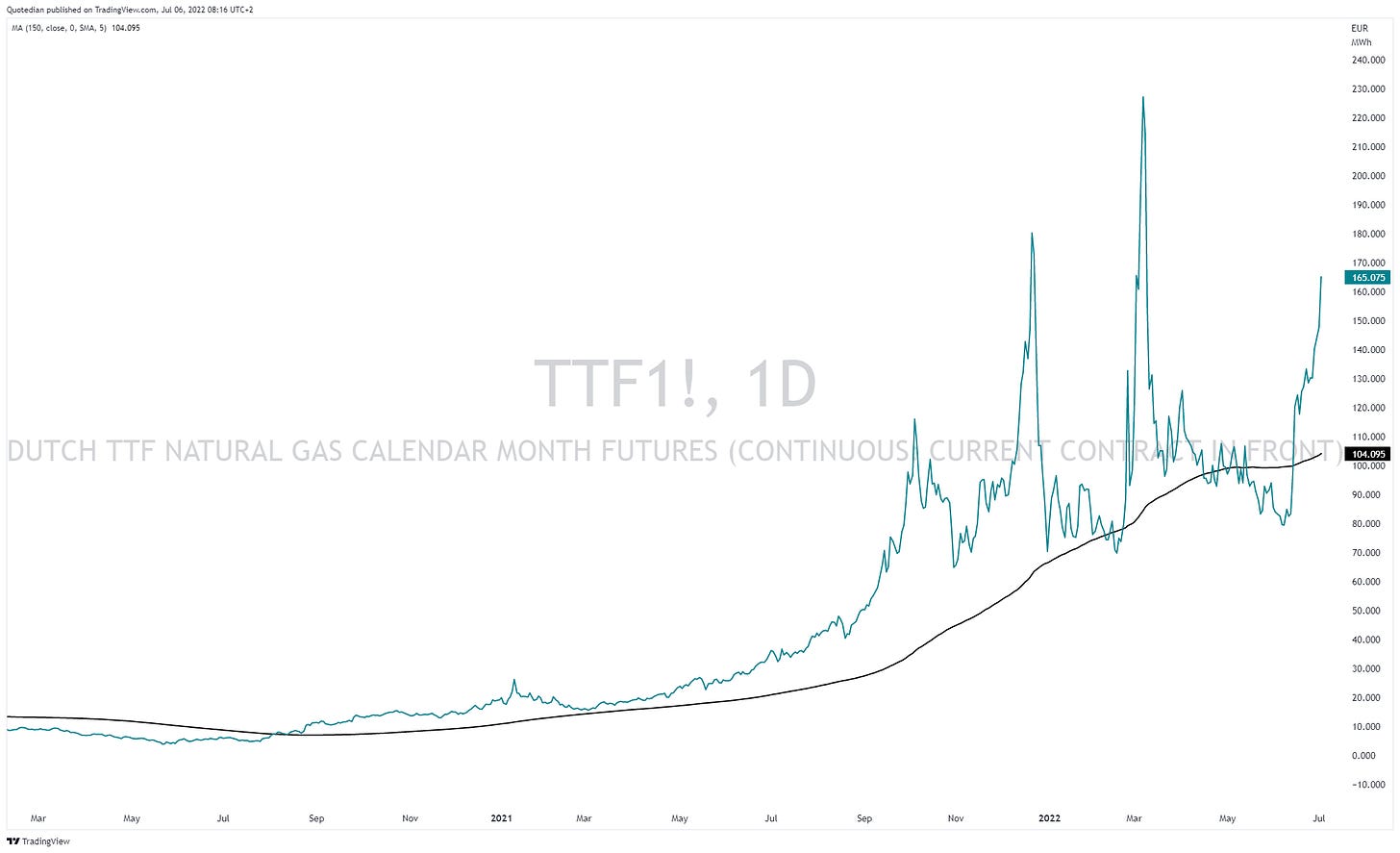

One commodity that is not dropping though is European natural gas:

pushing German Electricity prices to record all-time highs along the way:

This letter has got too long already (as promised ;-) ) and it is time to hit the send button. Shame, as we didn’t even got to discuss the UK muppet show political scene. Have a great Wednesday!

CHART OF THE DAY

Energy prices and energy stocks are correcting strongly over a looming global recession. Even though one of the most traded Energy equity ETFs (XLE) has broken some key supports, I’d be tempted to start overweighting the sector here again. The recession (fears) will eventually go away, the energy shortage problem not. Stay tuned …

Like today’s Quotedian? Share the love:

Didn’t like today’s Quotedian? Discuss here: