Summer Winds

The Quotedian - Vol V, Issue 114

“August rain: the best of the summer gone, and the new fall not yet born. The odd uneven time.”

— Sylvia Plath

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

After a longish Quotedian yesterday, we will keep it a bit shorter today as:

Everybody and his dog is waiting for Powell’s Jackson Hole speech today at 1600 CET

You deserve to go early into the last August weekend

So, let’s dive right in…

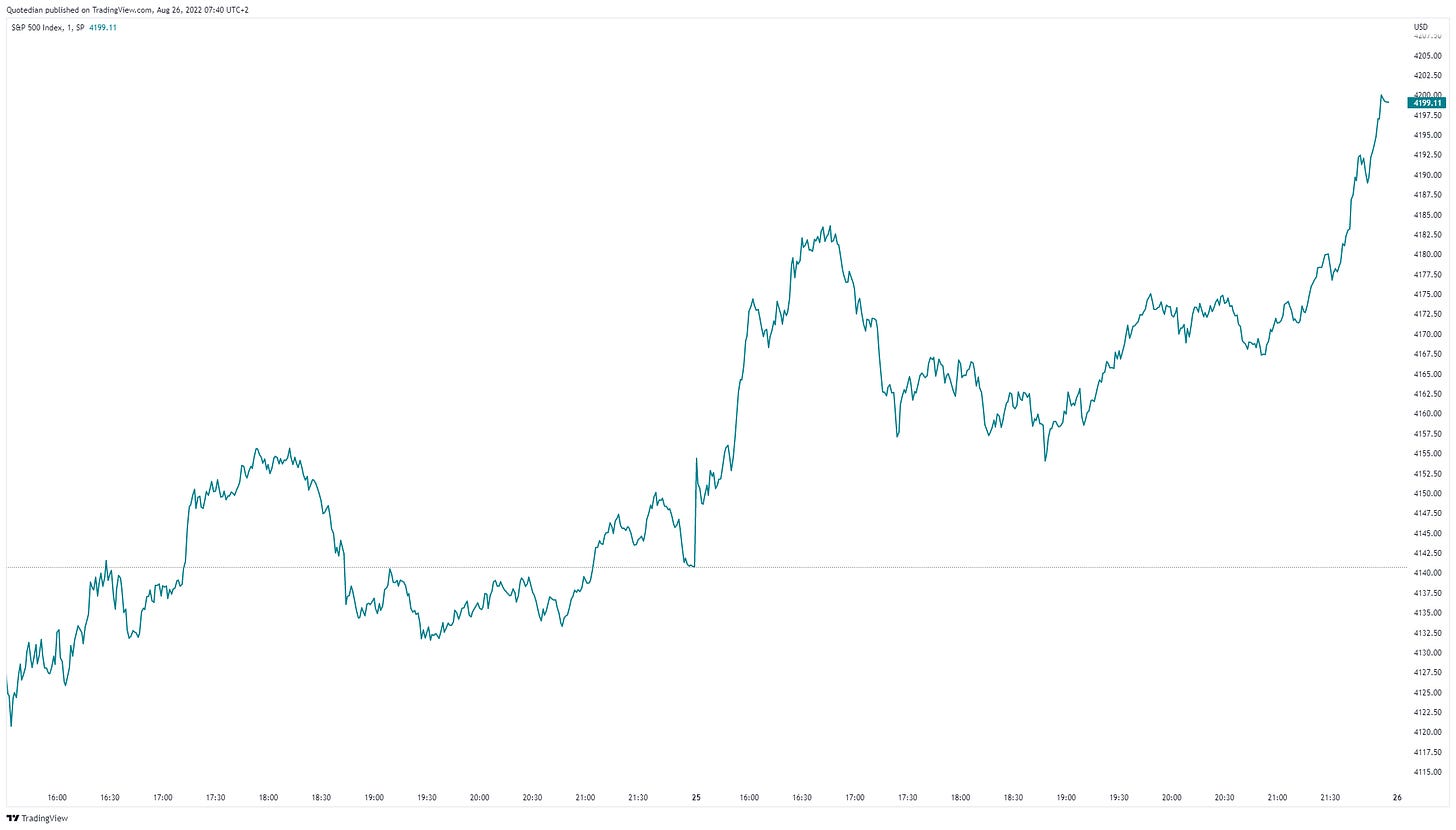

Equity markets around the globe ended Thursday higher, with US stocks accelerating strongly into the market close. Here’s the intraday chart for the S&P 500 for example:

It was a broad move higher, with a lot of participation (S&P 500 >90% advancers), the highest volume reading of the week and also wide sector participation:

No wonder the S&P’s market carpet looks greener than any garden in the Northern hemisphere right now:

What pushed stocks higher then, other than more buyers than sellers? Well, for one, positioning into Jackson Hole is quite bearish for stocks and bonds, i.e. speculators are expecting a hawkish outcome from the two-day, tax-payer-sponsored central bankers’ holiday. Here is for example a graph on the short bet my speculators on short-term rates:

Coupled with negative dealer gamma, once the stone got rolling in one direction the only possible outcome was trend acceleration. As a reminder and grossly simplified: In a negative gamma environment, options traders/hedgers are forced to sell more on falling prices and vice versa they have to buy more when prices move up. Hence, moves tend to get exacerbated. So, a possible outcome today is further strength into Powell’s speech and then a violent trend reversal if he is at least as hawkish as the market expects, which seems increasingly unlikely.

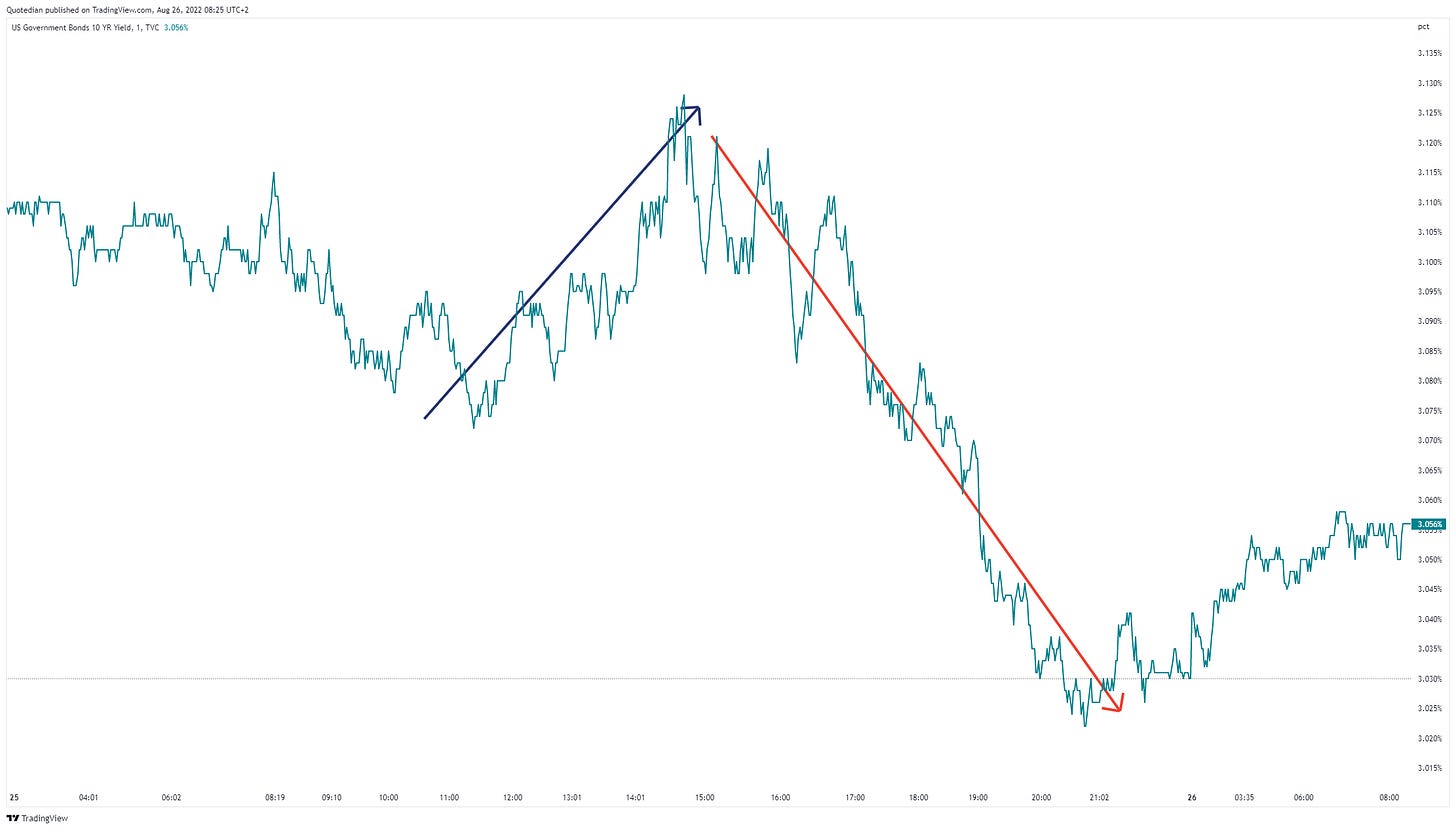

Fixed Income markets saw quite the (short-term) trend reversal on yields today, first spiking into the highest reading (US 10y yield) since late June, to then reverse on a pin’s head and drop 10 basis points:

On daily chart this looks as follows:

German and UK yields had an identical intraday pattern, with the latter reversing at a possibly important level:

Credit spreads narrowed together with yesterday’s equity rally, keeping the intermediate tightening trend intact for now. Here’s the ICE BofA US Corporate OAS index:

In currency markets, the US Dollar has now consolidated for four sessions, with very little progress in any direction. Here’s the US Dollar index daily chart:

and here the EUR/USD:

A Fed not living up to the hawkishness currently expected by market participants could of course push the US Dollar lower immediately, but purely from a chart point of view, this looks more like a continuation (of $ strength) than a trend reversal. But let’s see…

Finally, in commodities, natural gas prices remain elevated without any signs of a significant reversal ahead:

The latter shows just how screwed we Europeans will be with our utility bills for a long-time to come. The German cost of power chart already made the rounds a few weeks ago, but don’t miss the French cost of electricity, after EDF’s announcement that some of its nuclear reactors will take longer than anticipated to return online:

And on top of that, crude oil now also seems ready to move higher again:

Time has come to hit the send button - I wish you all a beautiful, last August weekend and make sure to check in Sunday afternoon for your dose of The Quotedian, which will get you in shape for Monday morning!

André

CHART OF THE DAY

Here’s an interesting, at least for market junkies interesting, chart on the number of consecutive days without reaching a new all-time high for the S&P 500. No message, but stay tuned just in case ;-)

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance