Sunday Brunch

The Quotedian - Vol V, Issue 101

"Everybody has a plan until they get punched in the mouth."

— Mike Tyson

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s QOTD can of course only refer to my plan for sending out at least two to three Quotedians during my holiday, with the punch in the mouth being a delayed travel schedule, technical difficulties, and too much not enough food & drink …

So, in similar fashion to all central banks around the world, with the ECB being the latest example last week, I quit giving any forward guidance (regarding the publishing schedule) and will be mostly short-term data-driven.

Hence, let me catch you by surprise with the Sunday ‘Brunch Edition’ of The Quotedian. Looking back over the past week, you managed in my absence to:

let the stock market rally over three percent (MSCI WORLD)

make an Italian prime minister resigns (ok, statistically not that much of an outlier)

allow the ECB to hike interest rates (this IS a statistical outlier) and even by 50 basis points to … drum roll … 0%.

convince Russia to switch Nordstream 1 (temporarily?) back on

push Eurozone PMI into economic contraction territory

and many other things you haven’t told me yet or I already have forgotten about again.

But let’s look at all major asset classes step by step…

Obviously, equity investors haven’t received the memo yet: if stocks are rallying on expectations of an economic recession that will slow/reverse central banks’ hiking cycle and push bond yields lower, investors are skipping a beat. Namely, the one where stocks fall sharply before all of this actually happens …

And they also forget that with every tick higher, the resolve of the Fed to decrease the wealth effect just increases. But hey, equity investors do usually carry rose-tinted glasses, as the rally right into the middle of February 2020 in the face of rapidly expanding COVID cases around the world proved.

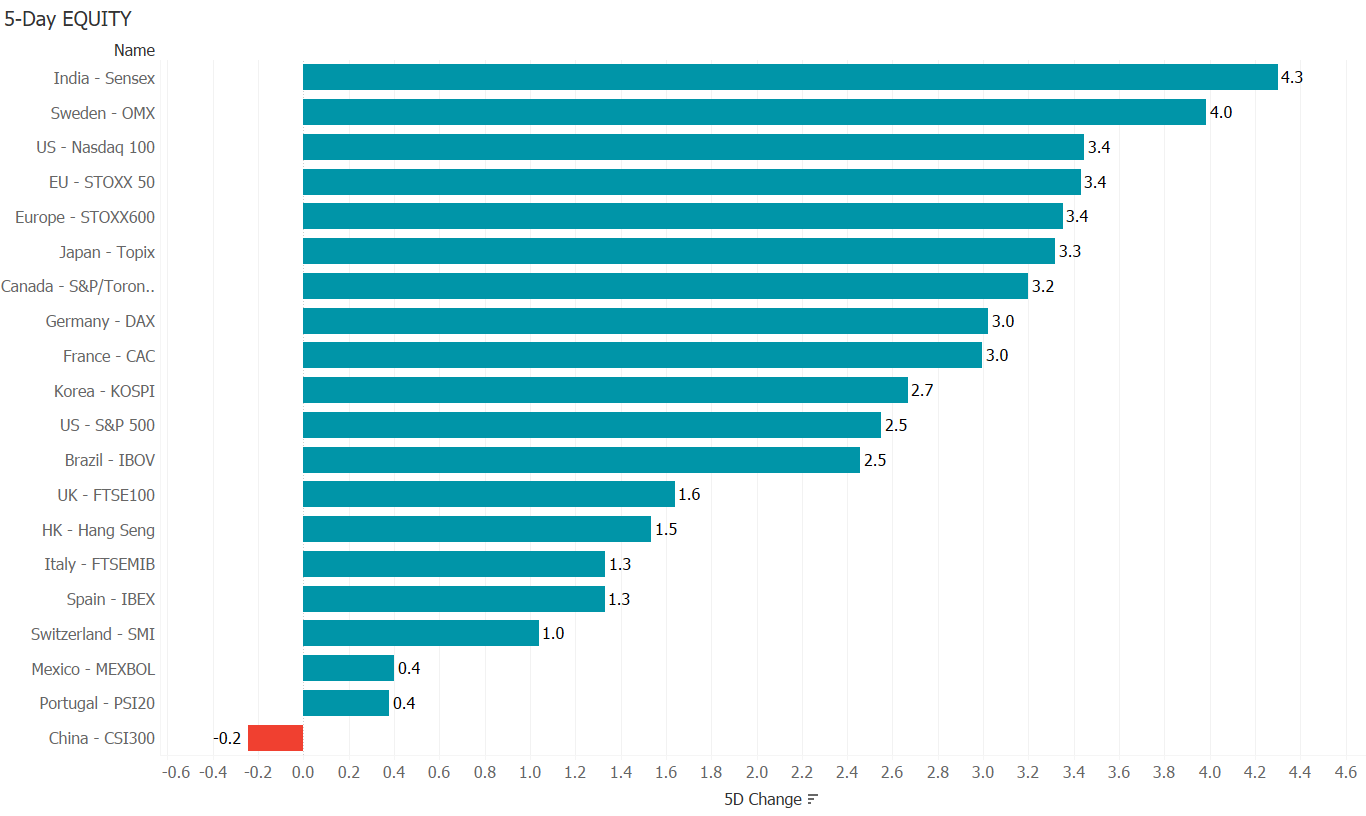

Anyway, stocks retreated on Friday after three days of consecutive gains, though the week still ended with significant advances for most equity markets:

Friday’s market carpet for the S&P 500 reveals that most weakness was to be found in the technology/communications sector after shares of SNAP dropped 39% upon release of their “earnings” report:

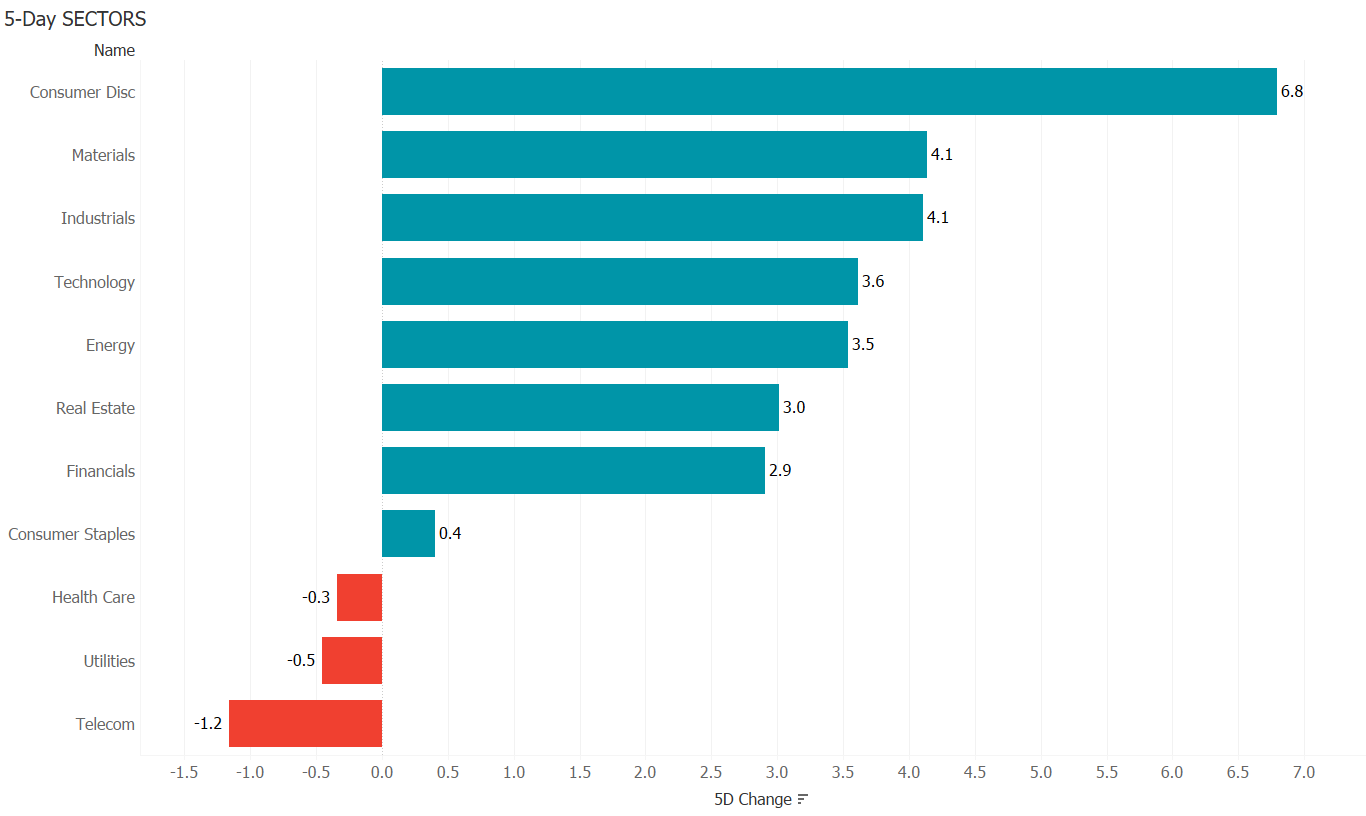

But yet again, there also seems to have been some profit-taking involved after a strong week especially for those sectors, though the star performers where consumer discretionaries:

A strong performance came from Apple (+4% WTD), which is up over twenty percent now since its June low and hit a new all-time high in relative terms to the S&P 500 during the week:

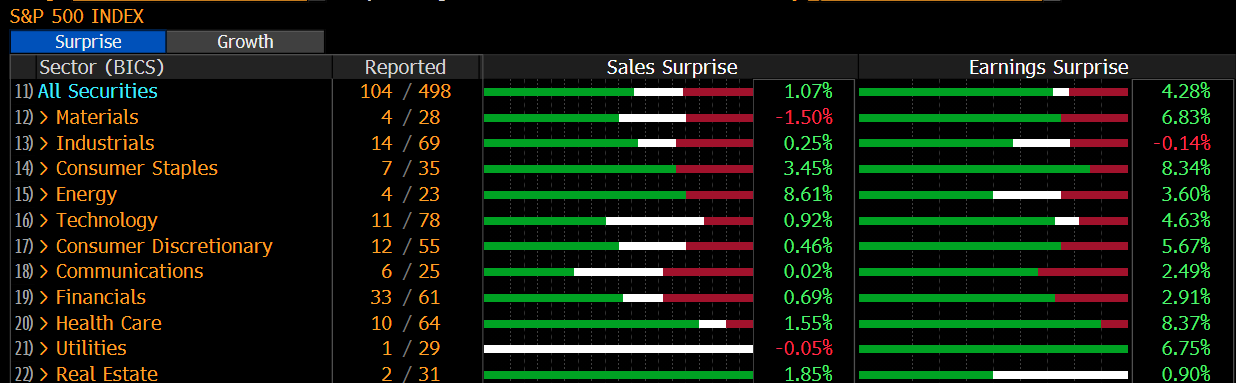

The company’s earnings report due next week (28/7) may be closely scrutinized by investors around the globe. And speaking of earnings, with about one fifth of companies having reported on both sides of the Atlantic, results so far have not been as bad as some feared:

And finally, as it is Sunday, let’s also briefly review the weekly performance of the best performing stocks on a year-to-date basis in the US and Europe:

Let’s finish the equity section with the observation that stocks are up now over 10% from their June 13 lows, which makes this technically a (upside) correction in a bear market. How much further to go? Well, on the S&P 4,175 would be the point to watch, as closing above there would break the pattern of lower lows and lower highs in place since the beginning of this year:

On the STOXX 600 448 would be the equivalent point:

In conclusion, the bulls still have to provide their evidence:

Moving into the fixed income space, the first observation would be that credit spreads are currently giving their approval to the equity rally in place, with spreads tightening. Here’s the BofA US High Yield OAS for example:

Bond yields themselves have dropped to the very lower end of our defined range. A decisive move below 2.75% for example would set the intermediate trend for bond prices to UP:

Similarly are Bund yields (10-year German government bond) moving into our support zone around 0.85%:

One area of continued tension is European peripheral yields/credit spreads, where last week’s resignation of Super Mario as Italian PM has in general lifted spreads of all Club Med countries and more specifically pushed the BTP to Bund spread above the Greek equivalent:

Yet overall, it was a good week for bond investors:

Moving into currencies, the US Dollar weakened across the board last week, which helped to fuel the rally in risky assets:

The greenback, as measured by the Dollar Index (DXY) has dropped down to the lower end of its upward sloping trend channel, and close observation over the coming sessions will be crucial to read the path of other asset classes:

Even the Japanese Yen, despite the BoJ inactivity and continued insistence on yield curve control (YCC), is having a day in the sun:

134.00 seems the immediate support zone to watch, though admittedly I see it rather above 140 over the coming weeks than down to that level.

In the commodity complex, Gold seems to have found support exactly where it should:

whilst oil (brent below) continues to trade within its four months range, but has started to drift somewhat aimlessly:

Here’s the weekly performance overview of the most important commodities, with yet another jump in natural gas prices (despite the relaunching of Nordstream I) standing out:

Make sure to enjoy the rest of your Sunday!

André

CHART OF THE DAY

This one has been making the rounds through social networks already, but it is too ‘good’ not to make it as today’s COTD, as it proves many points. One of them being: Fear sells. Stay tuned!

LIKES N’ DISLIKES

Likes and Dislikes are not investment recommendations!

Long China equity (FXI) / short India equity (PIN)

Energy stocks (XLE)

Long some Gold (direct or via short puts)

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance