T-Bill and Chill

“A national debt, if it is not excessive, will be to us a national blessing.”

— Alexander Hamilton

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

In fixed-income investing, there are three major sources of risk (and, ergo, return):

Duration

Credit

Convexity

We nearly always cover the first two in this fine newsletter in the FI compartment in one or the other form, but seldom the third. Convexity is a bit more complex 'beast’ to understand, but I would recommend the very recently released 9-pager by Harly Bassman, aka “The Convexity Maven”.

But going back to today’s title of The Quotedian, let’s just focus on the first, duration risk, today.

This is the current shape of the US yield curve:

In a normal market environment, you would expect the rational investor to ask for more yield the longer he invests in a US treasury note, right? Right! However, courtesy of the turbo-charged rate hike cycle of the Fed, interest rates have risen much faster at the short end of the curve than longer-dated maturities have.

So, what are the reasons an investor should not invest all into short-dated papers in the 3 to 6 months to maybe 1-year sweet spot? Very little. Just one actually: The roll-risk or re-investment risk, i.e. the risk that if you have to renew your T-Bill in 3, 6 and/or 12 months interest may be lower already and you have not locked in higher rates at longer maturities.

Hence, if you run a traditional multi-asset class portfolio it probably makes sense you have a barbell position on the yield curve for your fixed income allocation, with a lot of weight at the short-end and in function of your economic expectations some exposure at the long-end (10 year+).

Another approach to the traditional asset allocation school would be to hold all your assets in short-term papers with a cash element that allows you to be a hitman on tactical equity exposure, being it through market timing with index ETFs or high-conviction individual stock positions.

In short, in both strategies: T-Bill and Chill!

Any other suggestion?

On with yesterday’s market observations, of which there are not too many.

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Looking for true fixed-income expertise?

Contact us at info@npb-bank.ch

Global stocks started trading strong, initiated by a late rally in Asian markets (so late, that it happened after yesterday’s publishing of the Quotedian). Strength swapped into European trading but started fading shortly after lunch time. Here’s the intraday chart of the STOXX 600 index:

US stocks gapped higher at their opening, but then started giving away all gains and then some the rest of the session (S&P 500):

This in spite of slightly lower bond yields, but it was probably the waiting for Godot Nvidia that deflated the early gains.

Market breadth was pretty ambiguous, with four sectors up and seven sectors down, but the spread between best (real estate) and worst (financials) just slightly more than one percent. Declining stocks outpaced advancing stocks by about 3 to 2 - the S&P’s market carpet gives a good picture of yesterday’s market fragmentation:

Retailers were weak yesterday, after disappointing results reported by Macy’s (-12%) and Dick’s Sporting Goods (-24%), put a major drag on the sector. Here’ s the chart of the SPDR Retail ETF:

To finalize today’s US market observations a quick look at small cap stocks, which we haven’t done in a few sessions. The Russell 2000 has reversed from the upper end of its year old trading channel and has pulled back to the pivotal 200-day moving average:

An active trader’s paradise …

Asian markets are overall printing green this morning, lead by solid advances in Japan and with the notable exception of China mainland stocks.

According to index futures should cash markets in Europe also open on a positive tone in about half an hour.

Rates gave a bit of a breather to stocks yesterday, as the yield on the US 10 year treasury (and others) drifted lower:

However, one of the more important charts we should not lose sight on is the one of the MOVE, the bond market’s VIX equivalent, which is waking up out of lethargy again, with possible “volatile” ramifications:

This at a time when long-term bond prices (proxied via the TLT ETF below) are fighting to hold key support:

After the lengthy introduction above I think we are good to go with little happening in commodity and currency markets.

However, this could change quickly for both, especially the latter, as many investors are overlooking the ongoing discussion this week amongst BRIC+ countries and how they can make the “Global South” more influential (via commodities and currencies for exampe …). Definitely stay tuned on this one - not everything is Nvidia and Jackson Hole…

Have a great day,

André

CHART OF THE DAY

Here’s another reference to our ‘cool’ Quotedian-Title today:

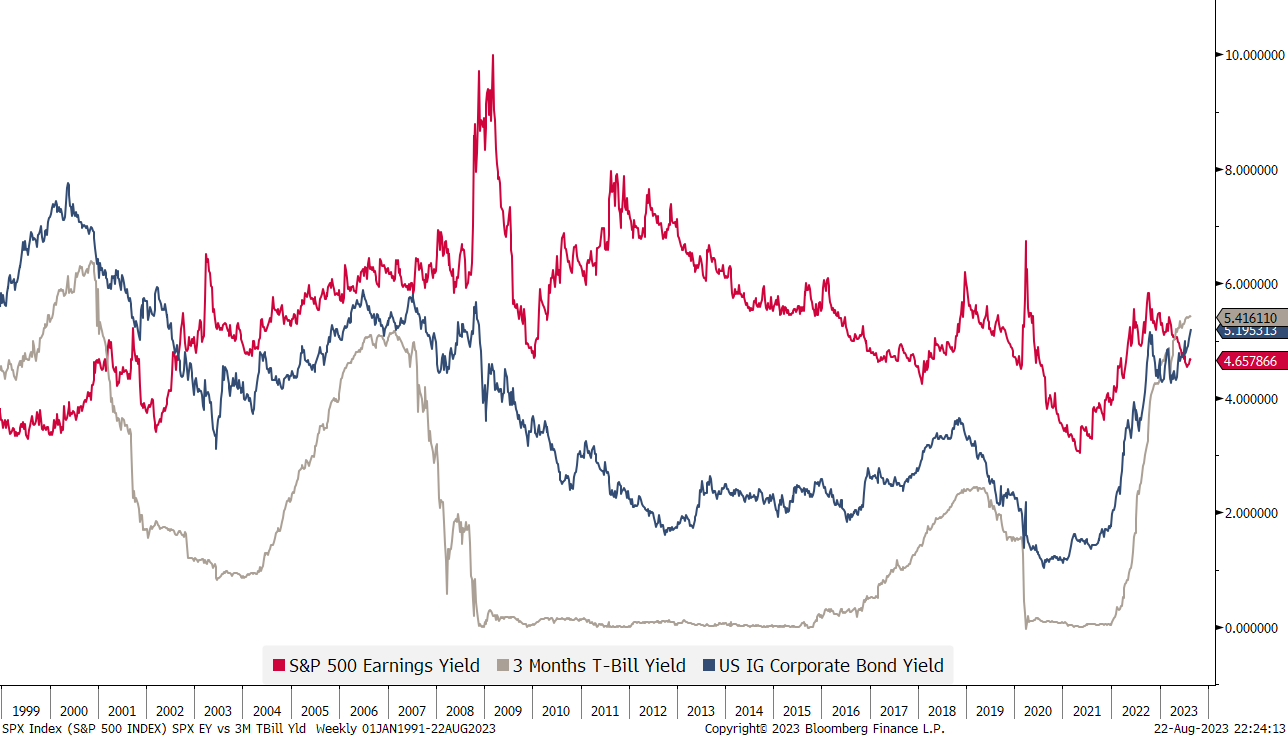

Today’s COTD below looks at the S&P 500 earnings yield (red), the yield of 3-months “T-Bill and Chill” (grey) and the yield for the US corporate investment grade bond universe.

T-Bills have a better yield than stocks for the first time in over two decades and a better yield than IG bonds since like forever. And to add insult to injury, keep in mind that duration risk (see beginning of this letter) is substantially higher for IG bonds AND equities.

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance