Tales from the Crypt(o)

The Quotedian - Vol VI, Issue 27 | Powered by NPB Neue Privat Bank AG

"Fortune favors the brave."

— Matt Damon

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

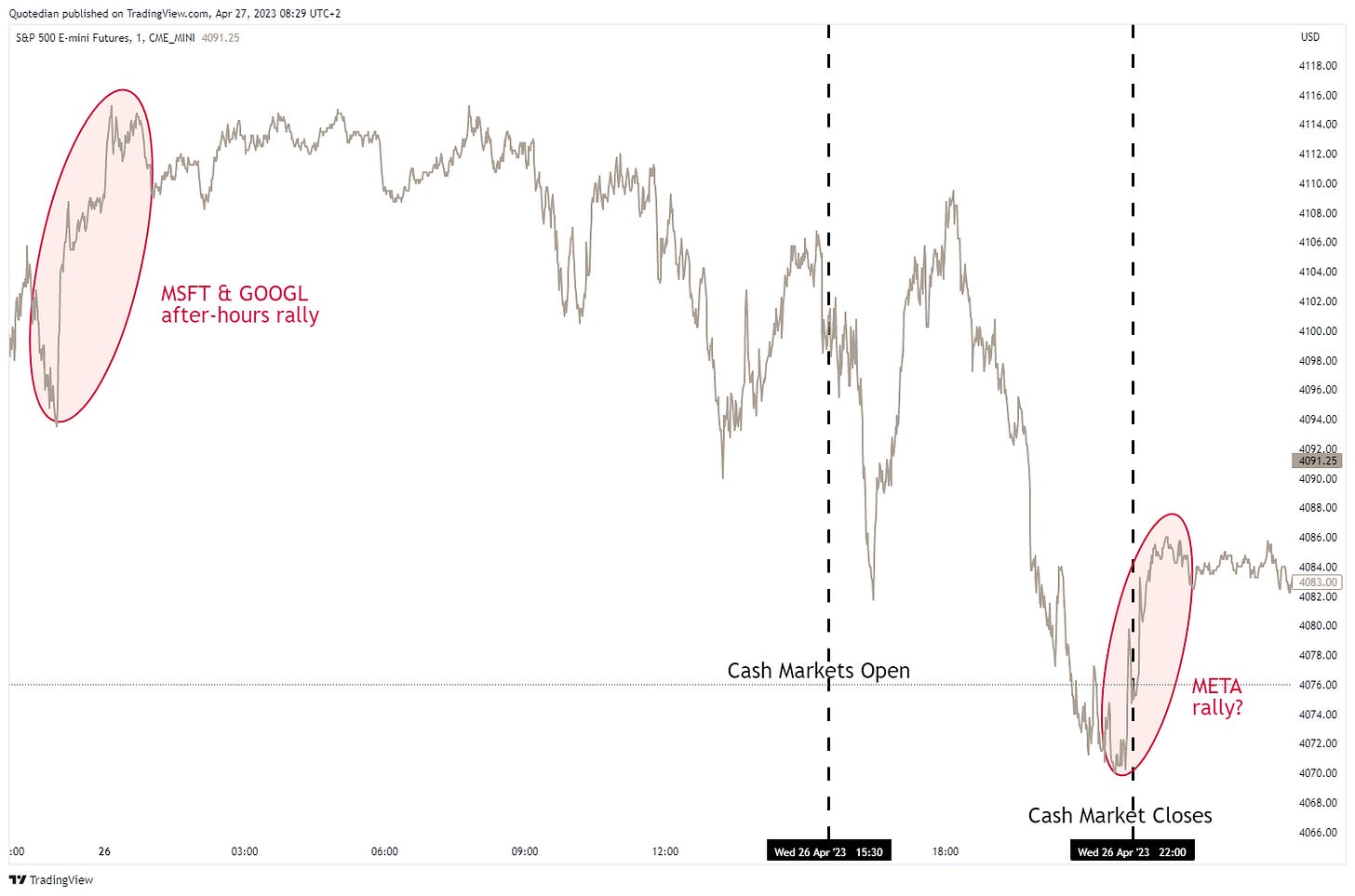

As suspected, did yesterday’s early gains seen in US equity futures, backed by strong earnings from Microsoft and Alphabet, start fading once the cash markets opened. Here’s the (futures) intraday action on the S&P 500 for example:

Meta (formerly known as Facebook) surprised with positive earnings after market close, and a 12%+ rally in their share price help left spirits and futures again a tad.

Out of a wide choice of US equity indices, only the Nasdaq eked out a gain,

meaning that breadth was horrible with four stocks down for every stock up on and leading to the only sector to show positive performance being tech,

and leaving us with a heat map on the S&P 500 clearly dominated by red, with the exception of some big tech names:

In other news, First Republic Bank (FRC), dropped further, reminding of us of the saying “What do you call a stock that is down 95%? Well, a stock that was down 90% and then lost another 50%” …

Asian markets showed once again surprising resilience, with most local indices printing green this Thursday morning. Seemingly they profit from the positive after-hours earnings releases in the US, or, maybe something else is at work?

European index futures are somewhat lower about 20 minutes before opening of cash trading.

The good old Quotedian, now powered by Neue Privat Bank AG

Once again I am running out of time, so let me skip fixed income and currency comments, where very little movement has taken place over the past few hours. This could change over the coming 36 hours, especially on the FI side, as we expect some US GDP data today (see agenda above) and inflation data (PCE) tomorrow.

Maybe to finish off today’s letter (make sure not to miss the COTD though), it is worthwhile mentioning that commodities took a second consecutive one percent plus hit yesterday, expanding losses to about five percent since the peak a little over a week ago,

driven mainly be a sell-off in the energy segment:

Time to hit the send button - have a great day!

André

In line with today’s theme of the Chart of the Day, did you know that NPB Neue Privat Bank AG can offer you a wide range of Digital Asset Banking Services, including Wallets for your Cryptos? Interested? Contact us!

CHART OF THE DAY

In today’s attempt at Tasseography precise interpretation of chart patterns, we look at the daily candle chart of the Nasdaq Crypto Index. The what?! Exactly, the Nasdaq Crypto Index. This index was created to provide investors a reliable and dynamic crypto asset benchmark. A key feature of the NCI’s™ methodology, designed to ensure the index is appropriate for professional investors, is a quarterly rebalance of the index constituents and its weightings (click here for more).

The current weighting is about two-thirds Bitcoin, 30% Ethereum and with the rest being made up of eight Altcoins :

And now to our osteomancy …

After the crypto ice age from November 2021 to September 2022, cryptos had gone into a peaceful hibernation mode. Recently, a global banking crisis seems to have rattled cryptos out of their winter sleep in the … well… “crypt”. The chart below suggests, that after breaking above resistance (black dotted) which then subsequently and successfully tested as new support (rightmost grey arrow), digital currencies could be turning higher again. This is further supported by the rebound on the 50-day moving average (grey line and rightmost circle) and the MACD (lower clip), which seems to be ready to give a BUY cross-signal at a higher level than the previous two.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

Thats a great quote🤣🔝