The Boot Drops

The Quotedian - Volume V, Issue 99

"The market is better at predicting the news than the news is at predicting the market."

— Gerald M. Loeb

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Housekeeping:

I will be 'on leave’ over the coming four weeks, but don’t despair! My objective is to still write The Quotedian, albeit at a slower cadence. The objectives are a) to get two to three Quotedians out per week and b) to get them out during the morning hours. The normal schedule should restart around mid-August, with an exam reviewing the previous four weeks, just to keep you on your toes ;-P

Ok, so admittedly it is still very early in the earnings season with a mere 5% of companies in the S&P 500 having reported, though the earnings shoe boot everybody has been fearing to drop seems to have started falling. Let me give you just two examples:

Banking behemoth stopping its share-buyback program in order to bolster their capital is about all you need to know regarding ease of access to capital over the coming months.

Fastenal, a supply-chain company that provides “nuts n’ bolts”, has a share price that is very sensitive to the economic pulse, and I have used it in the past as “canary in the coal mine”. Reporting on Tuesday, they actually met analysts’ expectations, but gave a rather bleak forward guidance during their earnings call. It was enough for me to Tweet out the following yesterday:

Which of course reminds me to remind you to follow @TheQuotedian on Twitter for intraday updates and (mostly) original content.

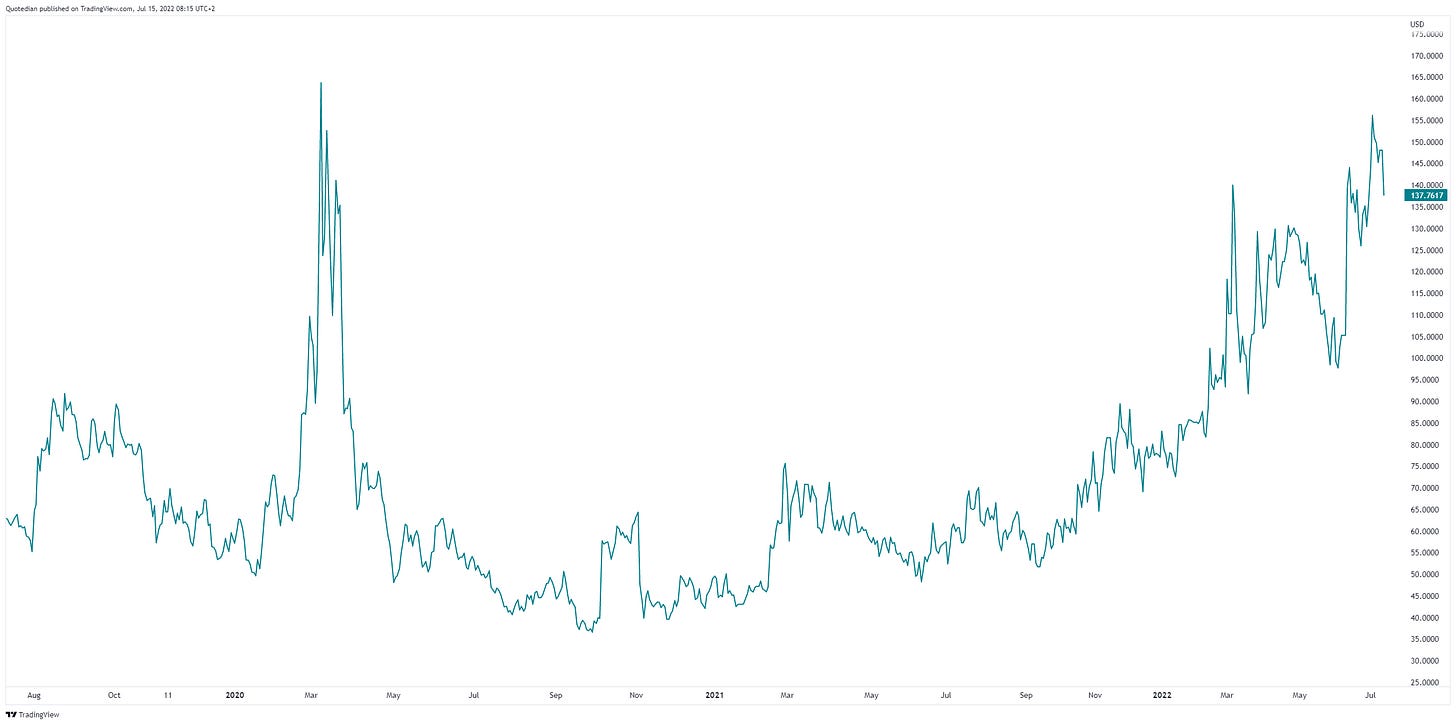

Anyway, the stock market itself can basically be split into two sessions: Session one saw stocks head lower on a higher inflation forecast coming out of the EU (7.6% in ‘22 and 4% in ‘23, both well above the two per cent target) and a higher the highest ever PPI final demand (11.3) reading coming out of the US. Admittedly, this time series is a rather new one (2011ish), but taking unfiltered PPI gives an idea:

The second part of the session was then the gradual (and miraculous) recovery of stocks, accelerating somewhat after Fed Governors Waller and Bullard came to the rescue, both essentially saying they preferred a 75 bp rate hike (as opposed to the full one per cent) at the July meeting in a bit less than two weeks.

Anyway, market internals leave no doubt it was not an easy session for stocks, despite the cosmetic applied over the headline closing number. Only two sectors (Technology, Staples) were positive on the day and the following heat map illustrates that more stocks were down than up during the session:

This is then also reflected in Asian equity markets this morning, with losing indices outnumbering the indices showing gains. Western index futures however remain stubbornly in positive territory. This leads to one final observation on the equity side: Stocks that fail to go down on bad news are a ‘warning’ sign …

Bonds had a relatively quite session compared to recent past, with the Tens for example trading in a ‘tight’ five basis points range. This is also reflected in the VIX-equivalent for bonds, the MOVE, which is off its highs:

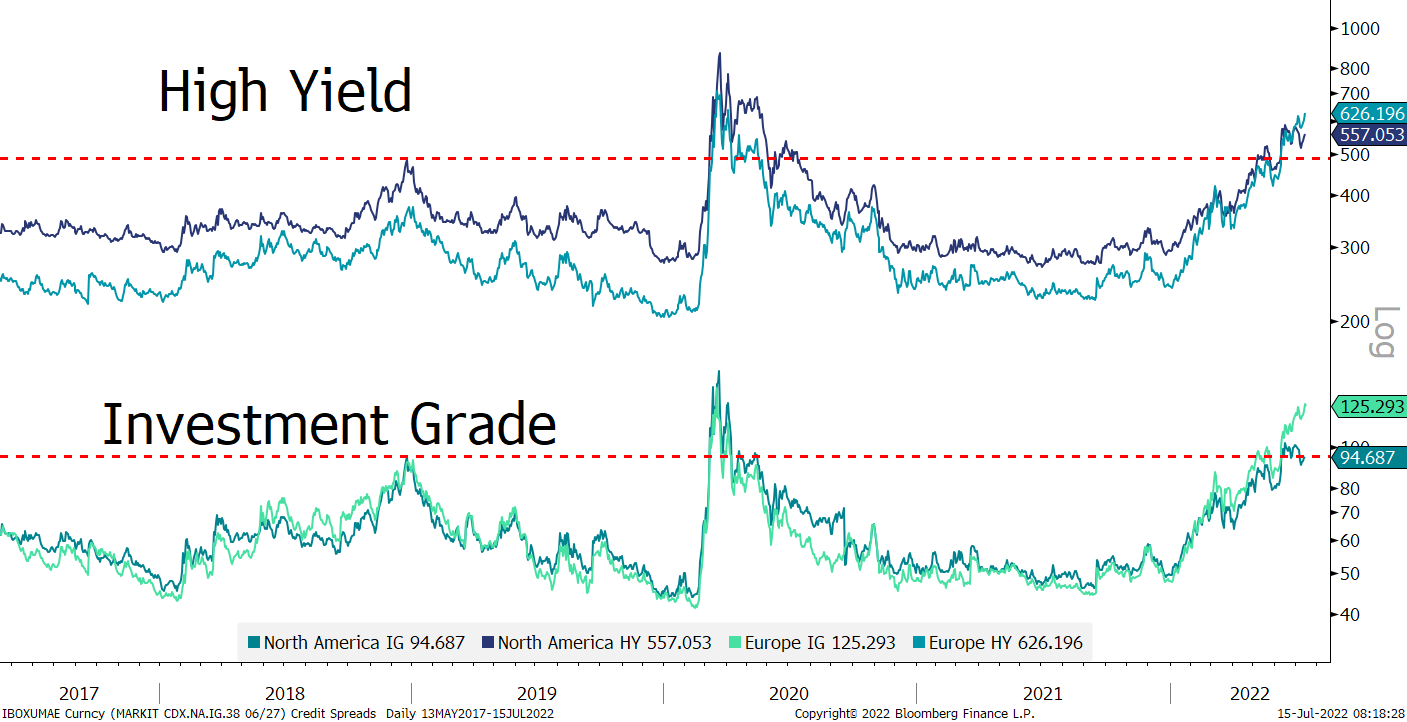

IG and HY credit spreads in Europe and the US however show little signs of relaxation, as investors continue to byte their fingernails going into earnings season:

Currencies in general and the US Dollar, in particular, continue to be the focus of macro mavens. The Dollar Index (DXY) trades at its highest since 2002 as its two most important components (approx 65%), the Euro and the Japanese Yen, continue to fall out of bed.

The USD/JPY cross reached its highest at around 139.50 yesterday

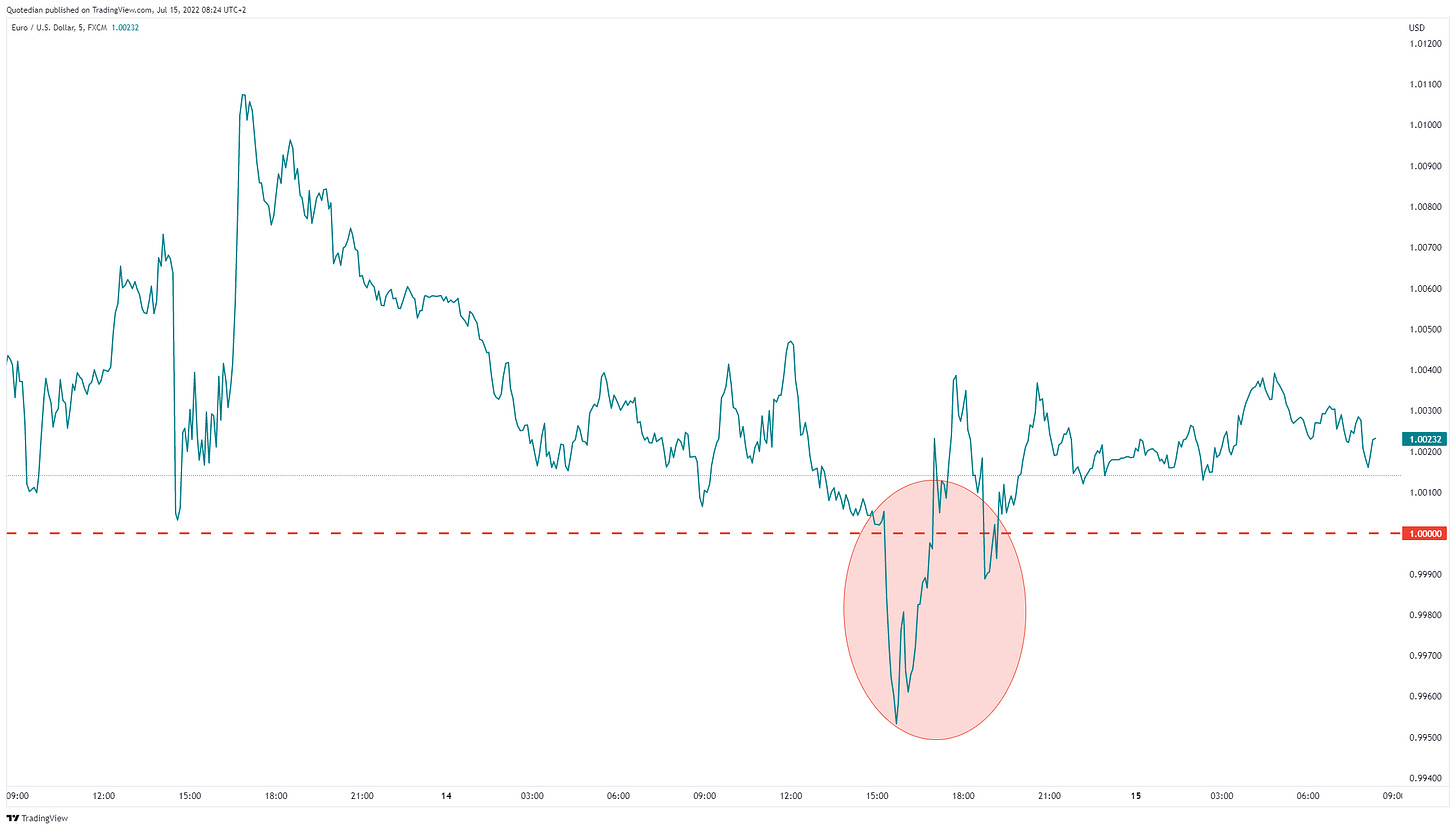

whilst the Euro traded cheaper than the US Dollar for a brief period of time before recovering:

Careful, spoiler alert: I think it is pretty safe to assume that this is not the last time we traded below par on that currency pair.

Yesterday I babbled so long about inflation, bonds et al that we wound up without sufficient time and space to look at the commodity pocket. So let’s have a bit a closer look there today, starting by asking two questions:

Would it surprise you to find out that crude oil yesterday briefly traded below the level seen at the start of the Russian invasion of Ukraine?

Yes, me too.

Does it feel like you're paying February prices at the pump again?

No, to me neither…

This raises a suspicion … let’s have a look at all major commodity ‘sectors’ and their respective performance since the day before the invasion:

Aha! Suspicion confirmed. Which then leads us to check one more thing - the inner workings (performance) of the only positive commodity since February - Energy:

In conclusion, it seems to be a refinery issue more than anything else. Hhmmm…

Time to hit the send button! To all of you a nice weekend and for those leaving on a summer holiday break: safe travels!

CHART OF THE DAY

ENJOY SUMMER…

LIKES N’ DISLIKES

Likes and Dislikes are not investment recommendations!

Long China equity (FXI) / short India equity (PIN)

Energy stocks (XLE); 1/2 usual position size

Long some Gold (direct or via short puts)

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance