The One Earnings Report to Rule Them All

Vol VII, Issue 29 | Powered by NPB Neue Privat Bank AG

“Bad days are good days in disguise”

— Christopher Reeves

Unless you have been living under a rock, you MUST have heard already of our new TOTALLY FREE newsletter - The QuiCQ! Tuesday through Friday, every day, market data + a brief comment + a chart of the day. Sign up fast!!! We will close the list at one million subscribers ;-)

Today’s letter will be a bit shorter, because normally I start typing over the weekend, which was a complete no-go this time around, with this view from my balcony from Friday to Sunday, 12 am to 2 am non-stop:

As today’s title would give away, and however incredelous this seems, the market’s main focus this week is indeed just all about NVIDIA’s earnings release due on Wednesday after market close:

As the arrow indicates, close to 65 cents per share are expected by analysts. Seven times out of the last eight earnings reports NVDA was able to beat those expectations:

Could another beat lead active managers to finally reduce their underweight (yes, underweight!!!) to NVDA?

But, let’s go back to last week for a moment, because Fed Chair Powell’s speech at the central banker paid vacation symposium at Jackson Hole was actually even more dovish than expected.

In his prepared speech, Powell stated that:

Listen to the most important comments by clicking on the image below:

The market reaction was according to the playbook:

Yields dropped,

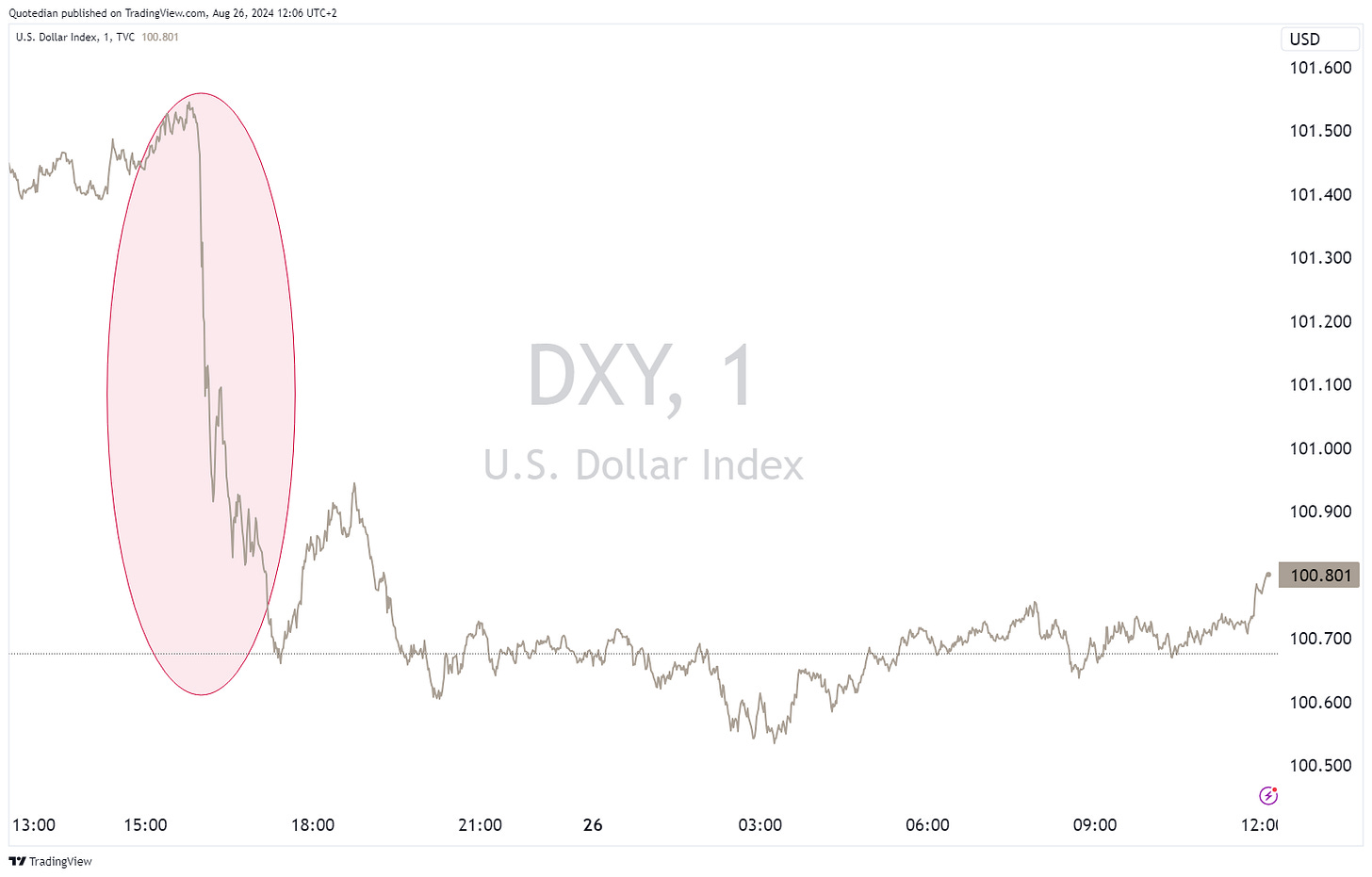

so did the US Dollar,

and stocks rose,

The lift on the S&P 500 (up 1.15% on the day) was enough to make the index close at its highest weekly close … EVER:

But the real stars of Friday’s session were small cap stocks, with the Russell 2000 closing up over three percent on the session:

The weekly chart on the same index is producing potentially interesting evidence of a start to a new bull run:

The RSI in the lower clip above has ‘failed’ to drop below 50 during the past few corrections. More often than not this is sign of internal strength building up, with a strong resolution to the upside. A multi-month bull run may be getting underway in small cap stocks … finally!

European stocks had a good week to and the broad STOXX 600 index is now less than 1.5% away from a new ATH:

In Japan, the Nikkei is consolidating around 38,000, which seems to be an important bifurcation zone:

Hong Kong’s Hang Seng index suddenly looks very constructive:

Maybe worth a (trading) buy?

Or maybe go even more aggressive and ‘play’ it via the Hang Seng China Enterprise Index:

Though the beta is only about 1.1

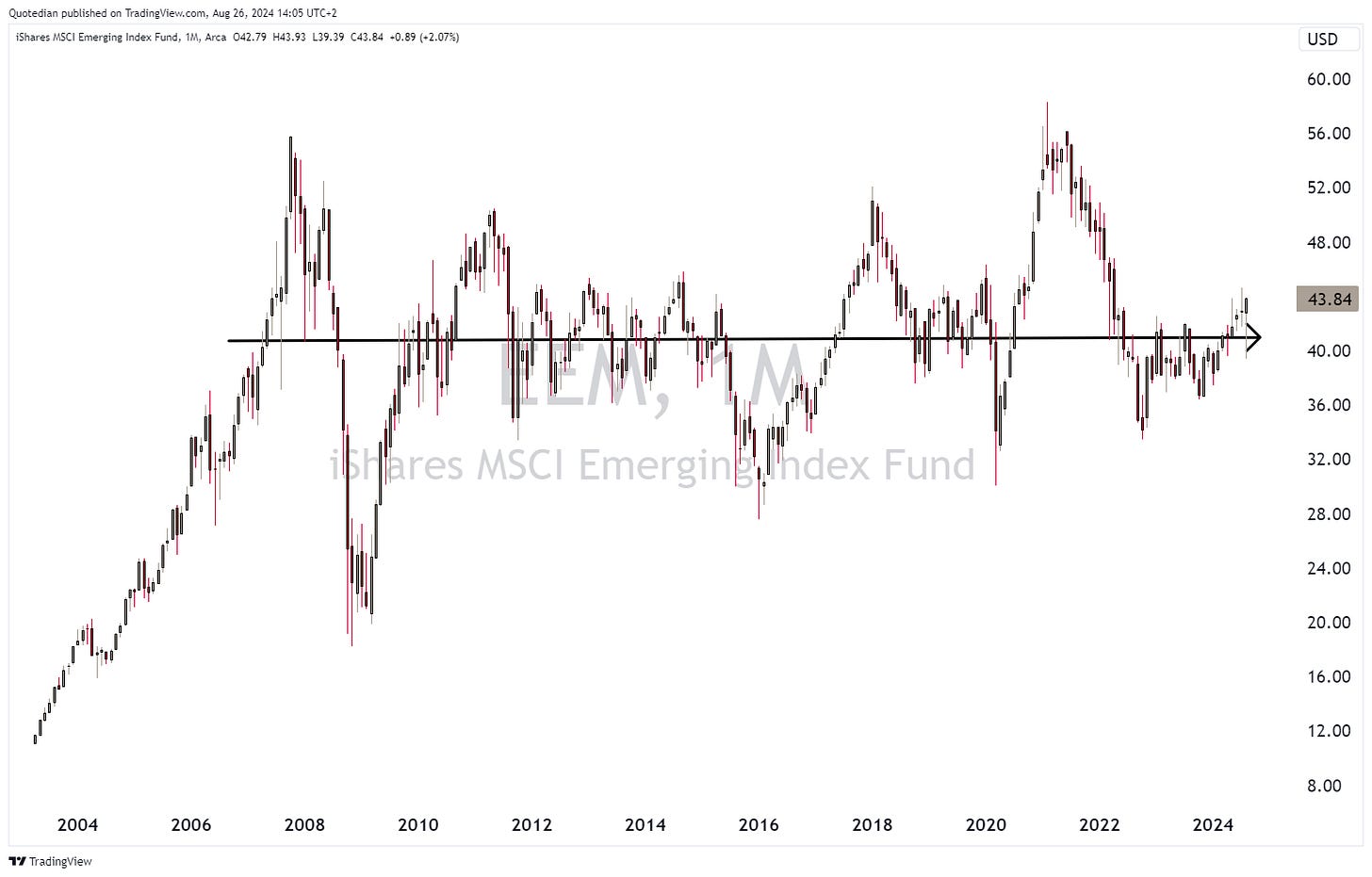

And as we are closing in on China, let’s talk emerging markets. Here’s the EEM (iShares Emerging Markets ETF), which makes the case in point that one cannot simply just be overweight EM - the question to ask is which EM, as as a whole, it has gone nowhere to past nearly 20 years:

Zooming in on the same chart, it feels like the uptrend is accelerating now:

And if we switch to the iShares Emerging Market ex-China ETF (EMXC), we suddenly realize that EMs are scratching at their previous highs:

Two EM markets I have been looking at more closely, are Taiwan’s TAIEX,

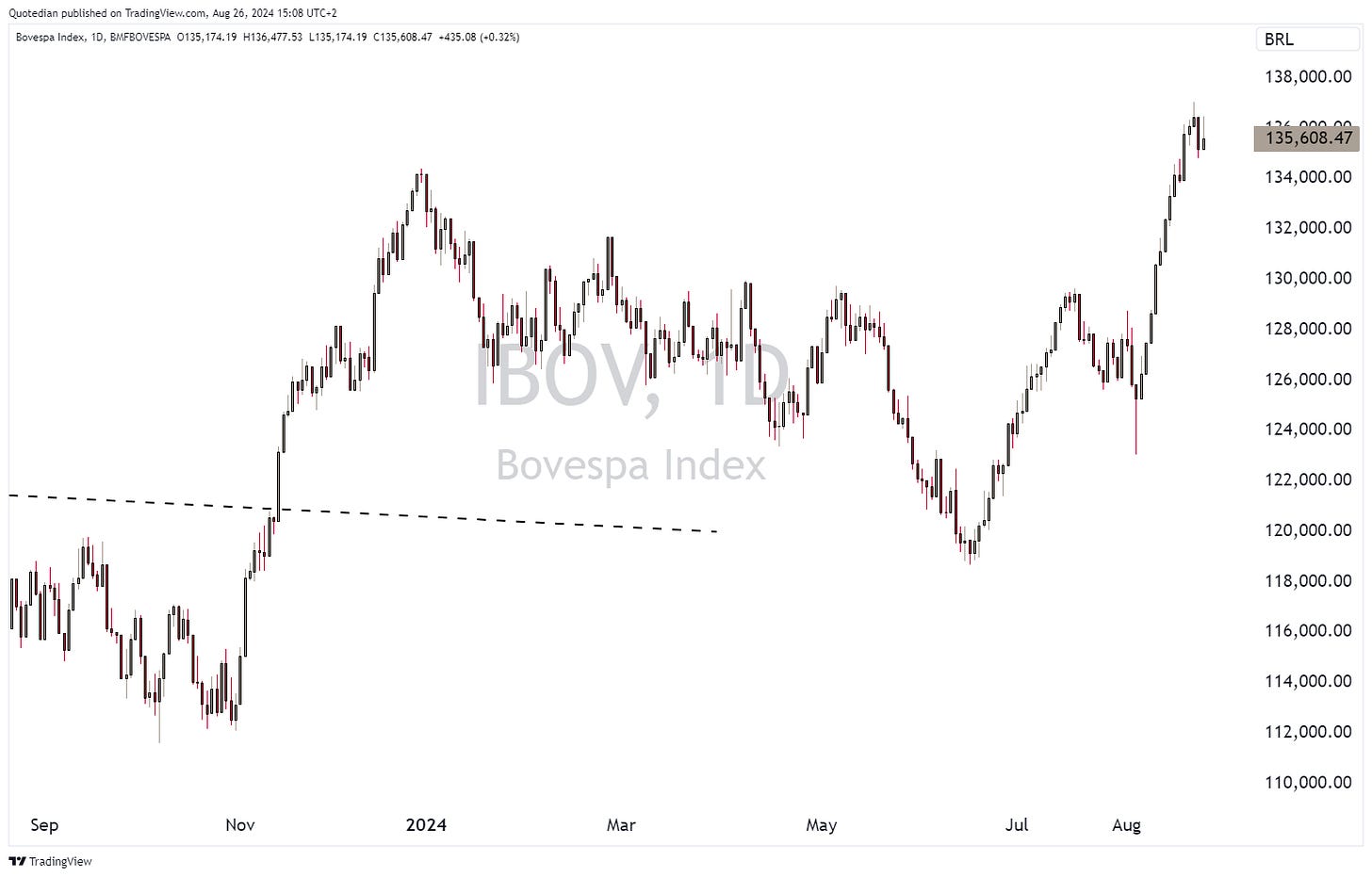

and Brazil’s BOVESPA:

The latter may have run most of its (bull) course already now, especially if the Brazilian CB is indeed to increase policy interest rates, but in case of the Taiex, the second leg higher may still lay ahead.

On the bond side of things, and as outlined at the beginning of today’s letter, yields dropped (prices rose) after über-dove Powell speech on Friday. The US 10-year treasury yield is at key support and looks like it will break lower:

Yields at the short-end are dropping even faster, provoking the yield curve inversion is now nearly undone:

The inverted shoulder-head-shoulder pattern we spoke about last week has now been triggered, setting the stage of a 10% rally in corporate investment grade bonds:

And also as highlighted last week, high yield bonds (HYG) decided to march higher already a few weeks ago:

US rate cut expectations (grey line) have also gone up again after Friday’s Jackson Hole event:

Though I find five cuts until year end a bit ambitious, as it would represent 125 basis points, some whispers can be heard on a 50 bps cut in September. This Bloomberg analyst put it well:

The US Dollar then in currency markets is falling victim to an increased number of expected rate cuts. Here’s the USD Index (DXY):

That 100.80 key support is being challenged as I type (and you read).

On the EUR/USD chart that translates into the currency pair trading just below 1.1200:

USD/JPY is getting hammered again too, though this time around it seems to be more Dollar weakness than Yen strength:

Looking at the USD/CHF chart, we can imagine that the Swiss National Bank (SNB) is getting nervous again:

And finally, the GBP is trading at its highest in over two years versus the greenback:

Gold is trading at a new ATH today:

And I really hope you took our advice “buy silver for a catch-up rally” below $27 three weeks ago seriously:

And as a last chart for today, we note that oil is suddenly five bucks higher again:

Unfortunately, time has come to hit the send button, so without further ado,

No, not that buy (well, too), but Goodbye:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance