The Other Ceiling

The Quotedian - Vol VI, Issue 36 | Powered by NPB Neue Privat Bank AG

“There is a bear market in political leadership”

— Thomas Thornton

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

** Housekeeping **

Still trying to find back to the daily format, this week has been truncated by travel and early morning meetings. Daily but short notes dominated by nice, pretty, colourful pictures (aka charts) will be the new format starting next week.

Is there something you absolutely do not want to miss in that new format? Is there something you would hate to continue to see? Things you always missed? Any other valuable feedback? Please comment below:

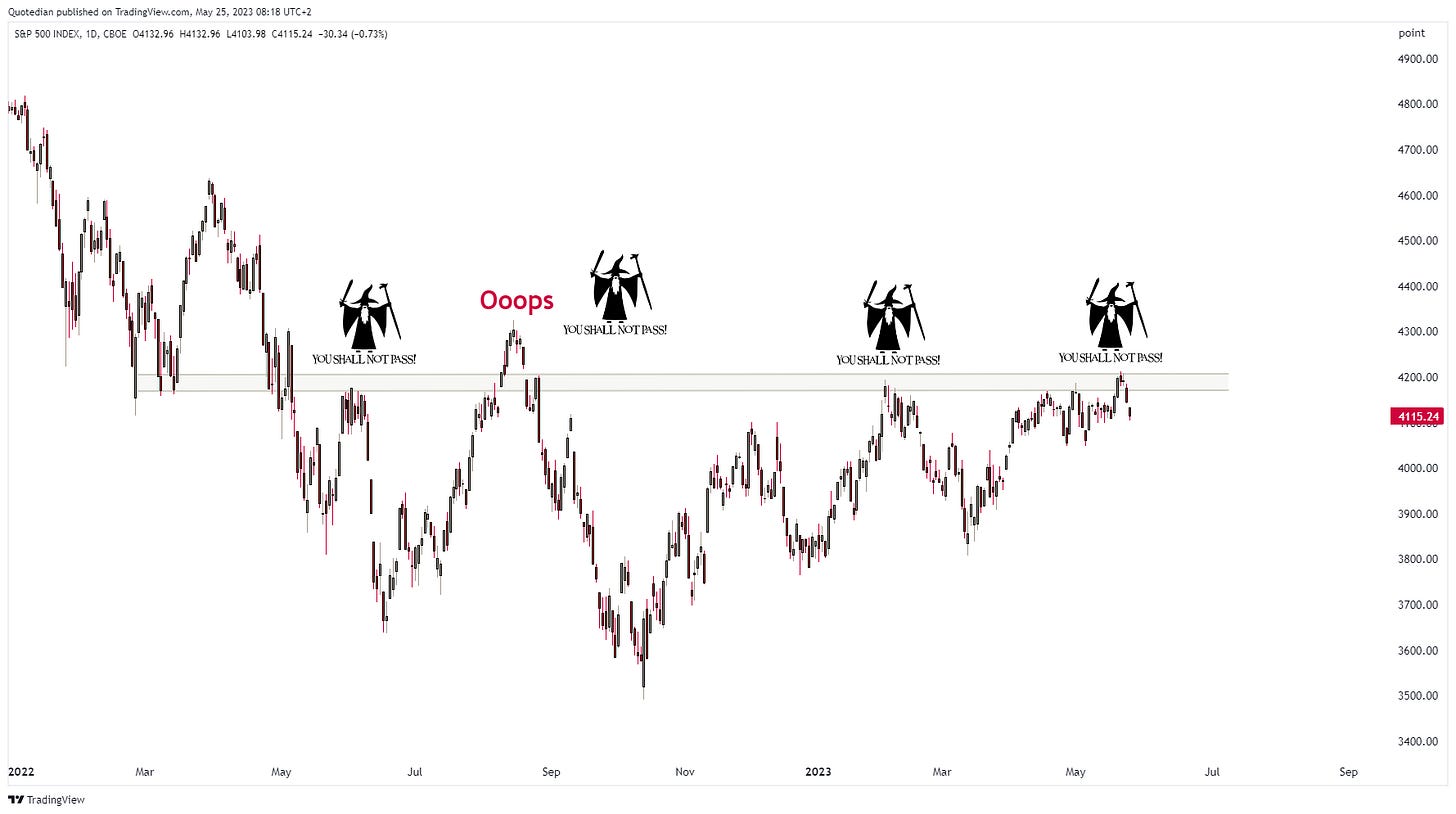

Whilst we have been focusing a lot of our attention on the US debt-ceiling in The Quotedian over the past few weeks, there is of course the other ceiling that does not surmountable right now. Yes, of course, I refer to 4,200 on the S&P 500:

Let’s have a turbo-charged look at some “stuff” from yesterday …

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

A consecutive third, weak session for US stocks, now also joined by their European cousins. Breadth was very negative on both sides of the pond with losers outpacing winners at a ratio of five to one.

Here’s the European heatmap for example:

The two percent drop in LVMH stands out above, and I think the following chart is worth showing on the occasion:

Many market observers commented that the China post-COVID reopening did not really have effect on the global economy as expected. Perhaps. But it definitely impacted LVMH, as to be judged by the accelerated rally since January. However, the Citigroup Economic Surprise Index (CESI) for China (grey line) has recently been dropping fast and furious, and has now started to drag the share price of LVMH (red line) lower too.

Here’s the S&P500’s heatmap from yesterday too for completeness purposes:

Of course, was the big (corporate) news after market close the earnings report from NVIDIA, where an AI-fueled forecast shattered all expectations and is pushing the stock 25% higher afterhours.

I will say it again, NVDA is one of my favourite companies and I’ve held it successfully on many occasion in the past.

BUT

at 35x price/sales, you can have it - I will not.

Asian markets are largely lower this morning, as are European index futures. US futures are mixed, with a big up registered for the Nasdaq, courtesy of the 25% jump in NVDA (which i think will fade later today).

Fixed income markets were dominated by higher drifting yields yesterday, for three different reasons I can identify:

Fed Governer Waller said he “would support rate hikes in June and July. Decision hinges on data” and he is in the camp that June is not a “pause” but either a “skip” or a “hike”

If a debt-ceiling agreement is reached, the treasury would flood the market quite immediately with a lot of new issues, and more offer means lower prices (higher yields)

and, last but not least, here’s three:

nuff’ said.

Last minute news just hit my inbox too:

Ah, it’s all so much fun.

Little to report on the FX side of things, where the US Dollar continues to strengthen in the face of a possible ratings downgrade, probably on the back of its current (still) status as safe haven:

As time has come to hit the send button, let me just finish of with a remark on oil, where the comments from the Saudi Energy Minister on Tuesday telling speculators who are betting against the price of oil to "watch out" and "I keep advising them that they will be ouching" helped to rally prices, it is not just the Saudi's that are keeping a lid on supply. Recent data shows that the US crude oil rig count fell to the lowest since last June.

I remain bullish.

Once again, please help to form the future of your future, daily Quotedian (long-form weekend issues will remain the same), by leaving your feedback in the comment section:

Have a great Thursday.

André

CHART OF THE DAY

A reminder.

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance