The Same?

The Quotedian - Vol VI, Issue 43 | Powered by NPB Neue Privat Bank AG

“We all come from the same root, but the leaves are all different”

— John Fire Lame Deer

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Short, time-pressed market comment section today, but before we start, a big thank you for all your proactive and constructive feedback provided after yesterday’s Quotedian. Most of you are pretty happy with the current format, specifically also with the layout and content of the dashboard, and ALL of you (who cared to vote) seem eye-wateringly agree that we are going back to the daily format:

So, thanks to all and on with the show!

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

In a nutshell, yesterday’s session was dominated by inflation readings out of the UK and a hawkish tone from Fed Boss Jerome Powell during a testimony given. In case of the former, Core CPI jumped to 7.1% versus 6.8% expected and 6.8% prior reading. This is turn pushed UK 2-year treasury gilts on an intraday basis to their highest since … drumroll …. extended drumroll … 2008!

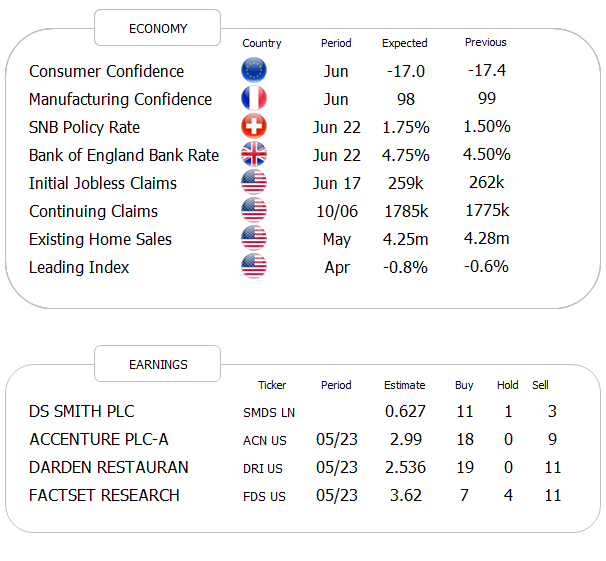

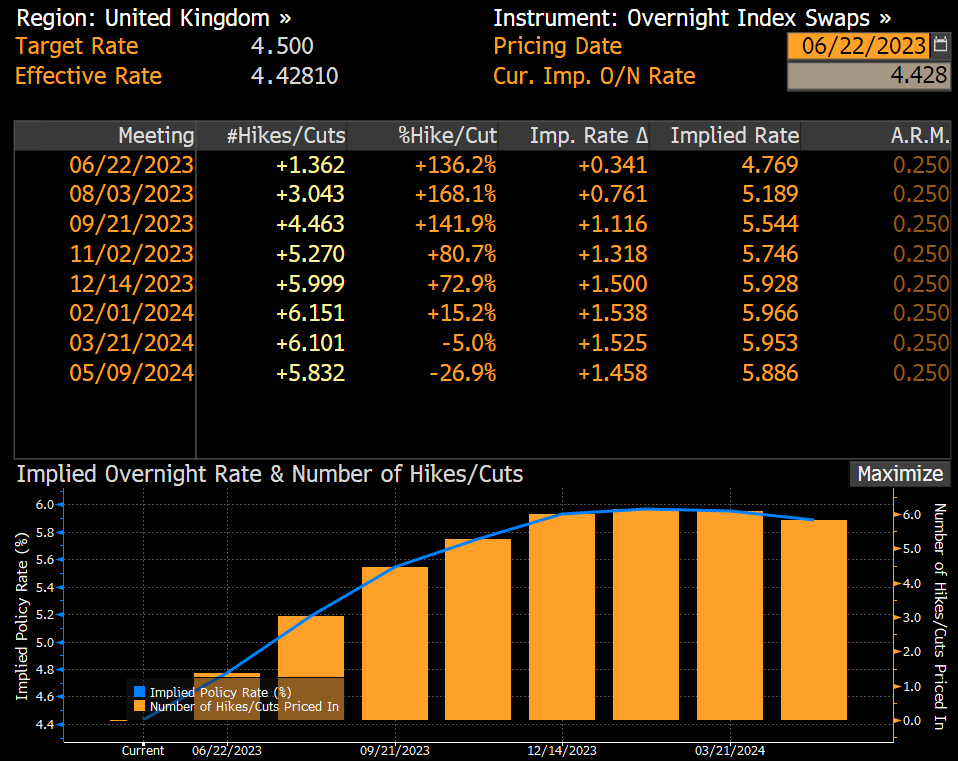

This leaves with the BoE probably with no other possibility than to raise interest rates by at least 25 basis points today. And if I interpret the data right, there is even a 30%+ chance for a 50bp hike:

And I would dare to ask, why not rise by 300 basis points and try to get that inflation stagflation monster under control?

Anyhow, later yesterday afternoon Fed Chair Powell appeared before the House Financial Services Panel and had a few hawkish comments for market participants:

“2 more rate hikes are likely this year”

“don't use the term "pause"

“it will take a long time to bring down inflation”

were only a few of the gems he dropped.

Bond yields reacted, as could be expected, by rising during the testimony (black arrow) but then actually softened again after a pretty decent 20-year Treasury auction (red arrow):

But more importantly, the yield curve flattened further, with the 10-2 year version reaching (briefly) the 100bps spread level:

As my good friend Paul at the fantastic K2 alternative AM fund outlet points out, this only has happened on the previous occasions: 1) in March 2023 and 2) in 1981 when then Fed Chair Paul Volcker went to hike rates to 20%….

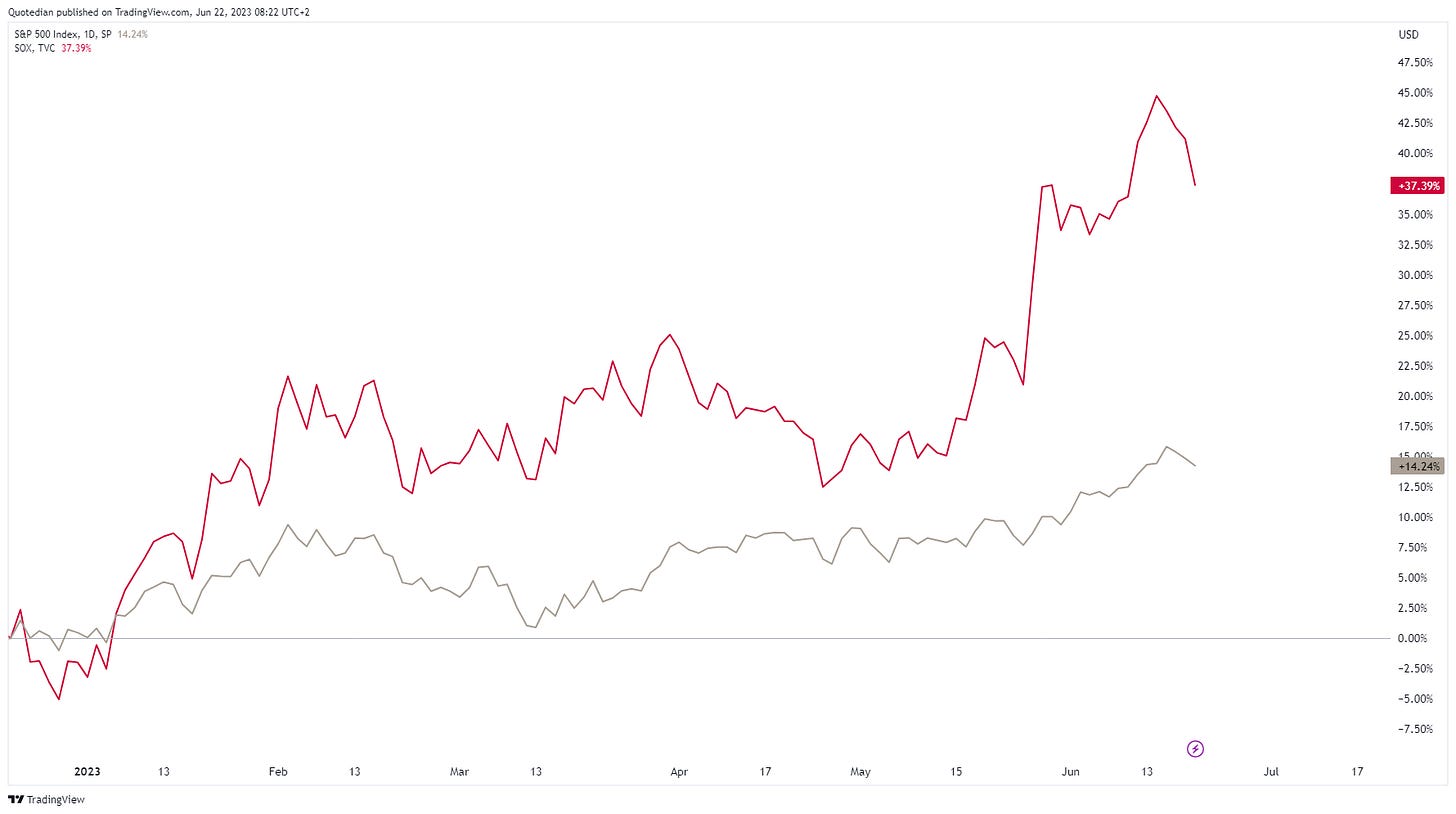

All of this fixed-income babble had net negative impact on US equities yesterday, with stocks dropping for a third consecutive day. What changed this time around is that longer duration assets correctly took the biggest ‘hit’, with the Nasdaq down 1.2%, the recently popular NY FANG+ index down 2.4% and semiconductor stocks (SOX) down 2.7%.

This is interesting, as the SOX undoubtfully has been leading the broader market higher since the beginning of the AI craze hype narrative at the start of this year:

Early days, but to be followed closely.

Interestingly enough also, despite the slightly larger drop on the S&P 500 than the previous day, breadth was actually substantially more positive, with the number of winners and losers being roughly equal:

Asian markets are mixed this morning, with the red color showing a slight dominance. Interestingly, but probably not surprisingly, the TOPIX in Japan is showing a positive print, whilst the more tech-heavy Nikkei 225 is down nearly one percent.

European index futures point to a rough start in about half an hour when cash trading opens.

I will skip currency observations altogether today, but would point out that in the infra-world between FX and commodities Bitcoin just boosted above the $30,000 level again:

Also, and don’t look now, Dutch Natural Gas (as European proxy) is up 60%-plus:

Today, watch out for central bank decisions from the SNB, the Norges Bank and of course, the Bank of England.

Also, uncle Jerome has a second testimony on the hill this afternoon.

Be safe,

André

CHART OF THE DAY

US equity earnings yield (red), US 3-months Treasury Bills (grey) and US investment grade corporate bond yields (blue) are all about the same (talking generously about earnings yields).

a) this does not happen to often and b) do these returns all come at the risk?

What a time to be alive!

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

https://twitter.com/macroalf/status/1671968725233180682?s=46&t=m9u2pb6un3Vguw5VeKQolg this has nothing to do with today's quotedian but i saw it and it reminded me of you🤣 who wants an asset manager when you have this and the inverse jim cramer etf🙄