The Trend is Your Friend

The Quotedian - Vol V, Issue 92

"It is better to remain silent and be thought a fool than to speak and to remove all doubt"

— Abraham Lincoln

DASHBOARD

CALENDAR

CROSS-ASSET DELIBERATIONS

As feared, there is little remarkable to report back from Monday’s session, as markets drifted aimlessly in the absence of any guidance from the US. The one thing really worthwhile knowing from yesterday is packed into the COTD section.

European shares jumped at the open, went on to trade sideways for the whole day and then started giving back gains towards the end of the session:

Energy stocks were the clear winners, whilst the real estate sector made the bottom of the performance table:

Global bond yields traded a tad firmer, as did the US Dollar and all is told from yesterday's ‘exciting’ session.

Taking an early look then at this beautiful, sunny Tuesday morning we see that the Australian Central Bank (RBA) has increased rates as expected, and the Aussie Dollar is in good old “buy the rumour, sell the fact” tradition a tad lower.

Asian equity markets and Western markets’ index futures are all trending up this morning, probably in a combination of better-than-expected Chinese Caixin Service and Composite PMIs

and the ‘hopes’ that the Biden administration may lift some Chinese tariffs soon in order to ease self-imposed inflationary pressures:

And just before we move into the promised “follow the trend” special, let me share this brilliant Tweet crossing my screen yesterday:

So, as suggested yesterday, let’s look at the prevailing trends of some of the major markets. We will do this by removing all price data from the charts, showing only the long-term trend indicator in the form of the 200-day moving average.

Starting with equities, the S&P 500 seems to be affronting its first serious bear market since the GFC in 2008/09:

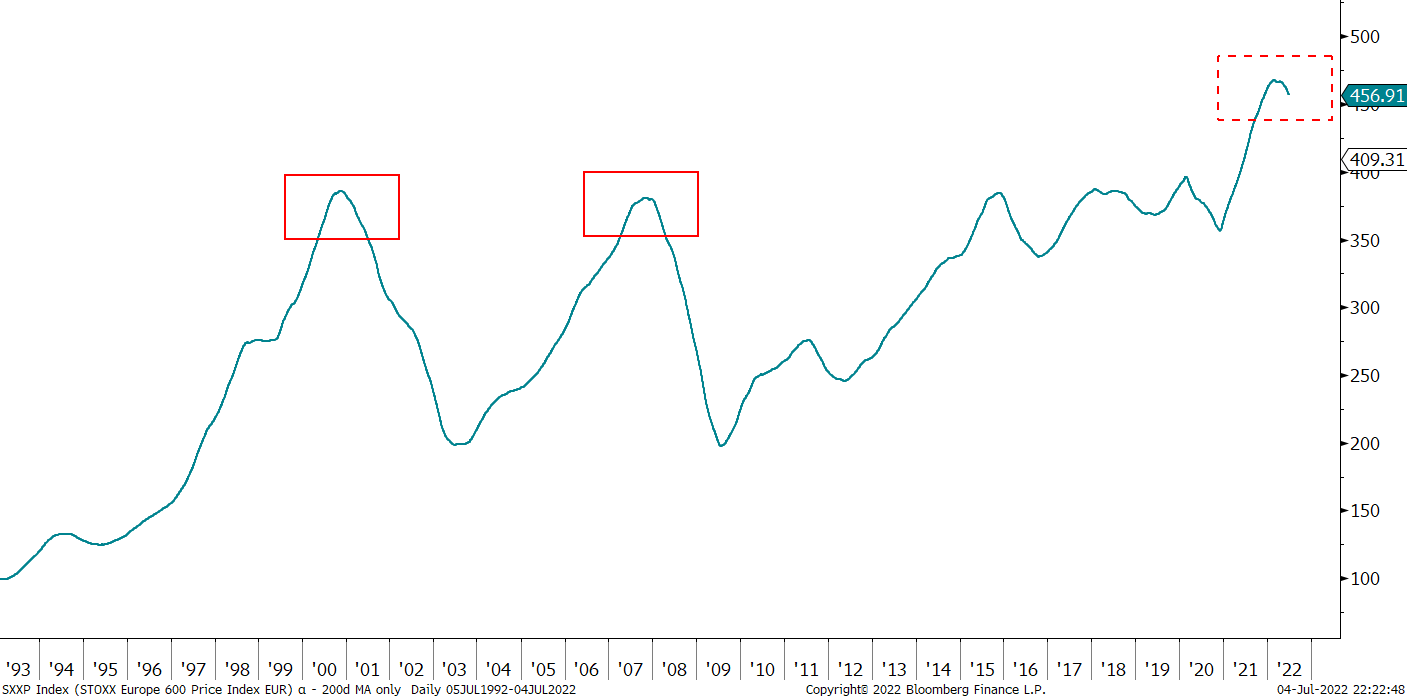

The uptrend for European stocks has been shorter, but is now also clearly rolling over:

However, under one of the many leitmotifs of the Quotedian, there is always a bull market somewhere. Energy stocks for example are not showing any fatigue from their uptrend:

And one trend that is possibly in its very early infancy, is the outperformance of Value stocks over growth stocks.

Ride it!

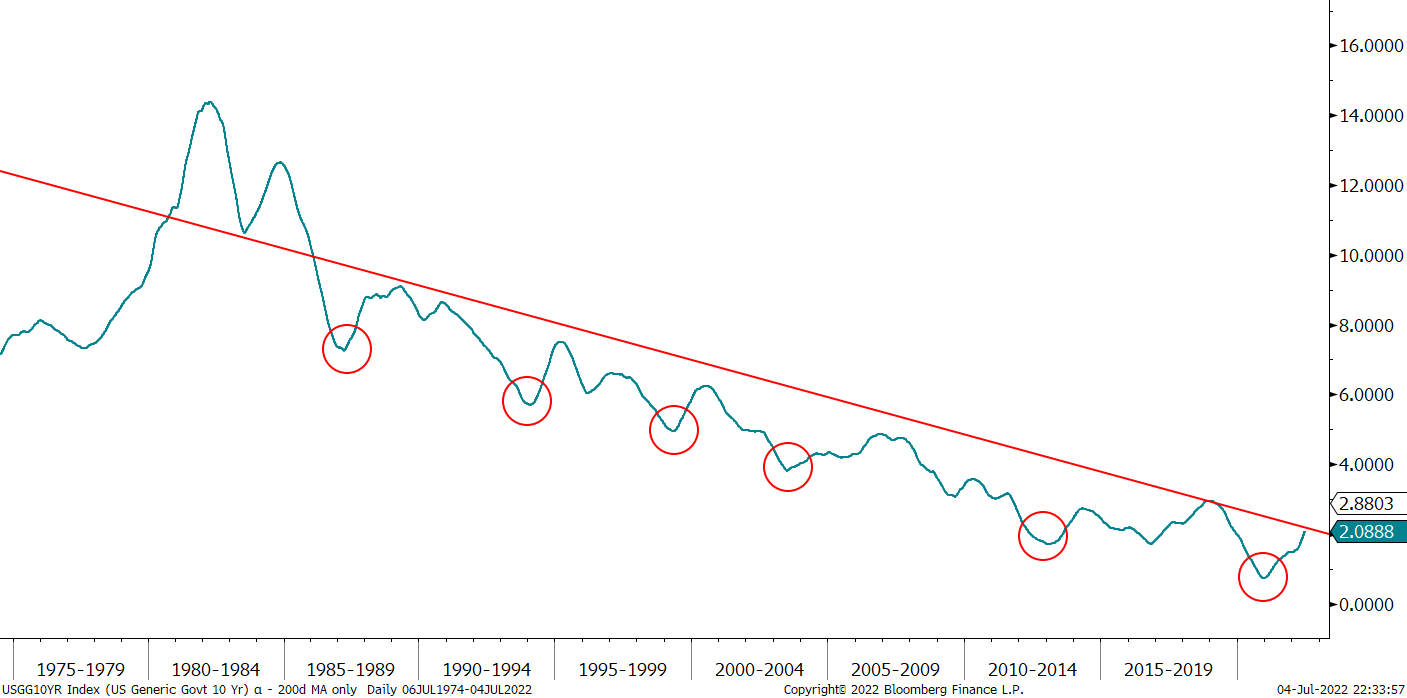

Another asset that has started an uptrend are bond yields, which of course means a downtrend for bond prices. However, given the multiple upturns over the past decades, it is probably more important to break the pattern of lower highs and lower lows, by moving above the red straight line:

A similar rule should be observed on the German Bund, for final confirmation of the end to the 40-year disinflationary trend:

Moving into currencies, the trend for the Dollar is up:

and to some logic, down to the EUR (versus the USD):

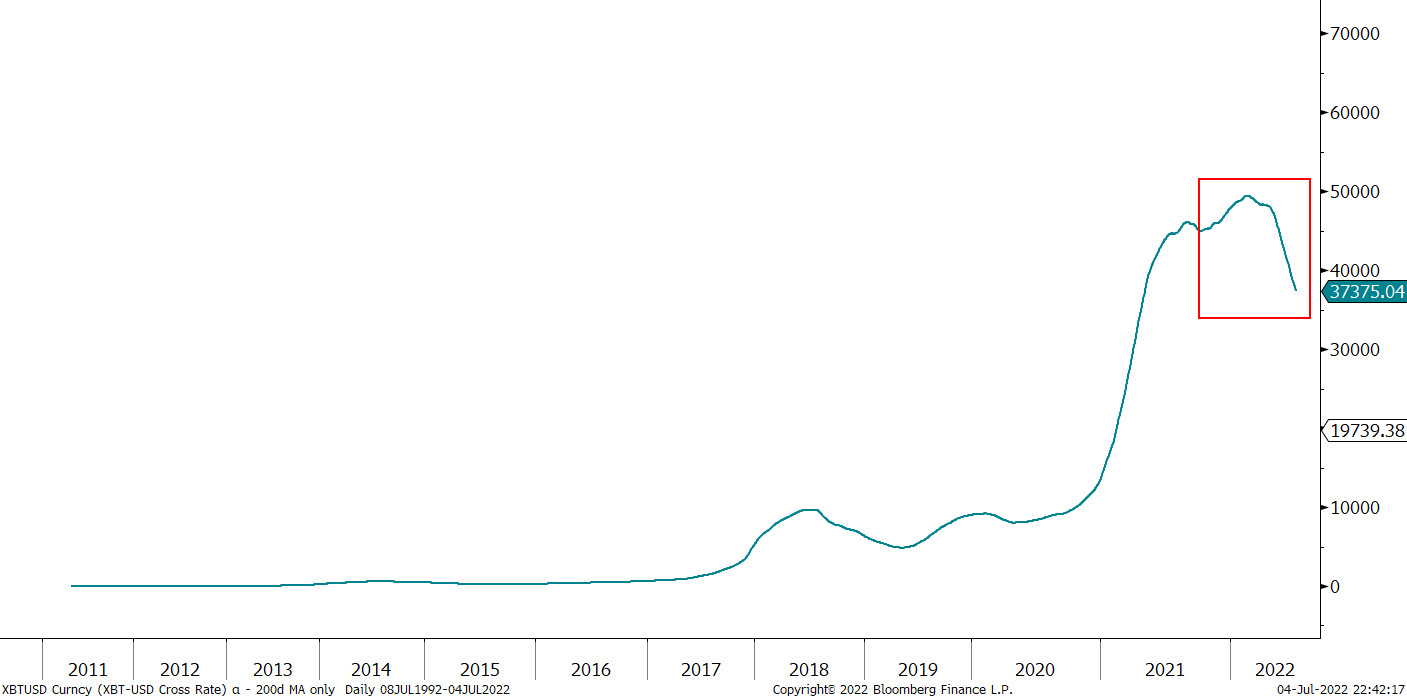

Cryptos, as represented by Bitcoin here, are in a clear freefall:

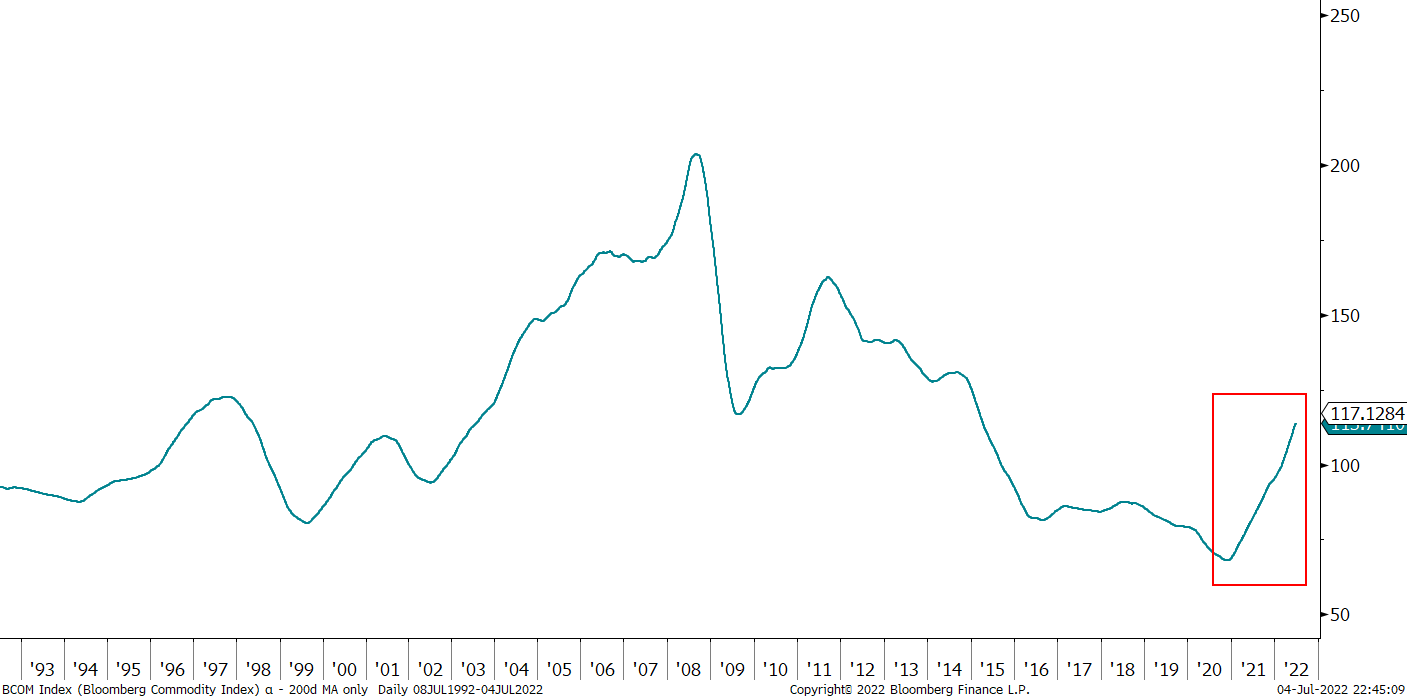

And finally, the whole commodity complex has moved into a sharp uptrend a bit over a year ago:

Of course are energy commodities (Brent below) exhibiting the strongest gravitational force on the commodities:

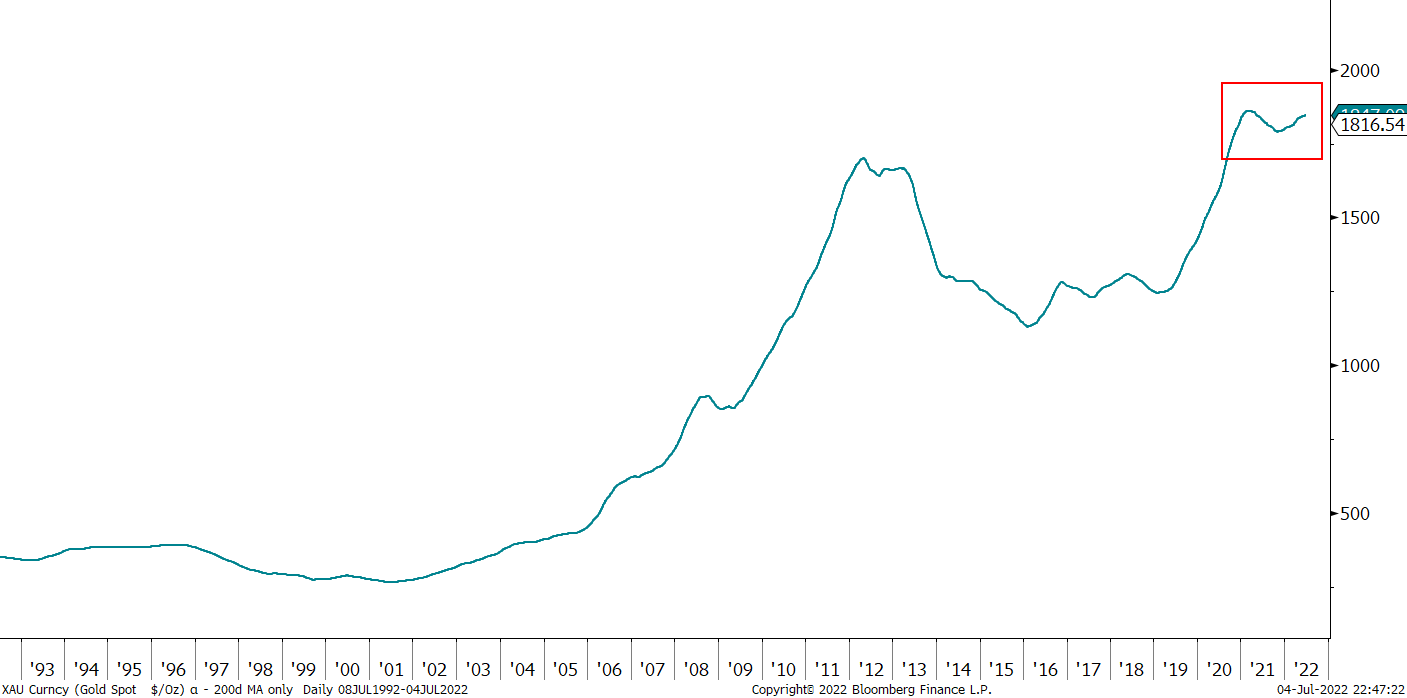

But maybe surprisingly is also Gold still in a bullish pattern:

Ok, enough for today. If you liked today’s approach to trend identification, why not share it:

And/or press the like button at the bottom of this mail. Also, always feel free to leave a comment in the comment section:

Time to hit the send button. Have a great Tuesday!

CHART OF THE DAY

If there is one thing you really, really need to know from yesterday’s session, it is this:

Germany reported its first trade deficit (-1.0bn) since 1991, which was on the back of the German reunification if I remember correctly.

Some would argue that it was the German surplus over the past decades that held the Euro up. We shall find out soon if there is anything to that theory …