This is the End (again)

Vol VIII, Issue 23 | Powered by NPB Neue Privat Bank AG

"If you want to be happy, be."

— Leo Tolstoy

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Today’s letter will be the last Quotedian before a summer recess … and a possible re-branding. With the letter in its eight year in the current form and the daily QuiCQ running as a separate product, I have been toying for a few weeks now with the thought of combining the two and inject some fresh blood into the layout and content.

I will take a final decision whilst sipping poolside a few cocktails …

In any case, you shall be back in late August, early September.

On to this week’s market deliberations!

In the context of “never short a dull market” the S&P 500 has eked out yet another weekly gain last week, reaching a new closing all-time high on Thursday:

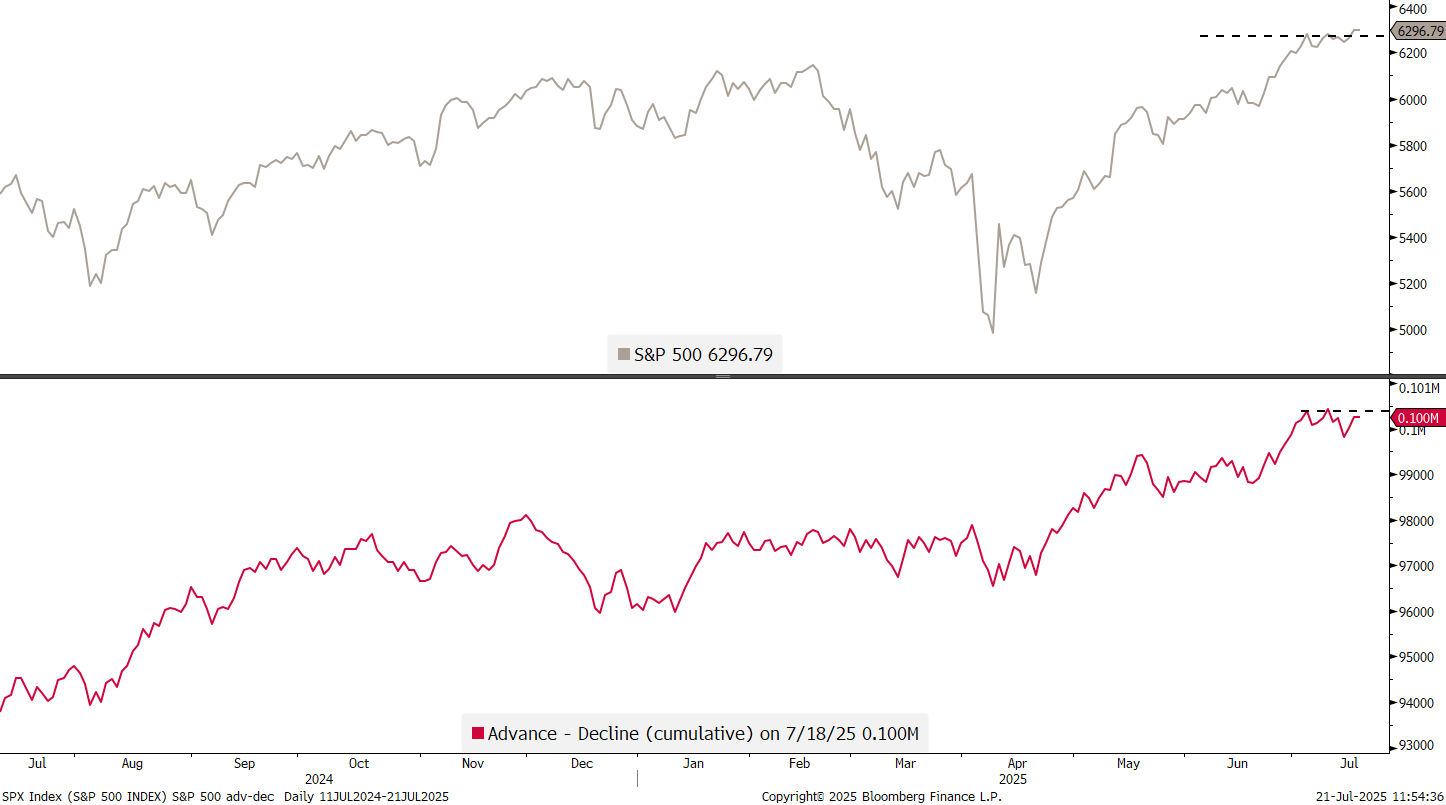

The haters of the rally, and there are many of them, point to the market breadth being thin and only a few, heavy-weight stocks are lifting the boat. And they have a point, as breadth (advancers minus decliners) has not yet made a new ATH:

And the weekly market heatmap indeed reveals that a lot of the heavy lifting is done by some of the mega-cap stocks:

HOWEVER, the S&P 500 is still at an all-time high - hate it or not - and just holding the index has made investors some serious money …

The same is true for those lucky people who are holding on to the Nasdaq 100:

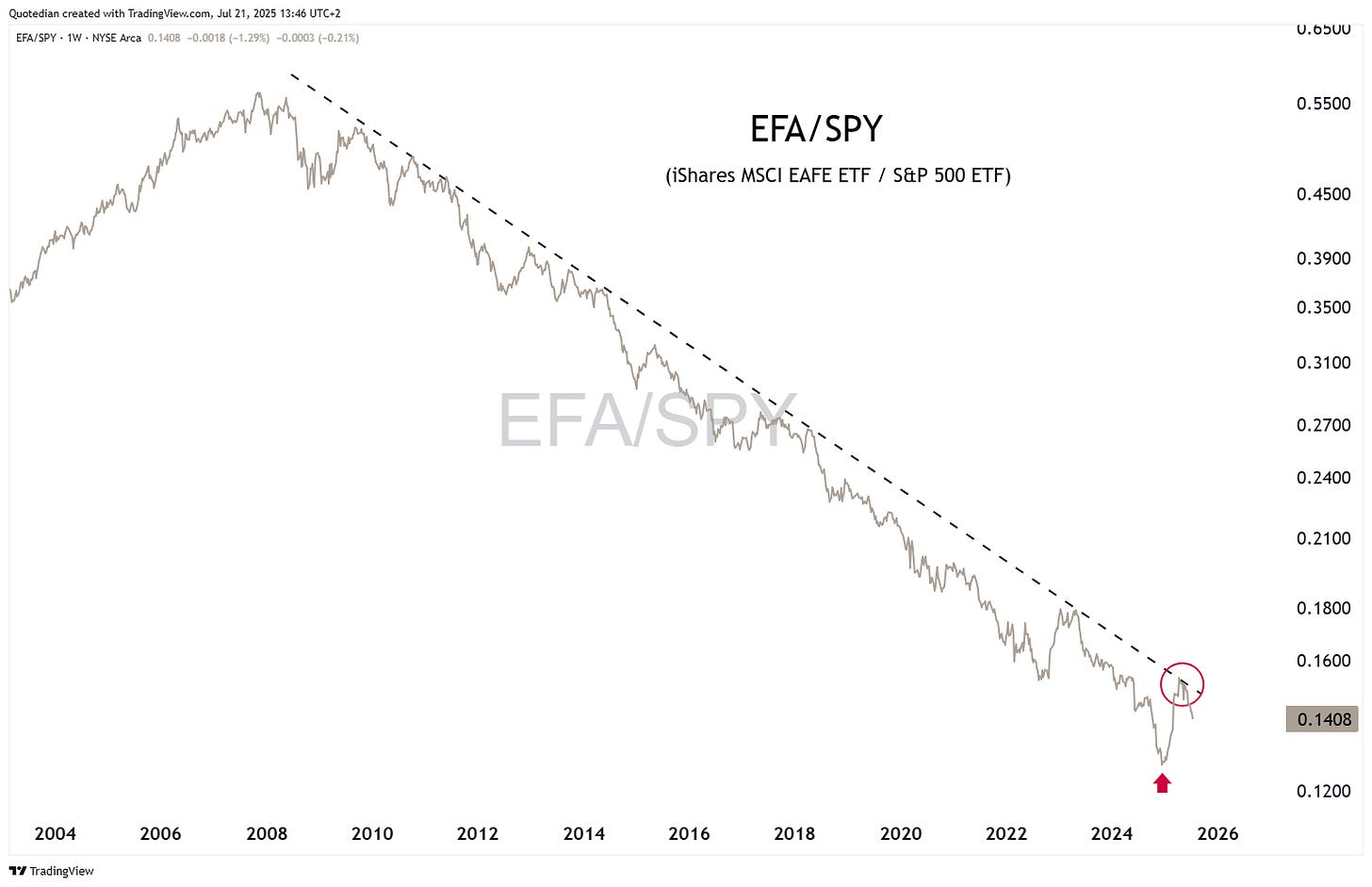

The outperformance attempt of World (ex-US) stocks has been stopped dead in its tracks, right at the level where it should have:

Sometime this charting voodoo stuff really works!

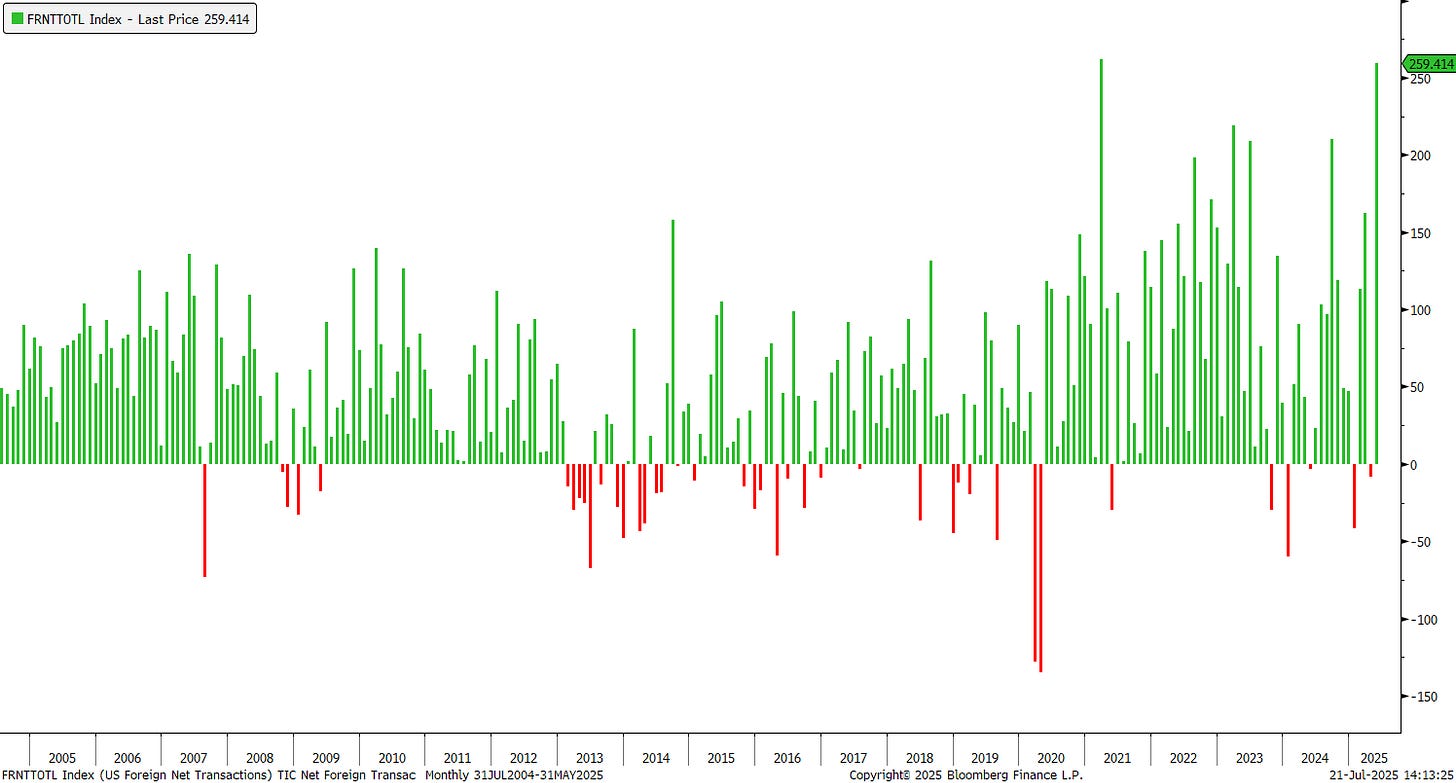

Staying with the US market a moment longer, the following chart of TIC data (updated through May 20025) shows that “Sell America” might be more bark than bite:

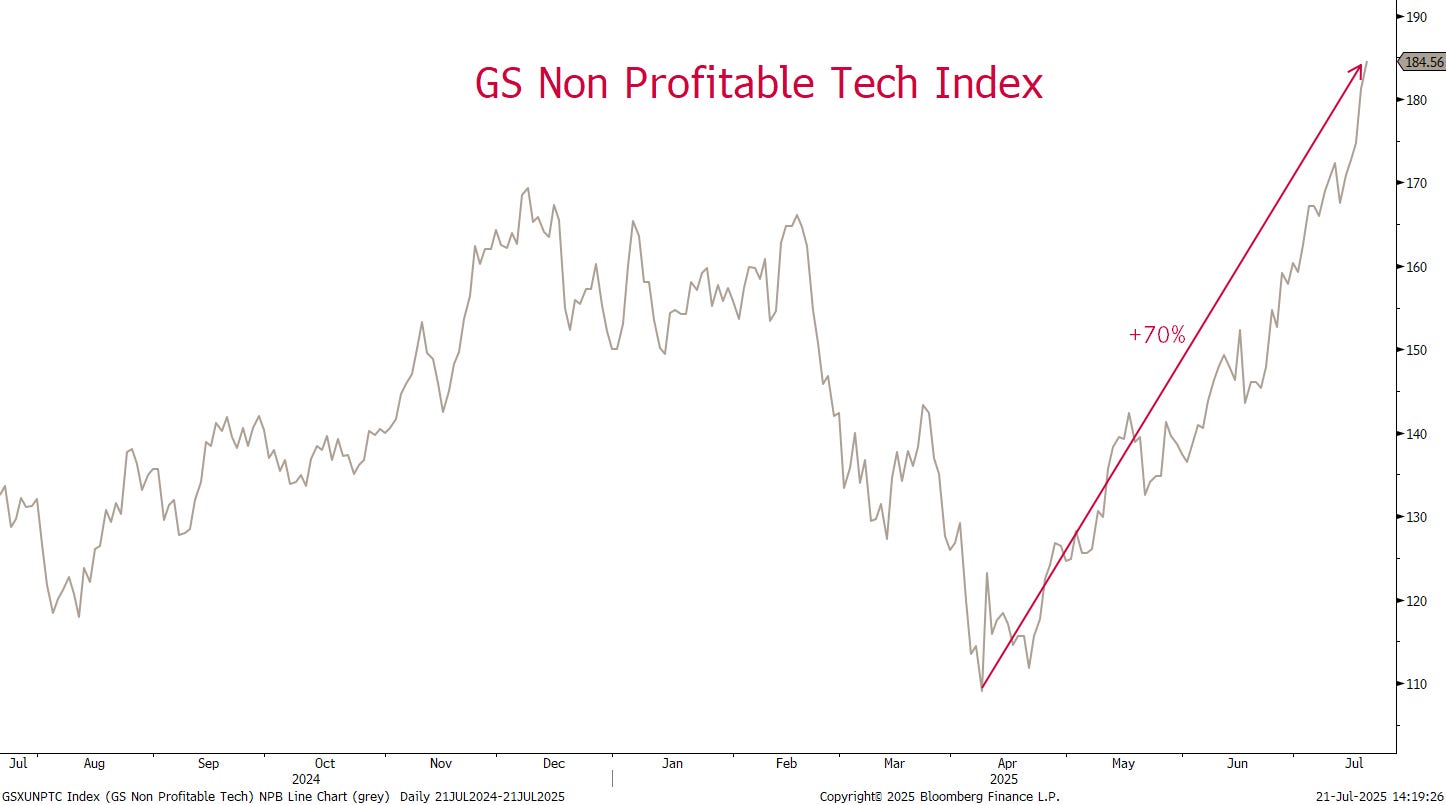

However, not all is hunky dory, with the frothier parts of the market having rallied 70% since the April lows:

And the price/sales ratio for the S&P 500 is at its highest level on record:

Over in Europe, the STOXX 600 continues to struggle to make any net progress and the chart still ‘feels’ heavy:

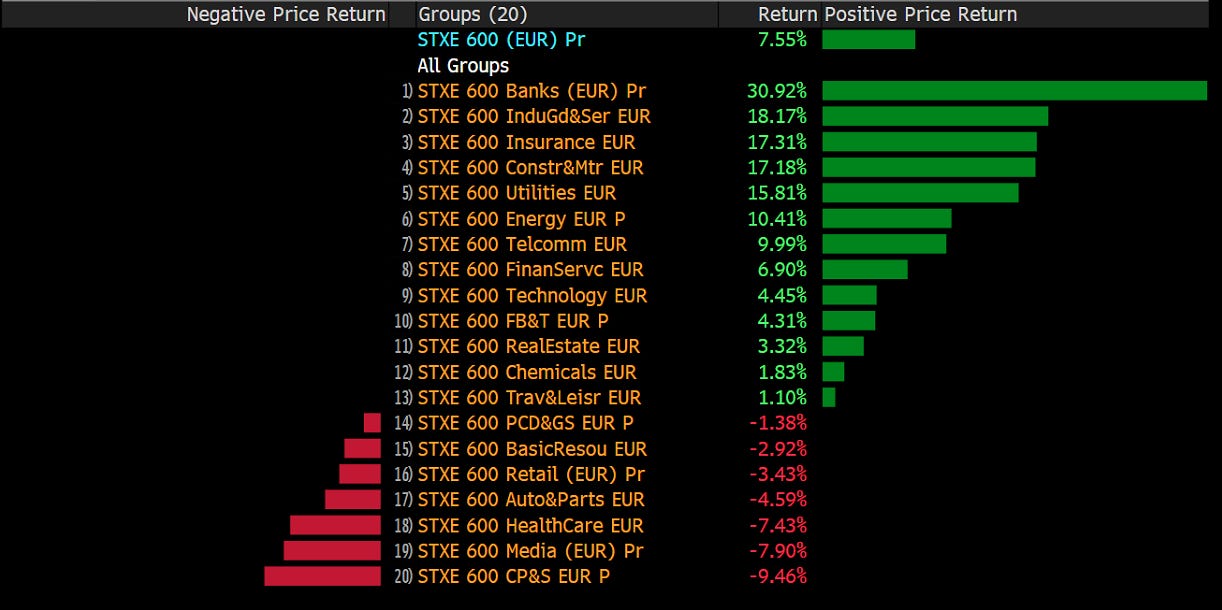

The year-to-date performance chart however reveals that it really mattered this year where you were invested:

That’s a 40% difference between best (Banks) and worst (Consumer Products).

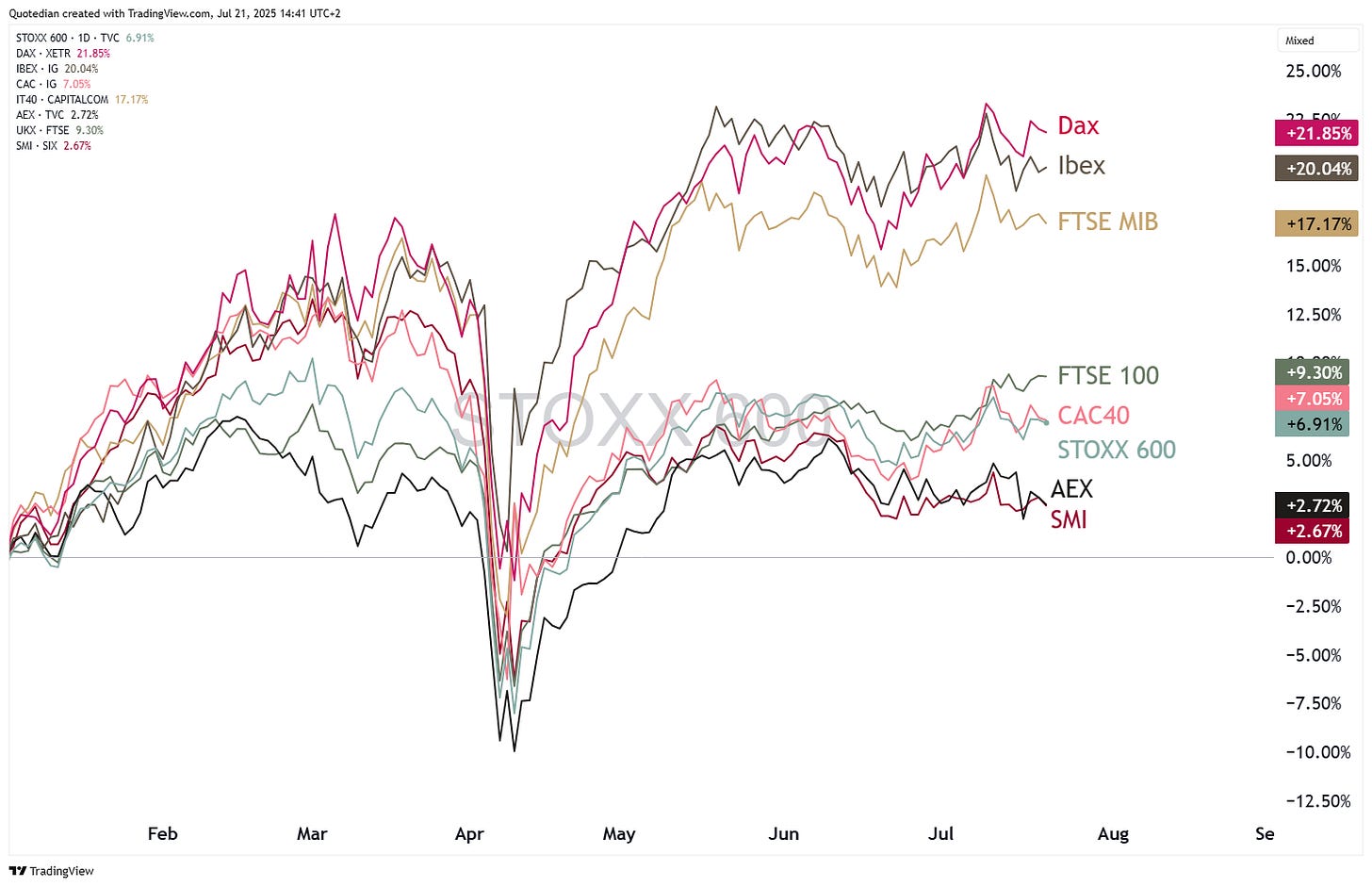

Regional differences may also apply:

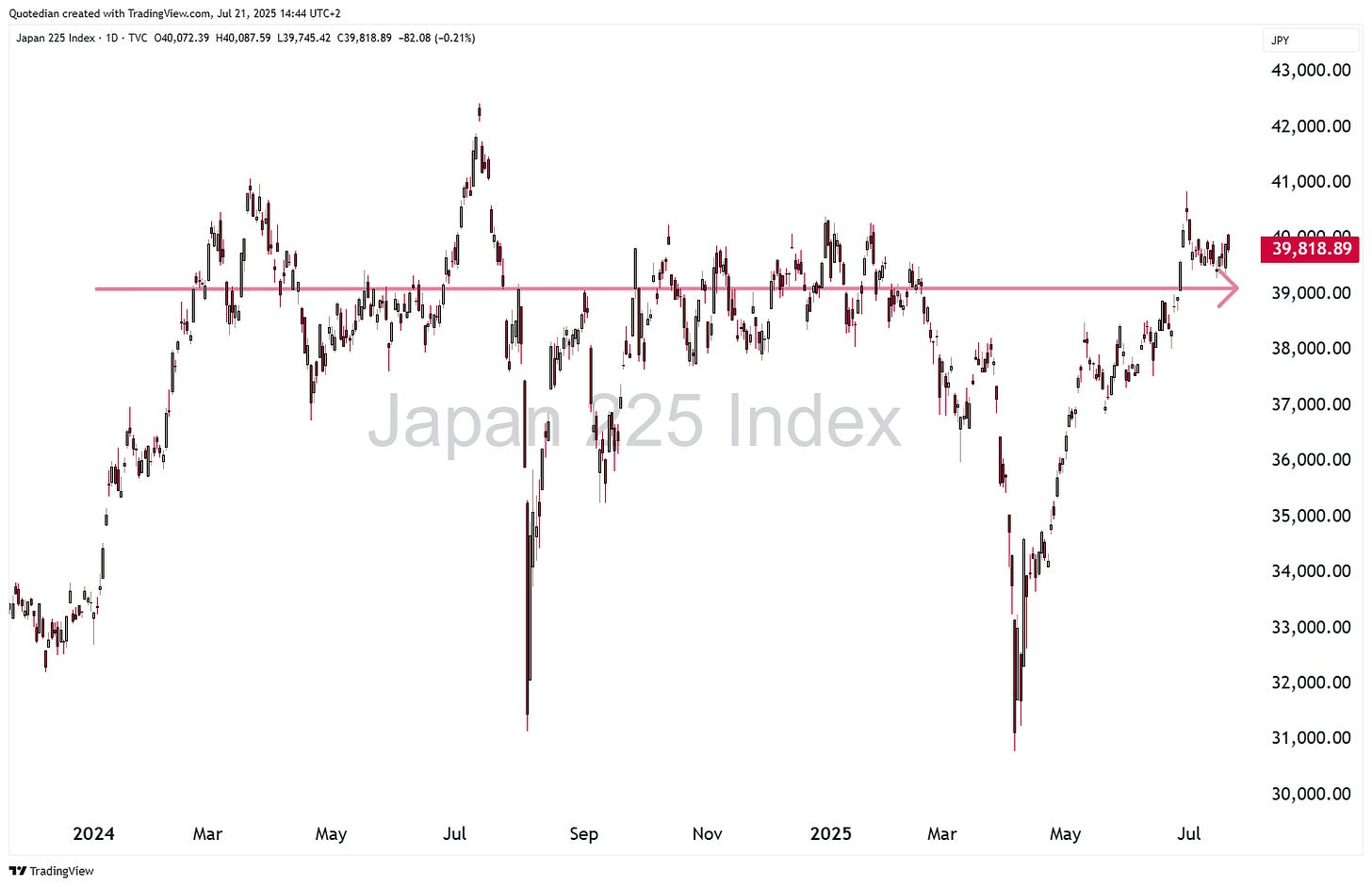

In Asia, Japanese stocks (Nikkei 225) have gone nowhere now for more than 18 months:

Markets were closed this Monday, but the impact from the LDP losing the upper house majority for the first time since the existence of the party, seems to have only muted impact for now.

Hong Kong stocks are on the move again, with the Hang Seng Index taking out an importance resistance (25k) this morning. A bit more confirmation would be good, but it indeed seems that the index is on its way to above 27,000 (+10%):

Simultaneously, China mainland stocks (CSI300) are breaking higher too:

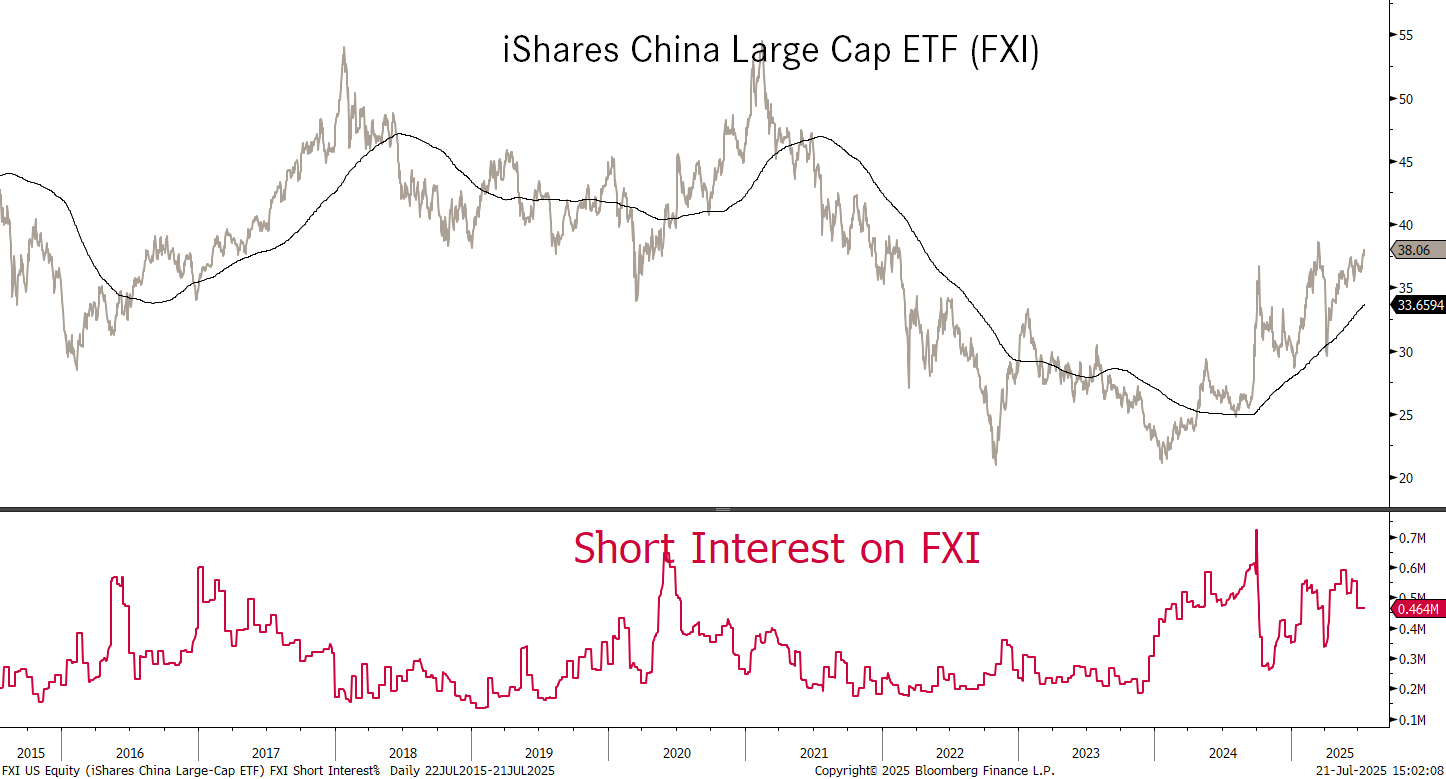

Whilst sentiment, derived via the short-interest on the largest China ETF (iShares China Large Cap ETF - FXI), remains negative towards that market:

Indian stocks are taking a breather, but only a drop below 24,500 (Nifty Index) would endanger the current cyclical rally:

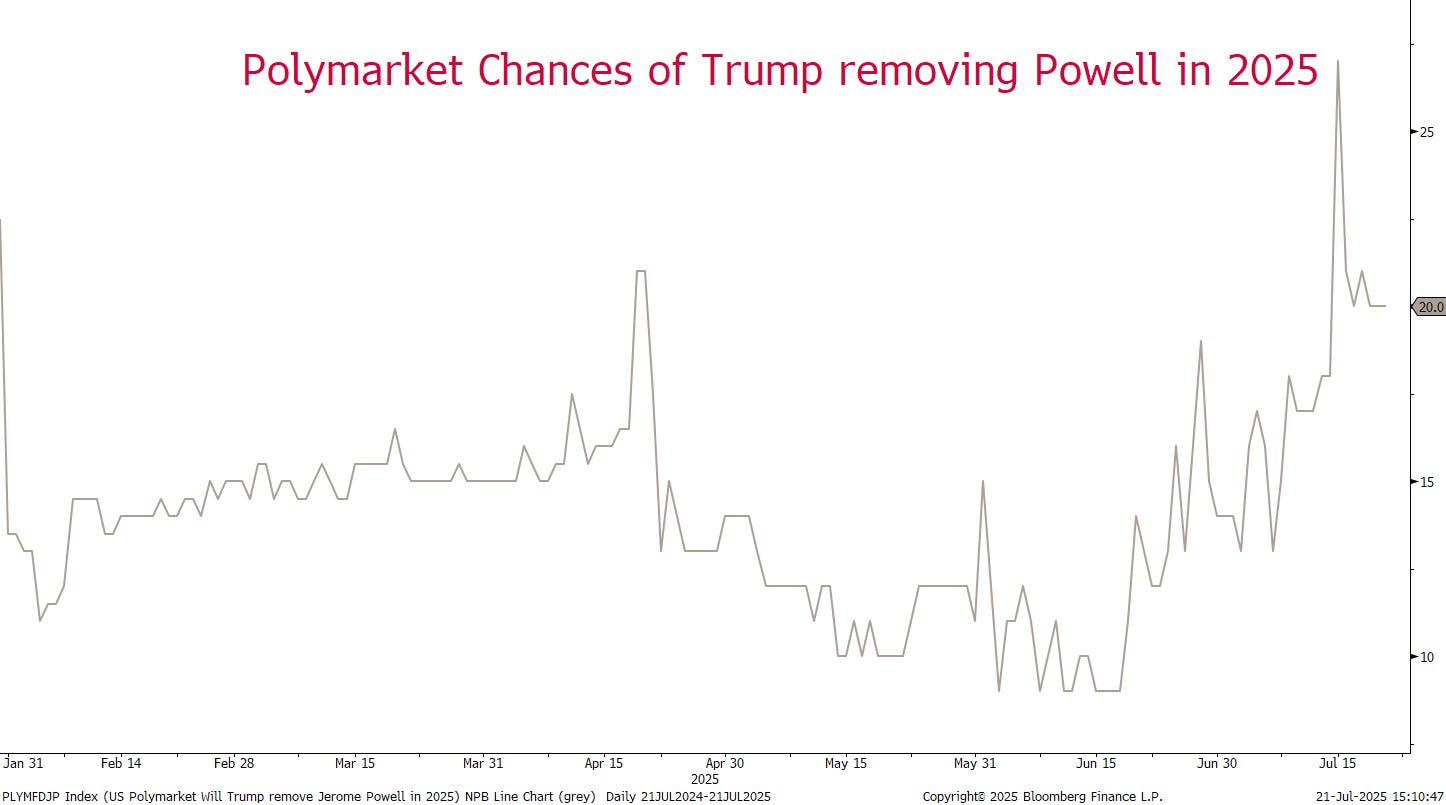

In the fixed income space, all eyes are on the showdown between Trump and Powell.

At the moment, the market is giving Powell an 80% chance of surviving the duel…

At the moment, no rate cut is priced in for the July meeting:

But will Powell give a dovish tone at the press conference in order to increase his survival chances? Perhaps.

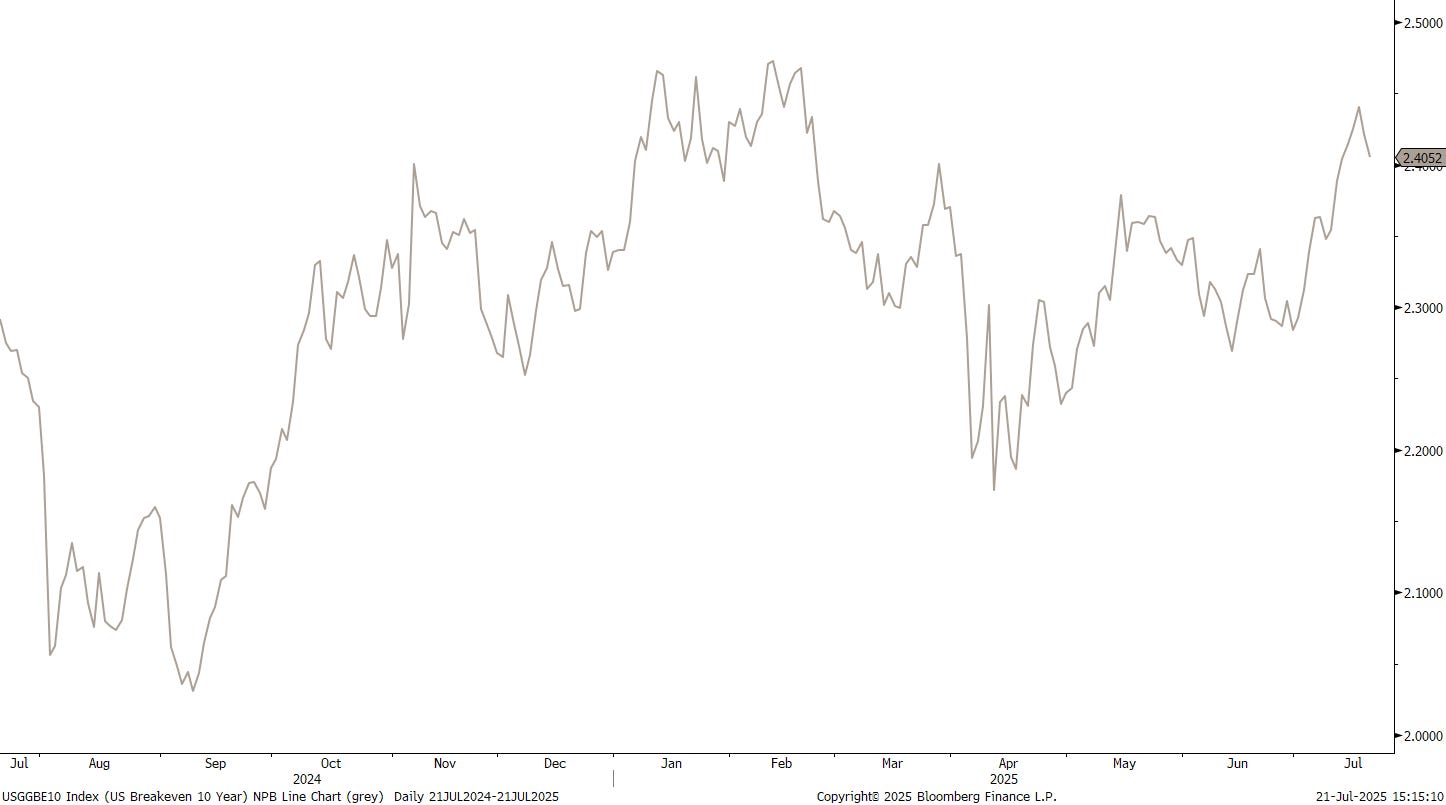

However, he should carefully listen to the message being given by the bond market, which currently is : “Be mindful of future inflation” as we can see from the 10-year Treasury TIPS Breakeven rate:

The 10-year US Treasury itself continues to trade range bound:

Not the 3% level that Treasury secretary Scott Bessent was hoping for, but having got rid of the volatility out of the Treasury yield is probably the second best thing.

Removing the volatility out of the MOVE (ICE BofA MOVE Index - a measure of bond market volatility - red line, lhs, inverted) is also the best thing that could happen to the stock market (S&P 500, grey line, rhs):

The other market we should continue to keep an eye is the Japanese Bond market. Also closed today (Monday 21.7.) it will be important to observe how yields behave post the LDP Upper House debacle. On Friday, they traded at their highest level since Bloomberg as data:

Let’s talk the Japanese Upper House election on Sunday as a segue into the currency realm.

As a first reaction, the Japanese Yen is showing some strength post election:

For now, the USD/JPY has retraced exactly 50% of the January to May sell-off; a resumption of the downtrend would be make for a beautiful picture here:

However, 142.50 and especially 140.00 must give to confirm the USD-bear resumption.

And talking of the US Dollar bear, looking at the US Dollar Index (DXY), chances are increasing the Dollar ‘recovery’ is already over again:

I know that the Dollar sentiment is very bearish, which would argue in favour of a continued US Dollar rally, however, I think sentiment and positioning are not the same. I.e., whilst many are talking about the US Dollar ‘death’, most investors are not positioned for it.

EUR/USD also looks already ready (pun intended) to move higher again:

And finally, the Dollar ‘recovery’ versus the Swiss Franc was extra shallow:

But who needs FIAT currencies anyway, when crypto is so much more fun.

Not only did Bitcoin reach a new all-time high last week…

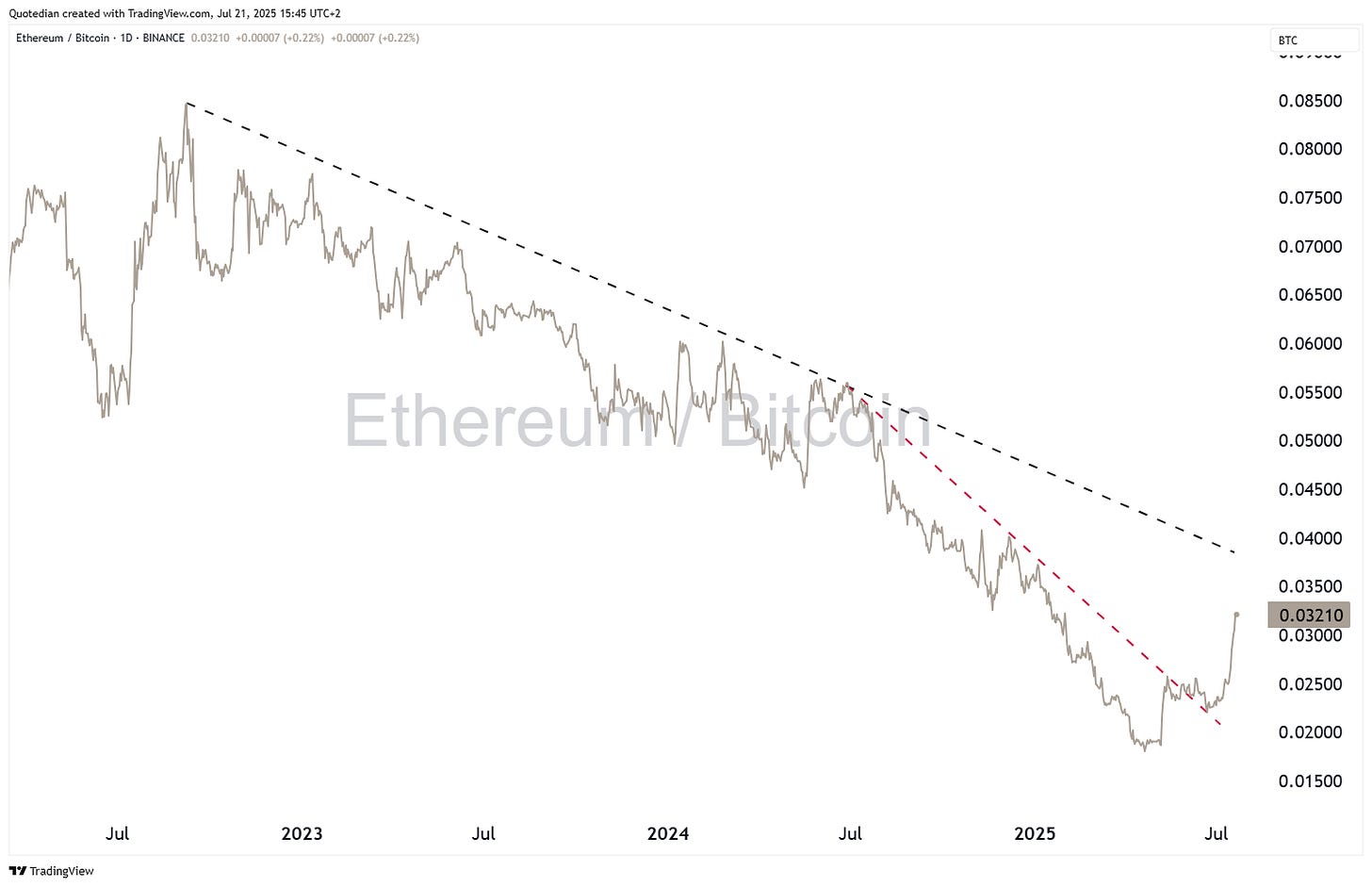

… Ethereum actually outperformed Bitcoin!

If this Ethereum over Bitcoin outperformance is a new trend, there’s still plenty of upside to play that!

The total market cap of cryptocurrencies is on the upmove again:

Last time (2021 - fat circle) a new ATH in market cap was reached after a multi-year consolidation period, the upside (growth) of the crypto-market was substantial …

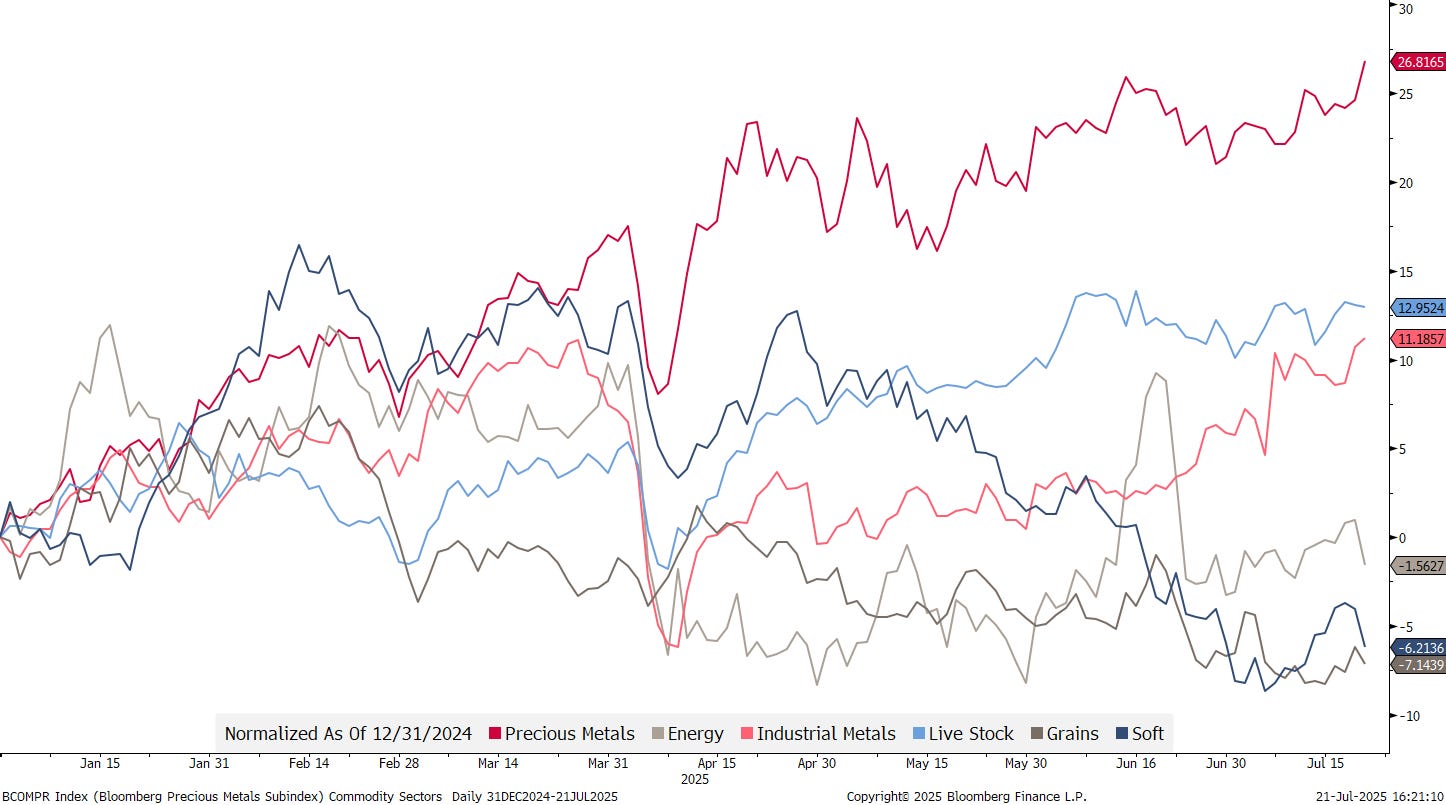

In the commodity space, precious metals (red) continue fly, whilst softs (blue) and grains (dark grey) are lagging:

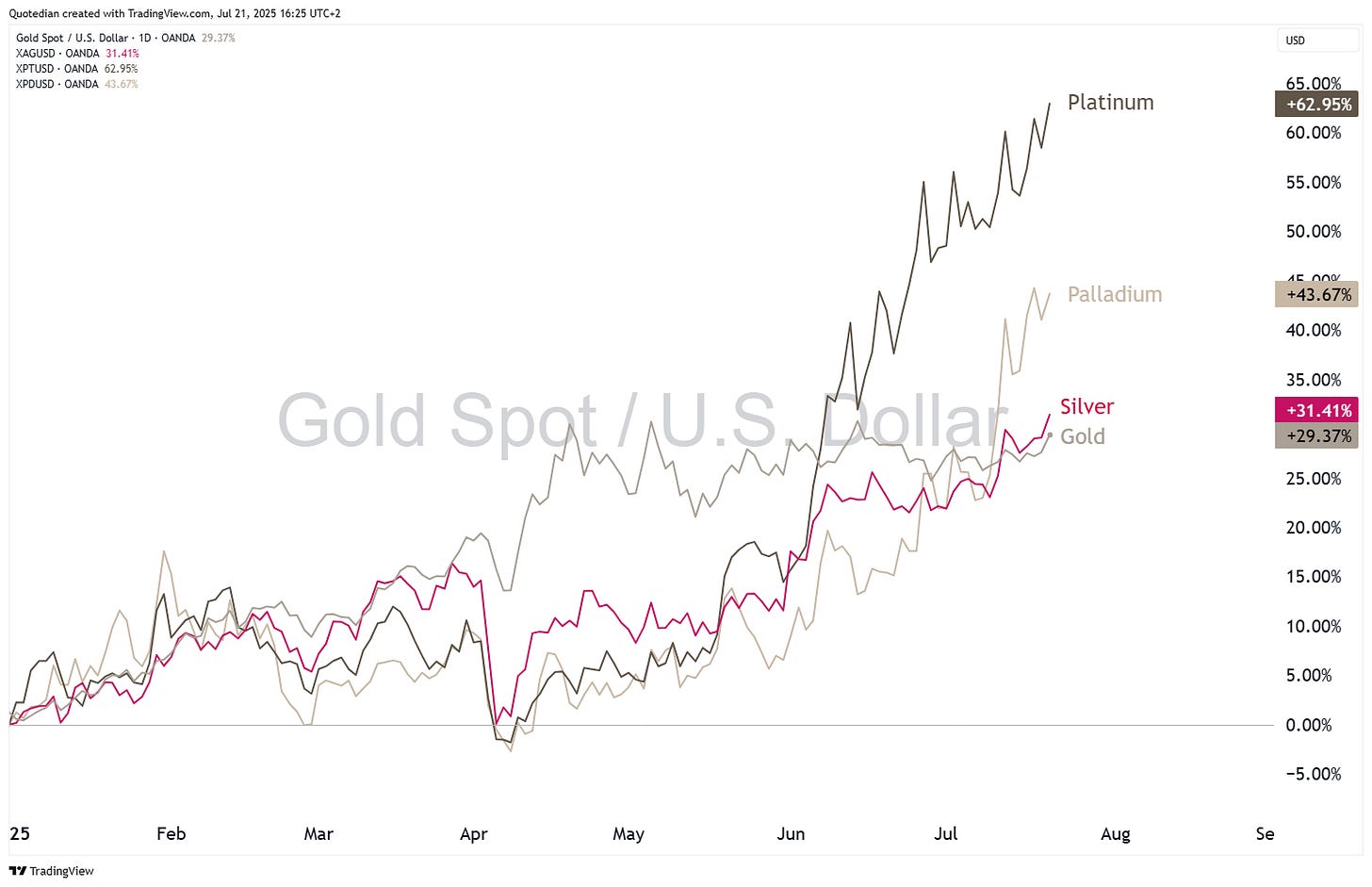

However, in the precious metal space it is not Gold or Silver that is the lead on a year-to-date basis, but rather Platinum and increasingly Palladium:

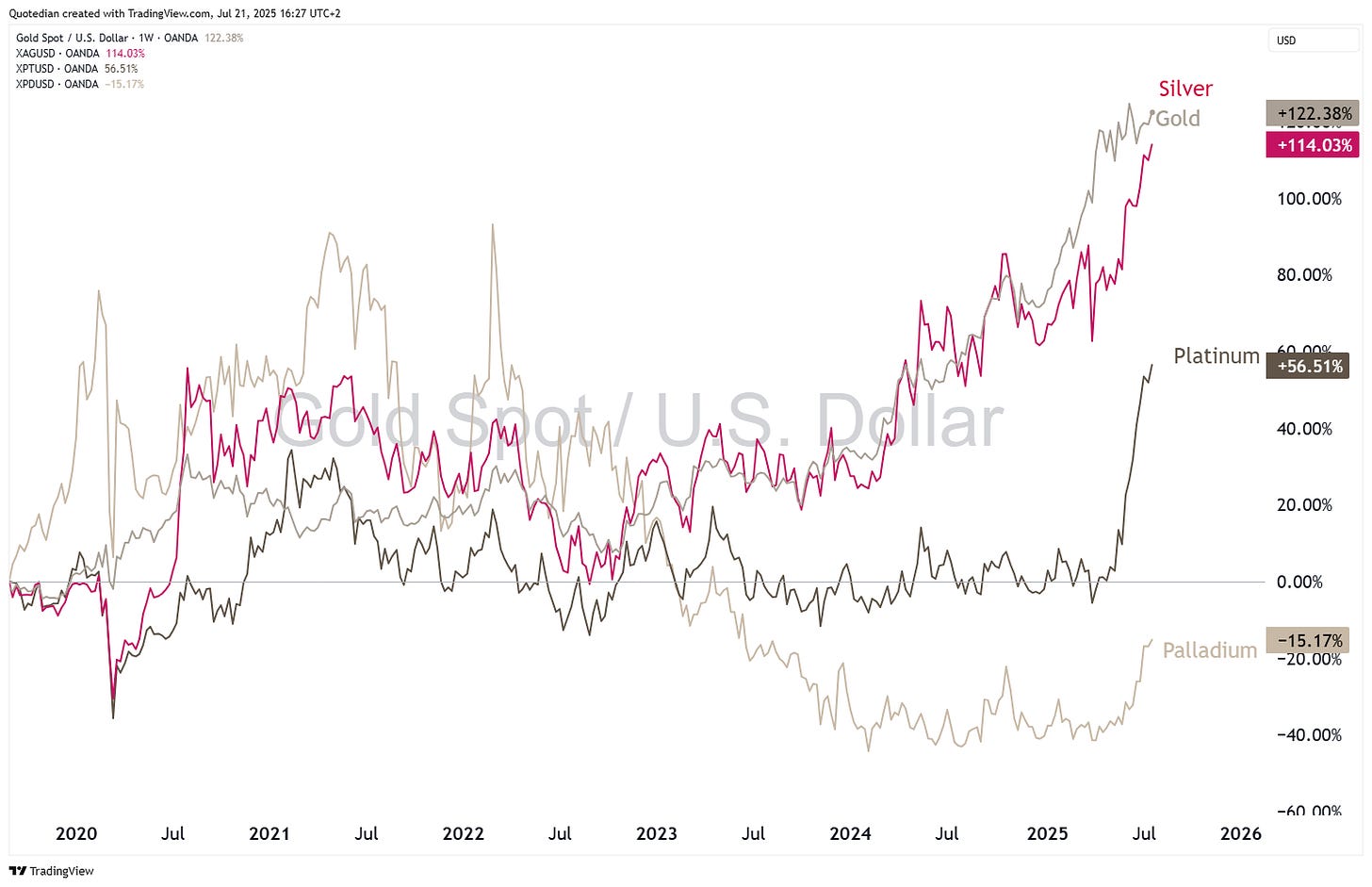

In multi-year terms, upside for both (XPT & XPD) remains substantial:

Copper may be ready to move higher again:

That’s all from me then … Enjoy your summer and see you again towards the back-end of August. With a new format for this letter and probably also for my waistline!

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG