TINA? TINAAA!

The Quotedian - Vol VI, Issue 11 | Powered by Neue Privat Bank AG

“The top three investing skills are: patience, temperament, and having your career coincide with a 30-year uninterrupted decline in interest rates.”

— Morgan Housel

DASHBOARD

CROSS-ASSET DELIBERATIONS

Last year I wrote a blog post called “Swapping the Girlfriend”, where the underlying idea was that investors should dump TINA (There Is No Alternative) for the now more attractive TARA (There Are Reasonable Alternatives), as rates had seen steep lift-off from ground zero.

In the end, that post never left my ‘Drafts’ folder, a cemetery for many good and not-so-good ideas.

Turns out, leaving TINA would have been a mistake in the first place, so let’s make sure that she forgives our infidel thoughts by begging her to stay, shouting her name: TINAAA! (There Is Now An Acceptable Alternative).

Let’s start our weekly review…

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

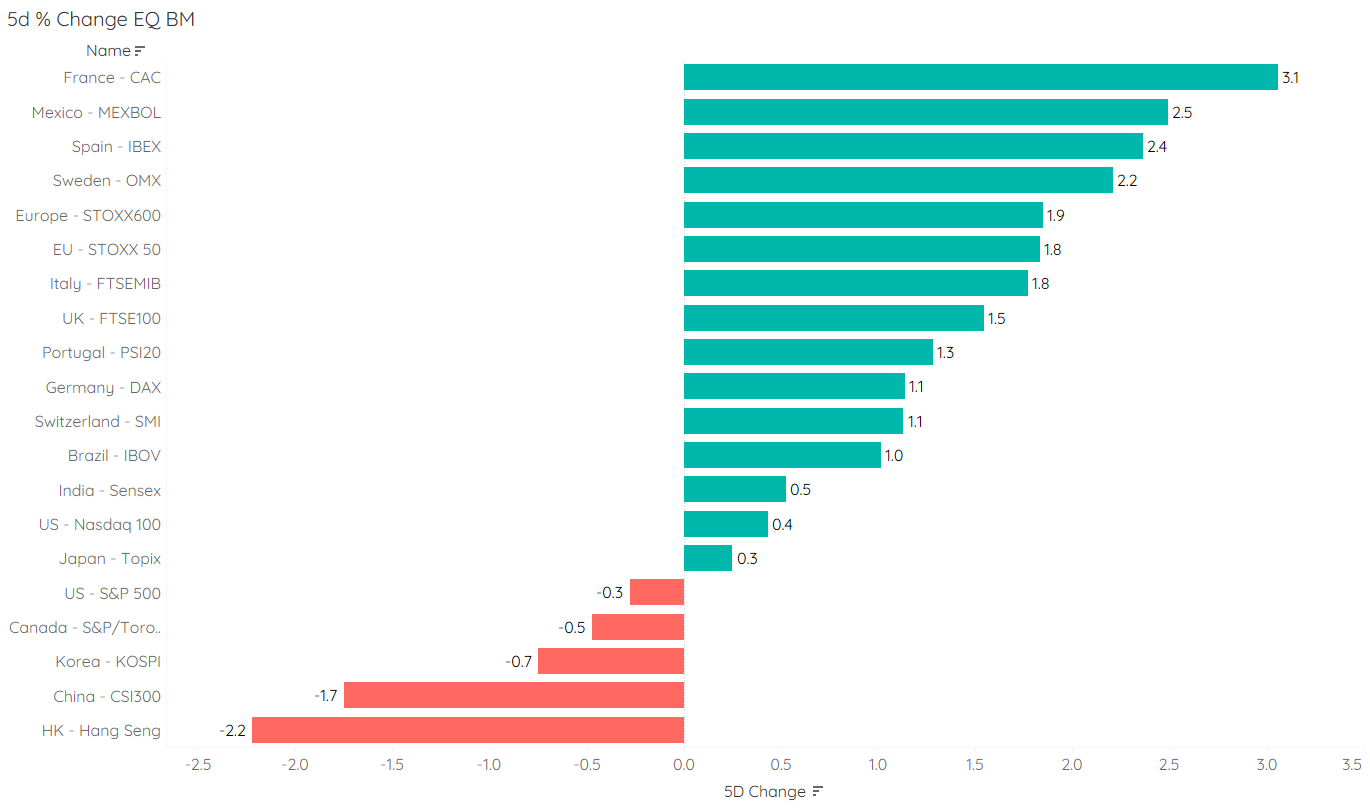

Beginning with global equity markets, we note that it was another volatile week for stocks, though most major indices managed to eke out some pretty decent gains:

Prominent exceptions include of course not only the Greater China equity complex but also the one index to rule them all - the S&P 500. The weekly heatmap of this latter index reveals the ongoing thug of war between bulls and bears:

A daily chart of the index reveals that the index on Friday dropped out of the rising uptrend channel, though we need to see the follow-through or lack thereof in Tuesday’s session first before coming to any meaningful conclusion (US markets are closed on Monday in observation of Presidents’ Day).

European indices (proxied via STOXX 600) continue to give, to the frustration of many, a much better and more constructive (technical) impression:

The negative divergence (red arrows) between the price and the momentum indicator (RSI) we discussed two weeks ago has so far failed to work as a sell signal.

As fore-mentioned, the other market sticking out on the weekly performance table above is Greater China, which seems to continue in a corrective mode and mood. Let’s have a quick look at Hong Kong’s Hang Seng index:

The chart reveals that a) the index has corrected close to 9% since its top in late January, b) it was up 55% in just two months right before the current correction started and c) a classical bull trap was set up for trend followers as the index notched just above previous resistance at 22,400 before starting the current correction.

It follows then from that European stocks continue their path of relative outperformance and momentum has even picked up a bit again the past few days:

However, the path (and potential) to “equality” remains long:

In other news, the FTSE-100 hit 8,000 for a first time and eight years after having reached 7,000 in 2015. That adds up to an approximate 1.7% return per annum. HOWEVER, adding in dividends, which are generous amongst the Footsie members, the annual return increases to 4.7% - not bad at all. As always, a picture is worth more than a thousand words:

What else?

Turkey opened their equity trading again this week, which had been closed since the terrible earthquakes two weeks ago. Volatile and directionless come to mind:

Let’s move on to sector and factor performance of this past week. Sector returns were a very mixed bag, as can be seen on the performance chart:

Energy stocks were under pressure, with most of the losses coming from the last session of the week (Friday). The argument for the sell-off in oil and oil stocks was the investors are increasingly worried that the Fed may be far from done with hiking rates after inflation is stickier than expected (what was that saying again about inflation being like toothpaste?). However, if you agree with that concern (I do), then there should be little reason for the most speculative corners of the equity market (non-profitable tech, Reddit and meme stocks, etc.) to be big winners on the week …

This brings us to factor performance, which indeed confirms that the more volatile and longer-duration stuff was indeed the week’s winner:

And talking about speculative stuff, the following chart shows how big the trading in 0DTE options (red below) has become, which could potentially bring us our first Volmaggedon since late 2018

For newcomers, 0DTE options are options which mature on the day. They offer investors …. speculators … gamblers an inexpensive way to take an extremely leveraged bet on a particular outcome for a stock or a market. Problem: very difficult to hedge for market makers which hence can lead to important market distortions. Watch this space….

Finally, serving as a segue into the fixed income section and if you are still wondering what I was blurting about at the introduction of today’s letter, the recent rise in interest rates has brought bonds, but especially also cash back into the rat race of asset allocation. For example, 2-year treasury yields, with close to no default risk and even less volatility, pay 4.62% as I type. Stocks, using the broad S&P 500 as a proxy, carry an earnings yield (inverse PE) of 4.59%. Arguably, that ‘yield’ is not guaranteed, there is some default risk and volatility is elevated (16.8%). Make your own conclusions…

Unfortunately, I do not have access to a Bloomberg terminal this evening, but the below chart serves as a proxy to what I just described above:

Talking about fixed-income markets now, here’s the performance over the past five days for different pockets of FI:

Credit spreads were relatively flat this week, which means that higher interest rates were the biggest negative contributors to performance. Indeed, did the entire yield curve shift higher on the back of stronger-than-expected economic data (CPI, PPI, Retail Sales). Here’s the chart of the 10-year US Treasury yield:

Zooming out on this very same chart, there is potentially some bad technical news for bond bulls …

Turning to European rates, despite Friday’s reversal lower on the German 10-year Bund, are yields approach new multi-year highs again:

As a matter of fact, yield at the shorter end of the curve (2Y) have already reached new highs:

Nearly multi-decade highs so to say:

Time to have a look at currencies, where the US Dollar had a good week against most major currencies, but especially so versus Asian monies:

Here’s the chart of the US Dollar Index (DXY):

In the DXY, the Euro and the Japanese Yen make up about two-thirds of the index weight. As the Euro was largely unchanged versus the USD

most weakness came from the Dollar-Yen cross as the BoJ announced its new governor, guaranteeing continuation of easy monetary policy:

Cryptocurrencies continue to signal “risk on” - another manifestation of the FOMO/YOLO mood dominating markets:

Finally, in the commodity complex, it has been a fun, volatile week as usual:

As already discussed further up, fears of continued Fed hawkishness manifested itself mostly in higher bond yields AND the oil price (induced recession):

However, Dr Copper is not sharing the black gold’s view:

Natural gas is now substantially cheaper than at the start of Russia’s Ukraine invasion, not only in the US:

but also in Europe:

Gold also continued to suffer under the strength of the US Dollar:

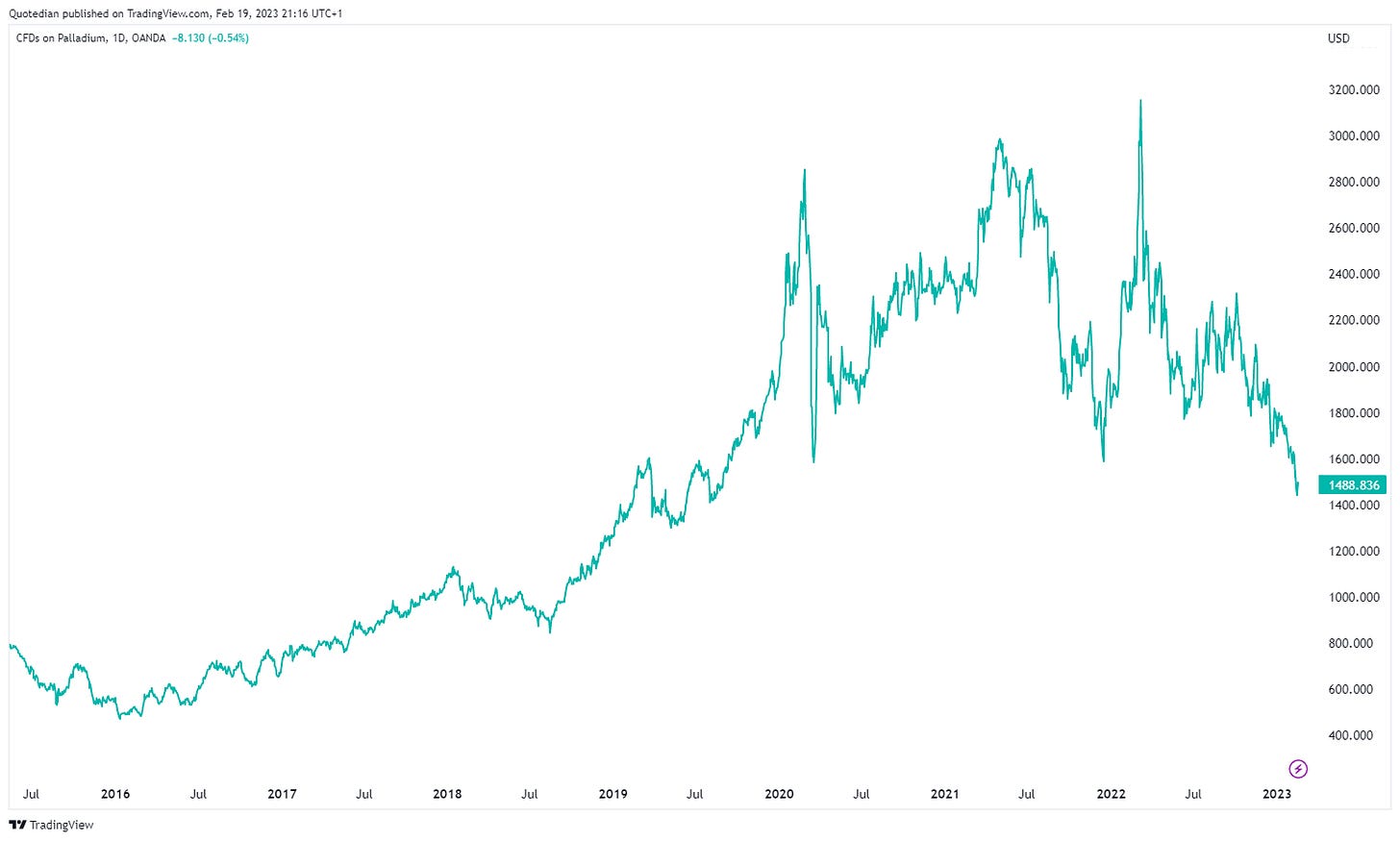

Noteworthy, Palladium is at its lowest level of the past four years:

Ok, time to hit the Send button.

Don’t forget to like if you like and also don’t forget to enjoy the rest of your Sunday. Monday is just around the corner.

André

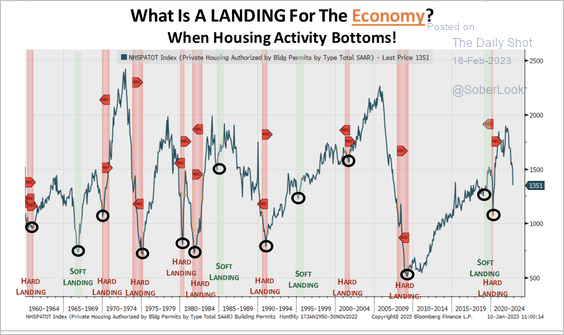

CHART OF THE DAY

An interesting chart here, asking (and answering) the question what counts as a landing for an economy.

Not quite there yet …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance