Toothpaste

The Quotedian - Volume V, Issue 89

Over the past 10 years, the ECB has gone from “Whatever it takes” to “Whatever …”.

— The Quotedian, June 2022

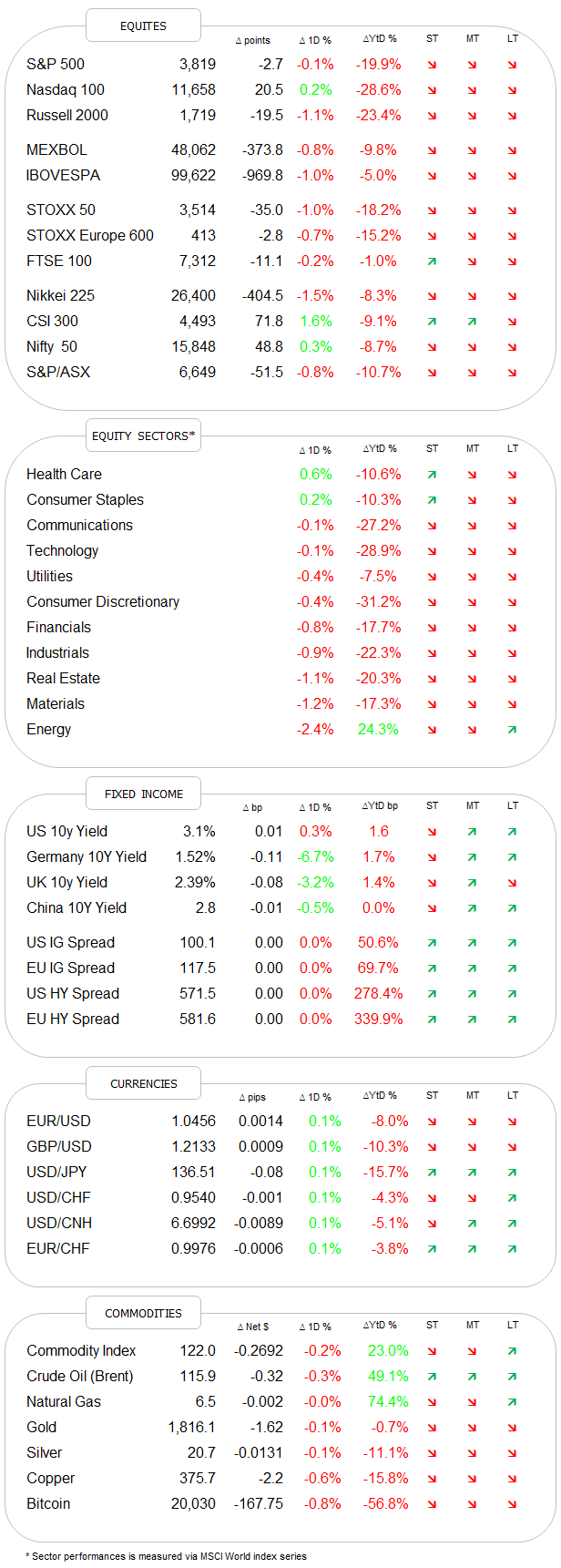

DASHBOARD

CALENDAR

CROSS-ASSET DELIBERATIONS

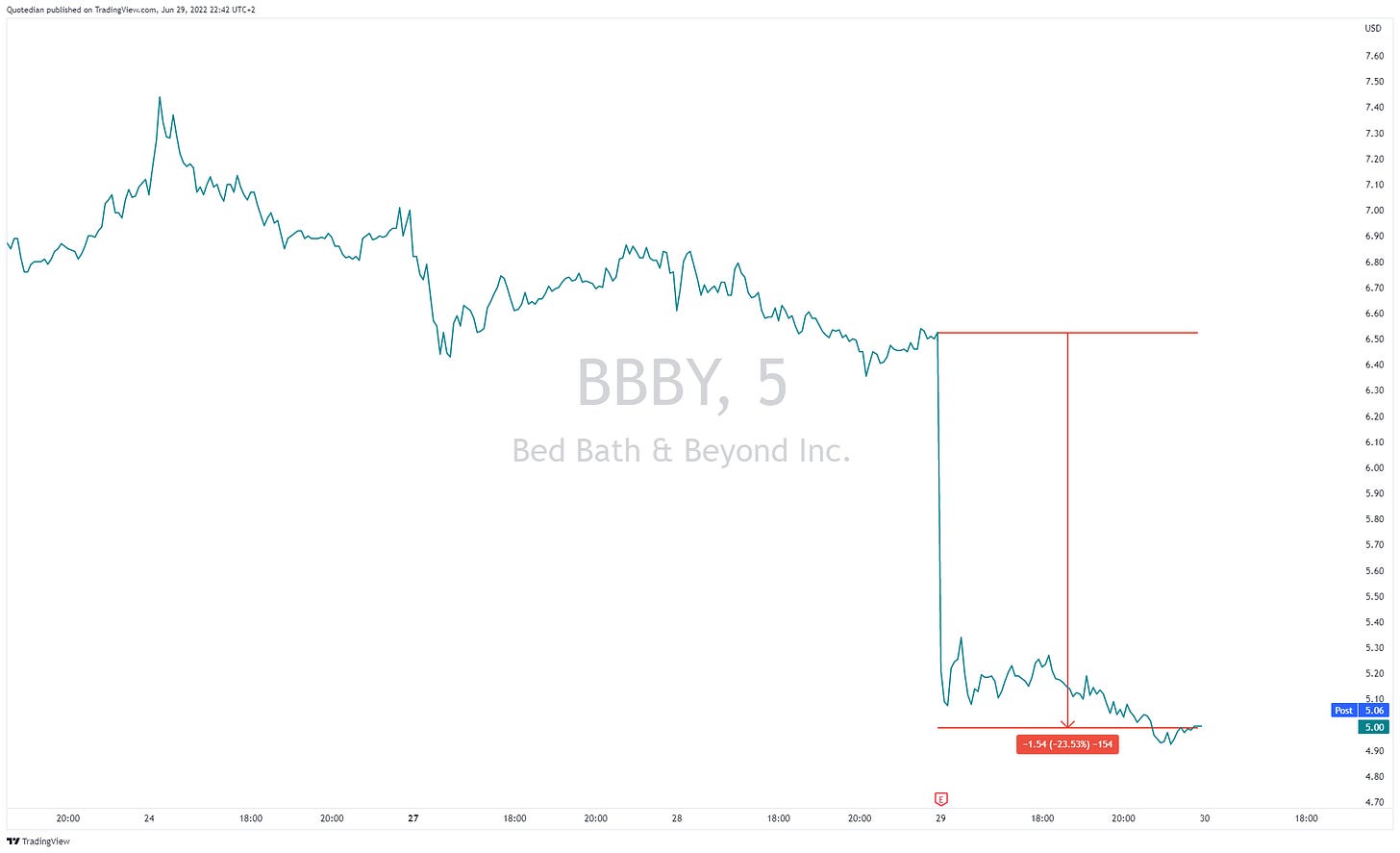

Global stock markets are down, let’s call it a general 20%, give or take. The sell-off started in tech stocks over a year ago and can be entirely attributed to overvalued stocks in combination with rising inflation/interest rates and hawkish central banks (from QE to QT). All this has impacted the P in P/E. Now, here’s the problem: We looked at a series as consumer confidence charts yesterday and the message is clear - the consumer is scared stiff. Of course, this will have is having impact on consumer spending. We saw that message coming rom Target, Wal-Mart and then Target again. Yesterday Bed, Bath and Beyond (BBBY) joined the club with a massive sales drop and larger-than-expected loss increase. The board of BBBY thanked by firing the CEO, investors by sending the stock 24% lower:

I fear, this is just the beginning and the E in P/E will further contract (especially as analysts seemingly continue to be looking the other way - see today’s COTD). This of course will lead also to another round of P reduction over the coming quarters.

To yesterday’s session…

Compared to Tuesday’s slump, yesterday was a relative flat line session, especially for US stocks. The Dow eked out a small gain, whilst the S&P 500 and the Nasdaq reported (tiny) losses. Here’s the past two days for the S&P 500, with yesterday being in the shaded area:

In terms of sector performance (see Global sector performance in dashboard above), energy stuck out, giving back all of the previous day’s gains and then some. Here’s the table for S&P 500:

The overall prevailing colour in Asian equity markets this morning is red, though the Chinese, Hong Kong and Indian markets offer some pockets of green. Staying in the area for a moment, according to my prop model which seeks to invest in the strongest market segments, Asia Pacific (ex-Japan) has been and could likely continue to be the area to overweight:

I will explain more on this model over the coming publications (likely starting next week).

Index futures on both sides of the Atlantic are indicating a lower opening for stocks in Europe and the US.

Of course is a lot of the sour mood amongst equity investors explained by ever increasingly hawkish central banks. Sitting together for the ECB’s annual conference (European version of Jackson Hole?), some of the mightiest central bankers are warning of the inflation they have created… [sigh]. Here’s our friend Jay:

“The process is highly likely to involve some pain, but the worst pain would be from failing to address this high inflation and allowing it to become persistent”

In his defense, he already told us this six months ago and who did not listen (Quotedian readers did, I hope) is now 20% less rich on his equity portfolio and also saw his bond portfolio taken a 10% cut.

Lagarde, who was still a inflation sceptic only a few weeks ago:

“I don’t think that we’re going to go back to that environment of low inflation”

To be honest, given the track record of central bankers, maybe so much inflation embracing should lead us to start betting on outright deflation, but we will not. Rather, maybe a (recession-induced) pause is due for the inflation theme? This chart would speak in favour of an inflation slowdown (of which we maybe got a hint in Germany yesterday):

Rates have accordingly come back a notch, with the US 10-year Treasury yield close to key support levels:

But overall, I unfortunately agree with Christine that inflation may be sticky. After all, you know what they say about inflation being like toothpaste:

„Inflation is like toothpaste. Once it’s out, you can hardly get it back in again. So the best thing is not to squeeze too hard on the tube.” - Dr Karl Otto Pöhl, BuBa President, 1981

A few observations from the currency space now. The EUR/CHF cross-rate dropped below parity yesterday, which is not a first, but a second:

In my view, this sets the stage for the EUR/USD cross to achieve the same “feat” over the coming weeks. The stage will be set once support at 1.0350 breaks:

What is causing the Euro weakness. On one hand, for sure it is interest rate differentials (the SNB hiked, the ECB not), but more importantly in my view the ECB is not the only central bank losing tons of credibility, but it is losing it fastest.

Over the past 10 years, the ECB has gone from “Whatever it takes” to “Whatever …”.

Another interesting currency observation relates to the Indian Rupee, which continues to hit new lows, as capital outflows accelerate. Here’s the (inverted) USD/INR chart:

Finally, moving into commodities, it is worthwhile and very painful to highlight that European gas prices are once again marching relentlessly higher:

Not, not, not good.

OPEC+ is to decide on their supply policy today. A lot of attention will go to this, after Macron’s “accidential” leak earlier this week and ahead of Joe Biden’s visit to Riyadh in July.

Time to hit the ‘Send’ button, have a great day!

CHART OF THE DAY

As discussed in the deliberations section, many signs are popping up that earnings may come under pressure over the coming quarters. The chart below shows that, with the exception of Emerging Markets, analysts are turning a blind eye on the possibility. Not looking does not mean it’s not there … stay tuned!