Typhoon Brewing

Vol IX, Issue 04 | Powered by NPB Neue Privat Bank AG

“Even dust, when piled up, can become a mountain.”

— Japanese Proverb

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Congrats on completing the second full market week of the new year! I know, I know, it feels like much, much more already. By the same account, do you realize it is now seven years since Covid-19 became a thing?

Ah, time flies when you are having fun!

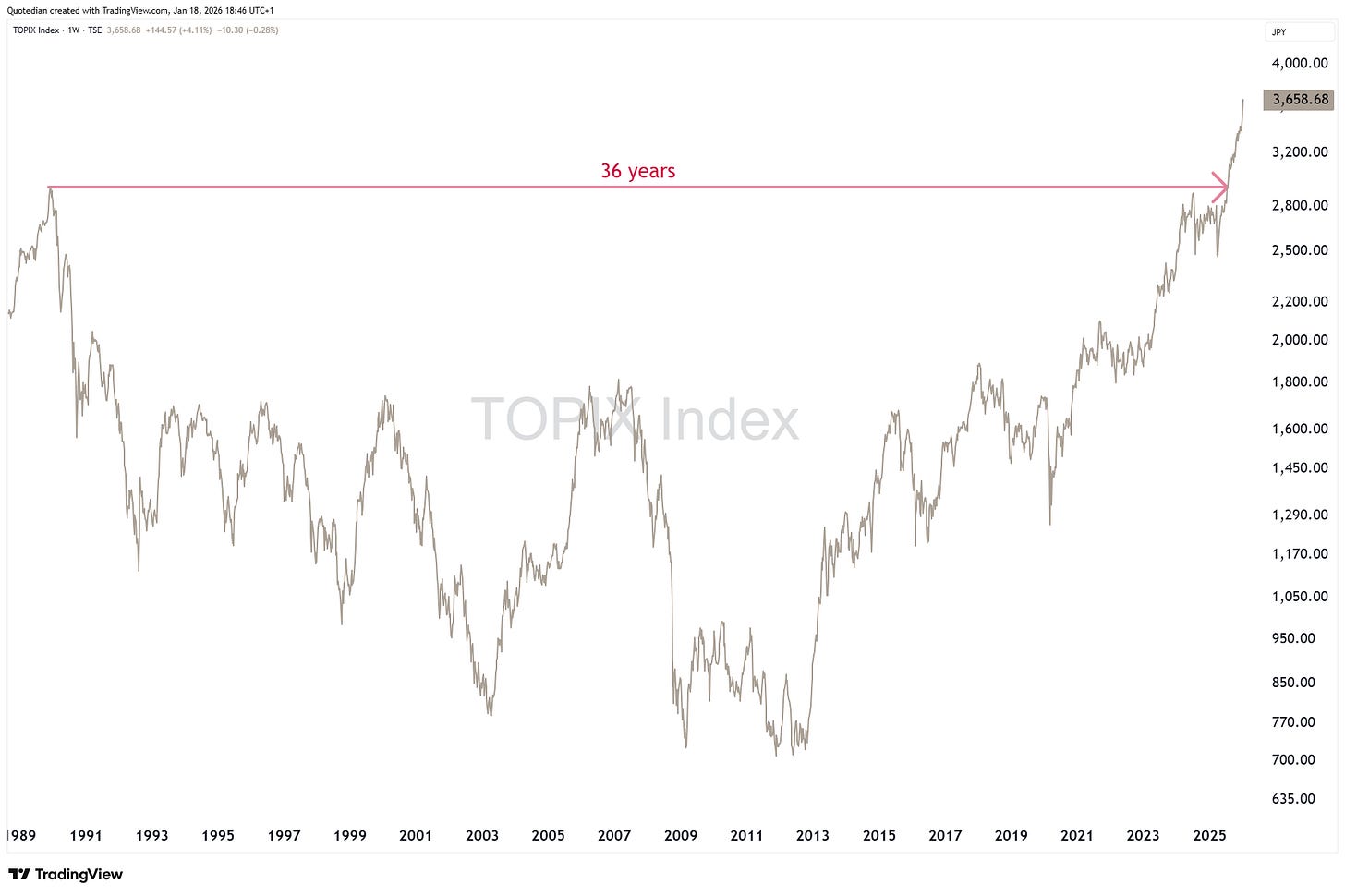

What DID take an awful lot of time was for the Japanese stock market to reach a new all-time high after the debt bubble burst in December of 1989:

36 years more or less, until stocks ripped through the ~3,000 level somewhere between July and August of last year.

Since then the Topix ripped another 25% or so … so what’s not to like?

Little, to be honest, and that is why we (we as in the NPB Investment Committee) maintain an overweight on Japanese equities, since over a year now.

HOWEVER…

We do think a Japanese-style typhoon may be brewing, which may not only affect the (is)land(s) of the rising sun, but may carry a global tsunami with it.

Why we would say such thing?

Abrupt changes in prices, with elevated rate-of-change (ROC), usually bring quakes with it.

Point-in-cases:

As already seen, not only have Japanese equity prices been on a tear, but have also beaten the almighty US equity market by a wide margin on an equal-weight basis over the past three years:

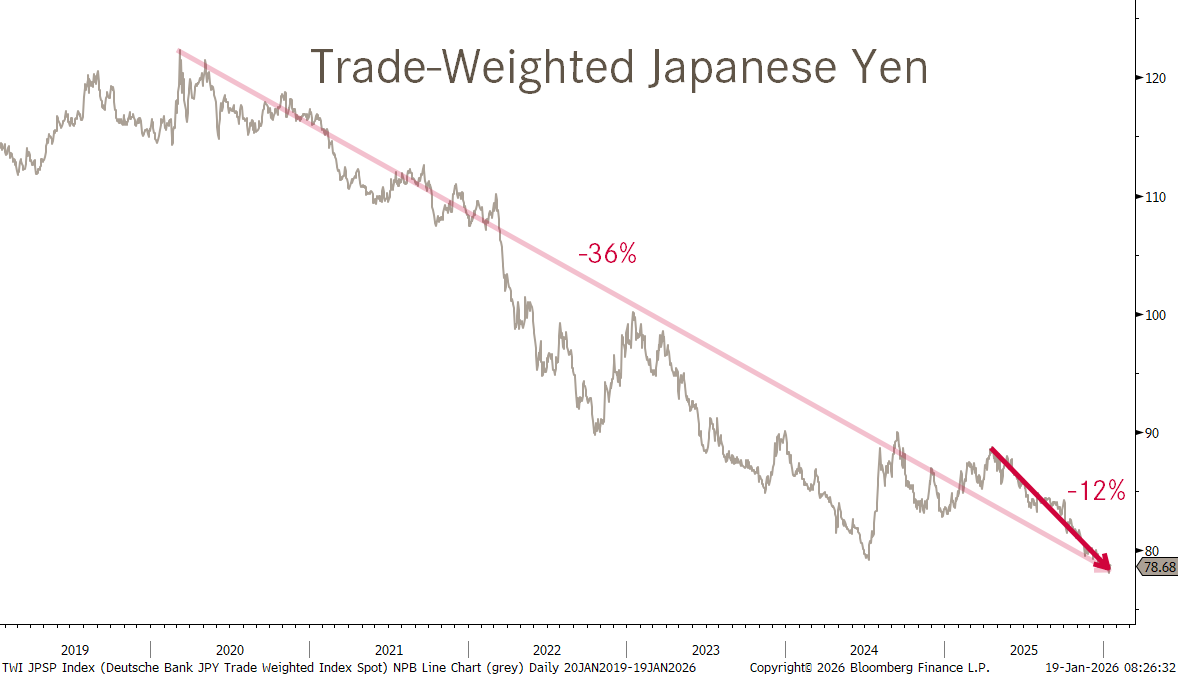

But outside the stock market, the two macro factors that could truly derail Japanese AND Global markets are the weak Yen…

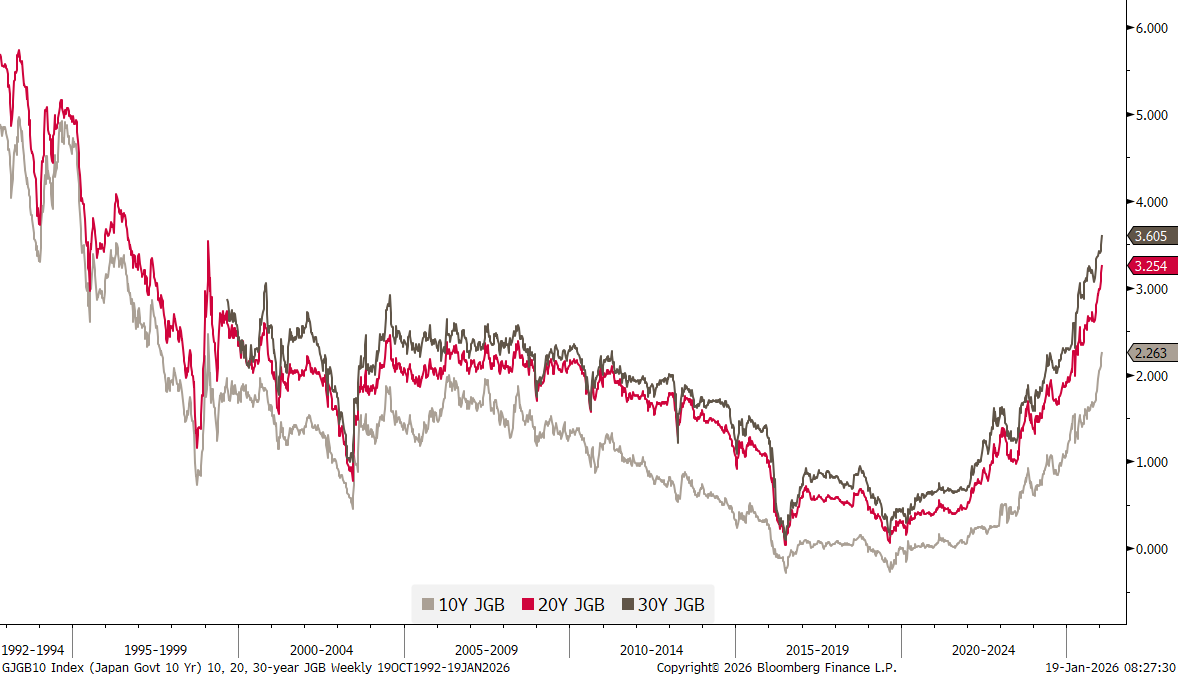

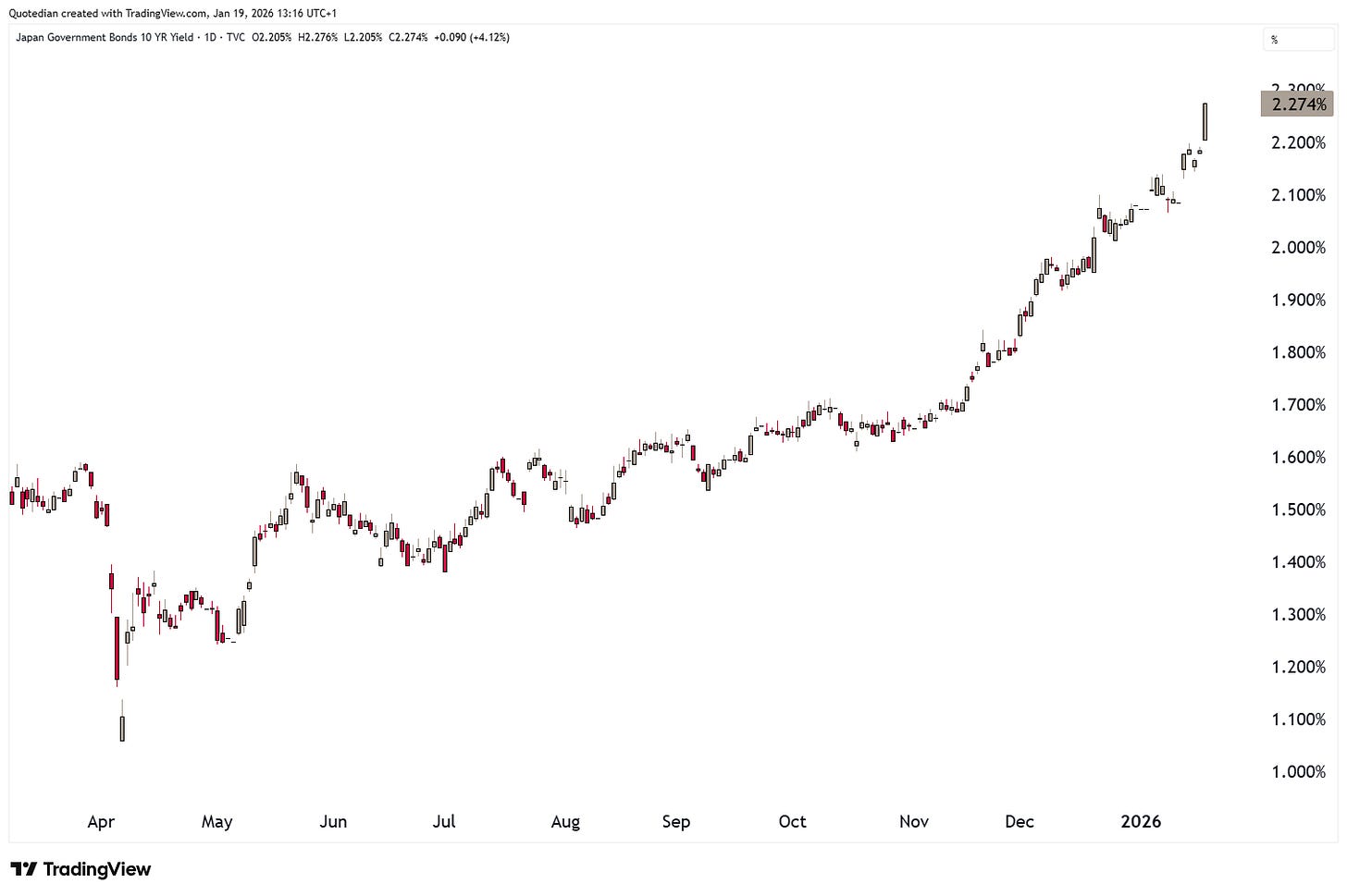

… and everybody’s Damocles sword, JGB yields, hitting their highest levels in decades:

So, why should this matter?

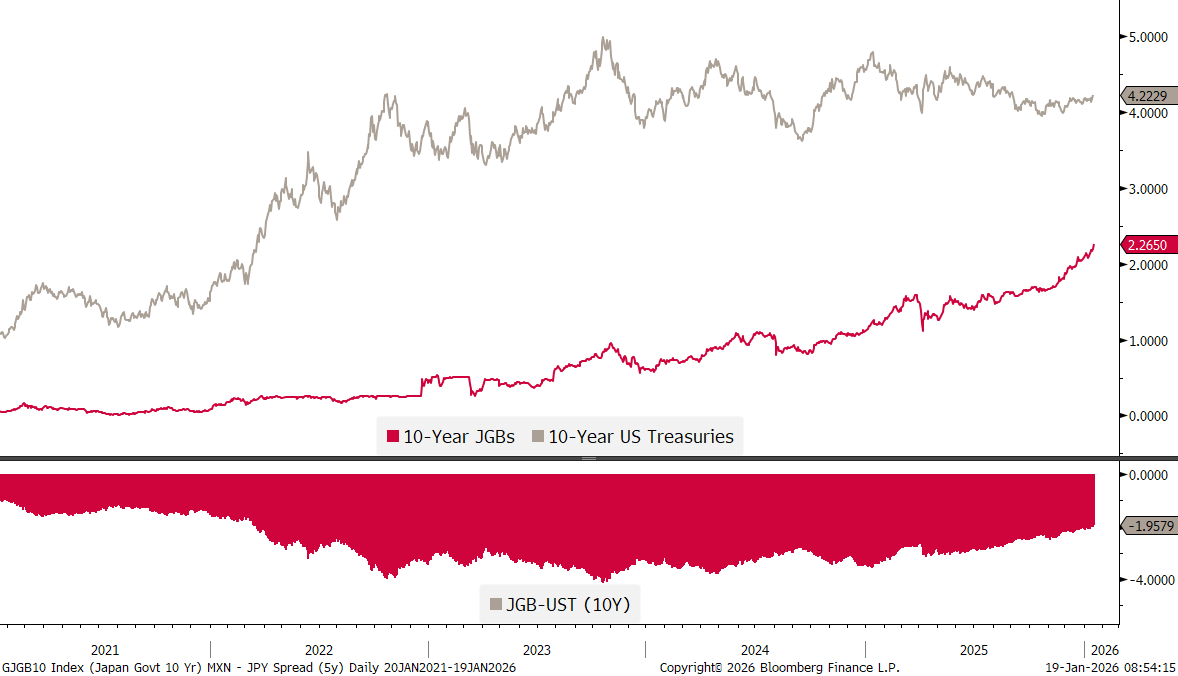

Well, the thing is that the Japanese carry-trade, i.e. borrowing at cheap Yen interest rate levels and then lending in higher yielding currencies (e.g. Mexican Peso) has been a highly profitable trade over the past years:

Not only will higher domestic (Japanese) yields entice Mr and Mrs Watanabe to repatriate foreign funds, but the dwindling yield difference (lower clip) may upend the entire carry-trade:

According to my friend Wilson (aka ChatGPT) the global Yen carry trade could be USD 10–20 trillion gross exposure, with USD 3–6 trillion net directional risk. That, is not pocket money.

Now, I do not claim to be a Japan expert other than I enjoy my occasional Sashimi take-away. But the above, coupled with a new prime minister, who not only seeks to re-establish the greatness of her LDP party through a confidence vote, given her astonishing popularity a few months into the job, but who is also not shy to pick a fight with its mighty neighbour China:

So, whilst the world is still looking towards the North (Greenland), it may be of better advice to turn the attention towards the East.

Onwards with some (brief) market observations across the different asset classes…

Global equities (MXWO) had a strong first trading week in 2026, but then got a bit stuck in the second week:

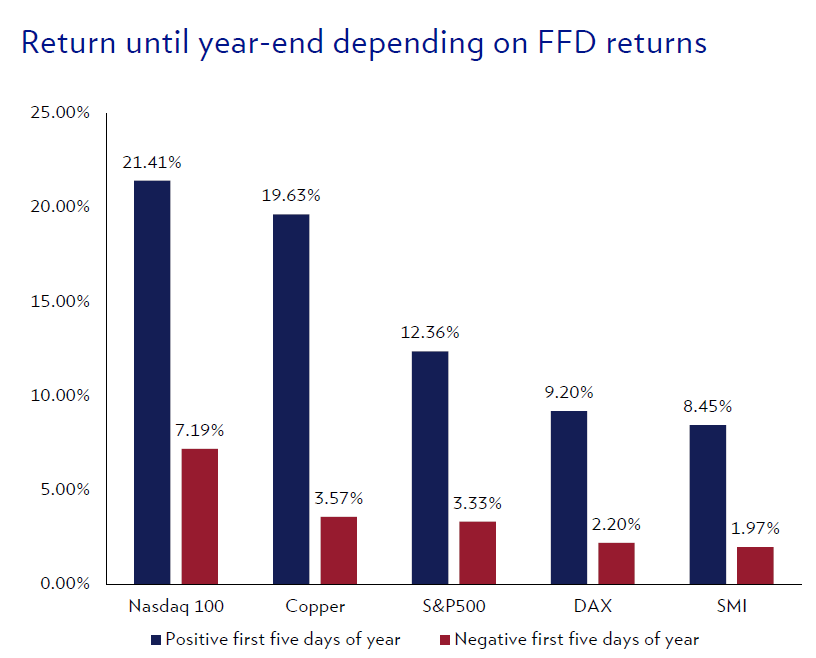

However, the first 5 days January barometer £(FFD) looks at just those first five sessions of each year, and dictates, that if returns were strong over that period, as they were this year, it tends to be a good year for equities. Here’s a graph from the very fine technical analysis team at Julius Bär:

Stunning, ain’t it?!

However, some sort of market rotation, which we have allured to several times over the past few months, seems to be indeed underway.

For example, looking at a year-to-date heat map of the S&P 500, reveals that five members of the Magnificent Seven family have been struggling these first two weeks:

Hence, we would suspect that the equal-weight version of the index (RSP) has outperformed the cap-weight version (SPY) since the beginning of the year:

Bingo!

But not only YTD has the equal-weight index done better, but actually since the Federal Reserve Bank’s second rate cut in its second cutting cycle on October 29th 2025:

Back to the Mag 7 for a moment, which are at danger of breaking down against that S&P 500 equal-weight index (MAGS/RSP):

Two segments that have performed extraordinarily well this year are small cap stocks,

and semiconductors stocks,

up eight and twelve percent respectively.

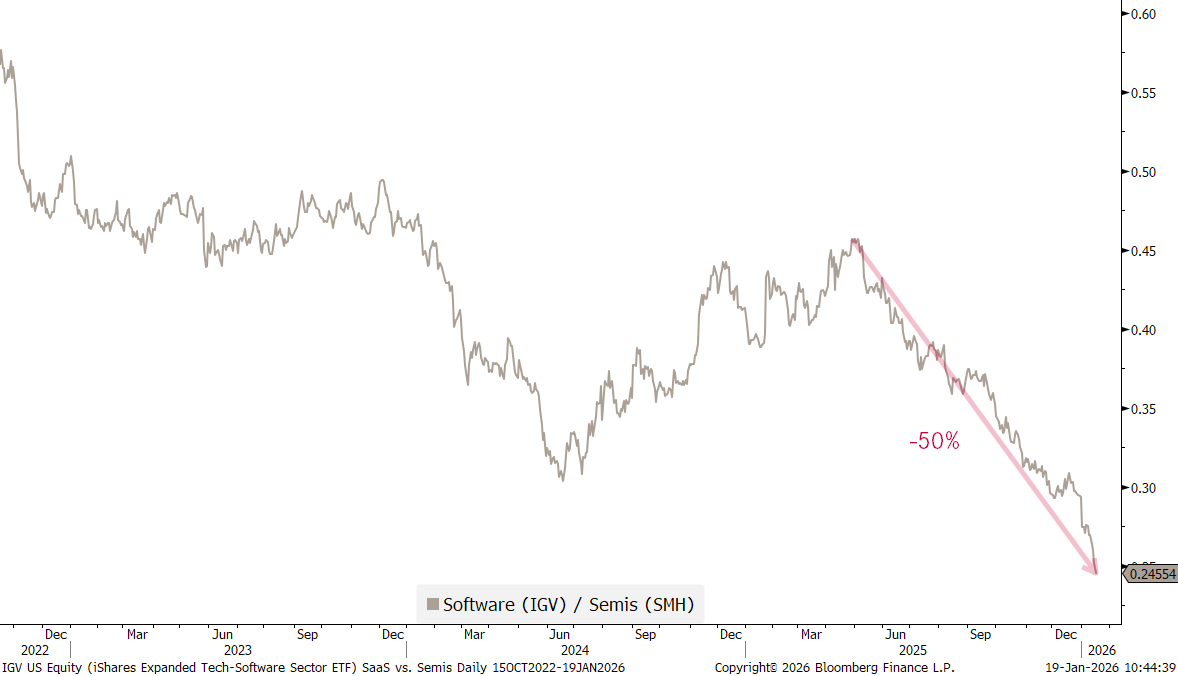

Software stocks (IGV - iShares Expanded Software ETF) are having a awful period,

but even more so if compared to the semiconductors:

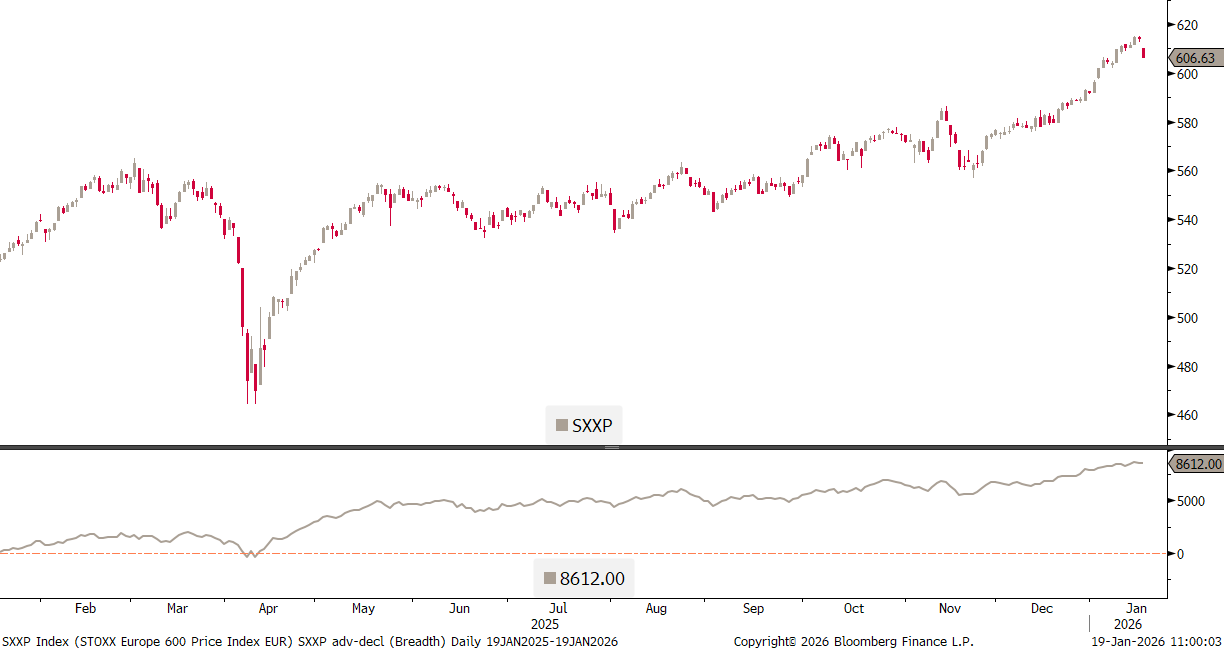

European stocks (SXXP) are down this morning post the renewed tariff threat by one capricious US president, but in general had a very good start to the new year:

But given the strong breadth (cumulative advance-decline ratio - see lower clip in following chart), this seems to be rather a buying opportunity than the onset of a larger drawdown:

One index that has been going from strength to strength is UK’s Footsie 100, breaking the 10,000 landmark on the third trading day of the year and not really backing since:

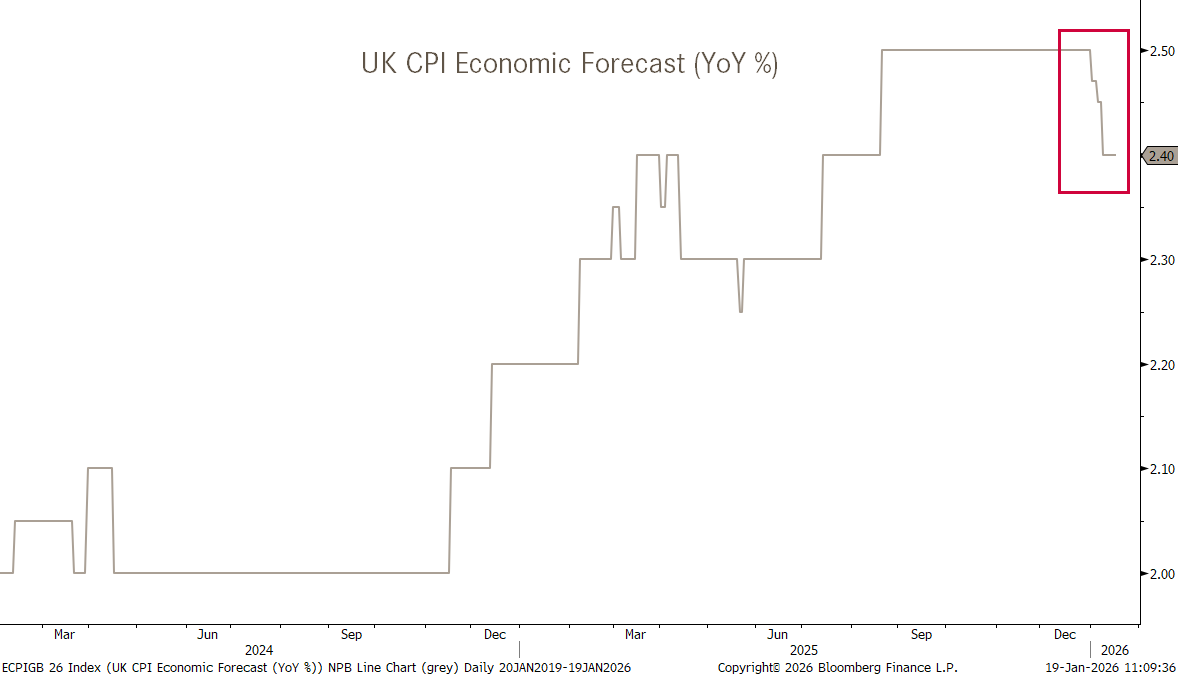

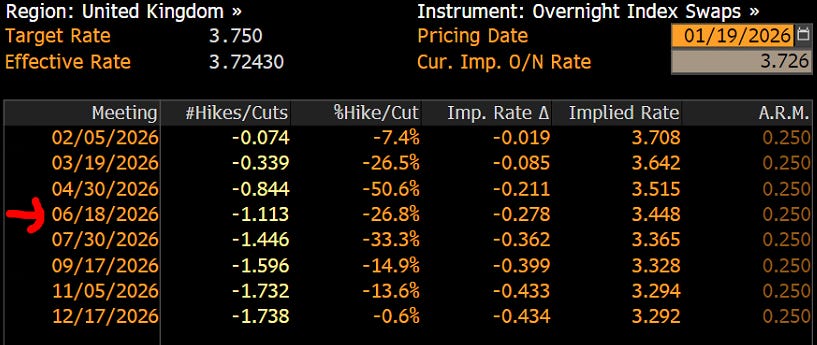

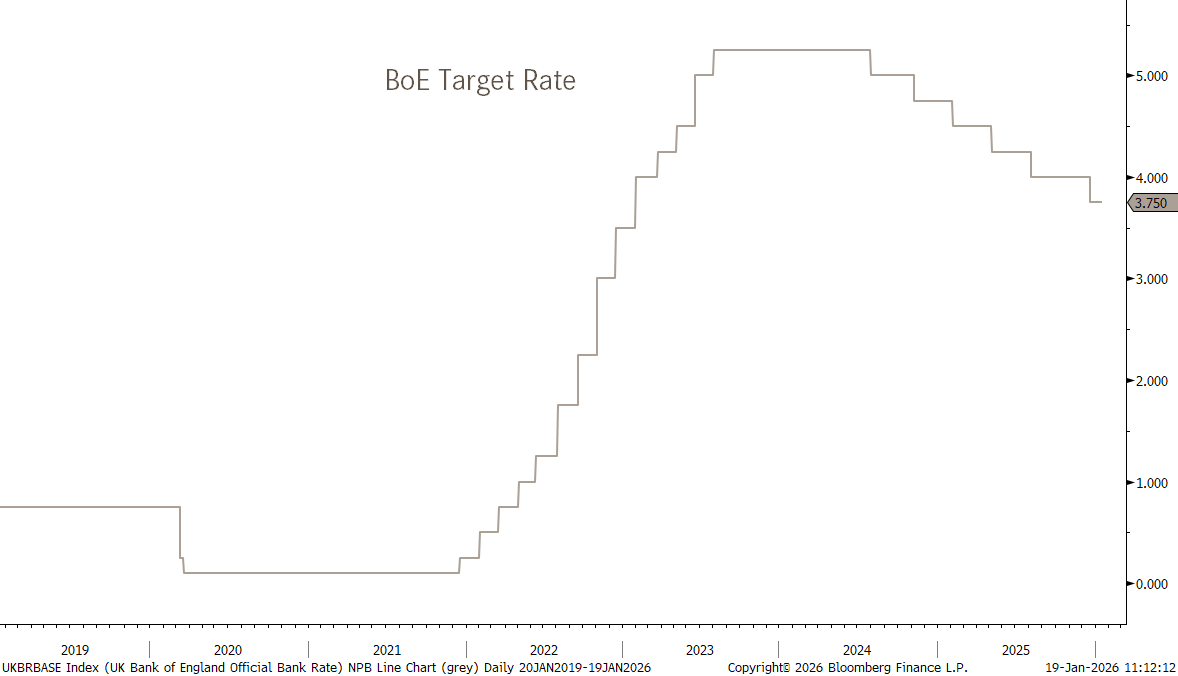

UK Inflation numbers are out later this week (21.1.), but 2026 full-year forecasts have been revised lower lately,

and the Bank of England (BoE) is expected to cut rates again by mid-year,

for a sixth time this cycle:

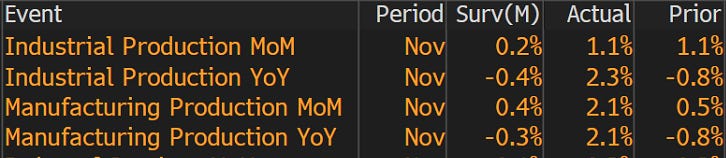

With some recent industrial output data surprising strongly to the upside in the UK,

it may be a good idea to have a closer look at the domestically focused FTSE-250 index for further “catch-up” potential:

In Japan, where by the way the following headline just hit the newswires as I am typing your favourite newsletter,

the Nikkei (and broader Topix) has been shooting higher since moving out of its consolidation triangle:

Hong Kong (Hang Seng) stocks just have been rejected for a third time from the upper end of their four-months trading range:

A similar pattern has been unfolding on the Indian equity market:

Though here we have got quite concerned regarding a possible break lower, especially as on relative basis to the rest of the emerging markets Indian stocks are tanking:

In bond markets, something seems to be on the move, as the US 10-year Treasury is seemingly attempting to break out (to the upside) of its trading range:

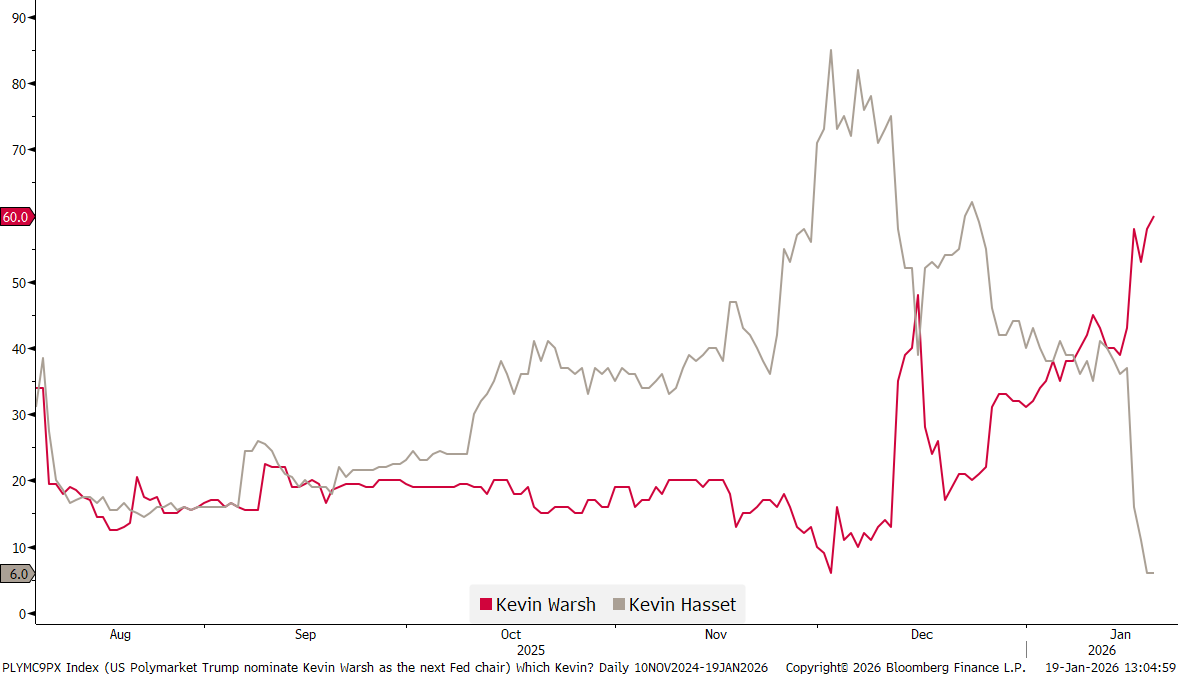

The move came in Friday, after former Federal Reserve Governor Kevin Warsh emerged as the top choice for central bank chair following President Trump’s remarks about Hassett.

"I actually want to keep you (Hassett) where you are, if you want to know the truth. Kevin Hassett is so good,"

Trump was cited as saying in a Dow Jones report published by Morningstar.

Prediction markets, such as Polymarket, adjusted their bets accordingly:

Despite Warsh being considered less dovish than Hasset, the bond market still silently revolted upon the news.

But the only really interesting and scary thing in this whole soap opera is that Donald Trump already had an eye on Kevin 34 years ago!!

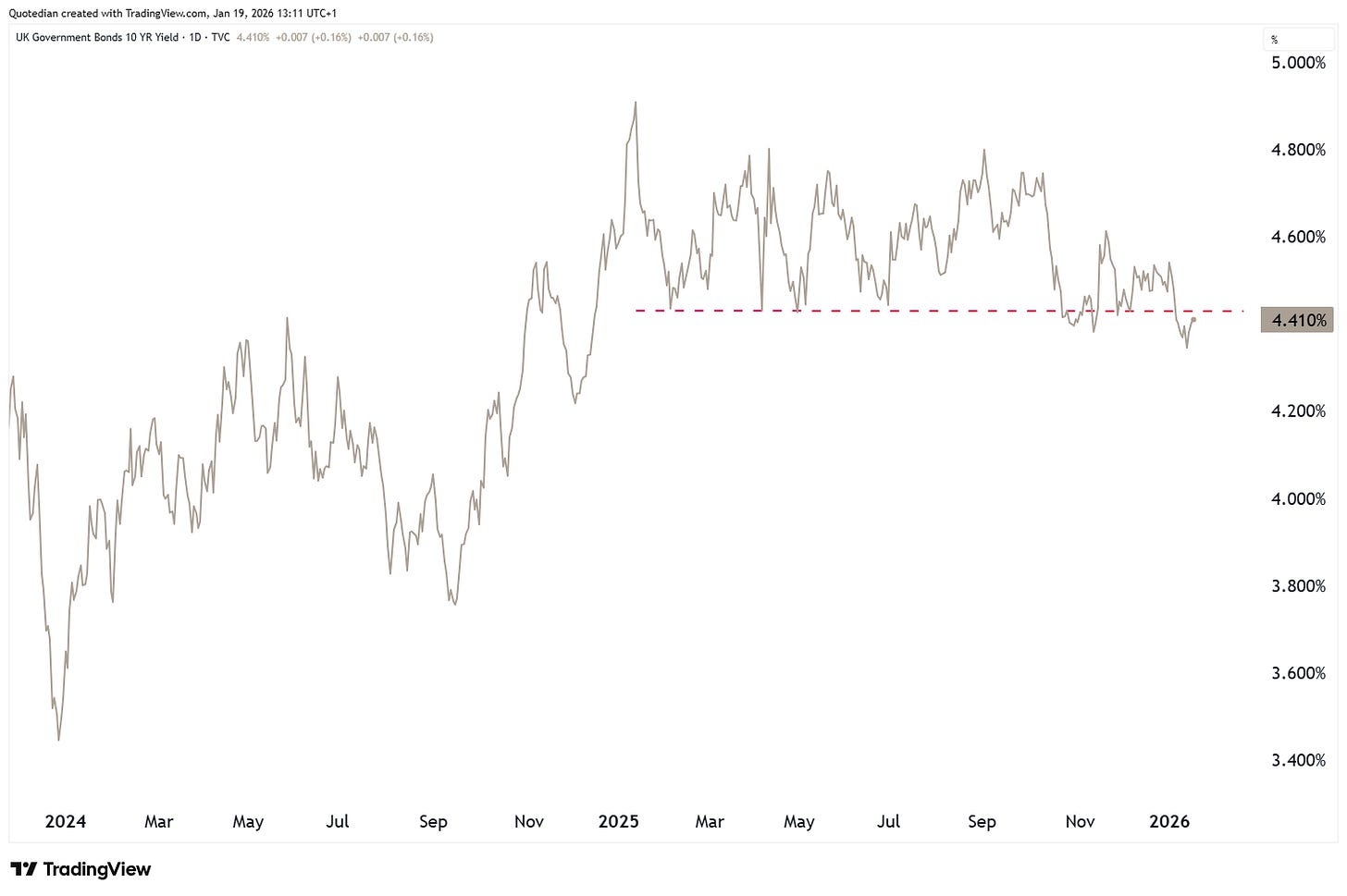

UK bonds have been behaving better, with the 10-year Gilt following below support at 4.42%. However, a renewed close below 4.34% would be necessary to confirm a UK bond bull market.

We have already discussed Japanese bond yields in the introduction to this week's Quotedian. However, since the snap election called for by PM Sanae Takaichi has been confirmed as I typed this morning (19.1.) and is accompanied by a campaign on a temporary sales tax cut on food, the bond market is also here revolting quite strongly with a 9 bp move higher. Here’s the 10-year JGB yield:

Let’s use the Japan yield discussion as a segue into currency market …

The Yen has taken the ‘news’ relatively calm, losing about one big figure or 0.5% versus the Euro:

Maybe Probably For sure, this snap election announcement was already well-expected and investors positioned accordingly. Maybe, but just maybe, it may perversely enough be a turning point for the Yen. Here’s the USD/JPY chart:

Technically, a setup for such a reversal would be in place via the divergence between price and momentum indicators (red arrows). But do not try the long side of the JPY (short side of the USD) unless the rate drops below 157.40 and for the less aggressive amongst you wait for support at 154.70 to give…

The EUR/USD, which had seen weakness since x-mas eve is putting in a key reversal today, but maybe not too much should be read into the move, with the US closed in observation of Martin Luther King day and lower volumes than usual.

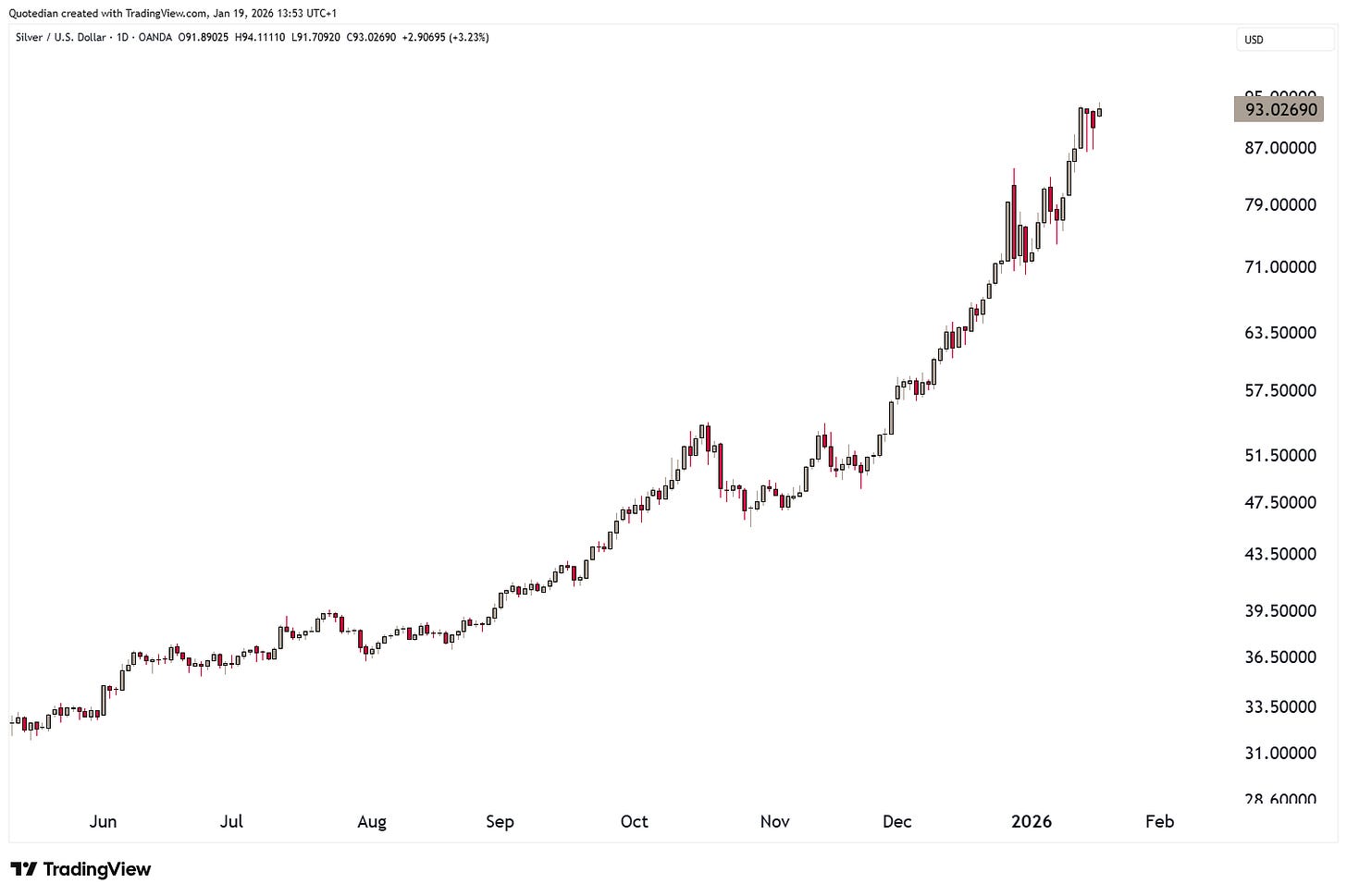

In the commodity complex, there is still no stopping of the precious metal rally.

How long for Gold to hit the 5,000 milestone?

Only seven percent to go here now.

How long for Silver to hit our lower target of USD120/oz?

Still 30% to go for that and Silver is hopelessly overbought (RSI) on all three time frames. Here are the current readings:

Daily: 72

Weekly: 85

Monthly: 93!!

And then again, every intraday pullback is immediately encountering strong buying again, pushing this metal from ATH to ATH.

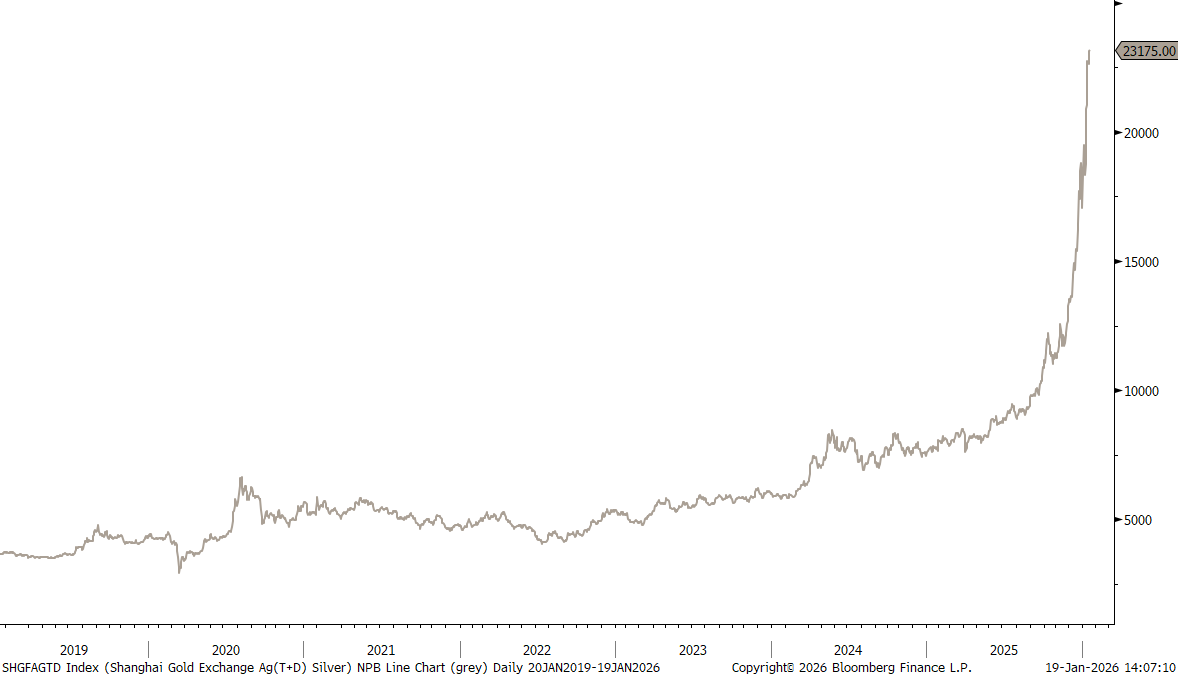

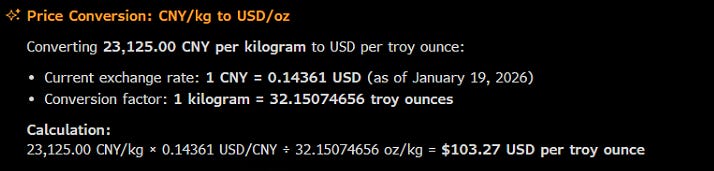

The following chart is the one of the price of one kilogram in CNY of physical Silver in Shanghai:

Converting, this results in a price above $103 per ounce:

As one very astute commodity trader (Tracy aka Chi) recently pointed out in a Substack post, due to supply constraints it is the physical market in Shanghai that is current LEADING and the paper market at the COMEX that is LAGGING. Reality will catch-up and explain the constant bid under the silver price.

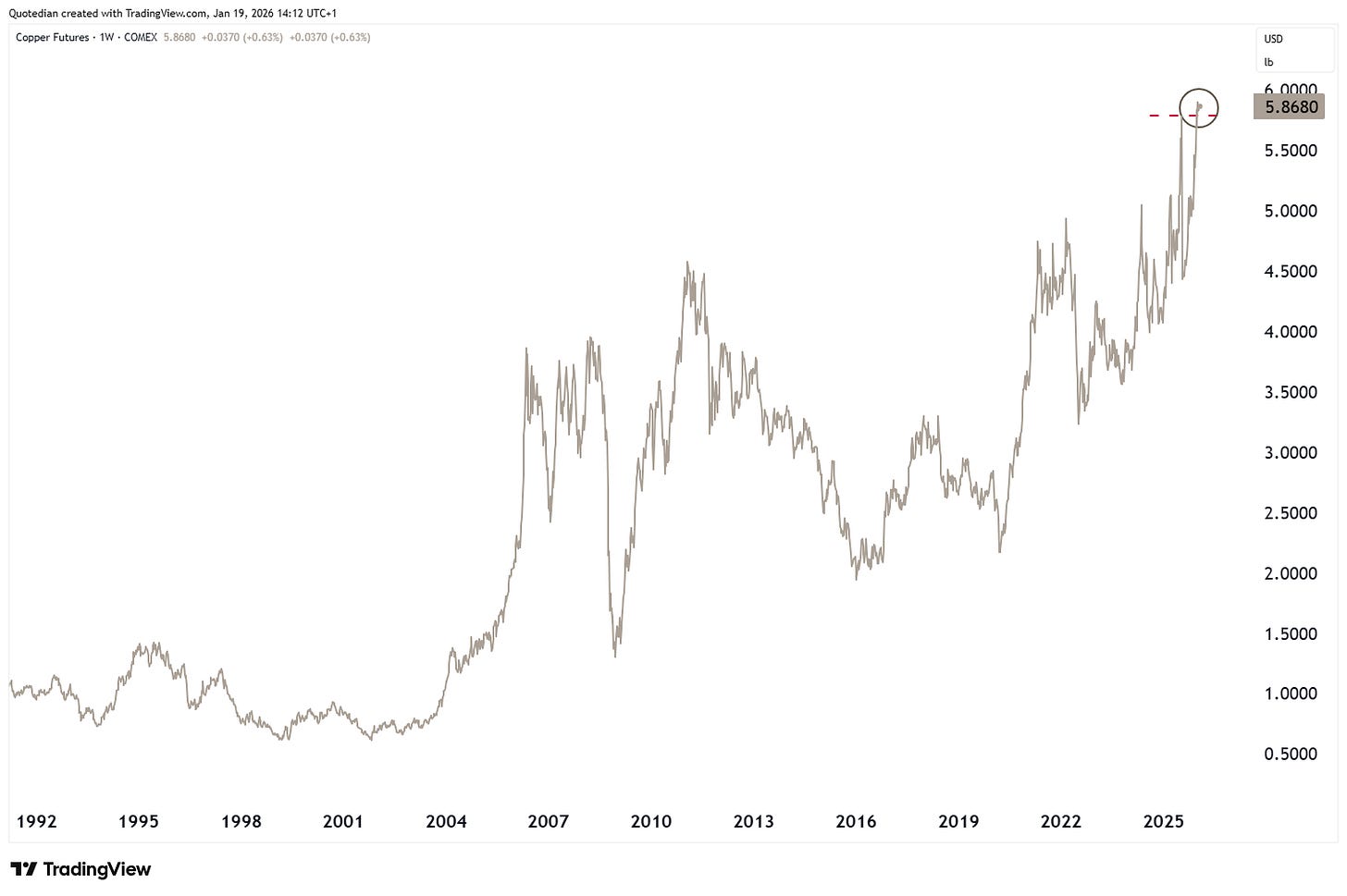

The move in non-precious metal copper has been more orderly,

however, here too prices have been hitting all-time highs:

So the 102 million oil barrel question remains: Is crude oil the next shoe to drop (i.e. rise)? The Iran situation and a possible US involvement led to a brief oil rally (see WTI below), but seems to be already over again:

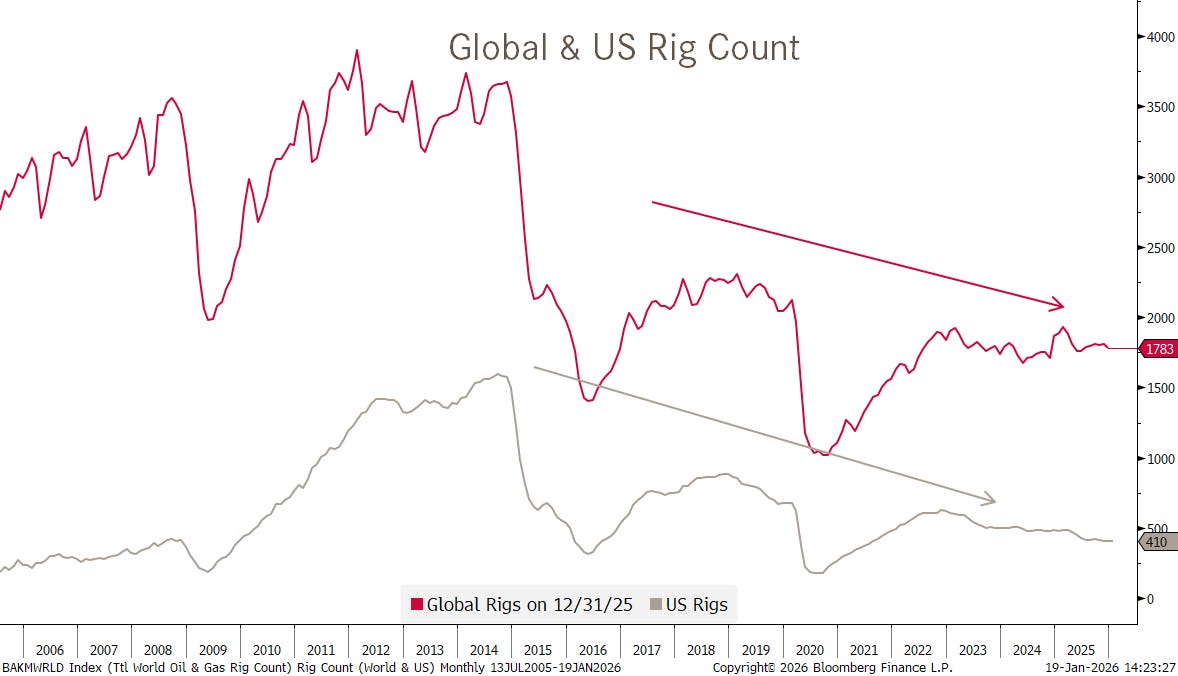

But to be honest, with geopolitic heading where they’re heading and rig counts flat to falling, it is only a question of time (and mafs) until we see a higher oil price:

Time to hit that send button - make sure to check in on the QuiCQ for intra-week updates and make even ‘surer’ to hit that Like button at the end or top of this email!

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG