Typo

Volume V, Issue 161

“The trend is your friend, don't fight the tape.”

— Marty Zweig’s Investment Rule #1

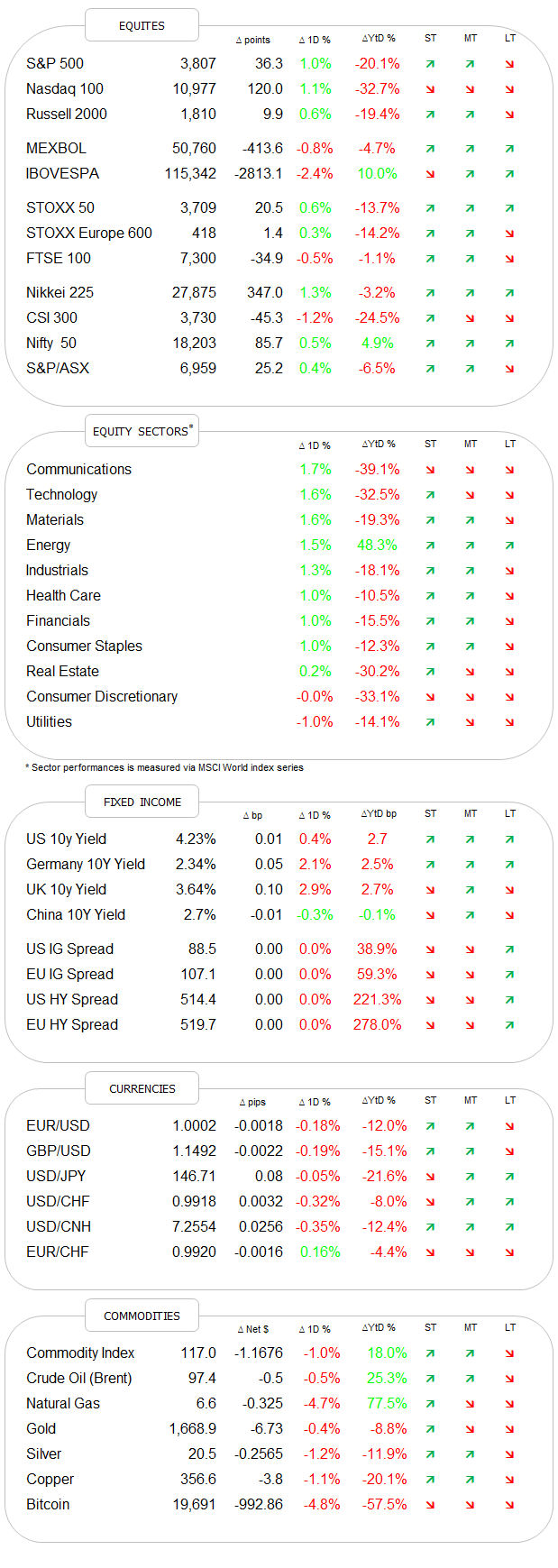

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s Quotedian will be extraordinarily short, as I had completely forgotten about a very early commitment.

So, let’s dive right in…

Stocks in Europe and the US closed up firmly for a second consecutive day on Monday. Whilst the latter is still trying to regain territory lost during last Thursday’s sell-off

European shares are actually already making new highs (SXXP) for the current bear market rally

with the narrower EURO STOXX 50 actually having closed above its 200-day moving average:

Quite the feat and even though we may not like it, this looks bloody bullish on the chart. Remember: Price Rules! (also, re-read today’s QOTD if in doubt)

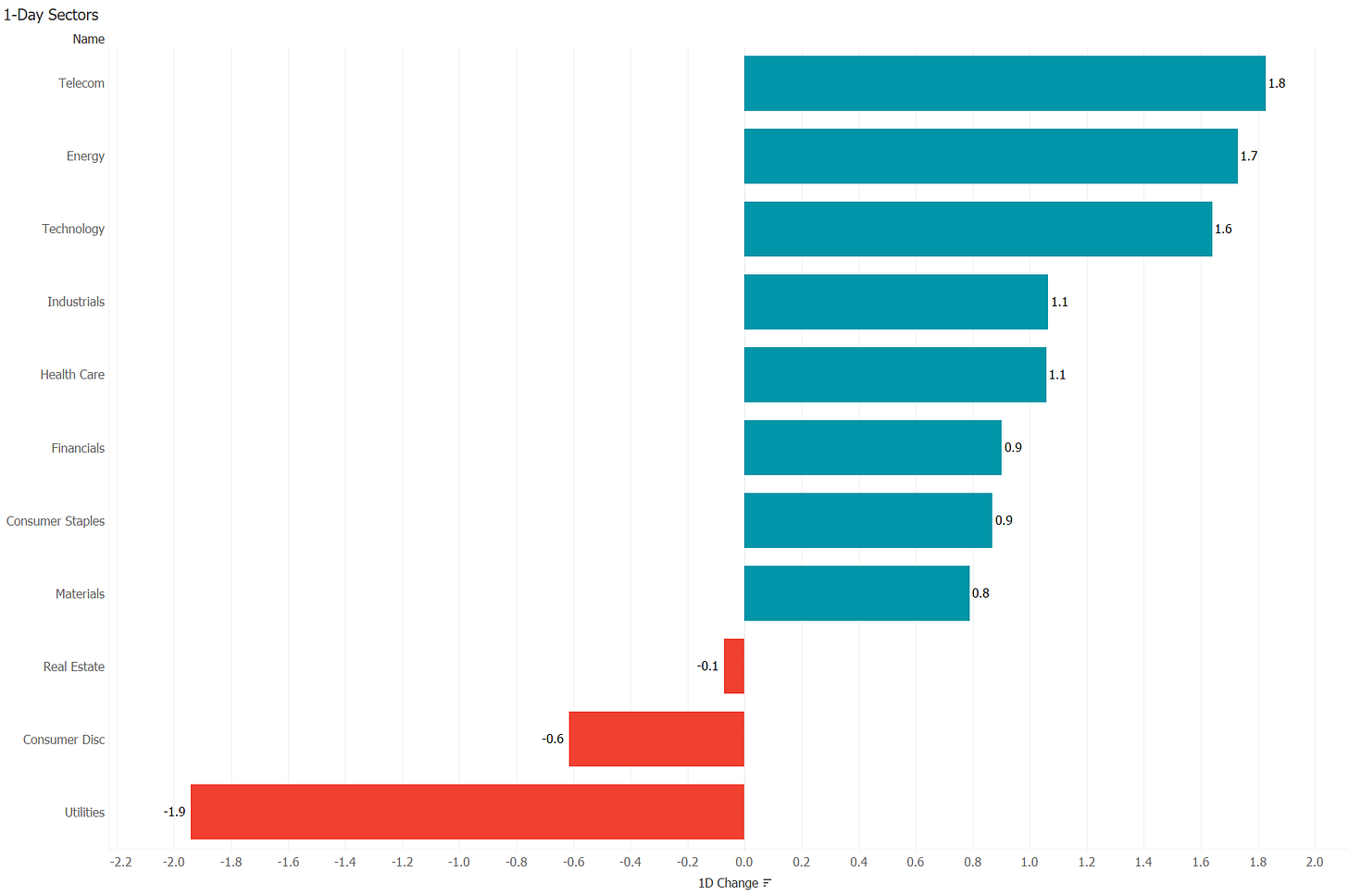

In US markets, eight out of S&P 500’s eleven sectors closed higher on the day,

and market breadth was about 3:1 in favour of advancers, leaving us with the following market heatmap:

Asian markets this morning are largely firmer this morning, with the exception of the Chinese complex (Mainland & HK), which is seeing some profit taking after two exceptionally strong days on Friday and Monday on the back of hopes of an easing to zero-COVID policies.

European and US futures are suggesting a flattish open to today’s cash session.

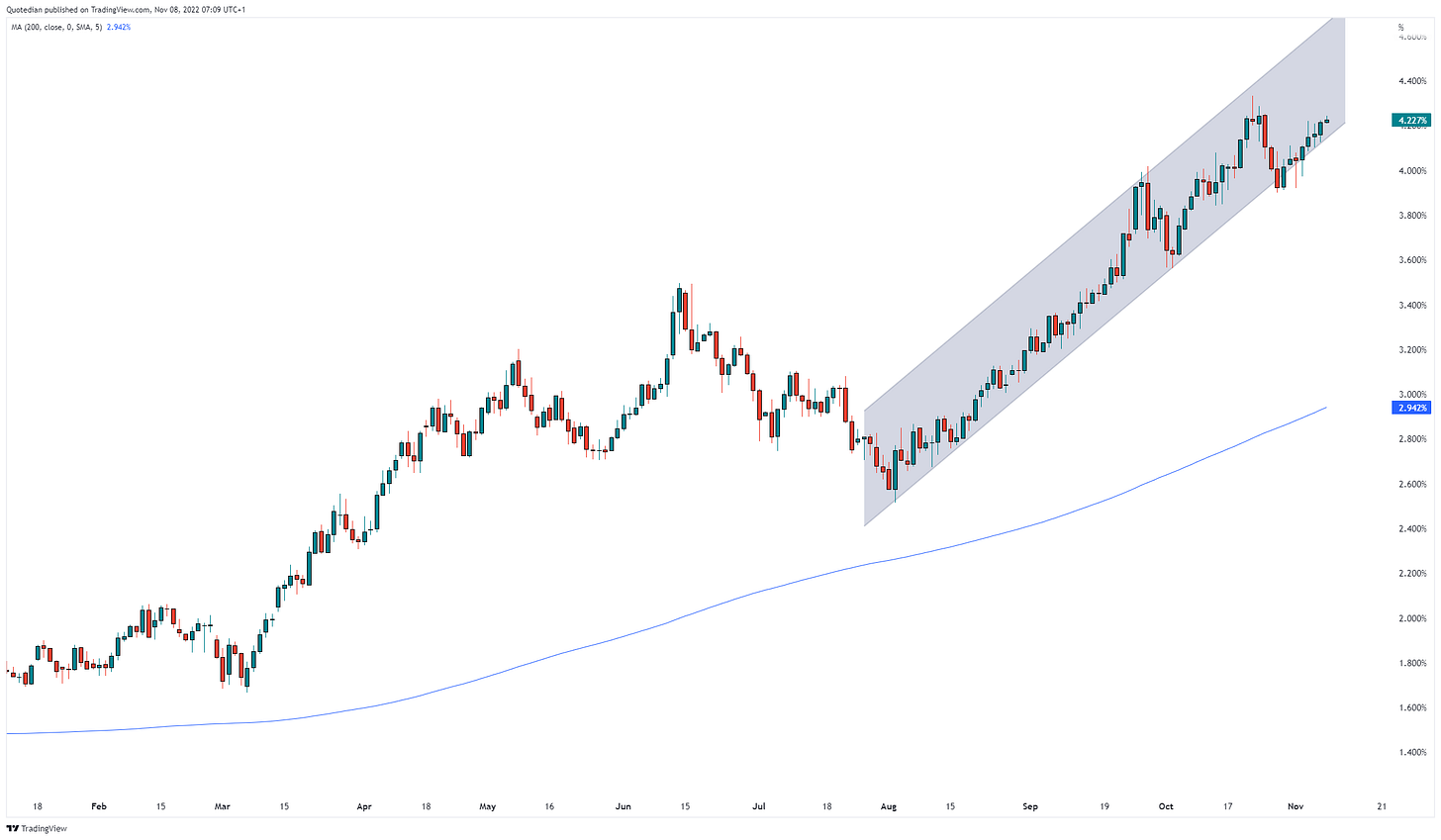

Bond yields moved a tad higher again, and are about to hit a new cycle high in the case of the US 10-year treasury:

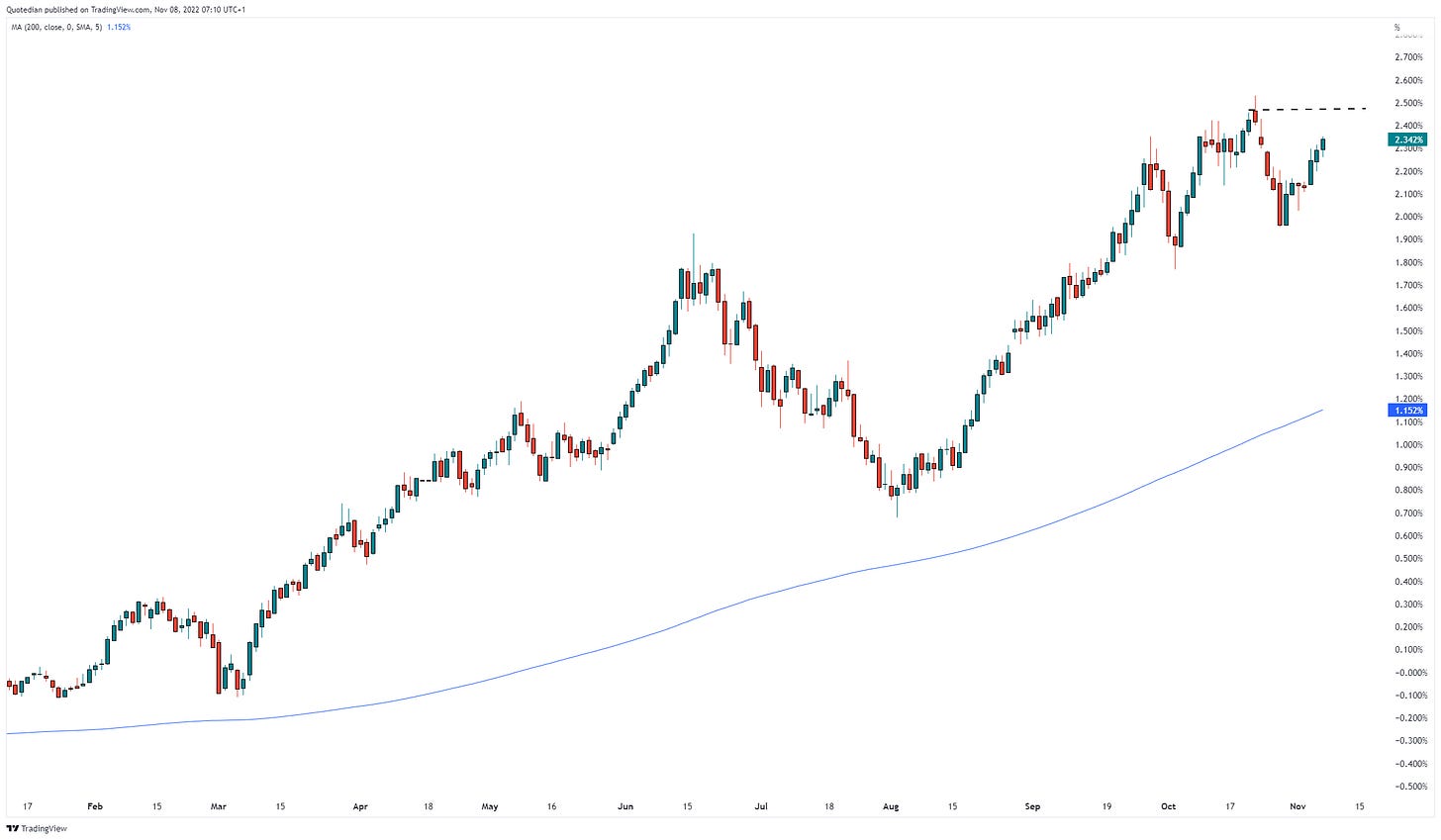

with German yields (as proxy for Europe) not far behind:

Whilst yields continue to push higher as just discussed, the US Dollar has failed to push higher and the chart (DXY) currently looks more like reversion rather than continuation:

On the Dollar Index (above) the 108.50-109.25 level (shaded) seems to be key. A break lower could be very positive for many other asset classes, and if rates would top out at the same time (after Thursday’s CPI number?), that would be the perfect setup for a continuation of the rally into year-end. But we are jumping the gun …

As aforementioned, I need to cut short here but we will be back tomorrow with some lengthier observations. Normally we should be in for a relatively quiet question (famous last words) as the US electorate is busy voting. Given that at a minimum a split house is expected and probably priced in, Thursday's CPI number will probably bring more excitement than today’s election.

CHART OF THE DAY

Remember the FAANG stocks? Probably you do, albeit they are now called MATANA or something similar. Anyway, let’s use FAANG.

So, according to the chart below, when you were told to buy FAANG, that was actually a typo. The true recommendation for sure must have been to buy FANG, also known as Diamondback Energy.

I mean, the relative performance speaks for itself …!

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance