Waiting Game

Volume VI, Issue 8 | Powered by Neue Privat Bank AG

"In a world of uncertainty, the only thing you can be sure of is volatility."

— Jim Rogers

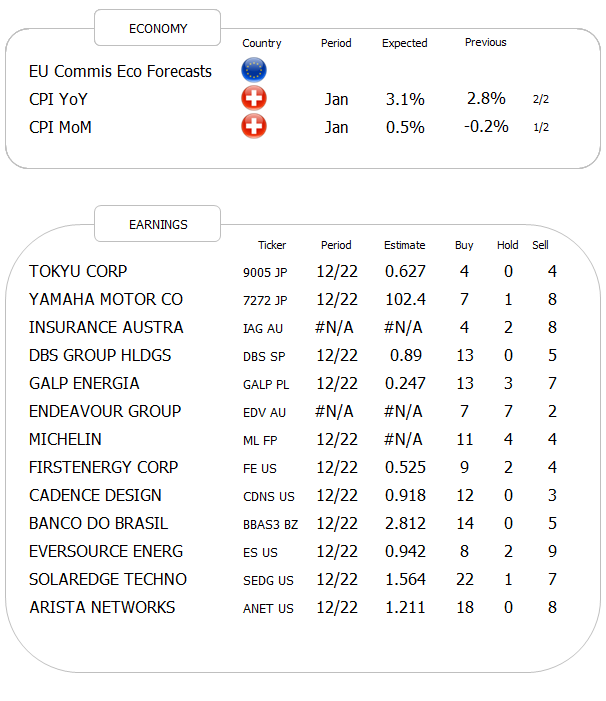

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

It’s Sunday afternoon/evening which means it is time for The Quotedian to initiate our usual weekly review of global financial markets. Reading today’s letter and then hitting the like button at the end will be the perfect entertainment until the Super Bowl LVII starts shorty after (European) midnight.

Let’s dive right in …

The good old Quotedian, now powered by Neue Privat Bank AG

NPB Neue Privat Bank AG is a reliable partner for all aspects of asset management and investment advice, be it in our dealings with discerning private clients, independent asset managers or institutional investors.

We started last Sunday’s Quotedian with the chart below and the reflection that for equities, February can be a bit more challenging from a seasonality point of view:

As we are nearly halfway into the month already, let’s quickly check if that analysis was worth anything:

At a first glance, it actually seems as if markets are holding up pretty well. The issue is that most gains came post-FOMC and pre-NFP. Since last Friday’s payroll number the tone and mood on global equity markets seem to have soured somewhat, which is well reflected in the weekly performance number for the first full week in February:

The chart of the S&P 500 reveals that this index is about to fall out of its most immediate uptrend channel and the MACD (lower clip) is also flashing a sell-signal via a negative cross:

But as we established last week, the index could drop as low as 3,800 without endangering the medium-term uptrend. The upper line in the sand for the continuation of the uptrend is now set at 4,200.

The 5-day heatmap of the S&P 500 gives further evidence of how difficult the week was for many stocks in this benchmark index:

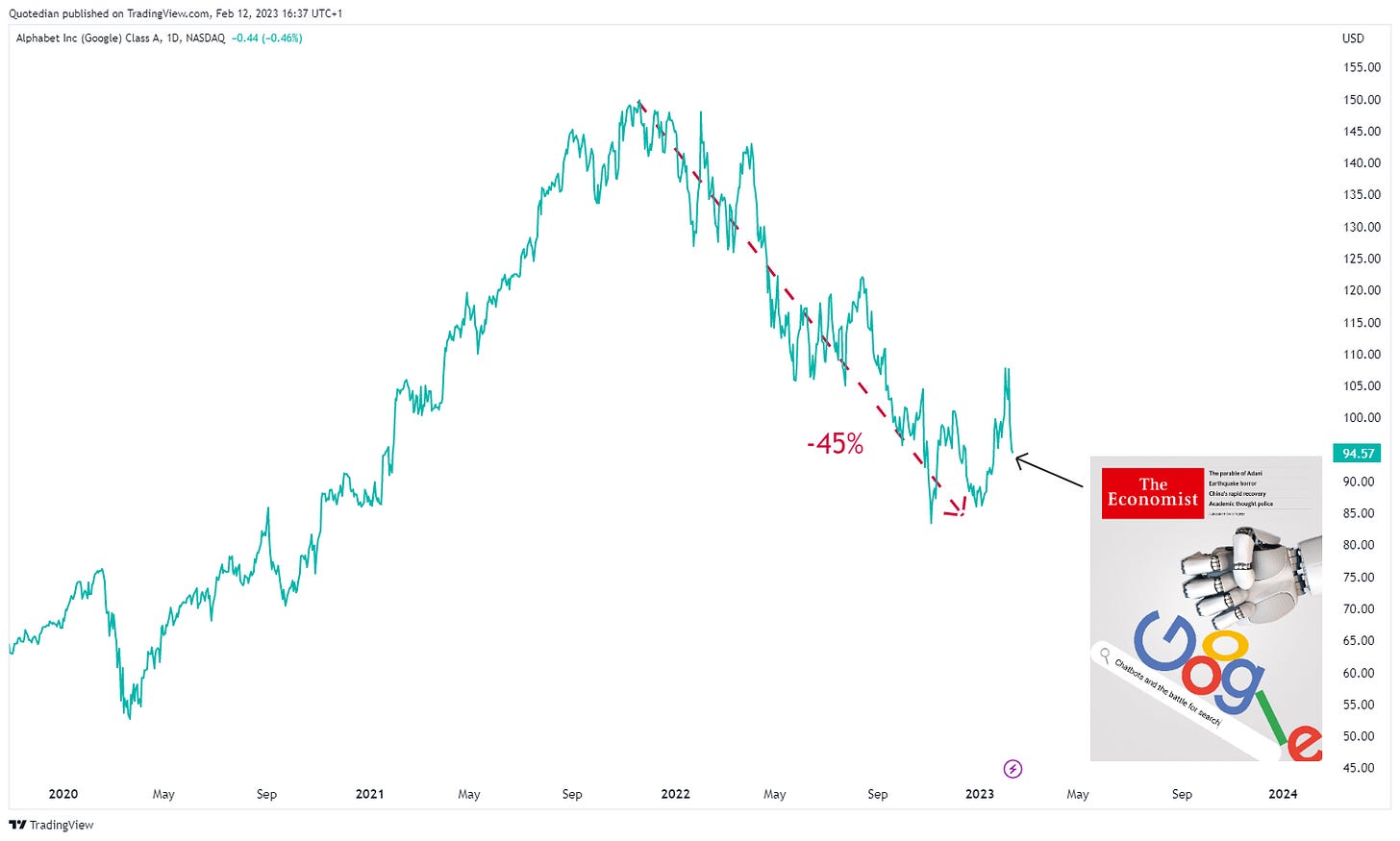

Comparing the performance of Microsoft (MSFT) and Alphabet (GOOG) one would be inclined to say that it is 1-0 in favour of MSFT with regards to artificial intelligence apps. Microsoft of course recently took a major (and expensive) stake in the highly popular ChatGPT, whilst Google went to present its own AI app, called Bard, earlier this week. Apparently, it was quite THE flop event and the stock tumbled close to ten percent on the week.

But there’s hope for Google! The Economist, one of the best sources for contrarian ideas, just made “the end” of Google their magazine front cover:

Let’s see if this will be enough to put a bottom in to share price of the company …

This is probably also a good moment to have our usual weekly look at the best performers in the US and Europe on a year-to-date basis and their weekly change:

In both cases there is quite a lot of red in the weekly performance column, indicating some mean reversion going on.

Turning to sector performance, the weekly performance stat reveals further that indeed it was a very difficult week for stocks, with the Energy sector being the only printing green:

However, we must also be aware that nearly all gains for the Energy sector came from Friday’s session alone, after the price of crude shot higher as Russia finally followed through on its long-standing threat and announced oil output cuts by 500,000 barrels a day starting March.

Here are some of the biggest winners in the oil sector on Friday:

Turning to fixed-income markets, the weekly performance table makes it evident very quickly that it must have been a difficult week for bond investors:

With equities weakening, one component contributing to the negative performance picture was surely widening credit spreads:

Indeed was a first small uptick since early December registered.

However, likely having had a much larger contribution to the negative performance werer rising yields after Friday surprise labour market report. Here’s the chart of the US 10-year yield:

Indeed is the yield back to its highest level since late December. And the yield curve (10-2 year) continues with its record inversion. Here’s the long-term picture:

And here is a close-up:

German 10-year Bund yields are also up nearly 40 basis points since its January lows:

But their 2-year equivalents are about to break to new multi-year highs, reflecting the ECBs newly found hawkishness:

Japanese 10-year yields are pushing towards their (artificial) 0.50% roof again,

as a direct result of wage inflation in the land of the rising sun getting out of hand:

Let’s use the Japan discussion as a segue into the currency complex, where the Yen ping-ponged on Friday as investors fretted over the Kuroda-succession news:

The daily chart is similarly non-conclusive as the mess above:

Versus the Euro, the greenback has gained some further ground over the week and is about to fall out of the immediate uptrend channel we crayoned last week:

1.05 and then 1.02 would be target points should that occur.

But the Dollar was not only stronger versus the Eurozone currency, but versus most other major currencies too:

Bucking the trend where the Norwegian and the Swedish Kroner, after the central bank of the latter surprised with a 50 basis points rate hike (i.o. 25 bp).

Versus the Euro, the SEK then gained over two percent on the day:

Let’s finish the currency section with the following table, showing that may crypto currencies have undone some of their recent gains over the past week:

Careful, as this could be a first sign of increasing risk-off mood by investors (and not just in the crypto space).

Want to leave a comment? A suggestion? A hot stock-picking tip? Click below:

Finally, in the commodity complex, there is little surprise that Energy was the leading commodity segment last week, given the Russian news:

At the other end of the performance gamma are industrial metals, which gave back some of their very decent gains of the past few weeks.

But let’s go a step more granular, looking at some of the major commodity futures:

Despite the strong performance of Crude, has the black oil not clearly broken higher yet, and is still trading around that all-important $75-$80 pivot range (WTI):

Gold failed to recover from the losses induced by a strengthening Dollar and is threatening to technically break down further:

And finally, after the Egg price shocker of lat week, now it is the price Frozen Orange Juice that is exploding in our faces:

Ok, time to hit the send button. Tomorrow Monday should be pretty quiet on the economic news front as you can deduct from the table at the beginning of this document, but next week will bring us the all-important (courtesy of the Fed) CPI number in the US. That should provide some fun and volatility!

Enjoy the rest of your Sunday!

André

CHART OF THE DAY

Did Lucy just pull the football on Charlie Brown again? Emerging markets were just about to break above two long-term key resistance points, but were stopped in their tracks as the US Dollar began to rise again.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance