Warn(er) Brothers

Vol VIII, Issue 37 | Powered by NPB Neue Privat Bank AG

“I am a man of fixed and unbending principles, the first of which is to be flexible at all times.”

– Everett Dirksen

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Before we get started, as I know that most of you do not read this fine publication right through the end, but rather stop short towards the end of the equity section (sigh), this will be the last Quotedian of the year. The next issue will be out in early January, with our usual year-just-gone-by ex-post analysis. Hope to see you all on the other side (of New Year’s Eve)!

Samuel Langhorne Clemens, better known as Mark Twain once famously quipped:

“History doesn’t repeat itself, but it does rhyme.”

This saying is now (too) often adapted by financial market observers, including yours truly.

But sometimes, just sometimes, history seems to be much more than a rhyme, a near repeat so to say. Consider this:

Twenty-five years later, Cisco Systems (CSCO), a internet networking company some of you may remember, hit a new all-time high this week:

This during the same week where a take-over battle for Warner Brothers Discovery (WBD) unfolds:

Now, think back 25 years:

Indeed! Back in January 2000 internet behemoth AOL announced its intention of taking over Time Warner for a whooping USD182 billion, creating the “AOL Time Warner” media giant, aiming to blend AOL’s internet dominance with Time Warner’s vast content.

I couldn’t find a chart on AOL Time Warner anymore, as the fate of the company was eventually to be swallowed up by others, but the Nasdaq Composite serves as a valid proxy:

But, wait, there’s more!!

We have discussed several times in this space how well as a contrarian signal the Magazine Covers of glossy publications work. And the TIME person of the year is especially good at this! Well, earlier this week, the TIME magazine made the architects of AI the person(s) of the year:

In case you are bad at facial recognition, from left to right:

Mark Zuckerberg (CEO of Meta)

Lisa Su (CEO of AMD)

Elon Musk (Founder of xAI)

Jensen Huang (CEO of Nvidia)

Sam Altman (CEO of OpenAI)

Demis Hassabis (CEO of DeepMind)

Dario Amodei (CEO of Anthropic)

Fei-Fei Li (Stanford AI Institute)

Again, is AI doomed?

But, still wait, there is even more!

The picture the TIME magazine used is a ‘remake’ of this one, taken during the 1929-1932 crash period:

And by the way, the TIME person of the year in 1929 was the Founder and Chairman of RCA, the poster child for the tech sector that year.

I don’t know what’s gonna happen from here, and many (including me) would argue that it is too early for the AI-bubble to burst because everyone is calling it an AI-bubble, but, oh man, wouldn’t it be great if it just did. You could not make this sh.t coincidences!!

On to our last weekly review - the next one will be in the new year with a traditional focus of looking back at the year just gone by.

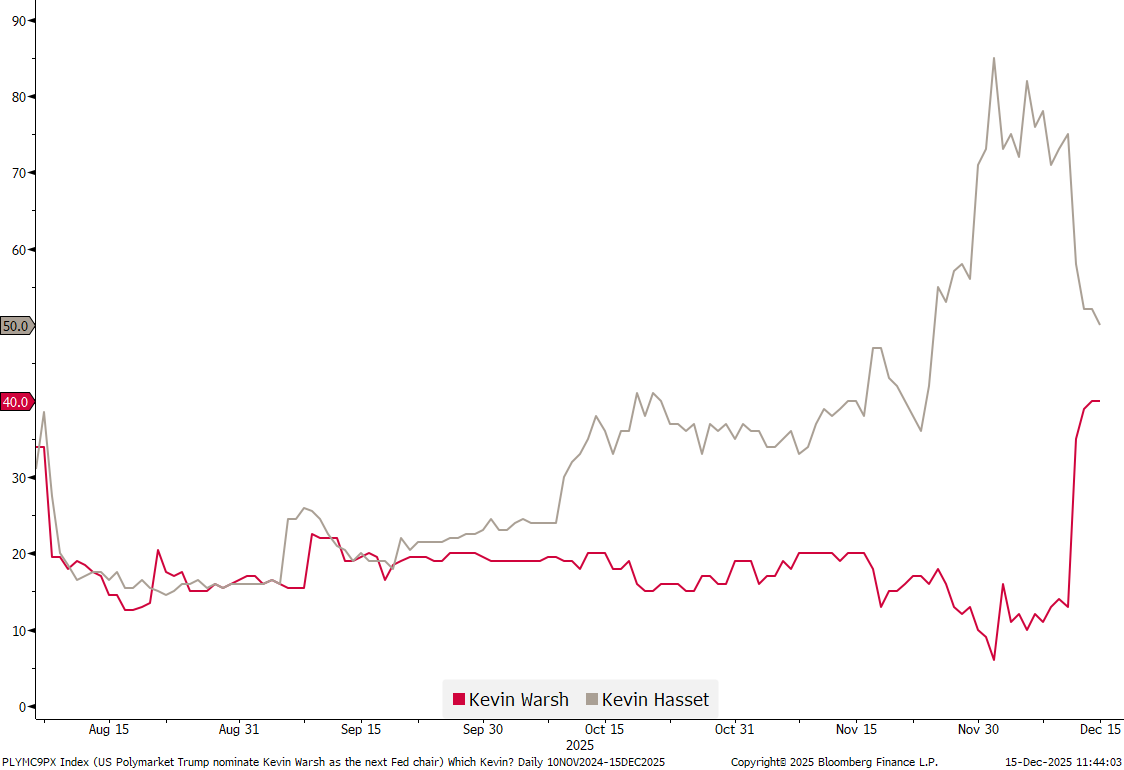

Stocks rallied last week on pre- and post-FOMC meeting, where a hawkish cut was expected, but a dovish cut delivered. Nevertheless, fortunes for equity investors turned quickly lower on Friday, after President Trump unexpectedly brought back Kevin Warsh into the Fed Chair race. Here’s the Polymarket betting chart on who the next Fed Chair will be:

Which Kevin will it be?

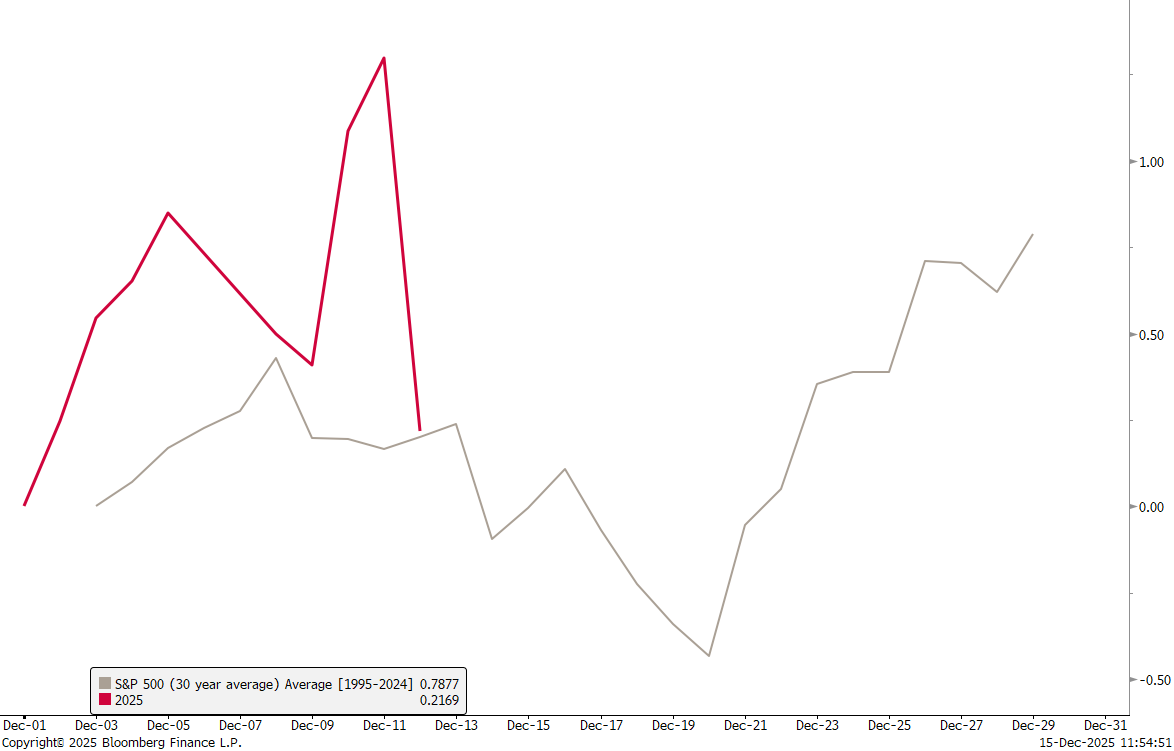

Stocks dropped enough on Friday to produce a negative return for the S&P 500 on the week, but it should not be forgotten that the index just printed a new all-time high on Thursday:

Also, weakness during this phase of December is pretty much the norm:

The Nasdaq-100 got harder hit on Friday and did not achieve making a new ATH last week. Quite “au contraire” is the index sitting on top of the 50-day moving average already again:

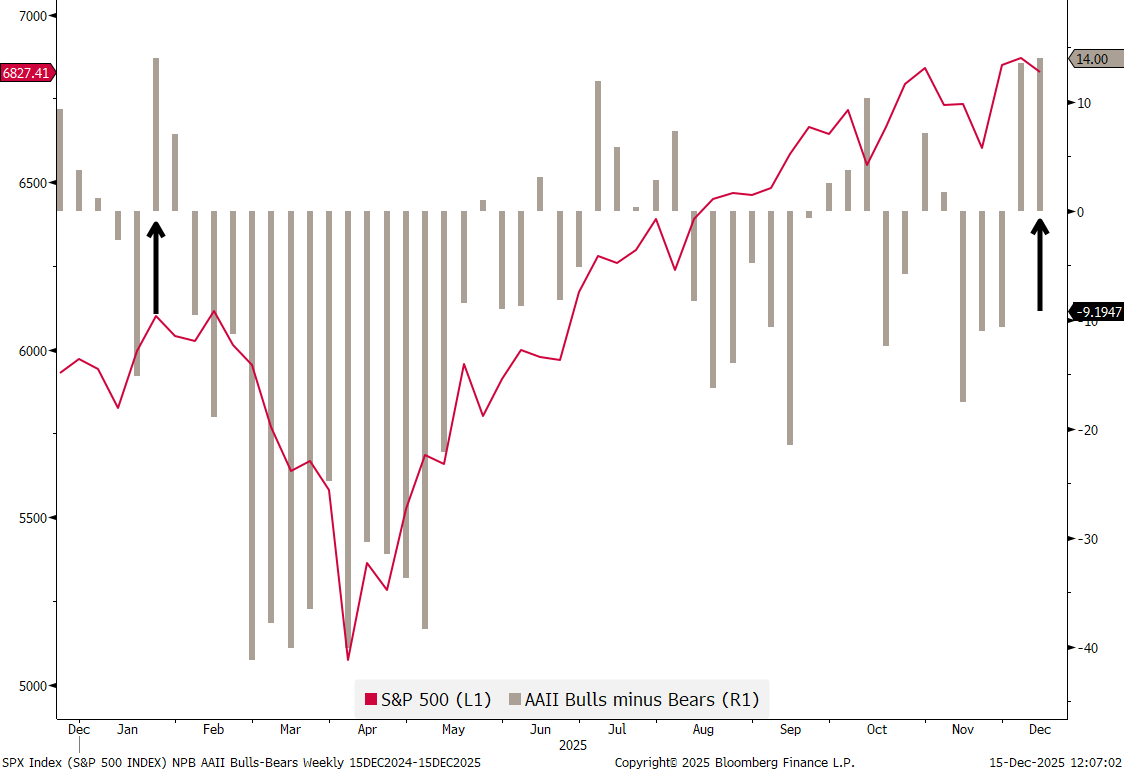

Did the (retail) crowd get too excited (read: bullish) post the new ATH in S&P 500? Perhaps. Our AAII Bull-Minus bear indicator shows the high ratio since early January of this year:

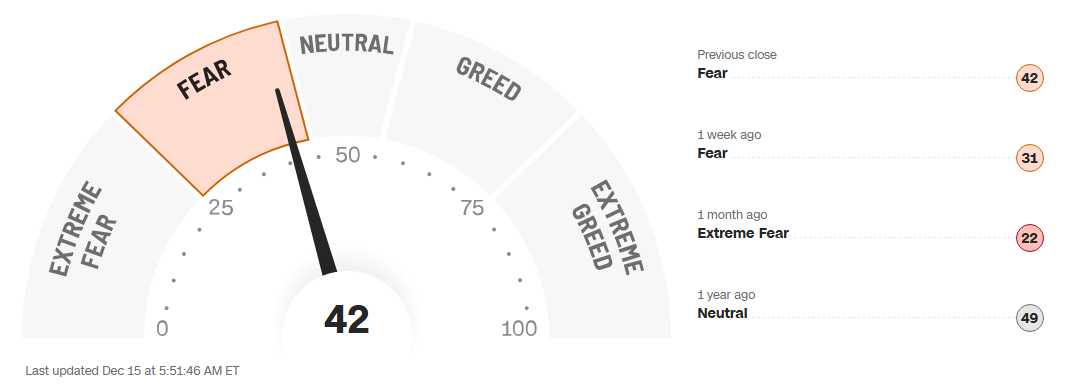

Having said that, the CNN Fear and Greed index has been between Extreme Fear and Fear for over a month now:

No irrational exuberance to be seen here … which could lead quickly to some FOMO again.

So has for example in Europe the broad STOXX 600 Europe index already completely recovered and then some from Friday’s sell-off:

Spain’s IBEX-35 is already flying again,

with especially the banks (red dots) pushing the boundaries higher:

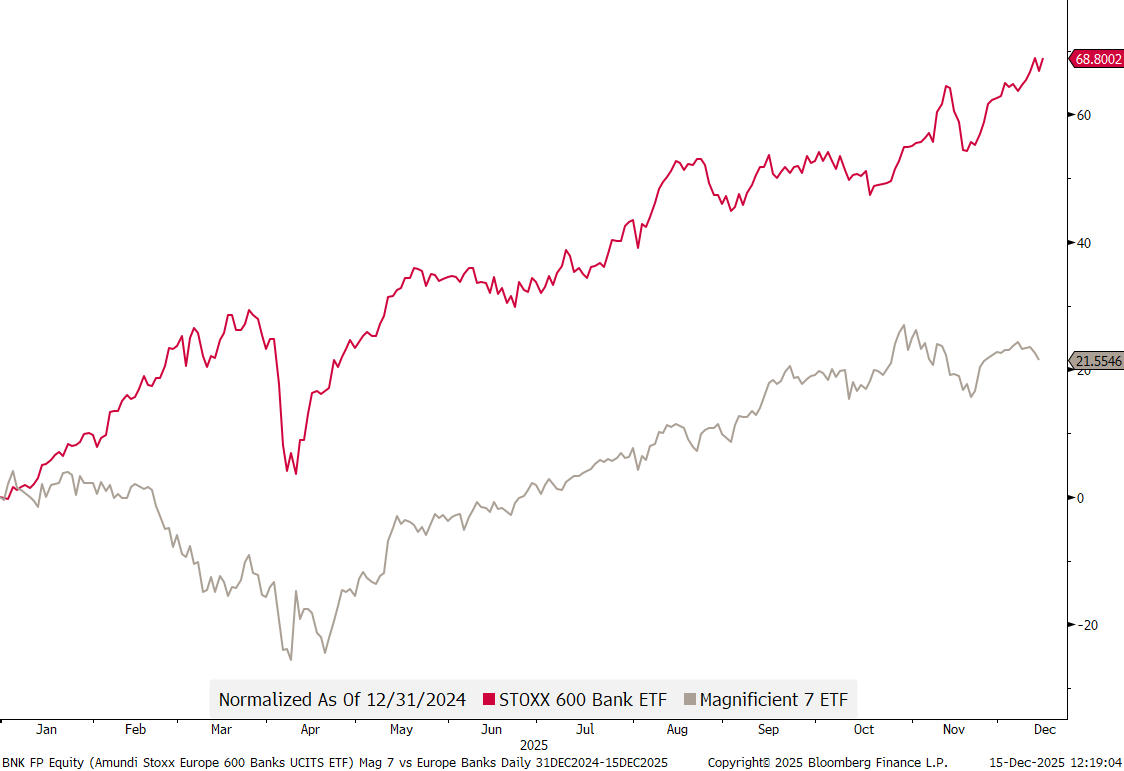

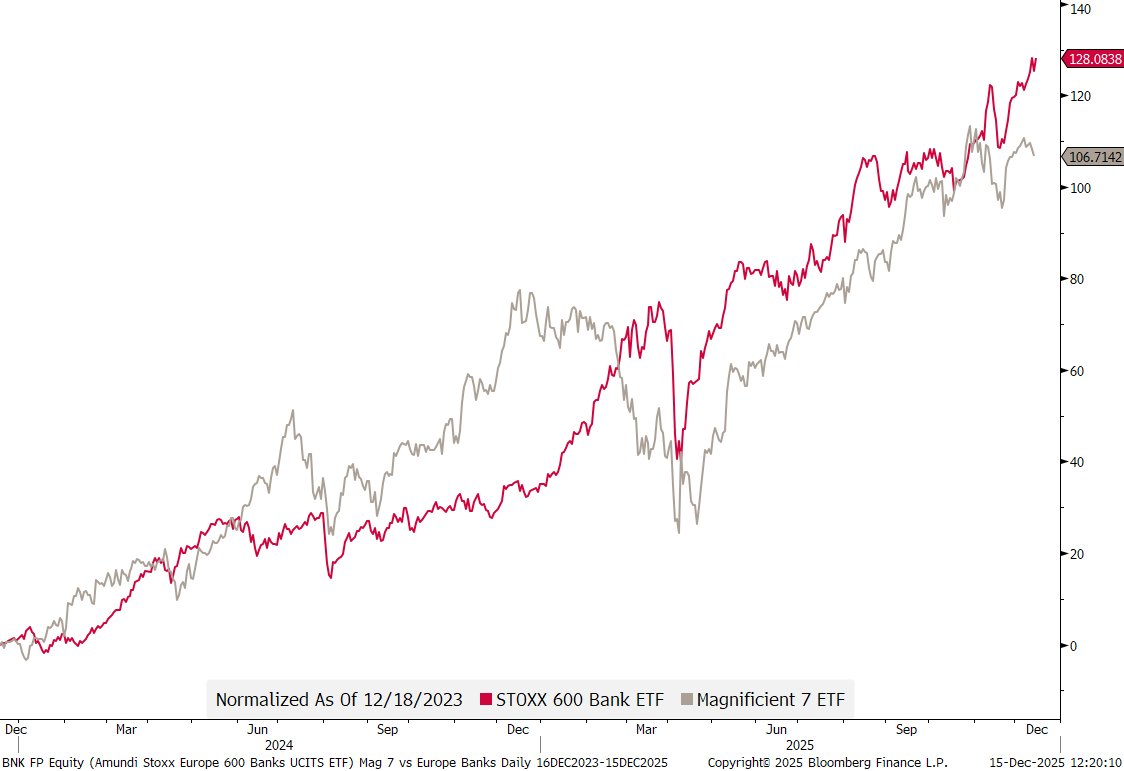

And talking of banks, European banks stocks (red line) continue to beat the Mag 7 (grey line) performance by a wide margin, not only this year,

but since two years running now:

Switzerland’s SMI has been one of the star performers as of late and is now less than one percent away from a new ATH:

Asian stocks were largely lower this Monday, as they “missed” Friday’s afternoon sell-off.

Nevertheless, Japanese stocks (Nikkei 225) seem to be ‘pausing’ rather than reversing lower:

As fore-mentioned, last Wednesday the Fed cut interest rates (as expected) again, but also announced a “Reserve Management Purchases” program, which included monthly purchases of approximately USD40 billion per month. Which is of course QE, just do not call it that.

Not-QE QE, so to say.

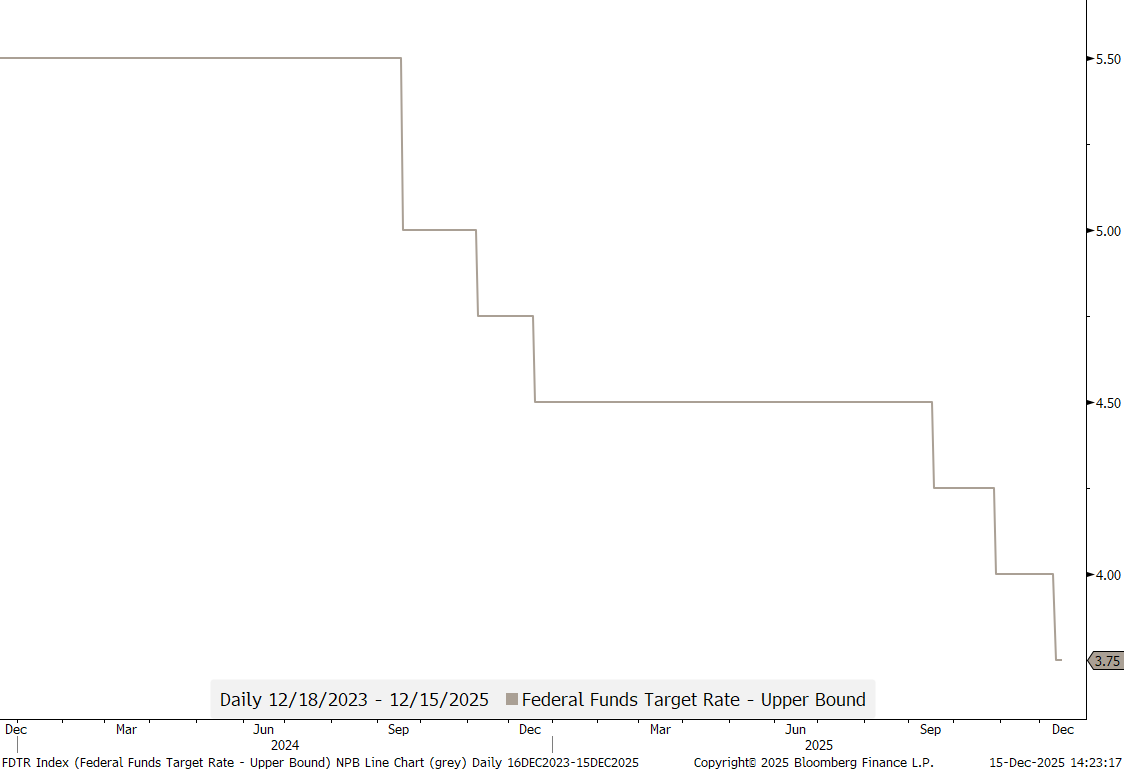

The Fed has now over the past year and a bit reduced interest rates from 5.5% to 3.75%,

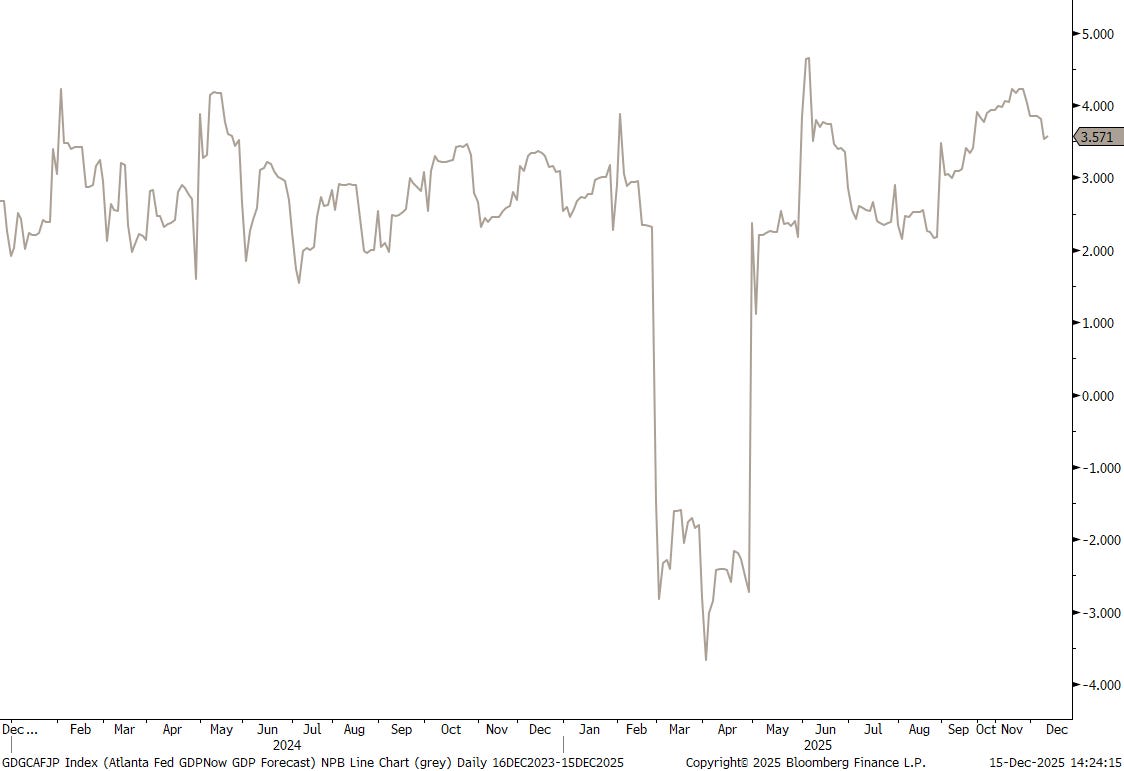

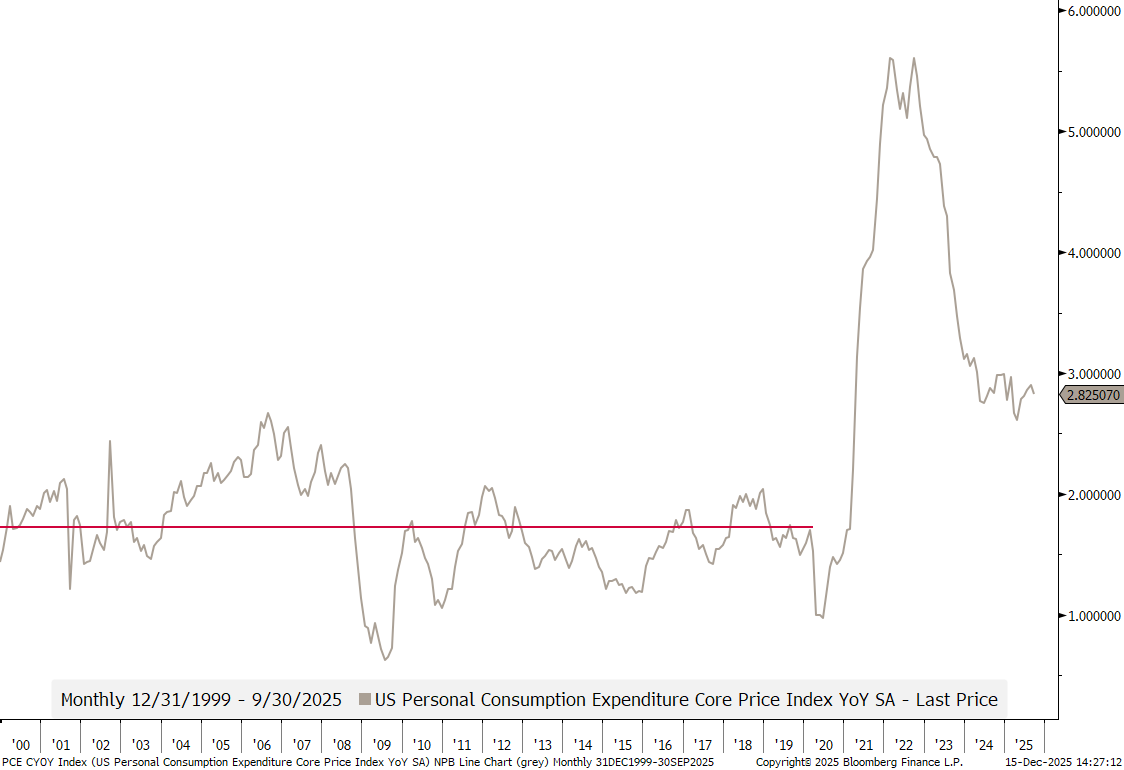

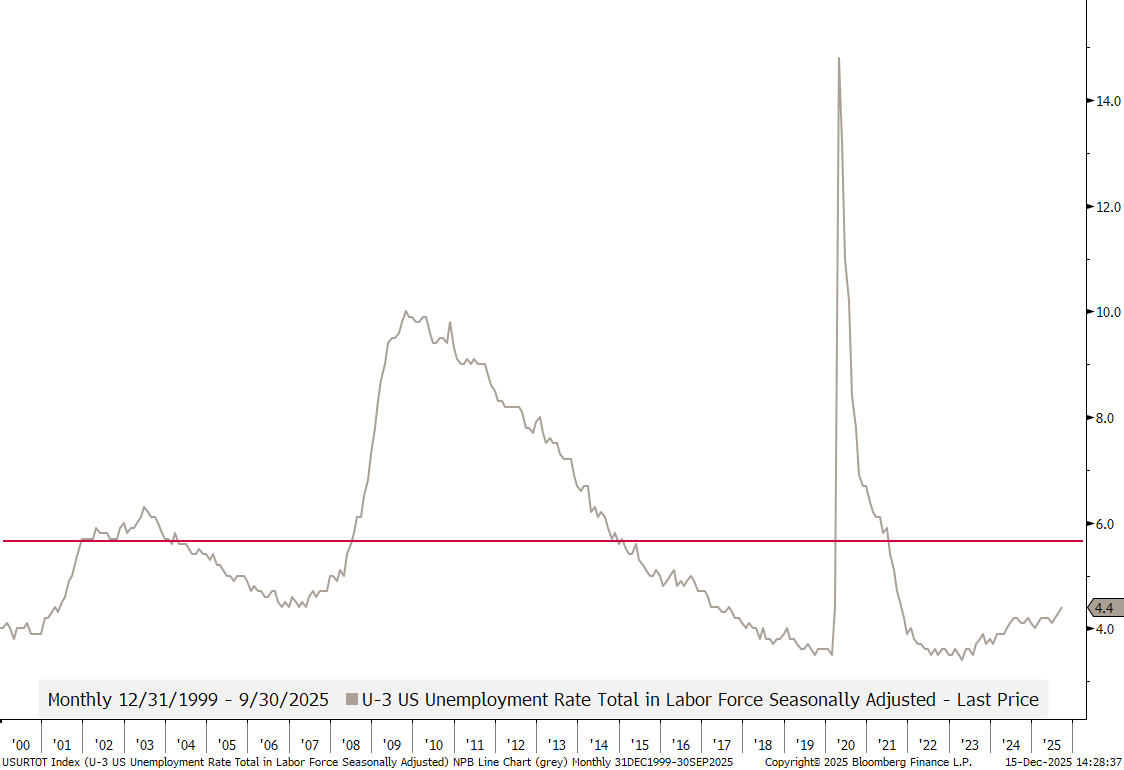

stopped QT (quantitative tightening) and reintroduced Not-QE QE. This at a time where:

1. Atlanta Fed GDP at +3.5%

2. Core PCE inflation at 2.8% vs. the 1.6% 2010-2020 average

3. Unemployment Rate 4.4%, well below 25-year average

Plus, arguably we have a Fiscal Firehose blasting and some estimated $1.2 trillion of AI Capex spending, gushing out in 2025-2026.

No wonder 10-year yields are now higher than they were when the easing cycle started in September of 2024:

Taking a closer look at the US 10-year Treasury yield, we note that the inverted shoulder-head-shoulder pattern is still valid and counts for a measured move to 4.40ish:

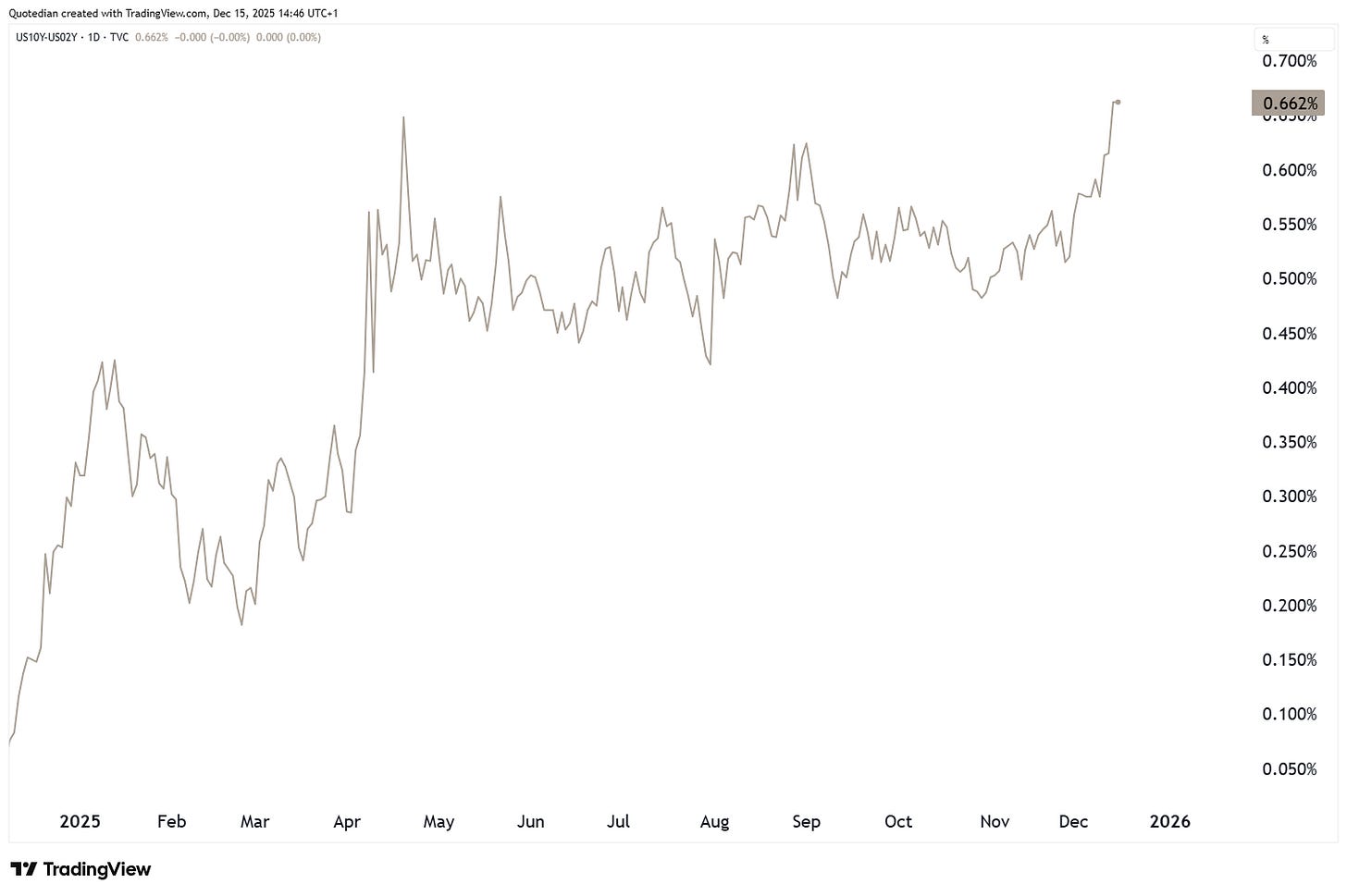

Also, unsurprisingly, has the yield curve (10y-2y) steepening,

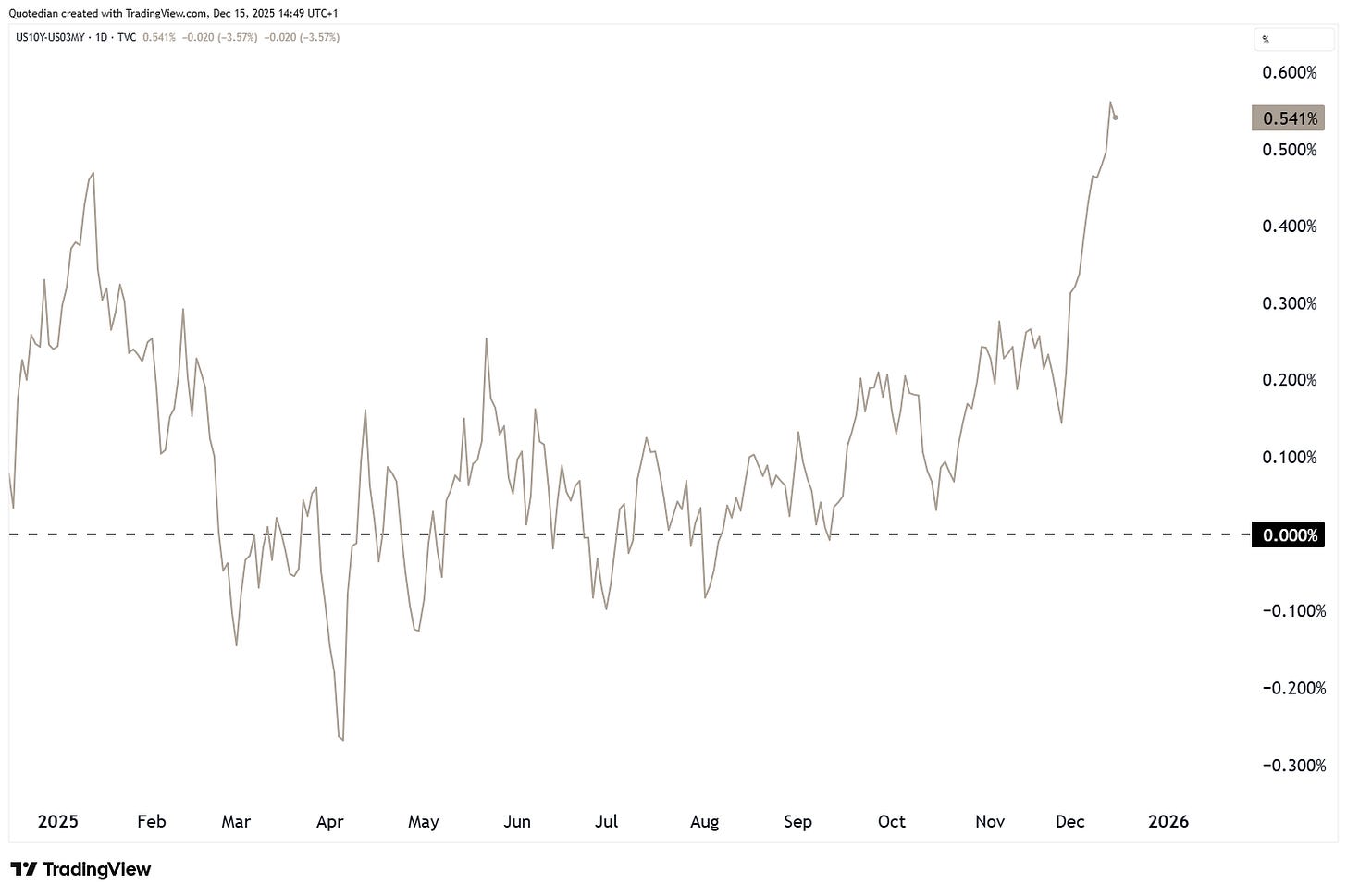

but the impact of the very lose monetary policy is even better visible in the steepening of the 10-year minus the 3-month bill:

European yields meanwhile have also been moving higher, which we would interpret for now as encouraging signs of re-accelerating growth. Here’s the German 10-year Bund as proxy for the region:

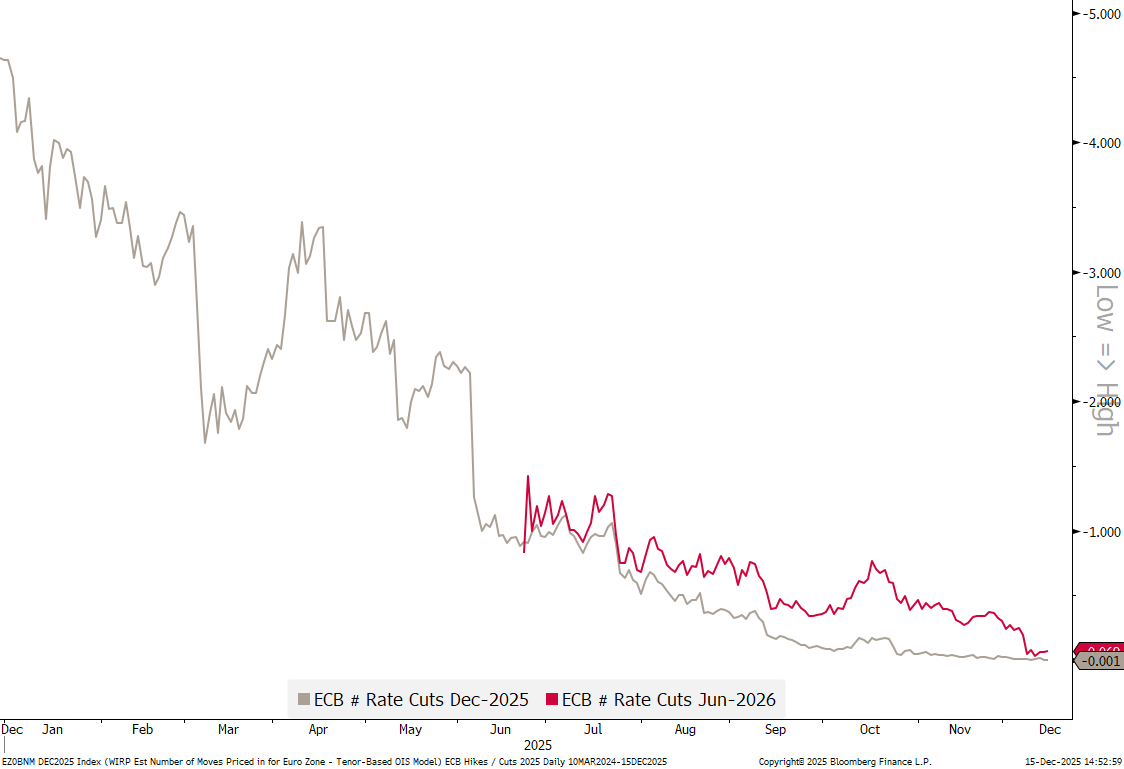

Accordingly, bets for further rate cuts over the next six months have dropped to zero:

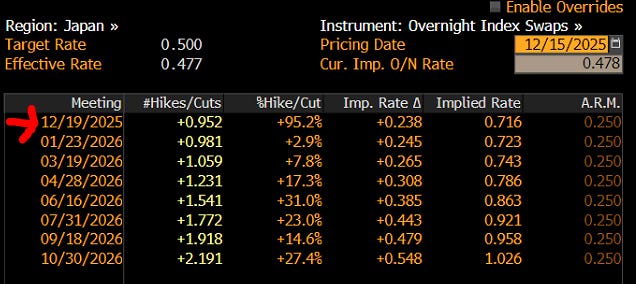

And in Japan, the market is now pricing in a rate hike this coming Friday with a 95% probability:

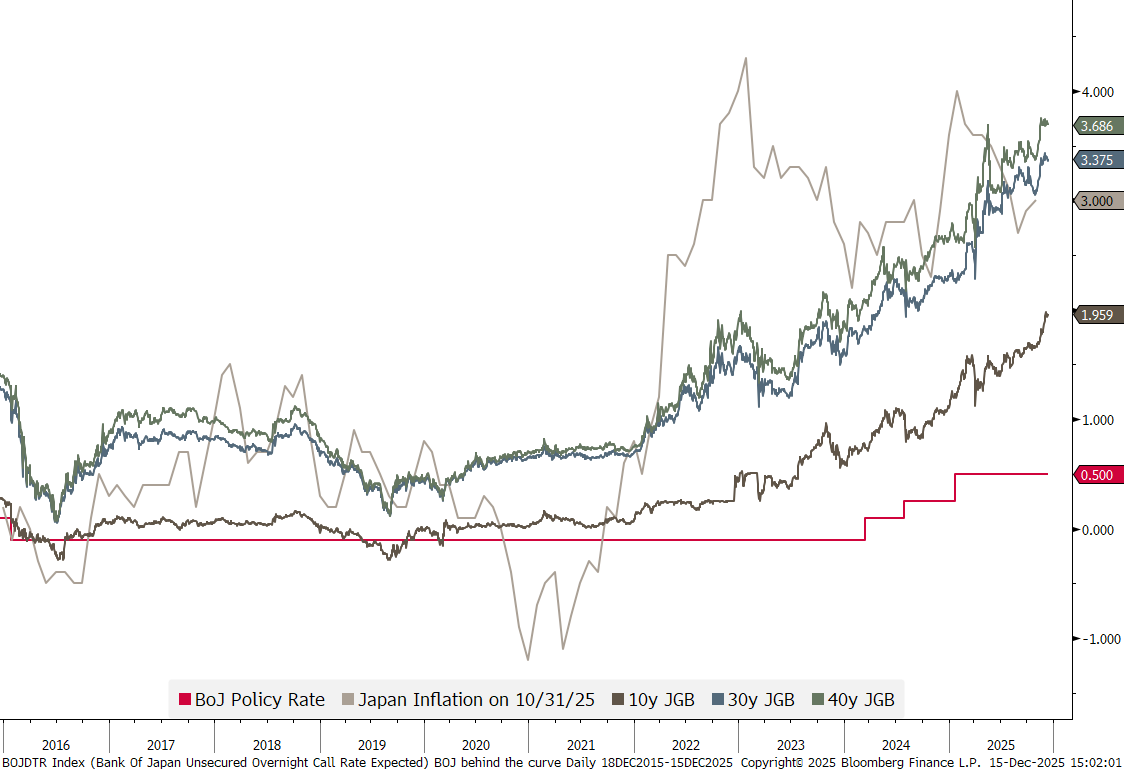

Of course, is the Bank of Japan (BoJ) which is still shell-shocked from three decades of deflation, wwwwaaaayyyyy behind the curve with their interest rate policy (red):

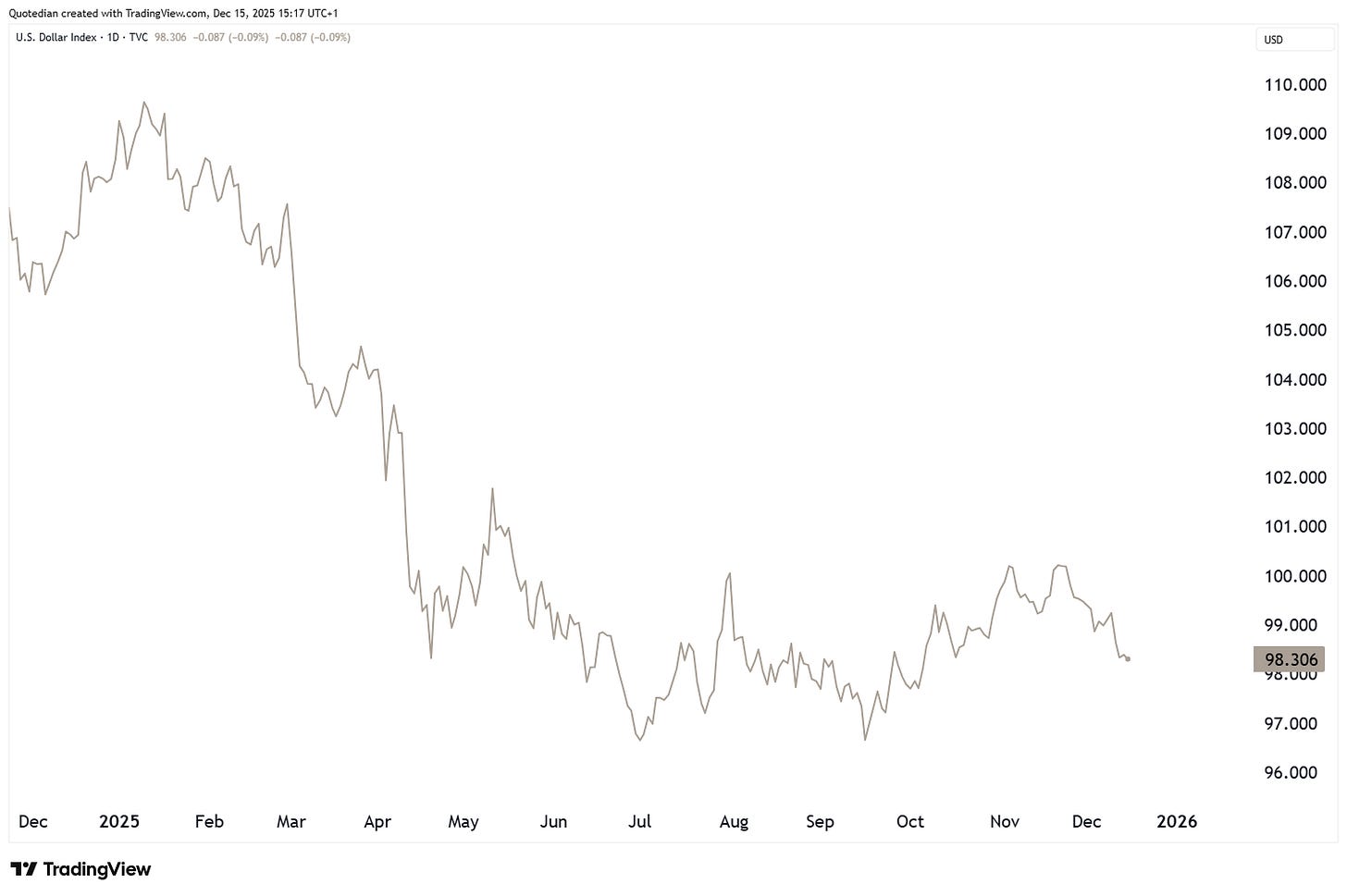

In currency markets, the US Dollar may being getting ready for the next leg down. Here’s the US Dollar Index (DXY):

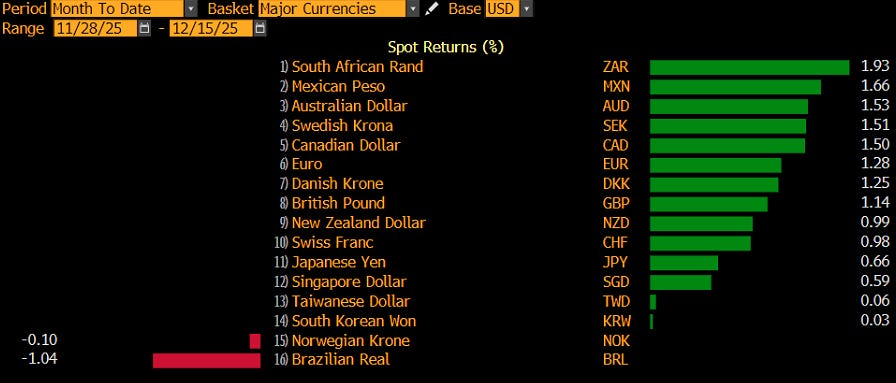

Since beginning of the month, the Dollar has fallen against nearly all other major currencies:

And this whilst the US Dollar continues to be very expensive (only to be beaten by the Swiss Franc), even after this year’s 10%-plus decline:

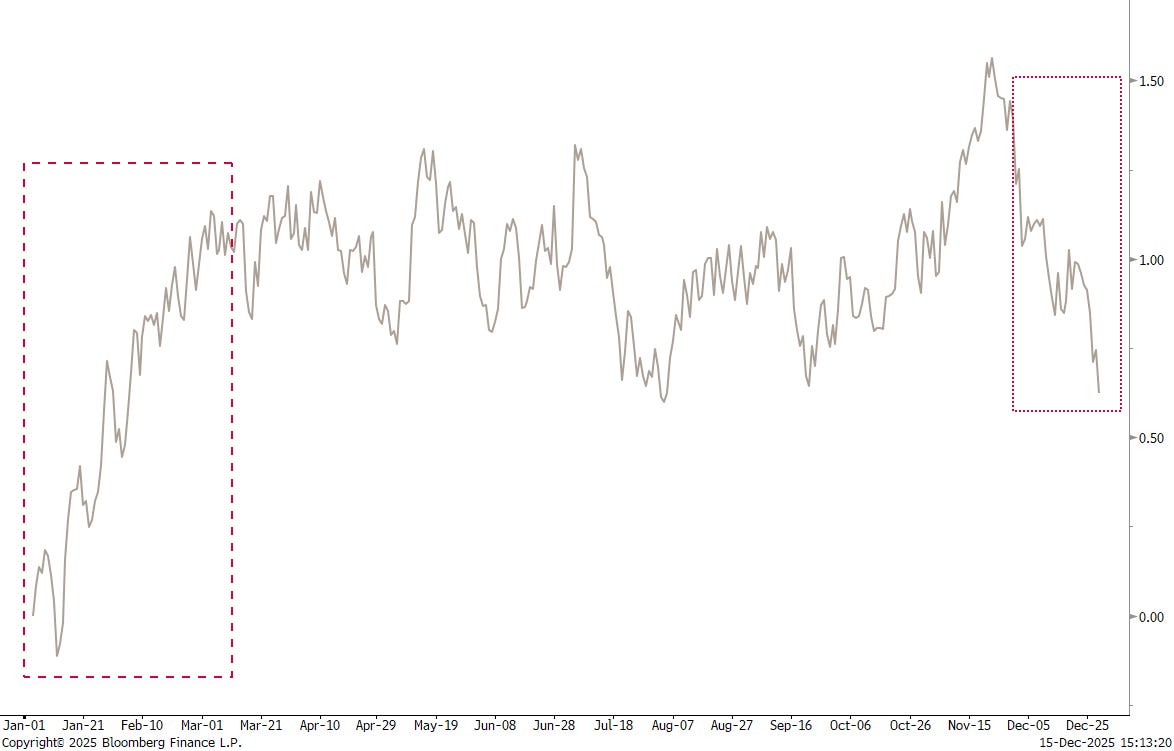

From a seasonality point of view, USD-weakness in December is not uncommon (dotted box), however, is then followed by strong seasonal tailwinds in Q1 (dashed box):

However, keep in mind that this “seasonal tailwind” did not help the Greenback at all this year:

Keep in mind the phrase “the man who drowned crossing the river that was five feet deep on average”, which is a famous parable illustrating that averages can be misleading, as a 6-foot-tall person can still drown in water that’s only 5 feet deep if there are deep spots in the middle.

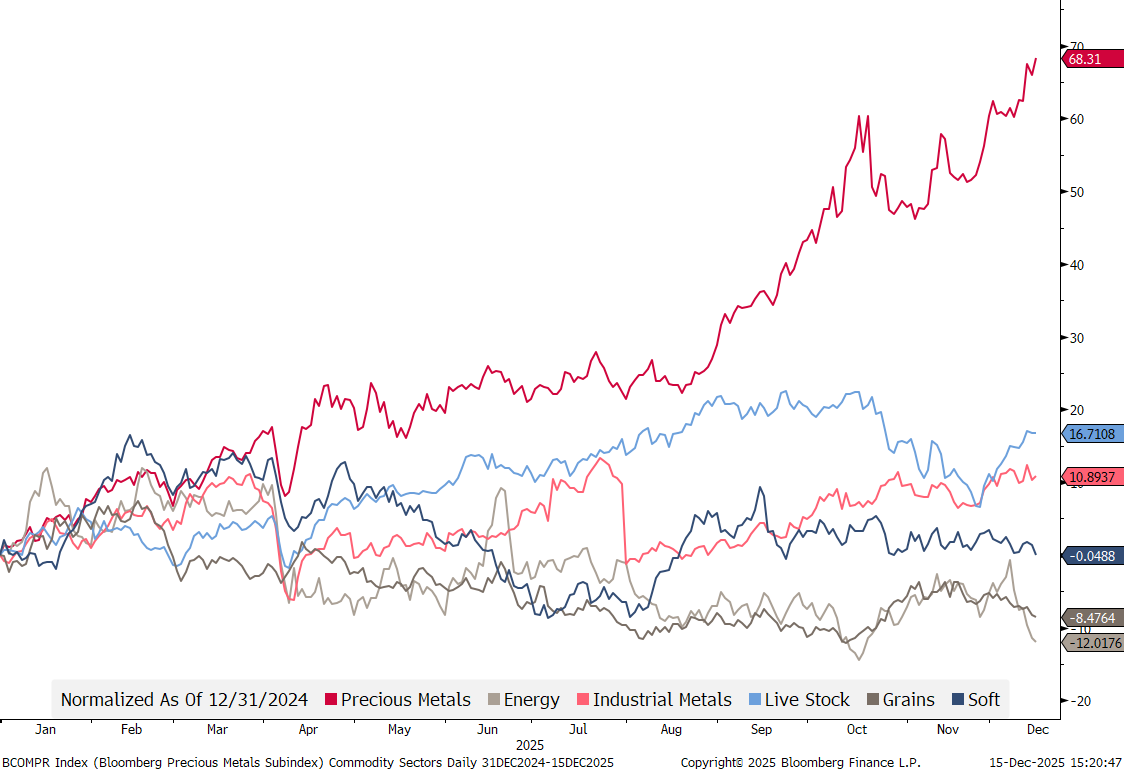

Finally, in the commodity space, it continue to be all about precious metals:

Especially Silver (grey line) has been on a tear over the past three months:

Every dip in silver has been very short-lived:

FOMO, YOLO and BTFD rule!

When will see Gold 5,000?

Best guess: Before next summer.

Oil continues to trade weak, and is probably ahead of one final wash-out sell-off - I would be an accumulator thereafter:

That’s all for this week, this month and this year!!

Have a great festive period and see you in the new year.

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG

Happy Holidays André! Thanks for another year of great Quotedians