What could possibly go wrong?

The Quotedian - Vol VI, Issue 32 | Powered by NPB Neue Privat Bank AG

"The major difference between a thing that might go wrong and a thing that cannot possibly go wrong is that when a thing that cannot possibly go wrong goes wrong it usually turns out to be impossible to get at or repair."

— Douglas Adams

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Only a quick note this morning, as markets remain eerily calm expectant ahead of the US inflation number (CPI) out later today. Or maybe its waiting for any movement at the debt-ceiling front

They’d better don’t hold their breadth, given that yesterday’s initial talks only lead to dashed hopes for a quick resolution.

In a letter to Treasury Secretary Janet Yellen, current and former leaders of the Treasury Borrowing Advisory Committee said the costs of the current standoff extend beyond markets to the time that financial firms are having to spend preparing for a possible default. (via Bloomberg, highlights mine)

Regarding the fore-mentioned CPI, as I have written on several previous occasion, this number is one of the most lagging economic numbers to be had and it shouldn’t matter, but, courtesy of the Fed, it does.

The good old Quotedian, now powered by Neue Privat Bank AG

In any case, the ‘wait-and-see’ attitude of investors brought us on the popular SPDR S&P 500 ETF (SPY) the lowest volume day of the year yet:

Three out of the eleven economic sectors eked out a positive return, with the best-worst spread at a relatively meager 110 bp:

This is the heat map for yesterday’s session on the S&P 500:

The daily chart on the S&P 500 continues to look for resolution, with 4,166 still acting as formidable resistance and the bearish pattern shown a few weeks ago still in play, but, admittedly starting to run out of time:

On the corporate earnigns front, Paypal (-12%) and AirBnB (-11%) disappointed, whilst Palantir (+22%) beat expectations. Speaking of Paypal, I hadn’t looked at that chart in a while. Quiet a sad picture there:

Asian markets are mostly printing red this morning, with some notable exceptions such as India or Vietnam, whilst European index futures are actually showing a small green.

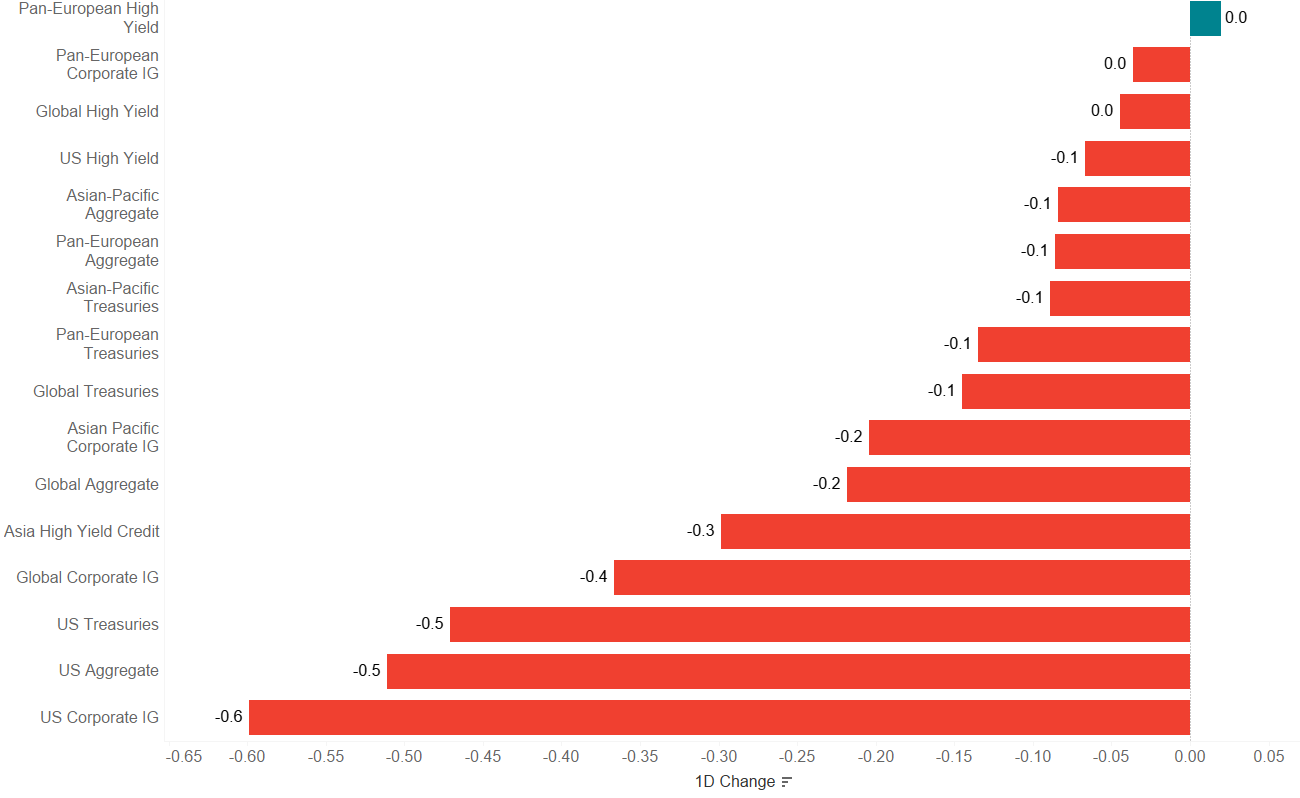

Little to report from fixed income markets, where global yields pushed slightly higher, provoking mild negative returns for bond indices:

Maybe standing out most was the move higher in UK rates, here’s the 10-year Gilt:

This looks like a cup and a handle pattern (don’t laugh, check it out here), with a break above 3.90% having pretty bearish implications for bond prices.

Nothing specific to highlight from FX and Commodity markets, hence, as promised, let’s keep it short (3 minute read according to Substack) and let’s reconnect on the other side of the CPI number.

Have fun,

André

CHART OF THE DAY

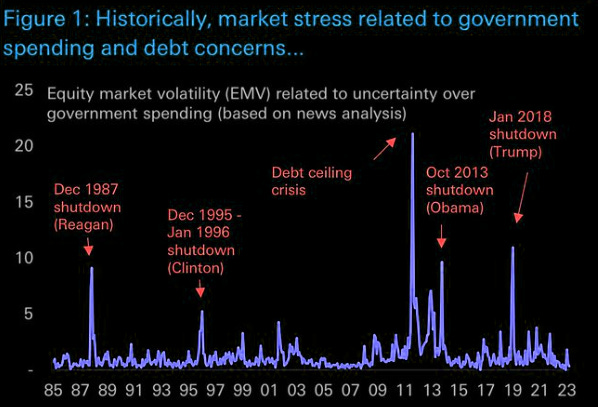

Especially equity markets are pretty relaxed regarding the upcoming debt-ceiling deadline. Whilst it is very likely that a last minute (or 5 past 12) solution will be found, a) the path until such an agreement has always been a volatile one and b) that tiny chance of a non-agreement would have disastrous implications.

Hedge when you can, not when you have to …

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance