Who let the dogs out?

The Quotedian - Vol V, Issue 109

“No man was ever wise by chance”

— Seneca

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Yesterday was the third least exciting day of the year in terms of market range (<0.70%)

and the lowest volume day of the year (histogram at bottom of chart):

So, I promise to try and keep it nice and short on this second last August Friday.

Three stocks were up for every two stocks down (S&P), with a similar ratio holding in sector performance, where energy stocks were once again the “Star” performers:

We normally (purposely) do not speak a lot of corporate news or individual stocks here, but as a group the (in)famous Meme-stocks took a hit yesterday after billionaire Ryan Cohen confirmed he sold his stake in Bed, Bath & Beyond (BBBY), which had become one of those Meme stocks over the past two years. The share slumped about 50%, pulling down other speculative clowns such as AMC (-16%), or GameStop (-13%).

Asian markets overnight were/are mixed, with red slightly gaining overhand, whilst European and US index futures also suggest some weakness at the opening ahead.

Moving into the fixed income space and in reference to the title of today’s Quotedian, Jerome Powell unleashed his FOMC dogs yesterday, sending them out to give a hawkish message ahead of next week’s annual Jackson Hole central bankers meeting (Thursday-Friday). Kashkari warned he wasn’t sure inflation could be tamed without a recession, George said the case for continuing to raise rates remains strong and Bullard is apparently "leaning toward" 75 bps in September.

So, how did the shorter-term (2Y) yields react to these hawkish messages? Exactly, by heading lower (!), though they recovered again during the overnight session. Here’s the intraday chart on the 2-year US treasury since yesterday, with the barking moment (left side of chart) indicated:

This would indicate that the market does not really believe this “forward guidance” by the Fed (no wonder, after its recent track record) and is still expecting a dovish pivot. Next week should be interesting.

In currency markets, the US Dollar was strong against everything yesterday, maybe better reflecting that hawkish Fed tone?

The EUR/USD cross-rate broke two smaller support zones and seems now destined to retest the multi-year lows from about a month ago:

USD/JPY is heading higher again too (red oval), which is not necessarily a constructive sign for risky assets if recent history is of any guidance:

In commodity markets, US natural gas prices (first chart) are hitting the highest levels in a very long time, as the parabolic rise in their European counterpart (second chart) turns out to be pretty contagious:

Time to hit the send button - I wish you all a lovely, relaxing weekend and make sure to read the weekly market wrap issue of the Quotedian on Sunday afternoon!

André

CHART OF THE DAY

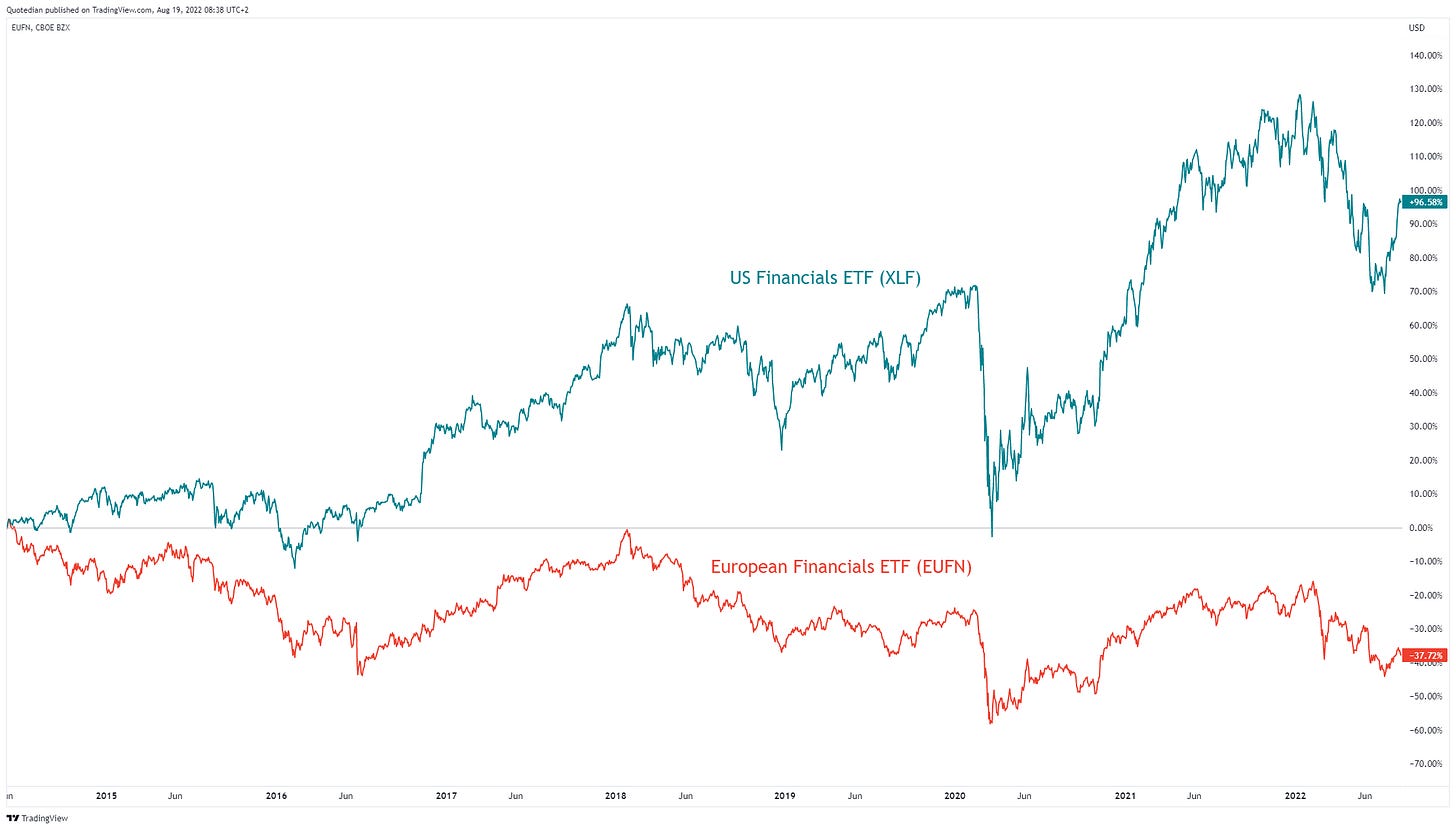

The European Central Bank (ECB) introduced negative interest rates as an emergency measure in June of 2014 and went back to zero rates shortly thereafter 8 years later …

The chart below compares the fortunes of European financial institutions (red line) versus their US counterparts (green line) over that period.

‘nuff said…

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance