You're Fired!

Volume V, Issue 167

“In the beginning the Universe was created. This has made a lot of people very angry and has been widely regarded as a bad move.”

— Douglas Adams

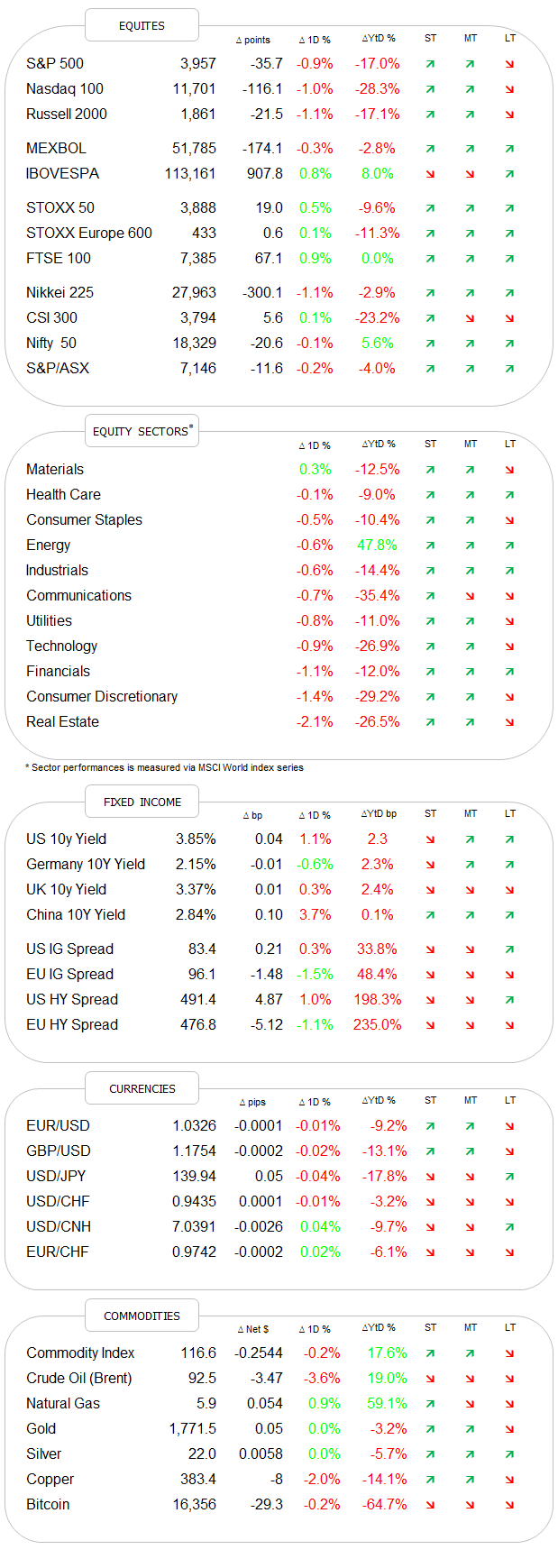

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

“It will probably be appropriate soon to move to a slower pace of increases,” and a moment later “But I think what’s really important to emphasize: We’ve done a lot, but we have additional work to do.”

These are the words of Fed Vice Chair Lael Brainard at a fireside chat event organised by Bloomberg yesterday.

And as her surname maybe tries to imply, she’s the one with the brainpower in the FOMC. Or at least, she’s an economist, unlike her boss, who’s a lawyer. But she’s also one of the doves on the committee, with some of the hawks to speak later this week.

In any case, the ambiguity of her comments was enough to bring some profit taking on the plain - no wonder given the previous two days’ strong performance on little else than massive short covering after a CPI “beat”. Here’s the S&P 500 intraday chart, highlighting the weakness in the last two hours of trading:

Breadth was pretty weak (or in other words, the sell-off broad), with only one stock up for every four stocks down. Also, only one sector (health care) was able to close just about up on the day,

leaving us with a rather reddish market carpet for the day:

One of the corporate news items standing out on Monday was the announcement by Amazon that they would be laying off 10,000 employees. It is actually not that much given their 1.5 million plus strong workforce but is definitely another sign the job market is quickly flipping from one of labour shortage and rising wages to one of large-scale layoffs as the fine folks at Gavekal laid it out in their note this morning.

Consider this review of layoffs by Charlie Bilello at Compound Advisors:

Notice anything? Yes, correct, these are all technology companies with a higher sensitivity to interest rates - and we all know what happened to interest rates this year.

Asian equities are flashing green this morning and in the case of China-related markets quite vehemently so. The Hang Seng in Hong Kong is up nearly four percent for example as I type, whilst mainland stocks are up close to two percent. The Taiwanese TAIEX is up over 2.5% too, probably partially due to a Biden-Xi meeting yesterday that could have gone worse, but probably also upon releases of 13Fs in the US, which showed that Berkshire Hathaway (Buffet) has initiated a stake in TSMC worth over $4 billion. Here’s a daily chart of the stock, up nearly eight percent today:

Over in bond markets, US yields firmed slightly on Monday after the two previous days’ slump, but on the chart barely visibly so:

Credit spreads hardly budged despite the weakness in equity markets yesterday, quite to the contrary so:

As my friend Paul Fraynt at Franklin Templeton’s K2 points out, this may be a function of a global search for yield and duration, something I can only agree with and plan to write a bit more about tomorrow.

In currency markets, the mighty US Dollar is now suddenly finding very little love:

Verus the Euro, the currency is approaching its 200-day moving average for a first time in a long time:

Also, see today’s COTD.

Finally, in the commodity complex, I missed addressing a question by one of our fellow readers (Hola Andrés!) regarding the price of crude in relation the Chinese eventual “re-opening” post zero-COVID policy and the general demand and supply situation. The clear answer is that I do not have a clear answer. From a longer-term point of view, I clearly believe that there is a strong floor to the price of crude, but where exactly that would be … $80? $70? $60 even? Of course, does the Chinese reopening stand on the opposite side of a possible economic recession in the coming months, which would dampen demand, as highlighted by OPEC just yesterday?

Short-term, the chart is not much clearer, with price (Brent) hovering somewhere around the $100 pivot-point:

So, in other words:

Long-term: buy the dip

Short-term: wait for a clear trend acceleration - either way

I remain however unambiguously bullish on oil stocks (sorry ESG-huggers), which in the worst case are similar to the run-off business of tobacco in the early 2000’s. Here’s Altria (MO) versus the S&P 500 over the past two decades:

Have a great Tuesday!

André

CHART OF THE DAY

The Dollar (top clip) has done its job. Will bonds (middle clip) and stocks (bottom clip) follow? Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

I thought you already forgot me 😁. Interesting view on oil. We will see if the increase of the demand due to the Chinese "re-opening" (if it happens) is bigger than the decrease of the same due to the economic recession.