“If everyone is thinking alike, then somebody isn't thinking.”

- George S. Patton

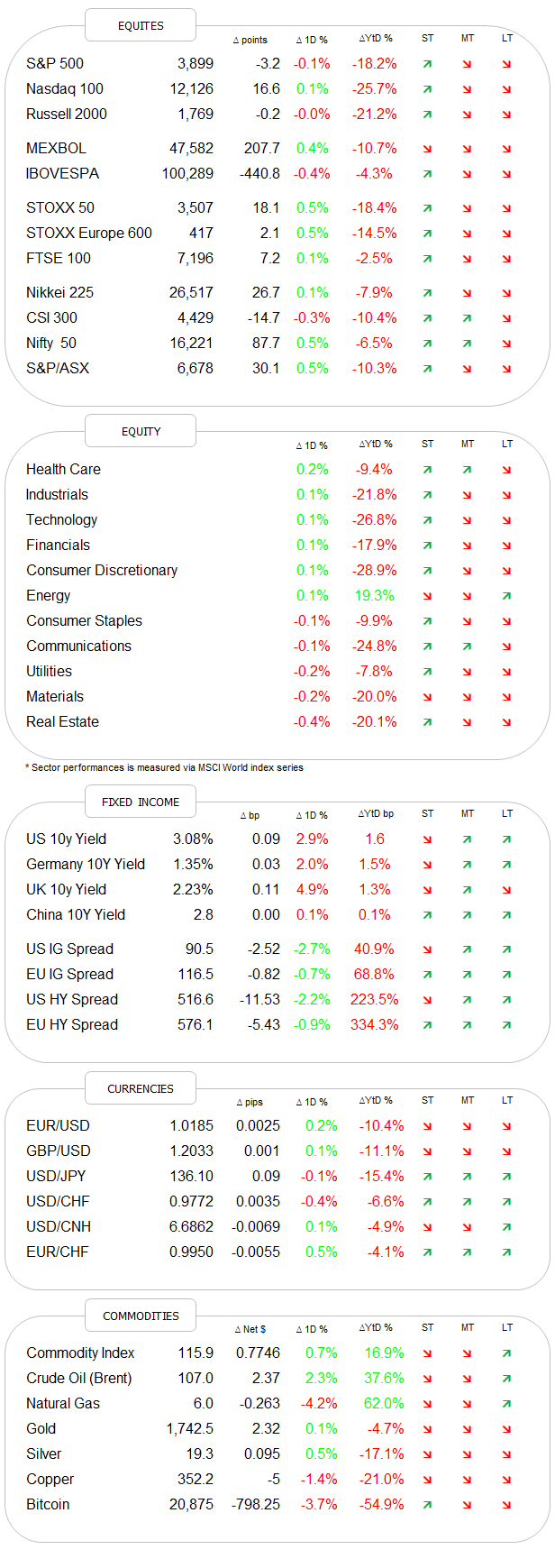

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s title is of course a reference to Friday’s seemingly dull session and today’s nearly void economic and earnings calendar.

Looking at Friday’s equity closings (S&P -0.1%, SXXP +0.5%), one could indeed assume that it was a lacklustre session. But looking under the hood, it turns out there was actually quite the ‘tug of war’ going on between bulls and bears. Here’s the intraday chart of the S&P 500 for example, with the main moves highlighted:

Red was the dominant colour with two-thirds of stocks lower on the day and only two sectors (Health Care, Technology) out of eleven printing green:

But looking back over the entire week, it was actually a very decent five days for most global equity markets, with really only Chinese and Iberian markets showing a negative development:

In a certain way, we (I) should have known it. The mood amongst investors has recently turned too negative, even if positioning has not reacted too much yet. so is CNN’s Fear and Greed index still in solid Fear territory, even after a week’s strong rally:

Or so is the AAII Bull/Bear survey only this week giving an extreme bear signal (which is bullish):

And from anecdotal evidence, I can add that I had lunch with some very sophisticated investors (have to be, some of them read the Quotedian) early in the week, and everybody was overwhelmingly bearish, me included. The thought did cross me that with everybody at the table being bearish, who was left to sell, but with the upcoming earnings season and everything else already going, the only way can be down, no? Maybe it’s a good moment to re-read today’s QOTD now again).

Before turning to bonds, and as it is Monday, we also like to have a look at the 25 best-performing stocks in Europe and the US on a year-to-date basis and see what they have done over the past five days:

Bond prices were under pressure the whole week as yields continue to climb again, though there is some green on the weekly performance table, as the equity rally also somewhat lifted the high yield boat:

So, clearly also not a Zzzuumerly week for bonds. The US 10-year Treasury is pushing towards 3.10% this morning. I would identify 3.20% and the 2.70-2.80 area as key resistance and support levels. A beyond those on either side will set the new intermediate trend:

Of course also rattling (emerging) debt markets is the unfolding bankruptcy situation in Sri Lanka, where the country’s president has fled, which in turn does not make “bail-out” negotiations with the IMF easier. Here is the country’s CDS rate chart:

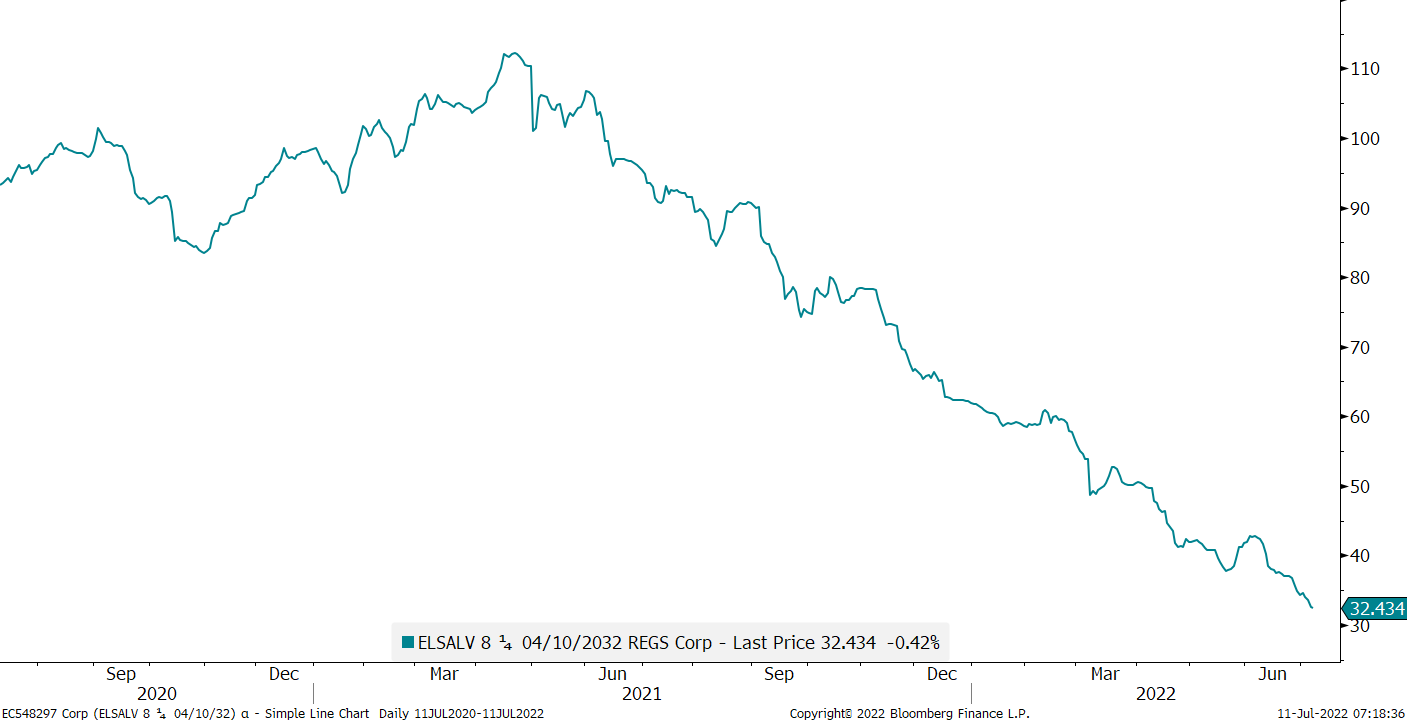

Though the reasons for the downfall of another emerging country, El Salvador, are different (Bitcoin), one can help to think that a wildfire is spreading quickly among EM countries. Here’s the chart of one of the country’s bonds (10-year). Mind the y-scale:

In currency markets, it was of course the week where the Euro broke key support after Germany reported its first trade deficit since 1991. That was arguably the glue that kept the currency together - next stop parity.

But not only did the Euro fall versus the US Dollar; most other currencies followed that trend too. A rising Dollar is usually and on balance not good for risky assets:

And then there are commodities of course … whilst the weekly performance of the energy subcomponent at +1.2 seems relatively muted,

the dispersion below the hood was enormous. Natural gas prices on the week in Europe (+15%) and the US (+5%) were through the roof, whilst crude (-4.9%) and gasoline (-7.5%) prices plunged. But for many commodities the volatility story was even greater than the already massive weekly numbers would suggest. Here’s the 5-day chart of Brent crude oil for example:

Ok, time to wrap up and hit the send button:

This morning, Asian equity markets are mostly lower, with the exception of Japan, where stocks are up in excess of 1% (Nikkei) after the ruling LDP party expanded its majority in yesterday’s election. The party definitely gained some sympathy votes after Friday’s assassination of former Prime minister Shinzo Abe. European and US index futures are down noticeably as I type. Other stories to watch: Musk drops bid for Twitter with a legal storm likely to unfold and the race of Downing Street number 10, one of London’s most popular nightclubs, is getting crowded with not less than ten contenders now. The more the merrier, as they say.

Have a great Monday!

CHART OF THE DAY

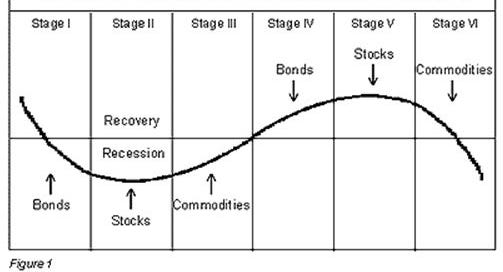

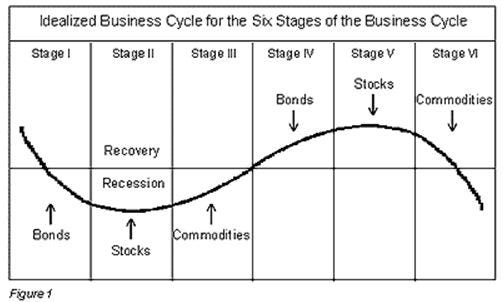

Last week’s commodities downturn has made the chart below popular over the weekend. It argues that we might just be in a normal economic/market cycle, where bonds topped out first, followed by stocks and now by commodities (illustration at the bottom). It would follow then that now bonds are the first to bottom, followed by stocks and later commos. Perhaps …

LIKES N’ UNLIKES

Likes and Dislikes are not investment recommendations!

Long China equity (FXI) / short India equity (PIN)

Biotech (XBI); trailing stop now at $66

Energy stocks (XLE); 1/2 usual position size

Long some Gold (direct or via short puts)

Euro

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance