ABC OMG

The Quotedian - Vol V, Issue 154

“Standing with the crowd is easy. It takes courage to stand alone.”

— Brad Turnbull

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Today’s Quotedian should turn out to be of a bit shorter nature, as a) I am fighting with some technical issues (aka Laptop dying) and b) on the equity side, what had been achieved during the regular session yesterday is seemingly being undone overnight.

Let’s concentrate on b) …

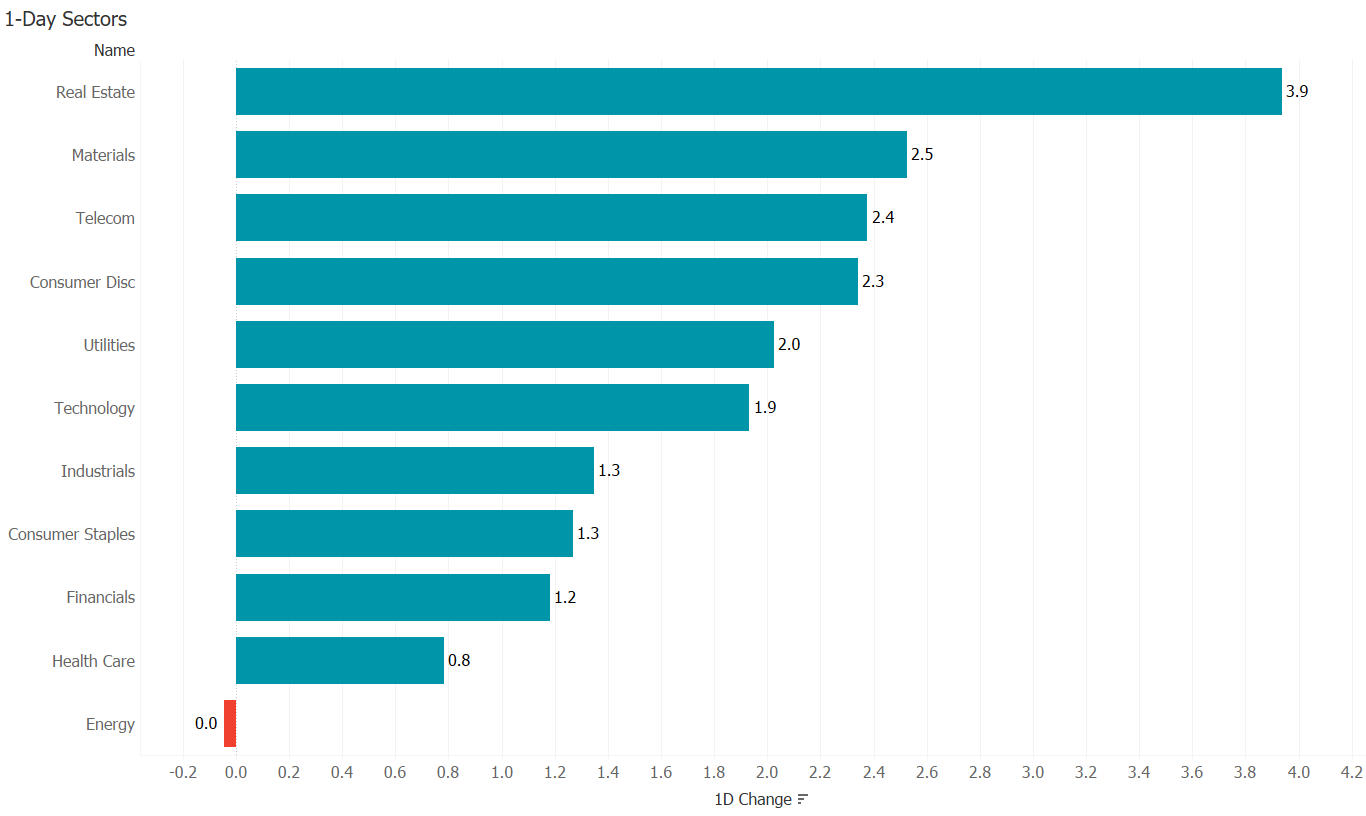

Equities saw a third consecutive session of healthy gains yesterday, with the S&P up in excess of one and a half percent (Nasdaq +2.1%), ten out of eleven sectors higher,

and 90% of stocks moving higher on the day, leaving us a beautifully green market carpet:

HOWEVER …

Tech giants and FAAMG (or better said MAMAA) member Microsoft and Alphabet reported after the closing bell rang, and both disappointed with their earnings to some extent. The problem for MSFT was a stronger Dollar and but especially also a weak sales forecast for their cloud business Azure, which had been the driver of earnings over the past few years. The stock traded five percent lower in after-hours trading. Which is quite precisely also the size of the drawdown that Google’s parent Alphabet shares are facing as I type. Alphabet’s slowdown in earnings should come to no surprise with all the recession talk that’s going on on a global basis (CEOs/CFOs cutting back on spending budget) and we had a canary in the coalmine dying already last week, with Snap dropping 30% after their earnings report.

Despite the negative earnings surprises from the two fore-mentioned tech behemoths which are pushing US index futures into deep negative territory, Asian stocks decided to focus on the positive US cash session and regional benchmark indices are mainly printing green as I type. European equity futures are calling for a flattish chart.

But just before heading into fixed-income markets, let’s have a quick review of our S&P roadmap chart of the past two weeks:

This chart has remained unchanged over the observation period (except for the updated daily candles, of course …Doh!) and has served us well so far. The only ‘thing’ I have added for today’s print is the 50-day moving average (blue line), to demonstrate that a short-term top for the current up move may be approaching. It is true, we are not quite in our (4) target zone yet, but close enough. The ‘wall of worry’ discussed yesterday remains formidable over the coming days (BoC, ECB meeting this week, FOMC next week, US mid-term elections the week after, earnings, etc.) so some consolidation would not be completely surprising.

Turning to fixed income, we find the probable ‘culprit’ for yesterday’s equity rally here in retreating bond yields. After German Bund and UK Gilt yields had started to consolidate lower already for a few sessions now, US Treasury yields finally also started some kind of descent:

The question remains though, is it an extended consolidation period similar to one observed during the summer months of this year or just a quick ‘n dirty thing like at the beginning of October? Stay tuned for the answer … 😈

But especially tune back in tomorrow, when we will discuss one of the major worries I have for the bond market, and hence for the entire spectrum of financial assets.

Similar to bonds being supportive to the equity rally yesterday, so where currency markets, which saw the US Dollar in retreat mode versus basically everything:

It cannot be stressed enough how important those two factors (stronger bonds, weaker Dollar) to the risk-on rally from a cross-asset perspective.

And it is probably also important from an egg-on-my-face perspective, which I have may auto inflicted a bit too early in yesterday’s Quotedian, after hinting that US Dollar failed to break out of its consolidation triangle at the right point in the apex. Here’s an updated chart of the US Dollar Index (DXY) we had been discussing:

Not too shabby, but now that damned 50-day moving average (remember S&P?) must be broken again for any further meaningful Dollar downside.

Let me cut short here today, but make sure to tune back in tomorrow with an extra large coffee (the Q will be long) or an extra dose of valium (the Q will be scary) … or maybe best both!

Enjoy your Wednesday!

André

CHART OF THE DAY

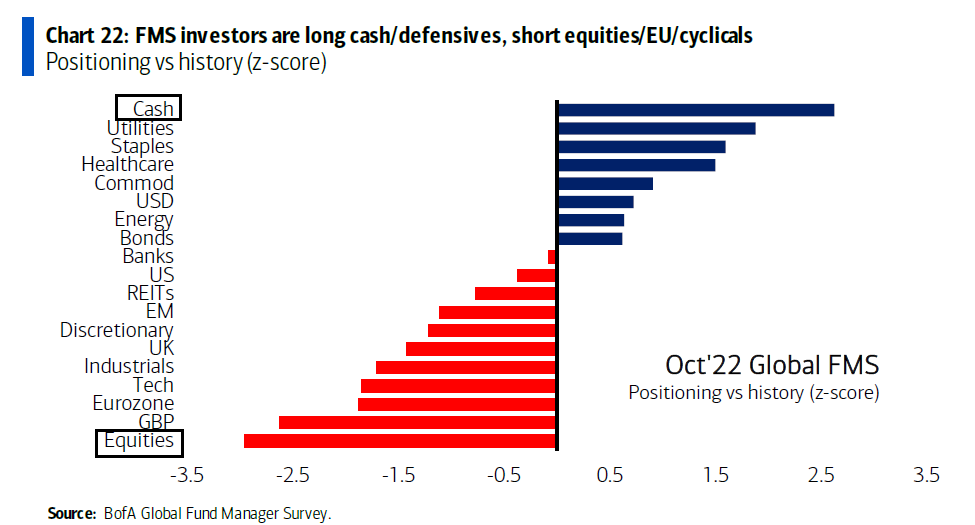

Bofa-ML’s most recent monthly survey of fund managers’ positioning showed some extreme positioning. Extremely out of stocks, extremely into cash.

Rarely is the crowd right when they all agree.

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance