Achtung Baby!

Volume V, Issue 187

“Then he got an idea! An awful idea! The Grinch got a wonderful, awful idea!”

How the Grinch stole Christmas, Dr. Seuss

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

** Housekeeping **

This is the last Quotedian.

At a minimum for this year …

I may throw one in on x-mas eve, to review the week just gone by. But I doubt it.

Or maybe if the market crashes 20% … but I am sure you’d prefer not to hear from me if only such a move would get me out of my pyjamas.

If all goes well, I shall write again during the first week of January, just to make sure you all survived the eating and the boozing, and of course, also to review the year just gone by.

On with the show!

[click this link to listen to U2’s excellent ‘One’ from the 1991 Achtung Baby LP whilst reading today’s Quotedian]

As this is the last Quotedian for the year, tradition would have it that you expect my views for the coming year - but I shall disappoint you … partially. I will lay out some of my macro roadmap over the following bits and bytes, but never forget the wisdom in the words of the great Louis Gave, part-eponymous of Gavekal :

“Money managers are not paid to forecast. Money managers are paid to adapt.”

Q: So, why today’s title “Achtung Baby!”?

A: Well, firstly because the ECB spoke with a strong German Bundesbank accent for the first time in at least a decade at this week’s monetary policy meeting. Secondly, because the announcement by the same ECB to start quantitative tightening (QT) next year, should raise your attention. No, it was no surprise or at least should have been no surprise and no, it is not so meaningful in money terms. Yet, it is meaningful that they intend to get started with it (QT), as it shows that the ECB will be much more hawkish than assumed by so many.

Q: And the reference to the Grinch and how he still Xmas?

A: Well he sent his little helpers (Christine, Jerome and the dotplots) out last week, seriously putting the Santa Rally in danger.

The Santa Rally and next year, because as the old Wall Street adage goes:

If Santa Clause should fail to call, bears may come to Broad and Wall.

Tbh, as they say, I turned quite even more bearish on risky assets during this week for at least the first half of next year. Central bankers confirmed (once again) this week that they will rinse and repeat until something more stuff breaks (also, see today’s COTD).

But let’s take it step by step …

It was not easy to be an equity index this week:

Nor was it easy being a large-cap stock, especially if you go by the name of Tesla:

I initially had started preparing this Quotedian on Thursday morning (organised little bastard am I, eh?), but had to throw nearly everything overboard after the last two sessions of the week.

One point I was going to make was that we agree on “The trend is your friend”, however, there had been no trend in equity markets for a month. Here’s the NASADQ for example as of Thursday morning:

I then prepared this meme to make it look funny silly:

It seems somebody heard me, as witnessed on the updated NASDAQ Chart:

Zooming out to a daily chart over the past year, this does not look pretty with the rejection at the downward sloping trendline (red dashed line) and the 200-day MA (blue line) now confirmed and the index only about six percent away from a new cycle low:

A similarly ugly chart for the S&P 500:

And the European chart (SXXP) just turned from very constructive to … well, Vorsicht Baby!

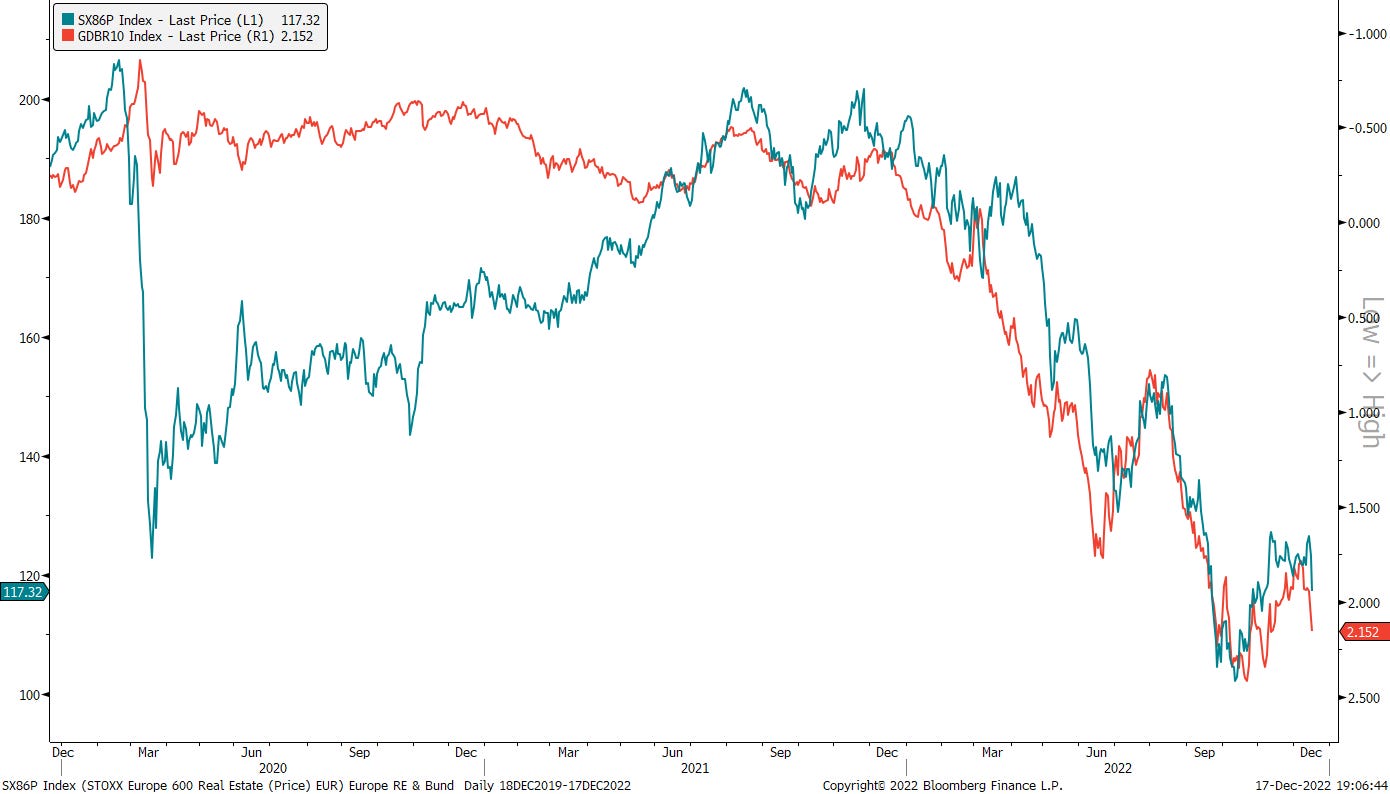

Staying with European markets for a moment, I am growing really, really concerned over European Real Estate. I am not sure how much restrictive monetary policy the European housing market can take, but my hunch, supported by the following graph, is - not much!

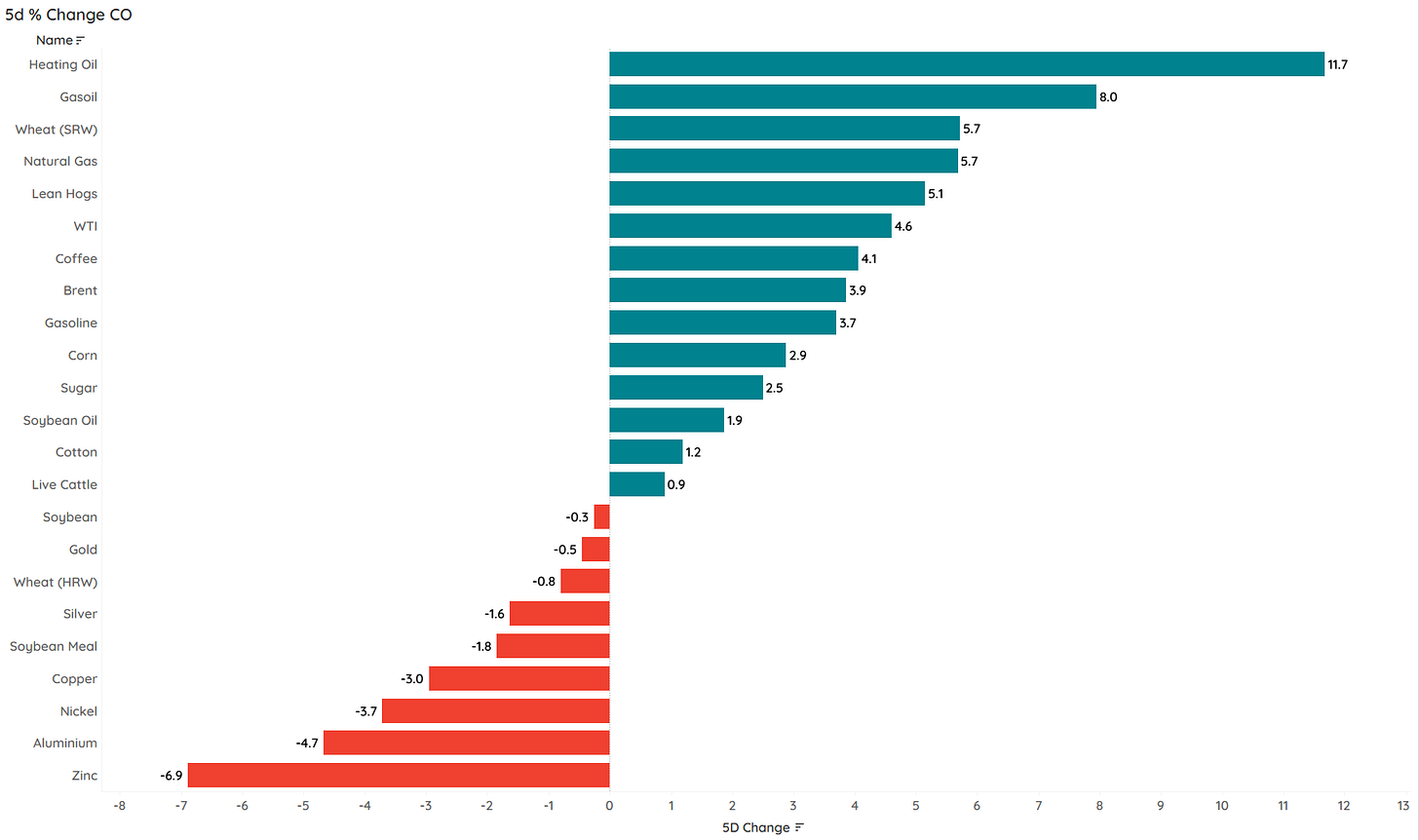

Let’s use this as a segue into last week's equity sector performance, which to no surprise had little prettiness to it (with the permission of energy stocks):

Going back to European Real Estate (green line) for a moment, here’s the 3-year daily chart for the sector:

The rising interest rate environment (Bund, red line) this year is clearly visible on the chart and it seems that the sector may have just been served a death blow.

A few charts on sentiment …

We already saw in a previous Quotedian that Wall Street strategists are jointly forecasting a negative return for stocks next year. Here’s that chart again:

Newsletter writers (such as yours truly) are also as bearish as seldom before

And individual investors’ sentiment is also at levels usually associated with major market bottoms:

Yes, but …

… sentiment is not equal to positioning and as the following graph shows are investors not really walking the talk:

Ok, before turning to fixed-income markets, let me also update our weekly stat on the top 25 performing stocks in the US and Europe and their weekly performance below:

Largely, winners continue to win, or as I like to say: “strength begets strength”.

The performance table for fixed-income markets quickly reveals that European bond investors have been taken by surprise by the ECB’s most hawkish tone since the days of Trichet:

Here’s the reaction of the 2-year Bund on a intraday chart:

and here’s the daily chart of 10-year Bund yield:

This led to a further inversion of the yield curve and my guess would be we may see much more inversion ahead as the short-end of the curve needs to catch-up with the ECB’s new terminal rate vision (4.2%?):

Back to the 2-year BOBL chart for a moment. On a daily chart, from a purely technical aspect, (much more) trouble for bondholders could lay ahead:

Here’s a great ‘meme’ from the inimitable Kevin Muir at the Macro Tourist:

US yields were a sea of calm in comparison:

Even the VIX-equivalent for bond markets (MOVE) calmed down meaningfully:

Needing to press ahead (a World Cup Final is waiting after all), let’s move swiftly to currencies, where the US Dollar strengthened versus many other currencies, but remained fairly unchanged compared to some of the big ones (EUR, JPY, CHF):

Curiously enough, it took the hawkish surprise from the ECB to put a (temporary) halt to the Euros rise:

USD/JPY continues to hold above the 200-day moving average:

In the crypto space Bitcoin tried a relieve-breakout to the upside after the news broke that SBF had finally been arrested, but then got victim of investors moving into risk-off mode at the end of the week:

Finally, unless you were invested in industrial metals, you had a pretty decent week with your commodities allocation:

Gold, unfortunately, starts looking a bit like a false breakout above $1,800, but not all hope is lost as long as $1,735 holds:

The chart of oil continues to look complicated, as the black gold is torn between China reopening, record-low inventories, expected global recession, etc. Here’s the WTI version:

Ok, time has come to hit the Send button.

But just before I do so, I invite you to click on the comment button below, and leave your feedback on the year just gone by with regards to the Quotedian. What did you like? What not? What would you like to see more/less of? Any other suggestions? Go ahead, do it:

If we don’t speak, merry Xmas to you and all your loved ones and may your best trade this year be your worst trade next year.

André

CHART OF THE DAY

Central banks have been trying to tighten monetary conditions by reducing their balance sheets (green line) and increasing rates (red line) all year long. The chart below shows the result of that. Expect more ‘accidents’ to happen more frequently …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

Thanks very much, nothing but positive feedback here. The Quotedian has become part of a daily routine and hopefully continues to be so. Happy Holidays André!

You know I have nothing but good things to comment. If I had to say something, maybe it would be super interesting to see how you evaluate and choose some investment decisions, but of course we have the second point of the disclaimer. Have a great Sunday 😊