Sore Thumb

Volume V, Issue 184

"The reason that 'guru' is such a popular word is because 'charlatan' is so hard to spell."

— William Bernstein

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

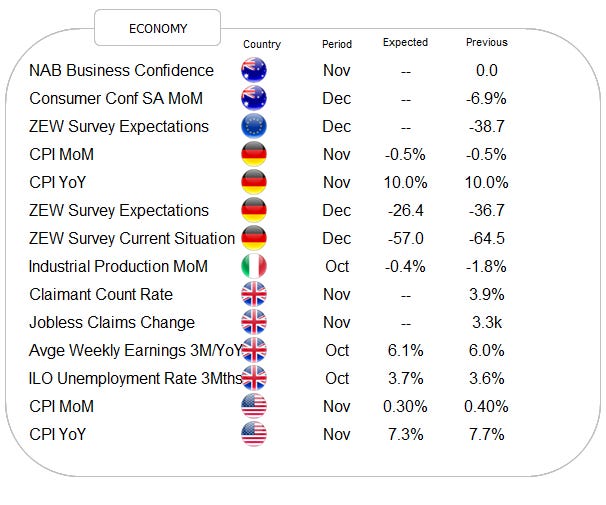

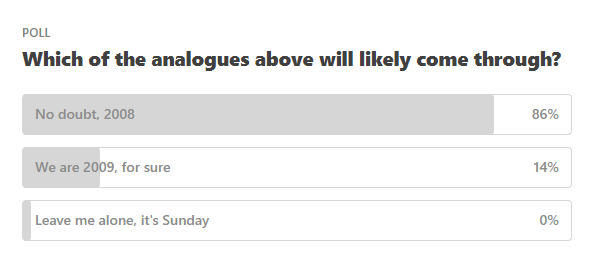

Good morning! Before we start our usual round of cross-asset observations and deliberations, here’s the outcome from Sunday’s poll:

And as a reminder, here are the two top options from the poll:

As usual, the sample size is pretty small (I would have written: “Come on guys and gals, what’s freaking wrong with you? Just poll, it’s free, anonymous and painless” - but the good angle on my right shoulder didn’t let me).

Anyway, the poll shows that Quotedians are remaining overwhelmingly bearish at this stage.

Do not worry though, you are not alone:

That’s quite surprisingly actually, and should immediately make us somewhat more constructive for next year ..

But anyway, on with yesterday’s session, which already stood in the sign of today’s CPI release. According to the intraday accelerating rally in stocks, equity traders think we should get a weak inflation print today:

On the daily chart, the S&P has held where it had to hold (3,900) and some sort of squeeze is seeing itself being formed. Resolution up or down? Today (CPI) or tomorrow (FOMC). Let’s stay tuned …

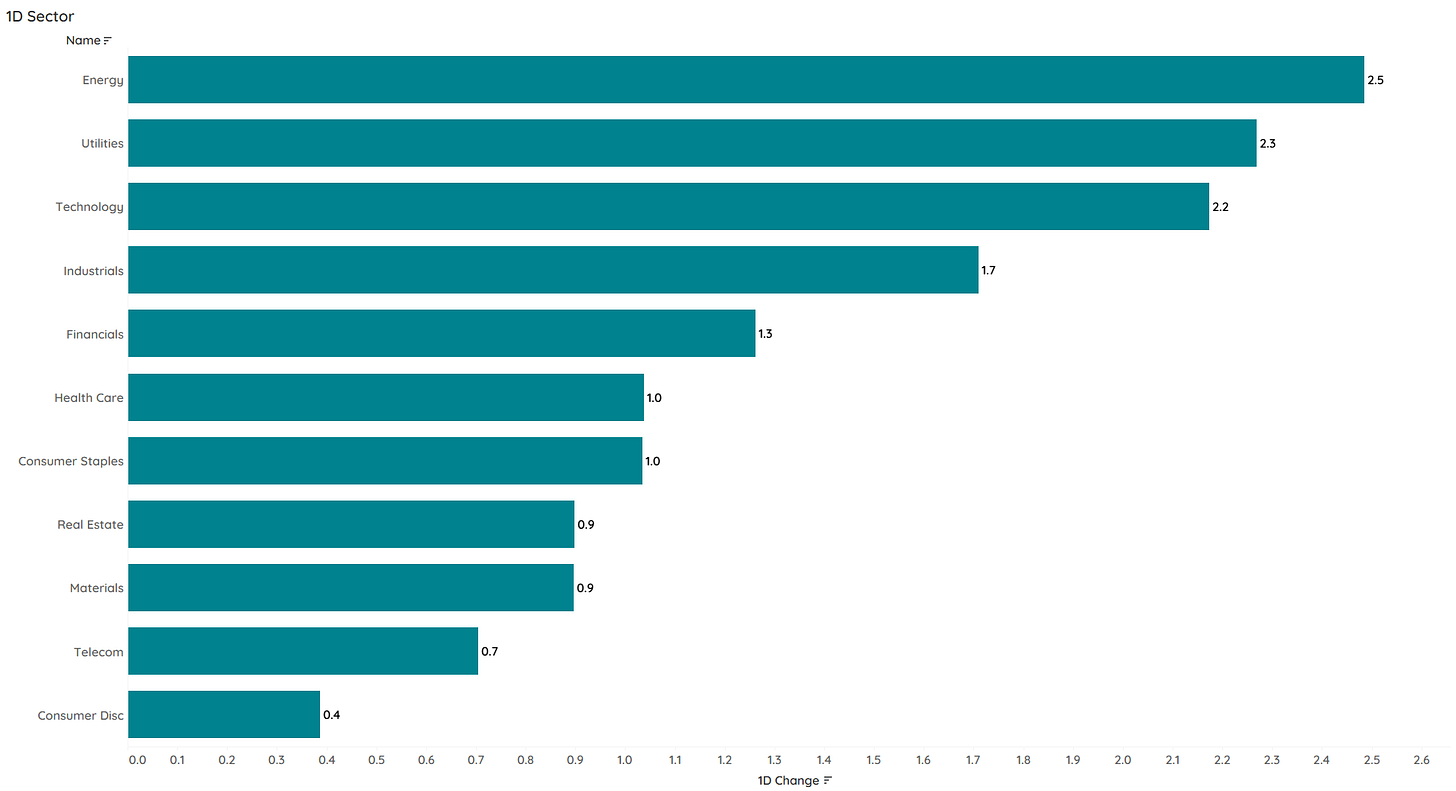

Participation was broad with over 90% of index members advancing on the day and eleven out of eleven sectors higher:

As a matter of fact, looking at the daily heatmap for the S&P, only one stock sticks out like a sore thumb:

Should $165 give on the Tesla chart, there are not a lot of straws to clutch onto until $120:

Asian markets are mostly higher too this morning, though less uniformly so than their US counterparts yesterday. European index futures suggest firmer stocks at the opening, whilst US futures are flat as I type.

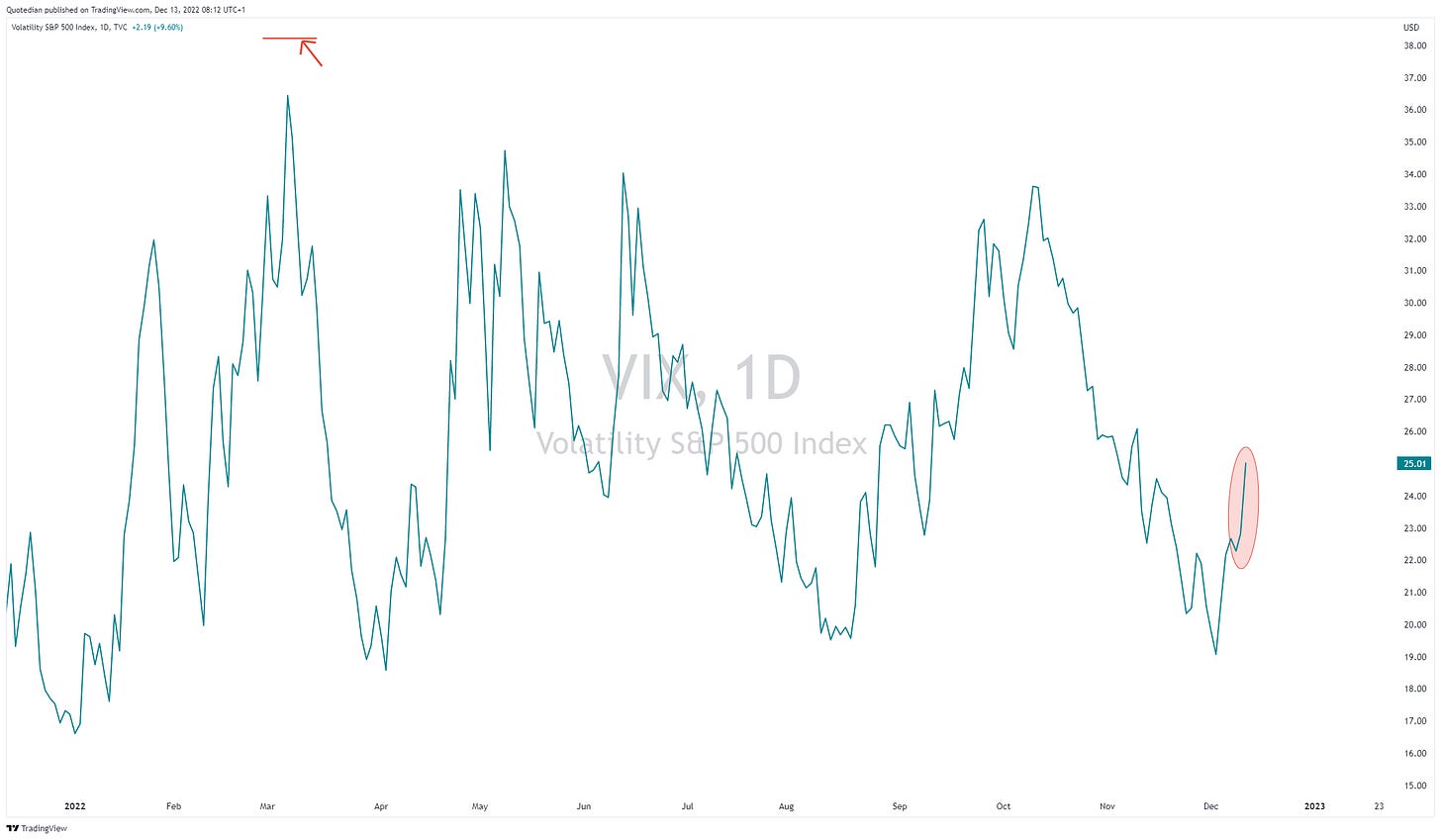

One surprising fact from yesterday’s session is that stock had their best day yet in December (S&P 500 +1.5%), but at the same time the Volatility index (VIX) shot up over 9% too - that is quite unusual:

But this serves as a good segue into fixed-income market observations, as the bond volatility index, MOVE, is on the move (yes, pun intended) again:

Seen on this one-year chart, maybe some of the importance of the move may be lost on the casual observer (which none of you are, of course), but zooming out to a multi-year period …

… we realize we are at levels above those of the European Sovereign Debt Crisis for example.

[Connected to increased bond market volatility is also a decreased bond market liquidity, which I had in mind to write about for a few weeks now. I need to put it off another day, but promise to revert this week on the subject.]

The other mildly surprising element to yesterday’s equity rally is that it happened not only in the face of a rising VIX but also rising bond yields. Yields on the US 10-year treasury benchmark bond rose close to 10 basis points, after a very disappointing auction:

Of course, is not only today’s CPI print in the US of importance (more on that in the COTD section), but also tomorrow’s FOMC meeting, where an increase by 50 bp from 4% to 4.5% is expected, followed by another 50 basis points increase next year and then rates should be put on hold - or at least that is the current path laid out by bond investors. Tomorrow’s press conference will matter.

But not only the Fed is expected to hike this week:

ECB - 50bp

BoE - 50bp

SNB - 50bp

Norges Bank - 25bp

CB Taiwan - 0.125%

CB Philippines - 50bp

CB Mexico - 50bp

CB Columbia - 100bp

Hike-a-gogo!

In currency markets, it has been eerily quiet the past few session, though the Dollar Index (DXY) continues to trade below its 200-day moving average (MA) AND right on key support:

On the other hand, versus the Japanese Yen, the US Dollar continues to trade above the 200-day MA and the Yen had an extra-weak day yesterday, after some chatter by officials left little hope for an abandoning of yield curve control even after Kurado will leave in spring of next year:

Nevertheless, I found this chart and trade idea from the fine folks at BCA Research interesting, suggesting a short on the EUR/JPY cross:

Put this together with that the same people see the Yen as 40% undervalued in terms of Purchasing Power Parity (PPP - careful, never a good timing tool):

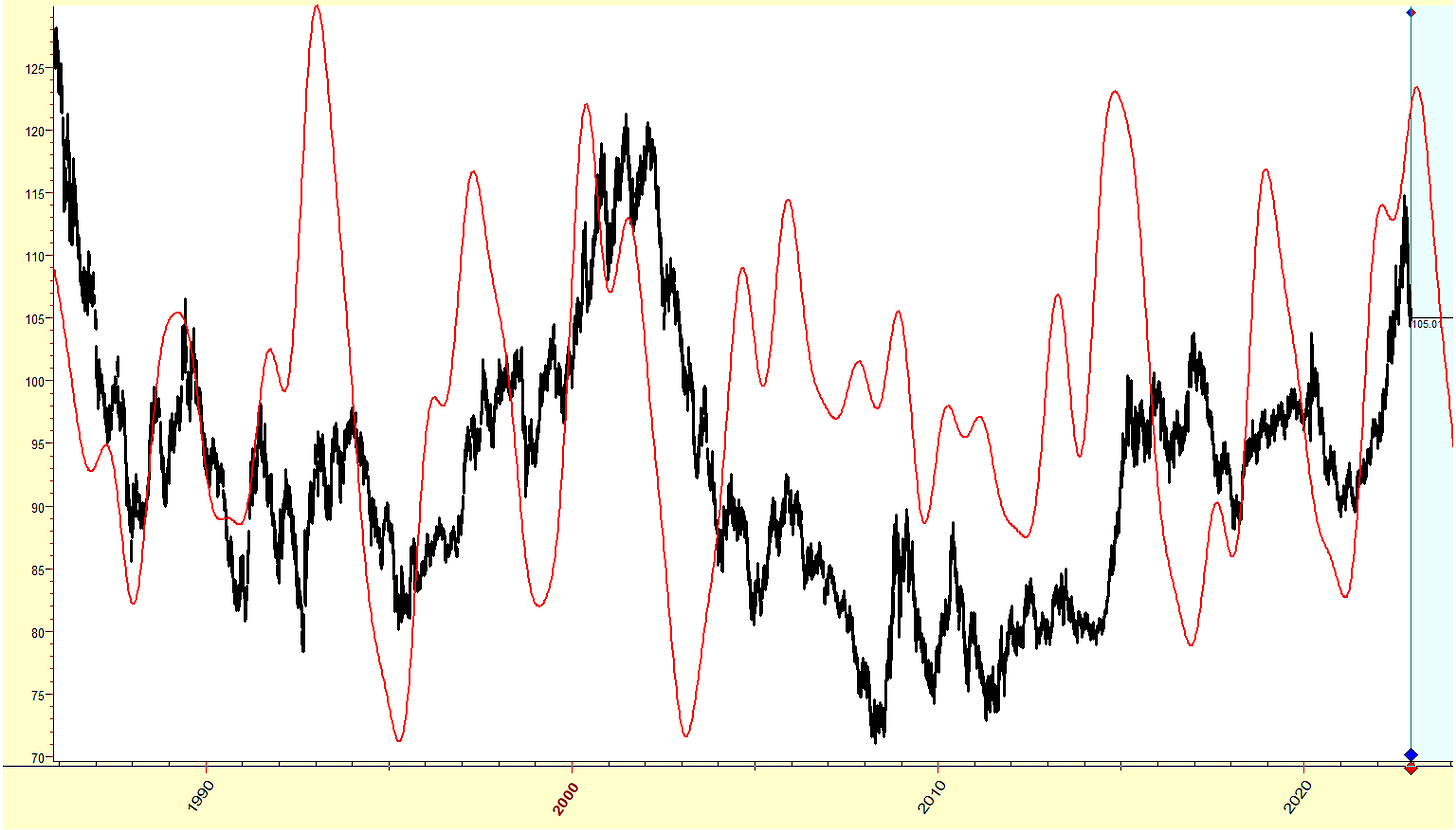

And finally, here is a mysterious (or mystical) chart on the US Dollar cycle by the inimitable Larry Williams:

In commodities, British energy prices saw a brief but huuuuuuge spike after a cold front hit the island over the weekend:

Gold is still consolidation recent gains below the $1,800 level:

But watch a break higher on Silver as an early warning system:

I’ll try to give a better update on oil tomorrow, but for now, the black gold seems to have found a short-term bottom as sentiment is getting one-sidedly bearish:

Time to hit the SEND button. We should be in for a fun ride over the coming days, so let’s enjoy that before the potential Santa Claus rally starts at the end of next week.

CHART OF THE DAY

Last year the Fed did a policy mistake by remaining in dovish mode for too long (transitory, remember). This year's Fed mistake is arguably their abandoning of forward guidance and having make the market look at such a lagging and biased/manipulated number as is the CPI. But hey, if they did that mistake on purpose, it worked …

Here are two different ways of looking at what happens to markets on CPI days. Definitely a pick-up in intraday volatility. Thanks, Fed!

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance