AI Believe AI Can Fly*

The Quotedian - Vol VI, Issue 62 | Powered by NPB Neue Privat Bank AG

* Today’s title was chosen before a certain airplane got downed yesterday

"Software is eating the world, but AI is going to eat software."

— Jensen Huang

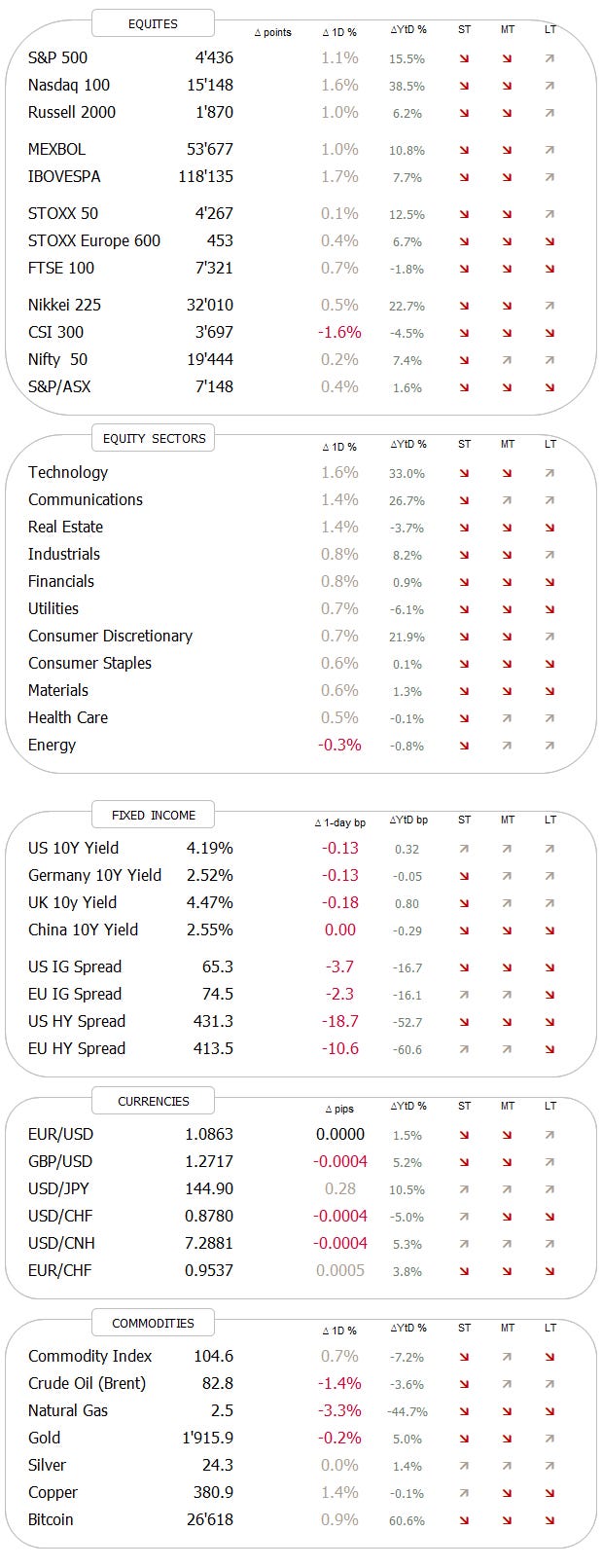

DASHBOARD

CROSS-ASSET DELIBERATIONS

(Click here, to accompany today’s newsletter with the fitting soundtrack)

Shortly after publishing yesterday’s newletter “T-Bill and Chill”, this … ehhmmm … ‘X’ (FKA ‘Tweet’) crossed The Quotedian’s screen:

Basically kind of sums up our point in one Twee …X, and once again confirms one of The Quotedian’s main doctrines: “Simplicity is the ultimate sophistication”. Having said that, Mrs Roch-Decter seems to have wasted three years on a CFA to come to such a conclusion …

Looking for sophisticated but simple asset management?

Contact us at info@npb-bank.ch

We were not going to write a Quotedian today, but the major rally in bonds (drop in yields) warrants a brief update. Let’s start there then:

Bond yields, which had been on a constant rise since late July/early August took a deep dive on Wednesday, bringing major relief to equity markets. As we said before, it is the bond dog waging the equity tail since the past few weeks…

Here’s the chart of intraday movements over the past five session on the Tens:

That was an 18 basis point drop in just slightly over 24 hours; not bad at all and probably explains the preceding pick up in bond volatility (MOVE), also discussed yesterday:

This translates into bond prices, as proxied here before by the TLT (iShares 20+ Yeaer Treasury Bond ETF) rebounding from the support level discussed by more than three percent in just two session - not a bad feat at all:

Ok, we spoke a lot about the what, but so far have neglected the why.

In one word three letters: PMI

PMI readings around the globe came in weaker than expected, overall at the composite level, but especially Service PMIs, which had been the last bastion holding up - until now … Here are some:

As aforementioned, the same as rising yields had put pressure on equities since the beginning of August, yesterday’s drop brought some relief, as witnessed by the equity performances on the dashboard above.

US stocks jumped, led by longer-duration stocks represented by the Nasdaq 100 in the chart below, where the index is recovering from just about the right level to remain in its intermediate-term uptrend:

And talking bond yields and long-duration assets, the opened, massive alligator jaw between Nasdaq (red) and Tens (grey)still needs to reveal if it will close by lowering the upper or lifting the lower jaw bone (or a bit of both):

The S&P 500 itself has still some more work to do to improve the current bearishness of the chart, but a move above 4,452 would be a first gain and big improvement:

Let’s see if Nvidida’s market HALO (see tomorrow’s Quotedian) is big enough to lift that boat.

So, without further ado, let’s have a look at those NVDA (after-hours) earnings. Summarizing all earnings details:

If you need to read all the nitty gritty details, click here.

Not all companies reporting yesterday saw a similarly good fate to their share prices. One of the pandemic’s superstars, Peloton (PTON), saw its share price drop 22% on the day. This chart was “funny”:

Anyway, as usual, running out of time, let’s press on, leaving the equity section with the observation that Asian markets are up to the tune of one percent across the region. Hong Kong stocks stand out with double that advance today.

European equity futures suggest the party will continue here for us, at least at stock market opening.

The US Dollar is at an interesting bifurcation point, with a small lift higher above 104ish improving the bullish outlook for the currency and samll drop lower increasing odds for resumption of the downtrend:

Stay tuned, as somebody I know pretty well, would say …

Anyway, time to hit the send button.

Happy hunting,

André

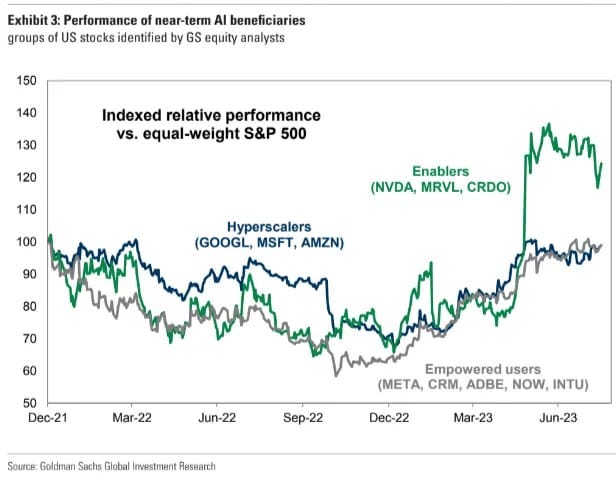

CHART OF THE DAY

An interesting chart from Goldman Sachs, that identifies three groups of AI companies (will try to replicate this for The Quotedian disciples for future following).

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

Hello André!! If that spread between Nasdaq and Tens "must" reduce, why not benefiting from shorting Nasdaq and buying Tens? Happy hunting too😃