An Inconvenient Truth

Vol VIII, Issue 21 | Powered by NPB Neue Privat Bank AG

“Many a beautiful theory has been killed by an ugly fact.”

— Thomas H. Huxley

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Howdy, fellow heat-sufferers! For starters, a warning: This week’s Quotedian will be much shorter than usual as ‘Yours Truly’ is in full Q3/2025 outlook mode, which takes up most of the resources and energy that the heat wave has left over …

Hence, this week we will have a look at some surprising facts and inconvenient truths … let’s dive right in!

An Inconvenient Truth #1

Trump’s Tariff Tantrum. Israel-Iran War. Record US fiscal deficit. Taiwan. Sticky inflation. We all gonna die. Etc, etc, etc.

YET …

Global stocks are hitting new all-time highs (ATH) after new ATH:

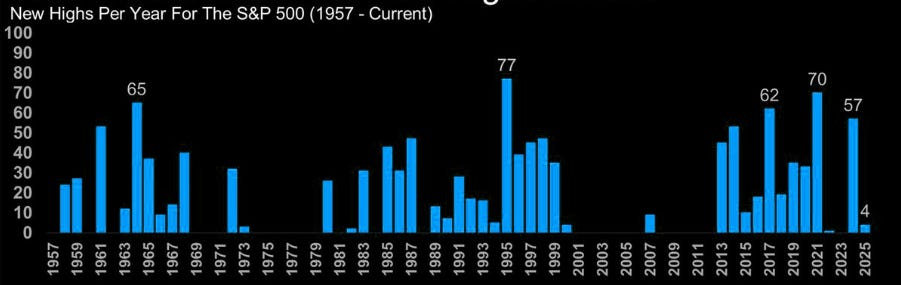

An Inconvenient Truth #2

Even in the case of the “lagging” S&P 500, we already hit the fourth new ATH of the year:

Maybe difficult to repeat the 57 ATH of 2024, but still…

An Inconvenient Truth #3

Evermore, the fact that the S&P 500 has recovered from a major slump in a short period, has pretty darn’ good implications for the next twelve months…

An Inconvenient Truth #4

Are we about to repeat the 2020 COVID experience on the Nasdaq?

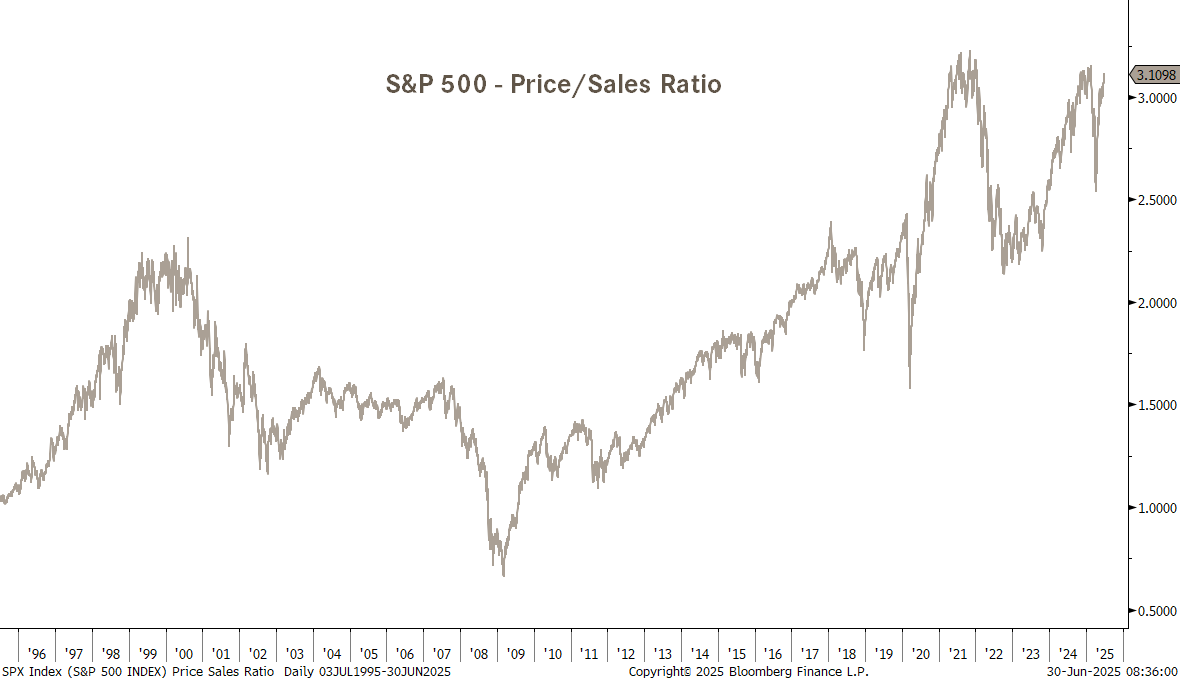

An Inconvenient Truth #5

However, all this equity strength has brought the S&P 500 back into valuation-nose-bleed-territory:

An Inconvenient Truth #6

Hence, other areas outside of US large cap growth may be of more interest …

An Inconvenient Truth #7

Emerging markets stocks are breaking out to new cycle highs:

An Inconvenient Truth #8

One of the supporting reasons for EM (grey) outperformance is of course the weak USD (DXY, red, inverted):

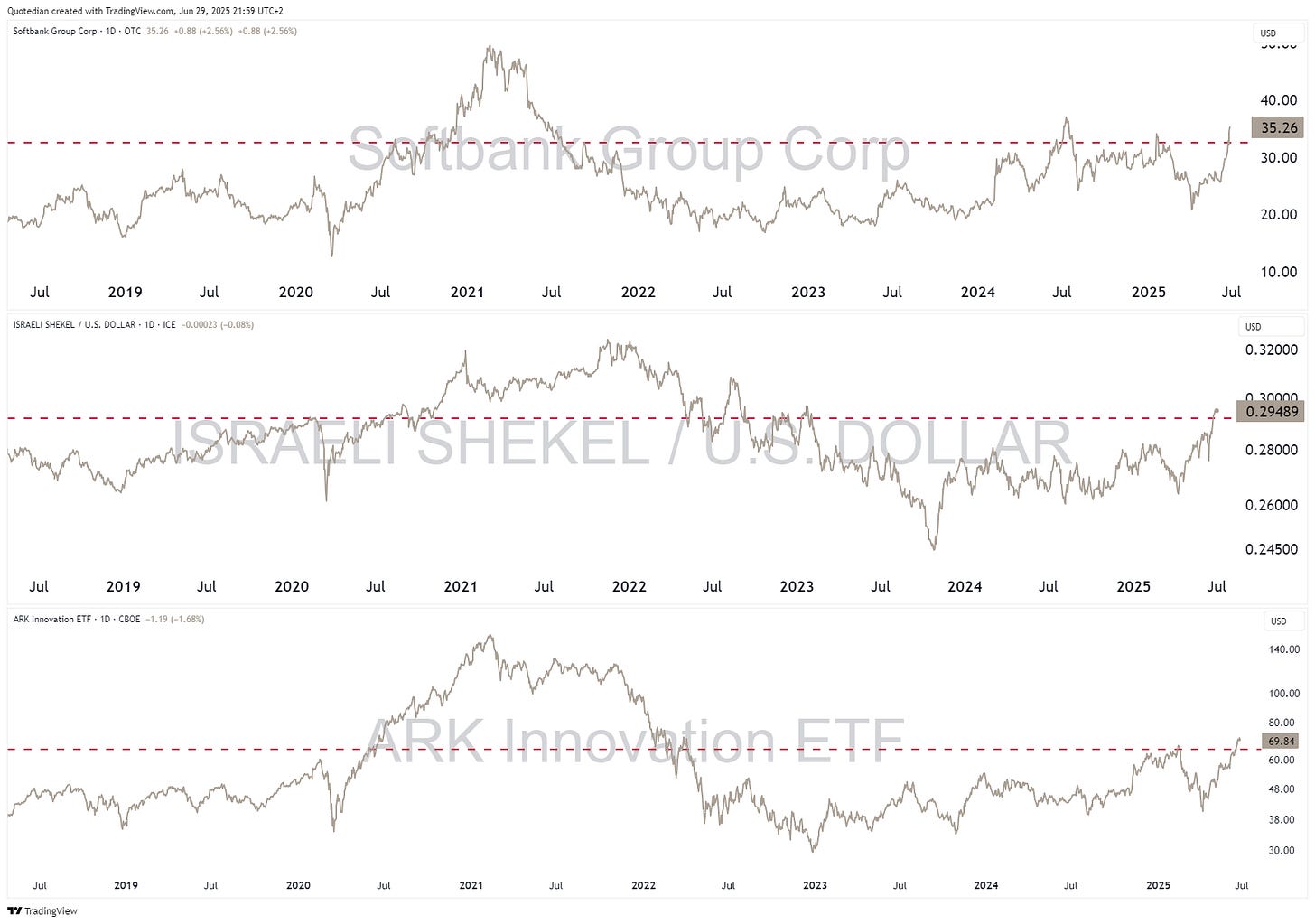

An Inconvenient Truth #9

Everybody “hates” Softbank, Cathie and the Shekel. Well…

An Inconvenient Truth #10

Ok, one more in the equity section …

For our younger readers, have you heard of the company International Business Machines (also known as IBM)? For our elder readers, can you recall?

That silly old company has outperformed giants such as Google or Apple over the past five years:

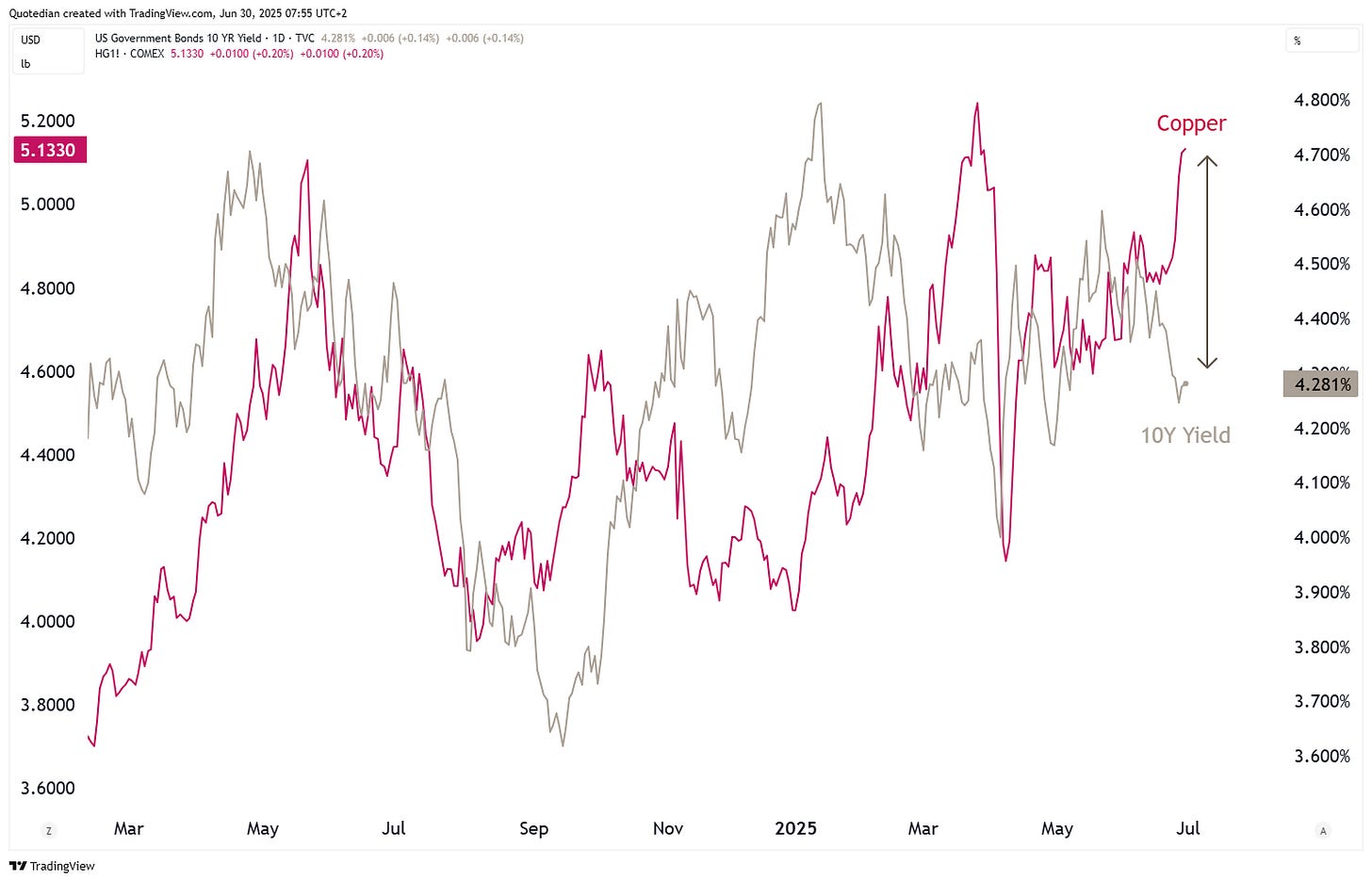

An Inconvenient Truth #11

Just one chart for the fixed income section …

A major disagreement between growth (Copper, red) and growth (US10 Year yield, grey):

An Inconvenient Truth #12

As we wrote many, many months ago (click here), you either love or hate President Trump. But in any case, his plan to weaken the US Dollar is working well, with a major technical breakdown at hand:

An Inconvenient Truth #13

Or in other words, the Dollar debasement is in full swing, with the Greenback having its worst first half-year period ever (or at least since Bloomberg allows me to do the chart below):

An Inconvenient Truth #14

Aforementioned Dollar weakness is of course also expressed in the price of Gold which has been on a tear the past two years. Starting tomorrow, July 1st 2025, Gold will be considered a Tier 1 regulatory capital, meaning it carries a 0 % risk weight. Not to be confused with being considered a High‑Quality Liquid Asset (HQLA), it still should be supportive to the price of the yellow metal:

Debasement, anyone?

An Inconvenient Truth #15

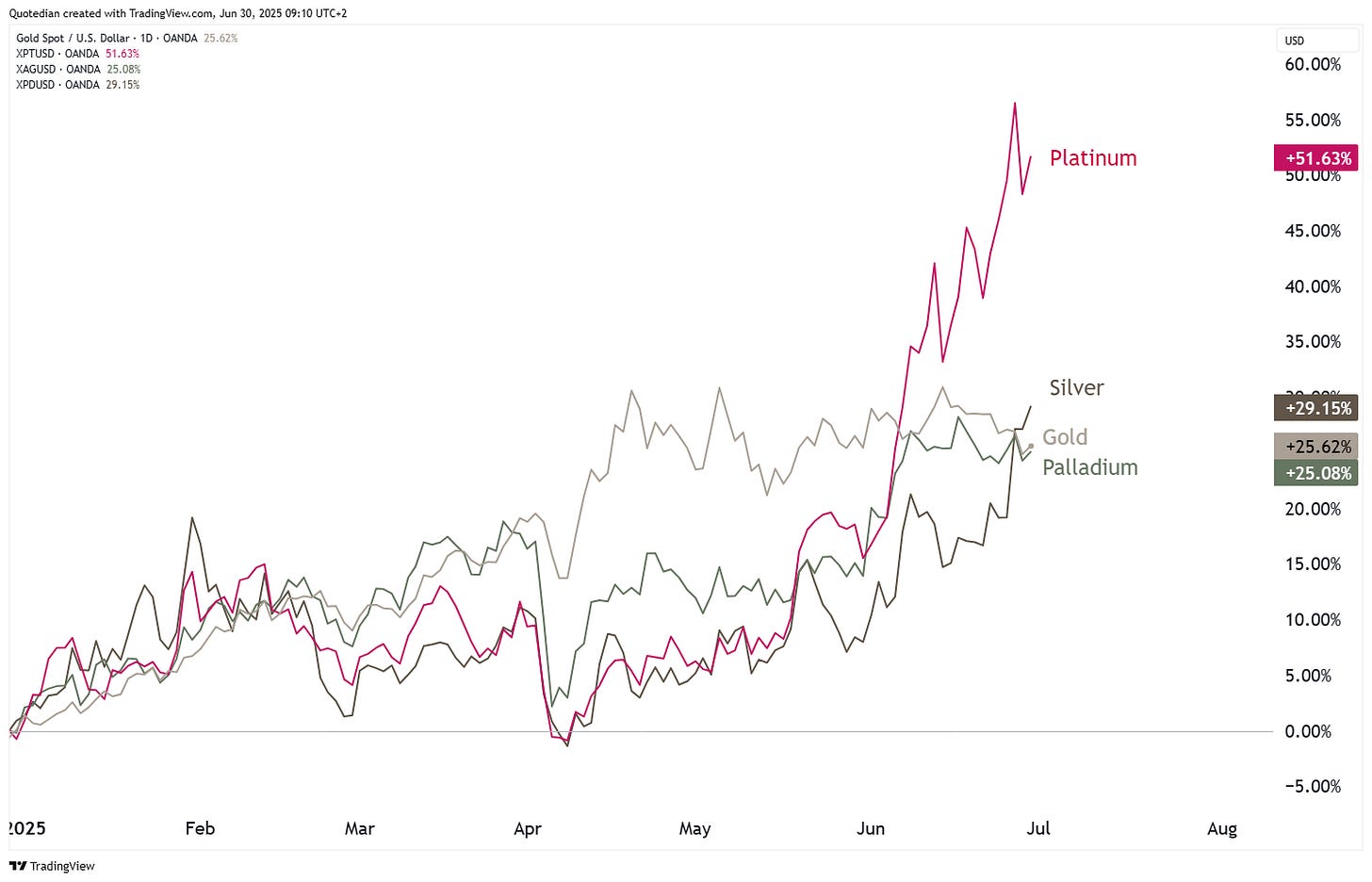

HOWEVER, Gold is NOT the best performing precious metal this year. That honour goes to Platinum!

Can Platinum then, which apparently is even scarcer than Gold, end its long-term relative under-performance?

That’s all for this week, folks! As mentioned, we are holding our quarterly investment committe this week, hence the conclusions thereof should be available to you early next week. Until then, see you in The QuiCQ 😉.

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG