Any Given Sunday

The Quotedian - Vol VII, Issue 20 | Powered by NPB Neue Privat Bank AG

“If you have nothing to say, say nothing.”

— Mark Twain

Not that there is nothing to write about regarding last week’s market action, but a prolonged Roland Garros final coupled with an anyway lazy Sunday afternoon, will make this week’s Quotedian look like a “QuiCQie”

Looking for “to the point” investment advice? Speak to us!

Contact us at ahuwiler@npb-bank.ch

It’s been an intense week, with the ECB providing its first rate cut since 2019, an NFP number that made yields go wild and a kitty roaring amongst other stuff…

Let’s get started with our speed round through the different asset classes!

Overall, stocks had a good start to the sixth month of the year:

Indian equities went through the ultimate rollercoaster after their national elections:

Mexico also had government elections and an ensuing stock market rollercoaster, albeit with a bit less of a happy end:

Even though a slide to the right at the European Parliament elections on Sunday was expected, (equity) markets are not liking it this morning:

Though the daily chart remains constructive … for now … :

Only a break below 4,890 would put the intermediate term uptrend on hold.

The S&P 500 closed just a few points shy from a new all-time high:

However, the 5-day heatmap reveals that most upside performance contribution has come from a select few (aka usual suspects):

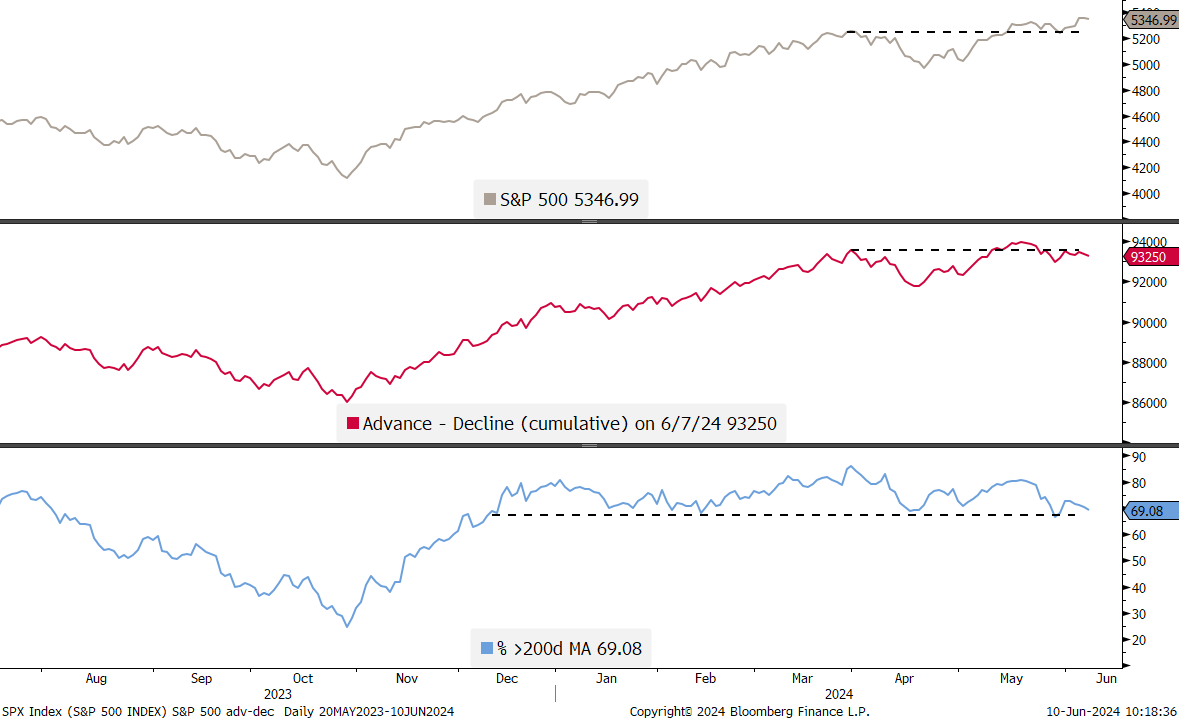

This narrower participation is then confirmed via a falling advance-decline ratio (middle clip) and less stocks above their 200-day moving average (bottom clip):

Global sector performance hence was accordingly disperse:

Small cap stocks did not like the strong non-farm payroll (NFP) reading published on Friday:

Support at 1,960 (~3.5% from current level) on the Russell 2000 should hold, otherwise we are in for a deeper correction.

On an individual equity basis, here is how the top 25 performing stocks in the US have fared over the past week:

And here are their European counterparts:

Bond yields had a wild week last week, with the drop from 4.50% to 4.25% on the US 10-year Treasury nearly completely undone in Friday’s session after the stronger-than-expected NFP number:

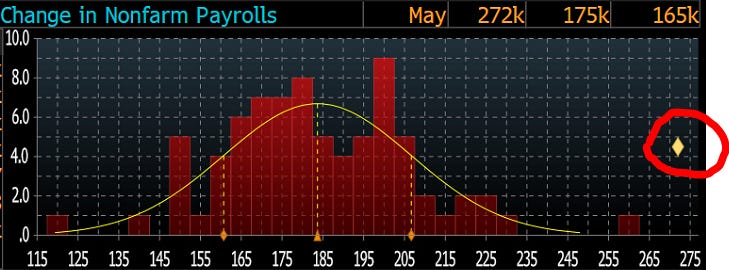

The guesstimate range for the NFP number had been comparingly narrow (160-205k) - hence the 272k number was a true outlier:

Not surprisingly then did chances for a June or July cut drop further

and the number of cuts from here ‘till year end dropped to one and a half:

The ECB cut last Thursday, for a first time pre-empting a Fed move to the downside and only for a third time moving before the FOMC at all:

The other two occasions (‘08 & ‘11) where the ECB moved (hiked) without the Fed were followed by traumatic experiences …

In any case, it was a hawkish cut, as ECB Chair Lagarde was quick and insistent to highlight that more cuts were not a given.

German yields quipped that by moving higher after the cut:

And then we got the European elections on Sunday - Mr Macron in France must have been very distracted by the Roland Garros tournament in Paris, as he seemed surprised that the populist right wing gained an important leverage at the European parliament.

It was only a week ago where we asked (click here) whether the spread between French and German government bonds was wide enough, reflecting the recent downgrade of French debt by S&P to AA- was correctly priced in:

It seems that re-pricing is taking place now …

Let’s use this as a segue into the currency section, where the glittering wonder that is the Euro is suffering after yesterday’s results (elections, not tennis) versus the US Dollar:

But then, nearly everything is up versus the Euro today:

Versus the Swiss Franc, the Euro has given back already nearly half of its year-to-date gains in just two weeks:

In cryptocurrencies, Bitcoin (still) looks ready to break higher, but so far has failed to do so:

I was going to right that downside risk will increase if Bitcoin fails to break out high soon, but then looking at CFTC-data (Commitment of Trader) we note that levered hedge funds are record short this cryptocurrency, making the downside less likely vulnerable:

Finally, in the commodity section, precious and industrial metals are cooling off somewhat. Here is the commodity sector performance of last week:

And here some popular commodity futures over the same time span:

Gold continues to consolidate gains at a high level, but a drop below $2,280 could provoke a deeper correction (to $2,200?):

Platinum has retraced nearly two thirds of its recent gains already:

Oil, which arguably has pulled bond yields lower as outlined last week, has stopped going down:

Have we missed the Natural Gas (long) trade?

The long-term chart would suggest not necessarily:

That’s all from me this week. Thanks for tuning in and thanks for hitting that like button!

André

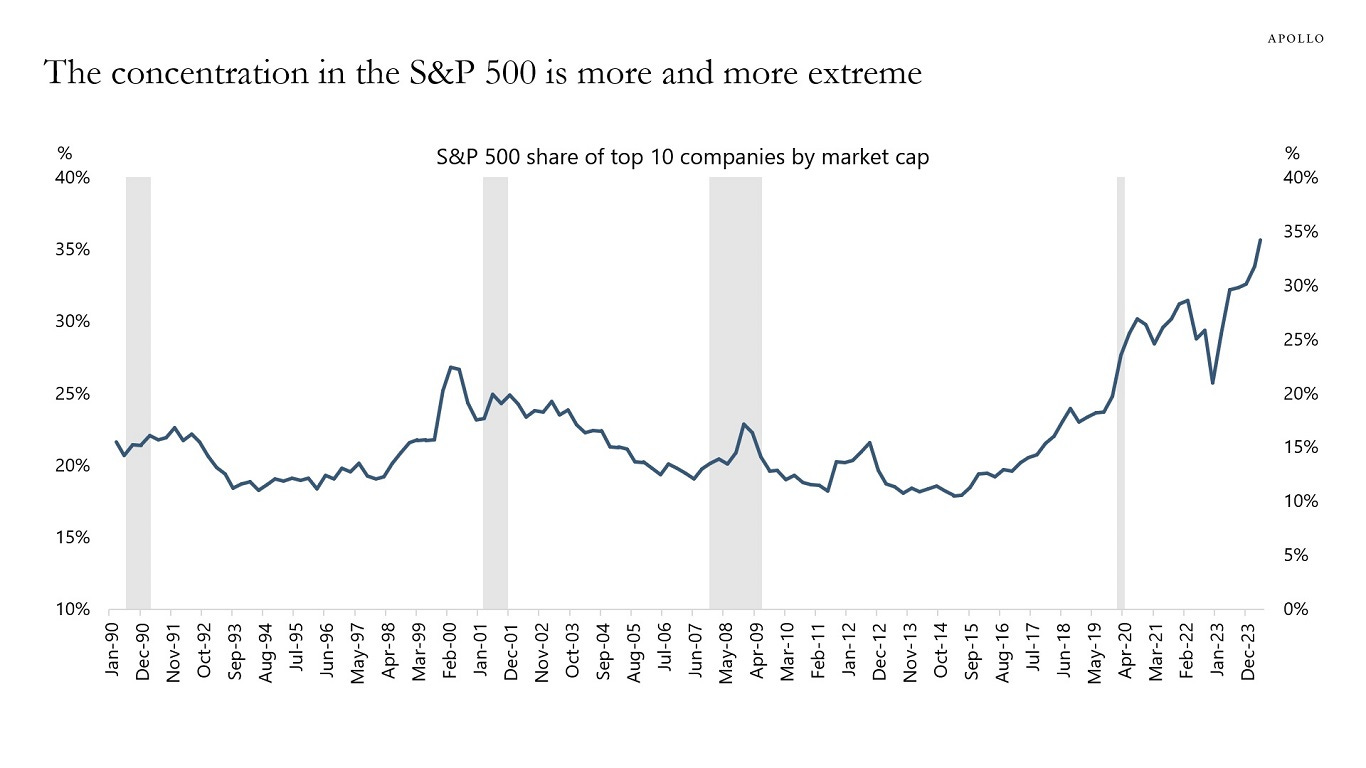

In the equity section above we discussed how the rally last week was led by only a few stocks, with participation ‘thinning out’. The chart below shows how concentration risk is becoming a real issue. Surely, the increased use of passive managers is further adding to this ‘problem’. Whilst there is no absolute number on how much is too much, it seems we may get dangerously close to that breaking point.

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance