Bluff Called

Vol VIII, Issue 14 | Powered by NPB Neue Privat Bank AG

“If you're playing a poker game and you look around the table and and can't tell who the sucker is, it's you.”

— Paul Newman

“Fold and live to fold again.”

— Stu Ungar

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

It ain’t easy being a newsletter writer nowadays. I always used to take pride in starting my weekly Quotedian at least a few days, if not weeks, before the publishing date. That pride has turned into a curse, as anything one prepares or writes runs the danger of being “out of date” a few moments later …

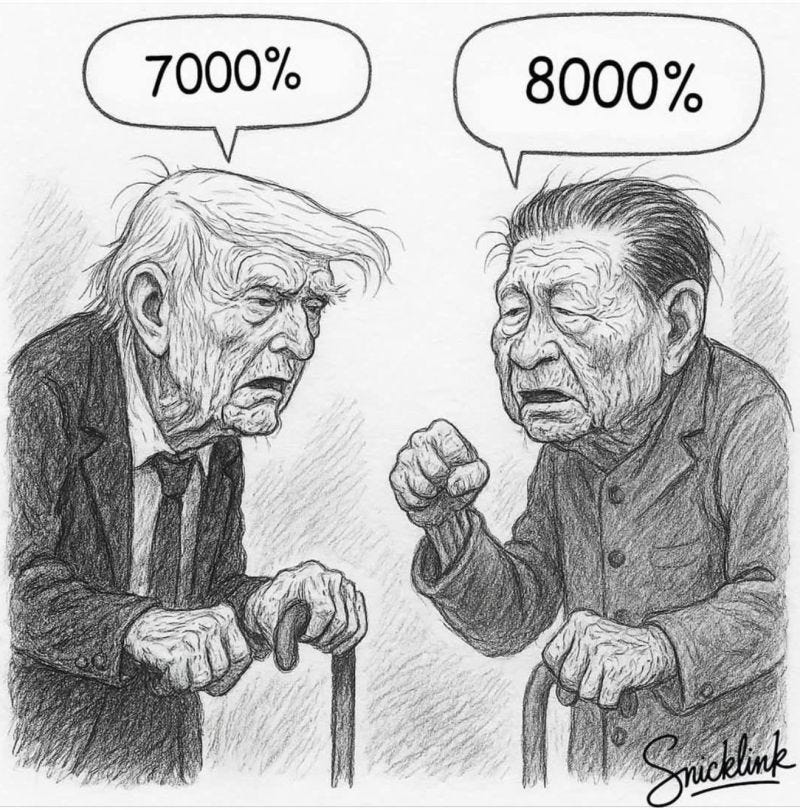

The phrase “prove” is in the “meme” at the top of the letter. Whilst humongously funny, it is already outdated as Trump and Xi continue to slapstick tariffs on each other. Unless that MAGA hat has a chip built into it, in which case it may be tariff-exempt.

Trump has blinked. And lost.

The Trump Tariff Tantrum is likely largely over. Secondary effects are here to stay. The damage is done. Sell the rip.

Life is strange. In what was at least felt as one of the worst week for (US) stocks, US stocks actually did pretty damn well:

Trading the US market did definitely not feel like a winning proposition over the past week or two:

As we stipulated in one of our QuiCQs last week, which seems years ago, the 90-day moratorium on tariffs has likely put A bottom into the stock market, but probably not THE bottom. And as we have also defined last week, it was NOT the stock market that pivoted Trump’s Tariff Tantrum, but rather the bond market (see ‘Fixed Income’ section below).

In any case, these are super-difficult times for short-term traders and long-term investors alike. Traders are rattled by volatility levels not seen since the pandemic five years ago,

whilst investors are torn between buying the dip (FOMO) and selling the rip. Check out the S&P 500 daily returns since obliteration day:

But as I highlighted in Friday’s QuiCQ (click here), the larger and longer-term problem to the US stock market seems to be that exodUS (click here) is indeed taking place.

Consider US treasury yields for example:

As a matter of fact, it was the worst week for bonds since a very, very long-time (2001):

That run-up in yield seems to be a clear indication that some investors have either voluntarily (China?) liquidated some of their Treasury positions, or were forced (overleveraged hedge funds?) to do so.

At the same time, we got that dreaded moment (aka Liz Truss Moment) when not only bond yields were rising, but the US Dollar falling into … ehhr… freefall. Here’s the US Dollar Index (DXY):

The problem is, even as this morning US equity futures are pointing to a substantial rally later this afternoon, the DXY continues to soften. To my point: exodUS.

Actually, the bond (yield) up, Dollar down move on the back of Trump’s Tariff Tantrum (TTT™) was aptly named ‘The Moron Risk Premium’ by the FT early last week:

Here’s a longer-term chart(weekly) of the DXY, demonstrating the importance of the current level (99.50):

Arguably, the EUR/USD has already broken out to the upside:

whilst key support (141.00) on the USD/JPY is holding … for now:

But if you are looking for THE ultimate prove of investors fleeing the US market looking for other Safe Havens, look no further than the USD/CHF:

We are now below key support in the company of the 2012, height of the European Sovereign Debt crisis levels.

Will the SNB announce emergency rate cuts and take their policy rate into negative territory before the next (June) meeting to weaken the Swiss Franc?

Probably.

Will they successfully weaken the CHF?

Probably not for long.

Suddenly, that Dollar Smile (click here) has converted into a skewed slant:

Have we spoken about Gold yet?

More safe haven buying here, with the price of Gold briefly reaching $3,245 the ounce on Friday and then again this morning.

Silver, which due to its industrial use, is usually quite exposed to the economic cycle. If the US economy is heading for a recession, as the price of oil would suggest (see below), the price is of silver is holding up surprisingly well (within its typical high-volatility frame):

Even Bitcoin seems to be the preferred ‘solution’ over the US Dollar, having regained the terrain lost following the Liberation day announcements:

And here’s that promised chart of the oil price:

For now, and maybe even better visible on the longer-term chart below, it is safe to assume that the previous floor ($65) on the WTI is now the ceiling:

To finish this week’s somewhat strange letter, let’s turn back to the stock market for a moment, even though the show continues to belong to the bond and currency markets:

On the long-term chart, the S&P has nearly reached the lower end of its multi-decade secular uptrend channel in place since the GFC bottom:

Sentiment is bombed out as the CNN Fear and Greed indicator would suggest:

Up from a record low reading of ‘4’ last week, it is still in extreme fear zone.

Retail investors (via AAII) also continue to be uber-bearish for 10 weeks running now:

One of our favourite “thrust” indicators, gave a buy signal last week:

The percentage of stocks in the S&P 1500 (US large-, mid- and small cap stocks) dropped below 15% (dashed line) and now rallied above that same line again, triggering the fore-mentioned buy signal (other occasions highlighted in green).

All in all, a dabble to the upside is probably worth playing here.

BUT … REMEMBER…

Nothing ever good happens below the 200-day moving average - hence keep your stops tight!

If the investing world is indeed to turn their back somewhat on the US, there is plenty of market share to give back:

An adjustment of the weighing of US equities in the index above to levels more representative of its economic size would be painful:

Hence, with this we end this week’s letter - make sure to stay update Tuesdays to Fridays via our daily QuiCQ letter, available here: www.quicq.ch

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG