Dilemma

Volume V, Issue 174

"Bears feast on thanksgiving, bulls on Christmas"

— Dale Pinkert

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Two topics dominated yesterday’s session and sent markets into a general “risk-off” mood and mode.

The first topic was that of rising COVID cases in China, which I had already pointed to in last Tuesday’s Quotedian. Here’s an updated chart:

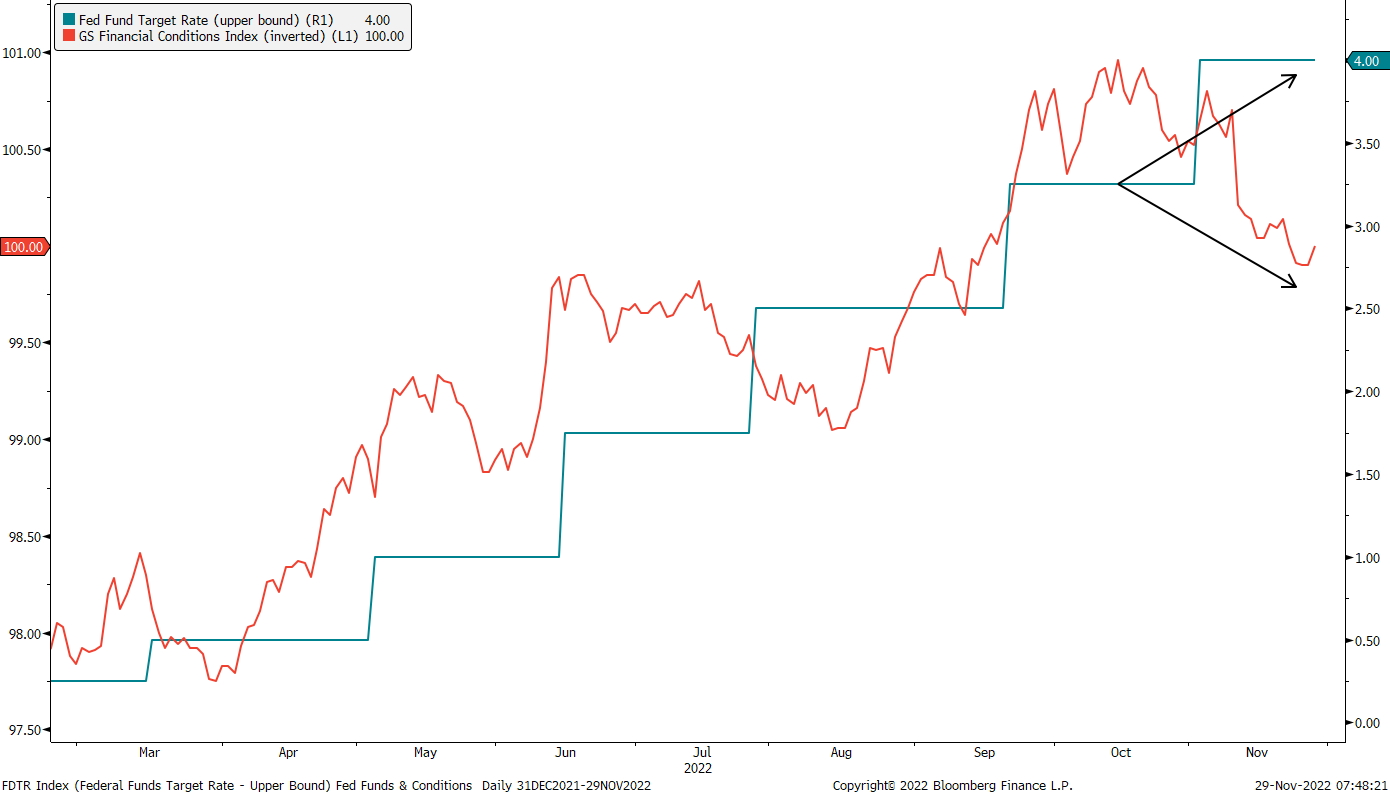

The second item that investors concentrated on, was newly found hawkishness by some FOMC members ahead of the last Fed meeting this year on December 14th. This chart probably explains why the Fed wants to sound more hawkish again:

Basically, the recent rally in stocks and bonds has softened financial conditions probably more than the Fed would like to say, having declared earlier in the year to fight inflation via reducing the wealth effect (mainly stocks and houses). There will be a speech by Fed Chair Powell on Wednesday, which probably will get quite some attention and the Fed will move into a self-imposed communications blackout this weekend ahead of the fore-mentioned FOMC meeting.

Looking at equity markets, as mentioned, risk-off ruled yesterday, starting with a big drop in Chinese markets (albeit they somewhat recovered by the time the closing bell rang), after this rise in COVID-cases and unusually strong protest by the population against further lockdown measures.

But it was actually US stocks which provided some of the day’s worst performances, with the S&P 500 and the Nasdaq both dropping one and a half percent.

Breadth was exceptionally weak, with all eleven sectors printing red

and over 90% of the index constituents down on the day, leaving us with a rather nasty market heatmap:

For now, the S&P 500 has been rejected just below the 200-day moving average and our first defined target zone, but continues in the strong upwards trajectory initiated in mid-October:

Small cap stocks, (Russell 2000, -2%) also continue to be rejected at the downward-sloping trendline of the bear market and the 200-day moving average:

European stocks (SXXP) continue to look overall more constructive (as counterintuitive as that may feel), having surpassed the downtrend and 200-day MA several sessions ago already:

Turning to fixed-income markets, the hawkish Fed talk yesterday, seemed to have had actually more impact on equities than on bonds, where rates remained largely unchanged. Here’s the 2-year US treasury yield for example, which after a brief intraday spike ended where it had started the day:

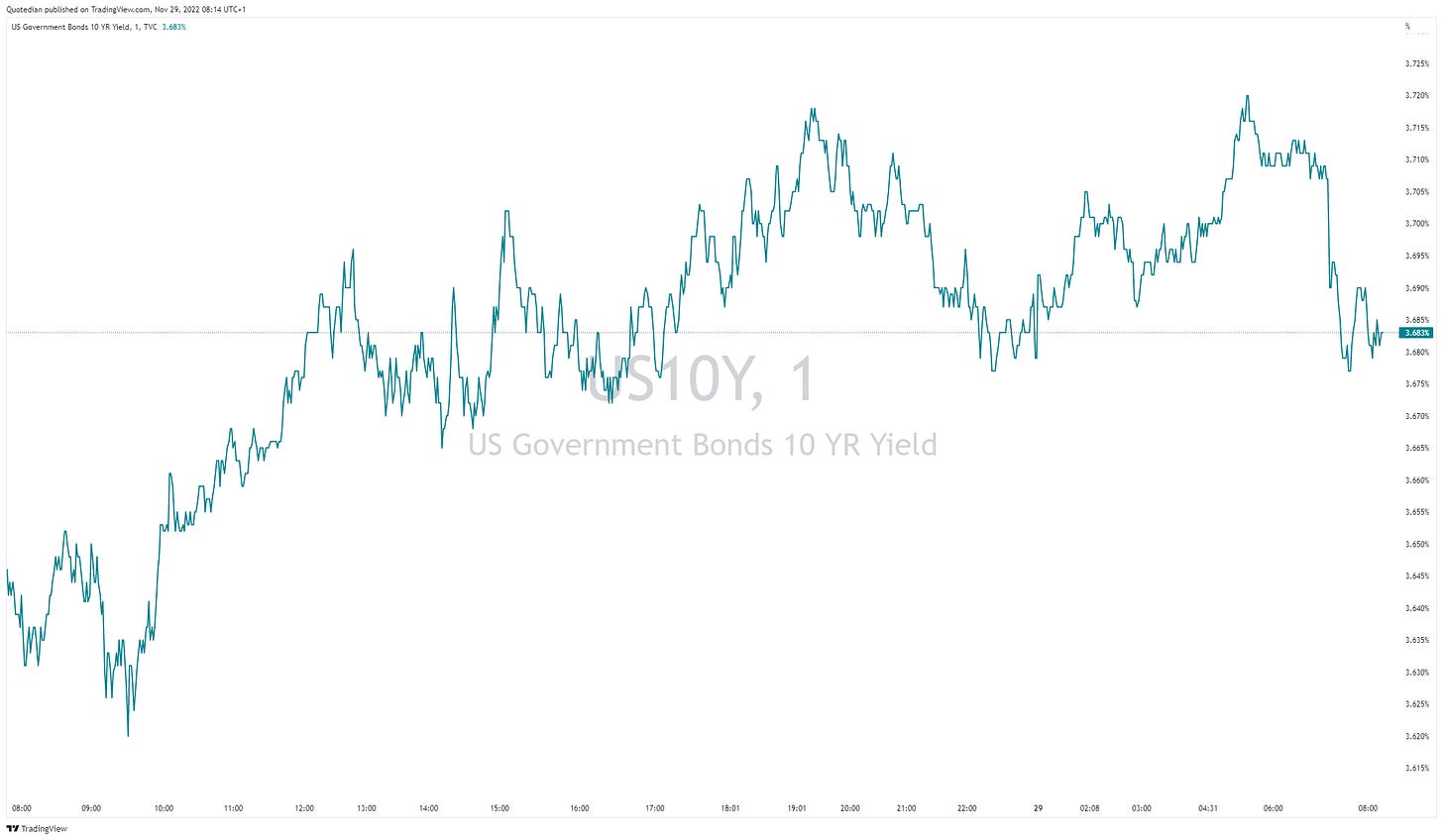

Though 10-year yields nudged a tad higher on the intraday chart:

This move is actually barely visible on the daily chart:

The curve remains deeply of course deeply inverted:

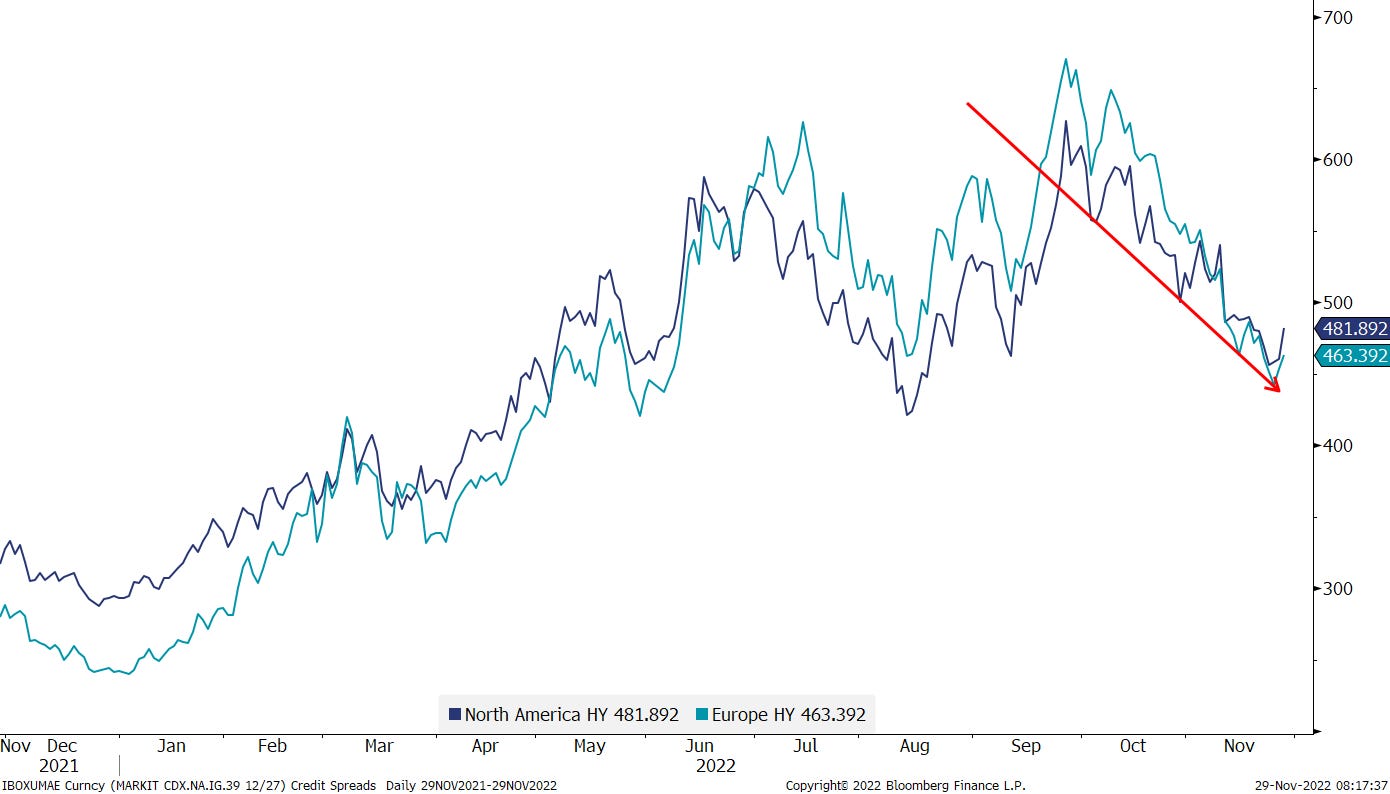

Credit spreads unsurprisingly widened a bit on the back of equity weakness, but overall remain in narrowing mode:

One of the more eye-catching facts is the continued gap between bond (green, rhs) and equity (blue, lhs) volatility:

Who’s right, who’s wrong? A dilemma (😉) for investors …

In currency markets, the US Dollar had a universally strong day as investors focused on risk-off:

For the EUR/USD cross, this $-strength yesterday meant rejection at the 200-day moving average and there’s also a (weak-form) argument to be made for a double top:

For now, as long as the currency pair holds above 1.02 the uptrend remains intact. In case of a drop below that level, a more complex consolidation is playing out, with the Euro possibly dropping back to parity or slightly below again.

In commodities, oil was once again the focus, with the price of crude (WTI) seeing a massive intraday drop with a rally back into the close for a second time in less than a week (black arrows):

On both occasions, the selling pressure came after renewed fears over prolonged China lockdowns. Here’s a closer look (past 5 days):

For Gold, I am still watching that possible pole and flag formation to confirm itself, but has so often with Gold lately, paaaaaaaatience is required:

Ok, enough for today. Have a great Tuesday!

André

CHART OF THE DAY

We are just about starting the last (shortened) month of the year and I can imagine that many investors share a common dilemma: Start reducing risk after the recent rally and lock in whatever recovery ‘gains’ are available, or stay fully invested to hopefully reduce even more what still must be hefty year-to-date losses?

Seasonality shows that Santa usually comes, but effectively only towards the end of the month, with some important volatility before that.

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance