Ghidorah

Vol IX, Issue 05 | Powered by NPB Neue Privat Bank AG

“A bubble is a bull market in which you don’t have a position.”

— Eddy Elfenbein

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Ghidorah, an armless, bipedal, golden and yellowish-scaled dragon with three heads, two fan-shaped wings, and two tails, is not only a 1964 Japanese Kaiju movie, where it fights versus Godzilla, but in this week’s Quotedian, we also use it as a metaphor for a triple-whammy problem that seems to be approaching global markets quickly.

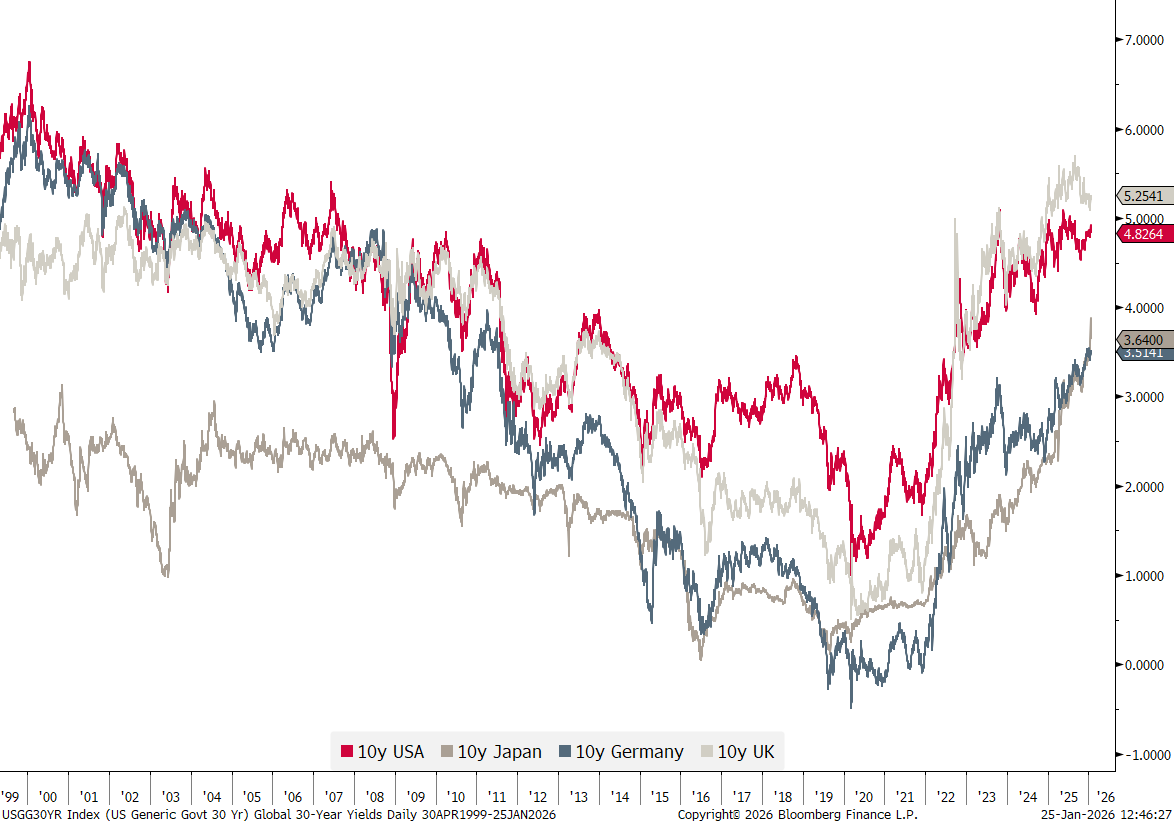

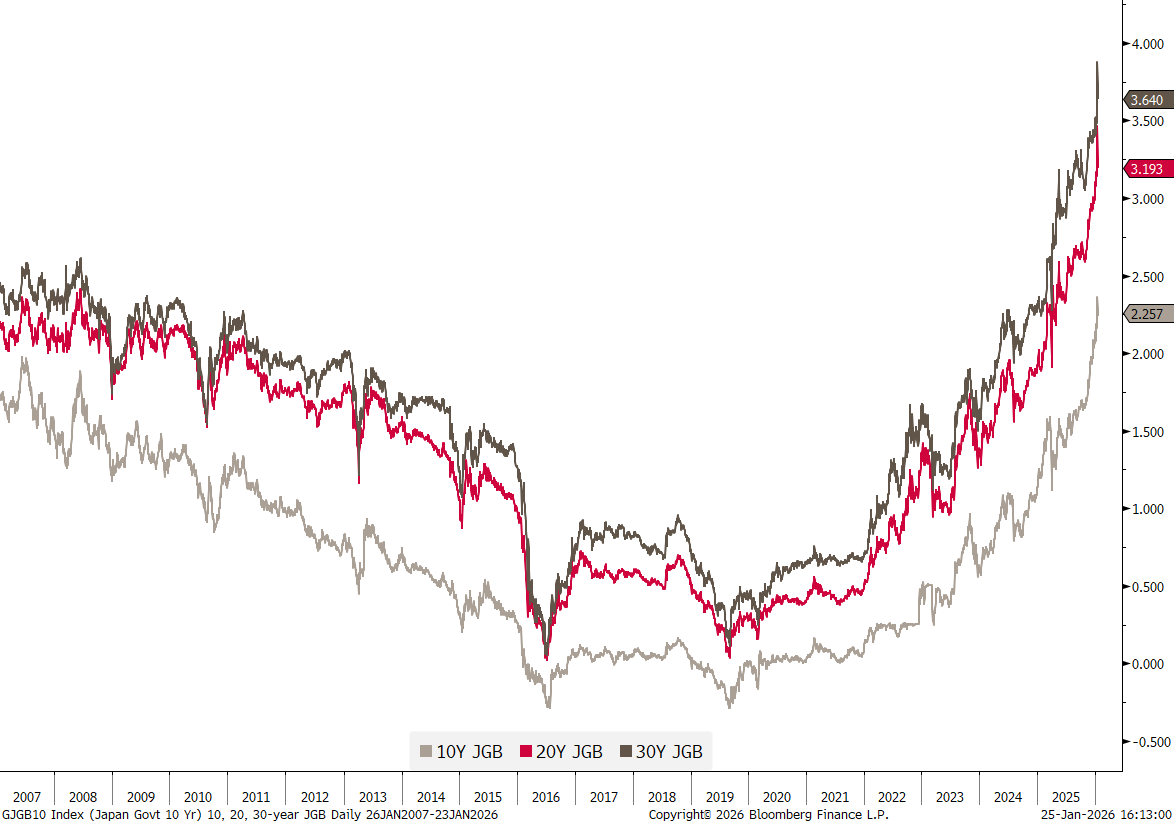

The centre head are global yields, which, as we have discussed on several occasion in this space and also in our Quarterly CIO Investment Outlooks (click here), have been pushing higher over the past few years, and, which after a pause, may be ready for the next leg higher:

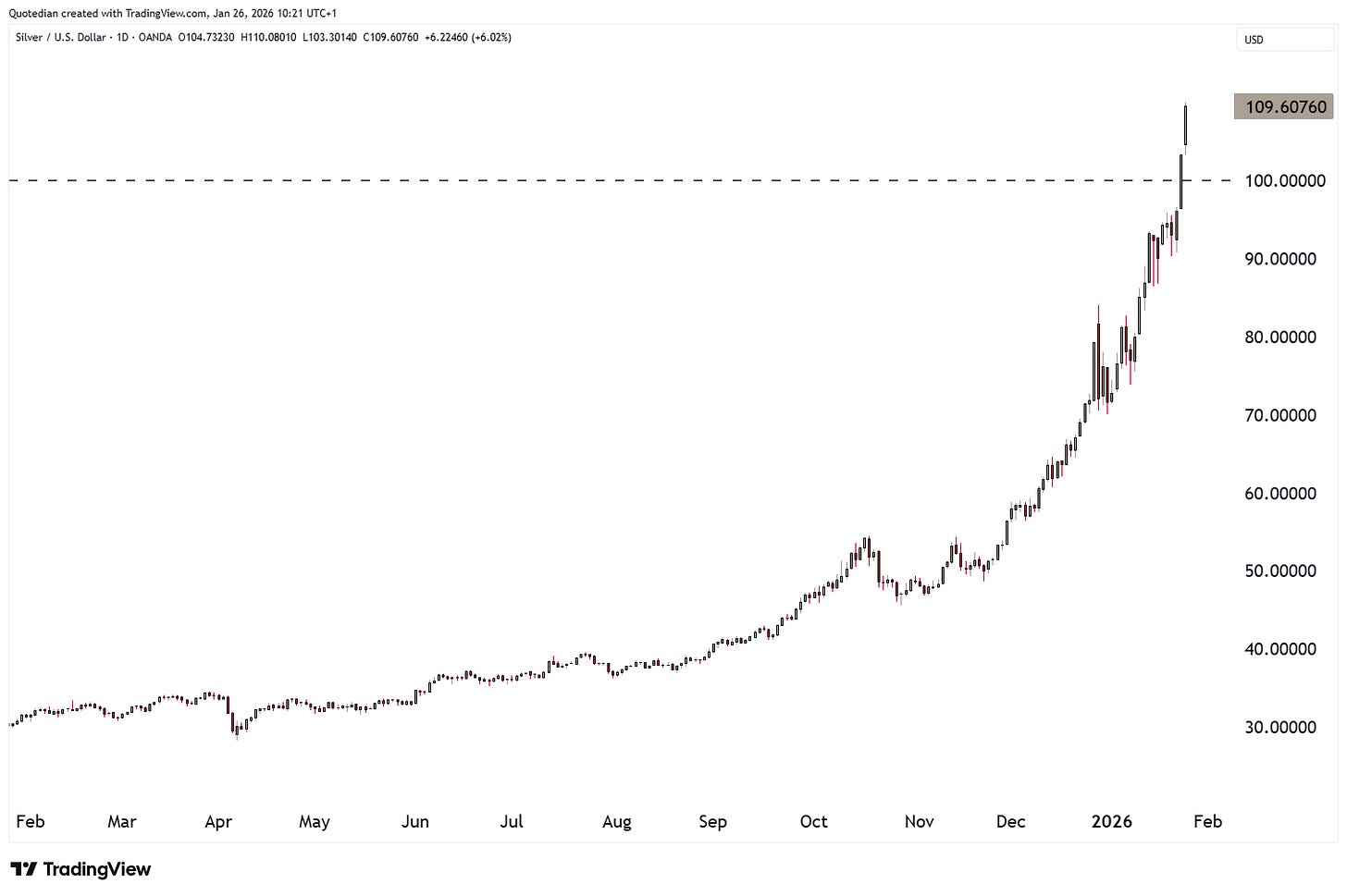

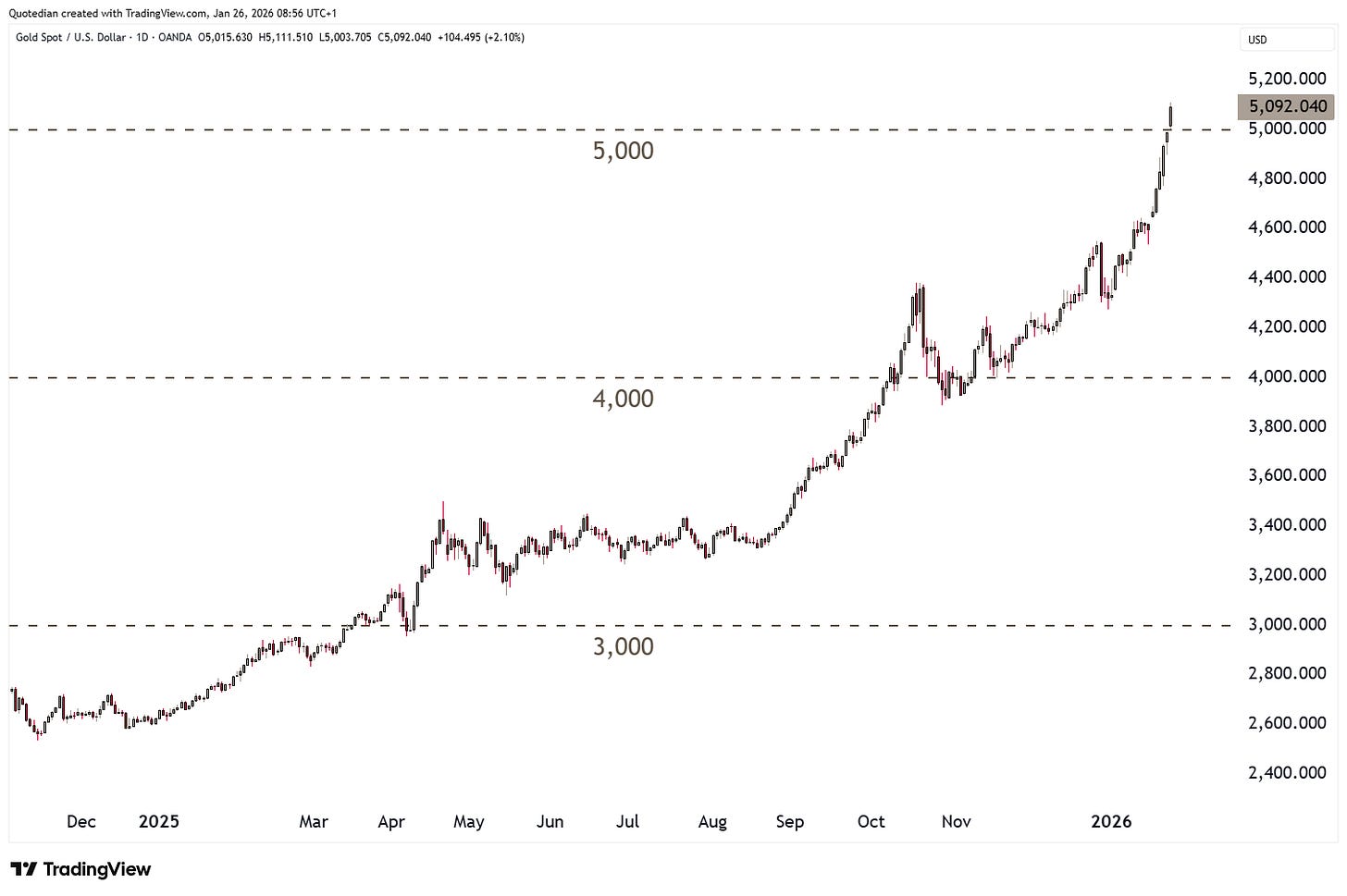

Another Ghidorah head are global commodities, lead by Gold and Silver, the two currencies that followed the barter-system a few thousand years ago,

are hitting the landmark level of $5,000,

and $100 respectively.

The last head, to the left (right from a observer’s point of view), is the US Dollar, which increasingly starts looking like the odd one out, the Curly of the Three Stooges,

with the next leg down seemingly ready to get going:

Hence, this week’s Quotedian will try to study that three-headed monster from a distance to try and identify where it may be heading and its implications for global macro markets.

You may will probably not agree, but equities are actually only a sideshow in this global macro drama unfolding.

Nevertheless, we will take higher equity prices (another expression of the currency debasement trade) as long as the persist. The Greenland panic seems to be over, as the S&P 500 is less than a percent away from a new ATH:

The Nasdaq-100, recently a laggard, has seen its chart-picture improving, recovering strongly over the past few sessions:

This move higher has likely been supported by the Magnificent 7 rebounding on a key support level:

Undeniably, a market rotation is underway, as the equal-weight version of the S&P 500 has been making a new ATH this week,

and small cap stocks (Russell 2000 - red) having taken the clear lead:

European markets (SXXP) are also less than one percentage point from a new ATH:

However, Swiss stocks (SMI) are lagging in this recovery:

In Asia, Indian stocks continue to look weak,

especially on a relative basis:

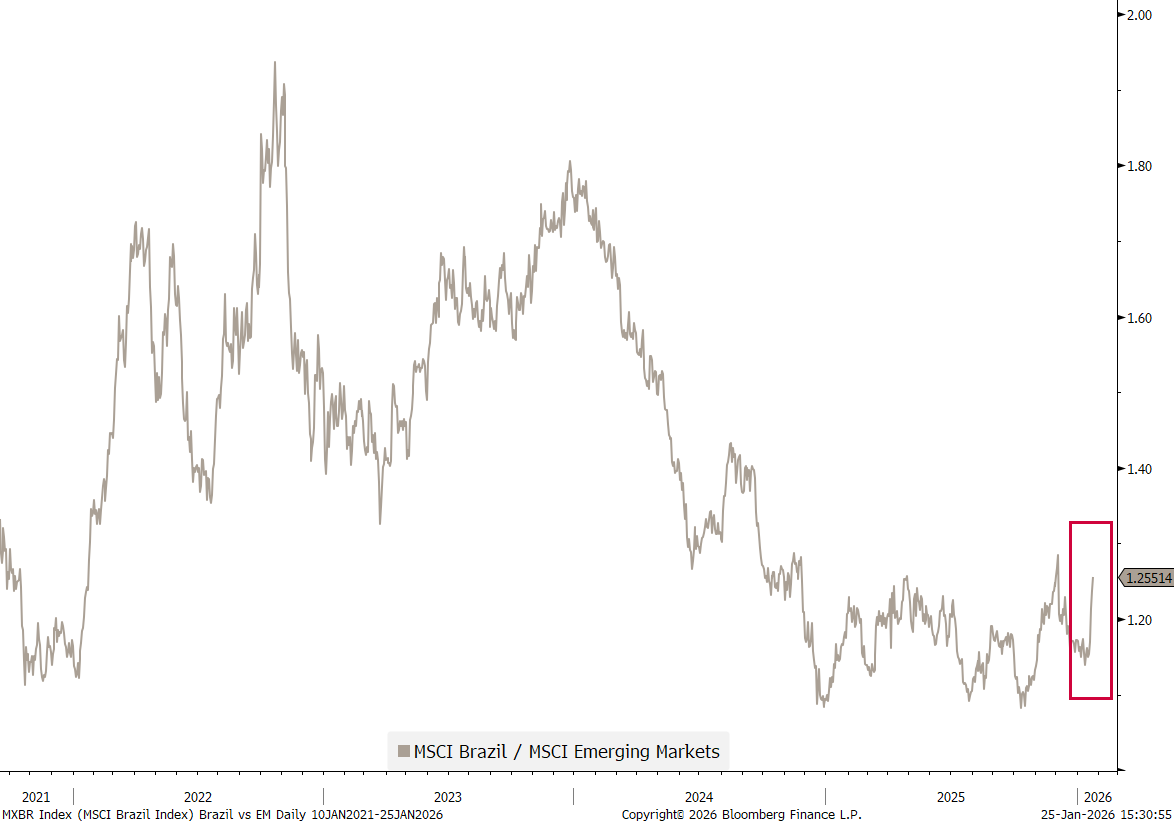

However, maybe it is time to overweight Brazil in an emerging market context:

Especially, if this relationship is going to hold up:

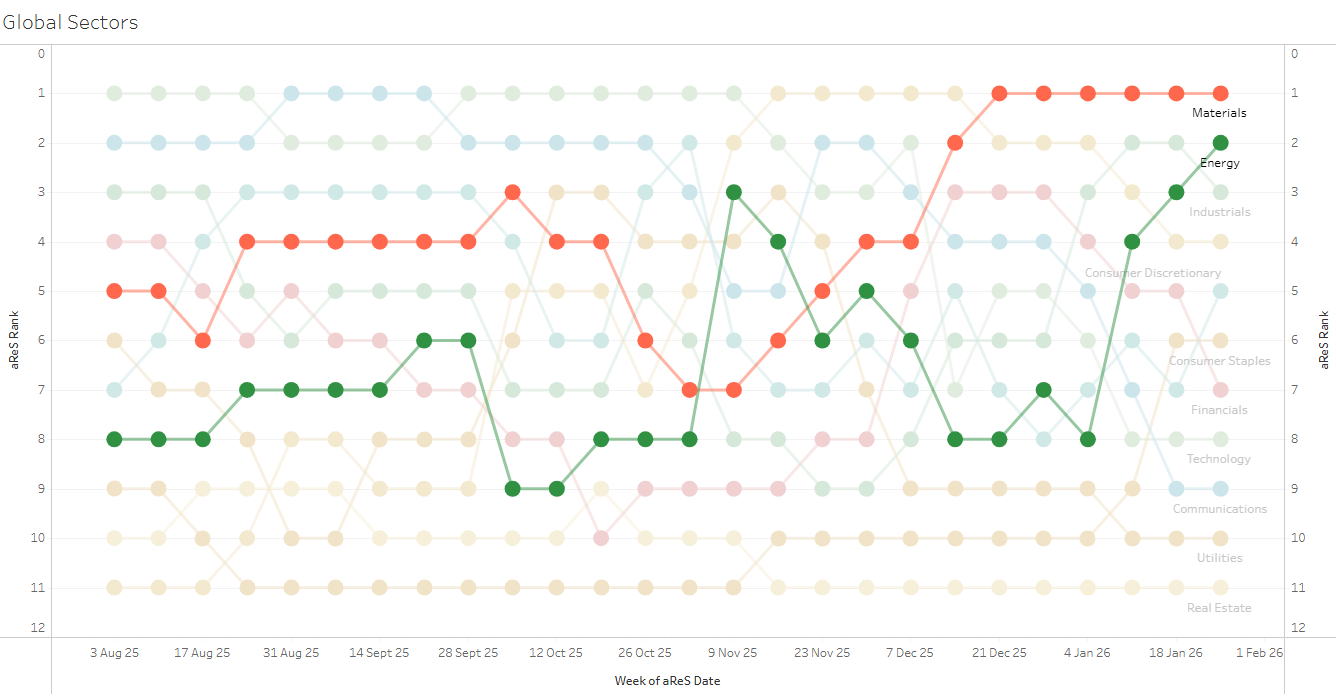

Talking slowly but surely of commodity markets, the two top sectors leave little doubt what or who is ruling markets right now:

Energy stocks have shown the best relative momentum behaviour over the past four weeks,

One of the sector’s posterchilds, ExxonMobil (XOM), has broken above multiple resistance levels and out of a multi-year consolidation pattern:

But, the truth is, that other, higher-octane oil titles, such as Transocean (RIG) which is part of our focus list (available to clients only) are high-performers since a while already:

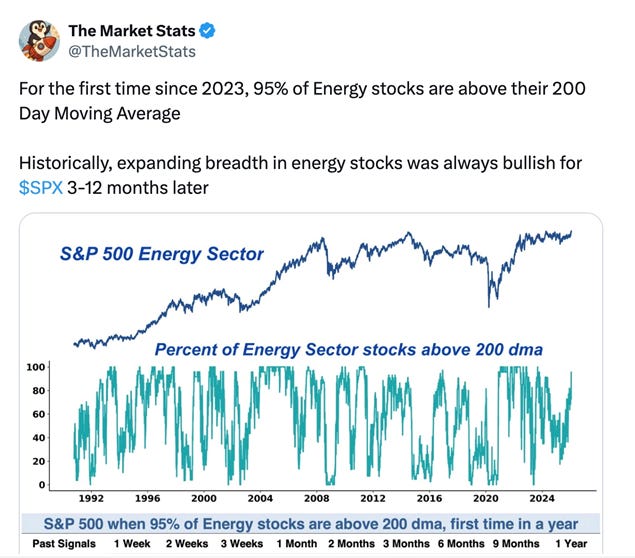

In any case, as the following tweet X-post (what a loss of brand recognition) shows, breadth is fully in favour of a trend extension for energy-related equities:

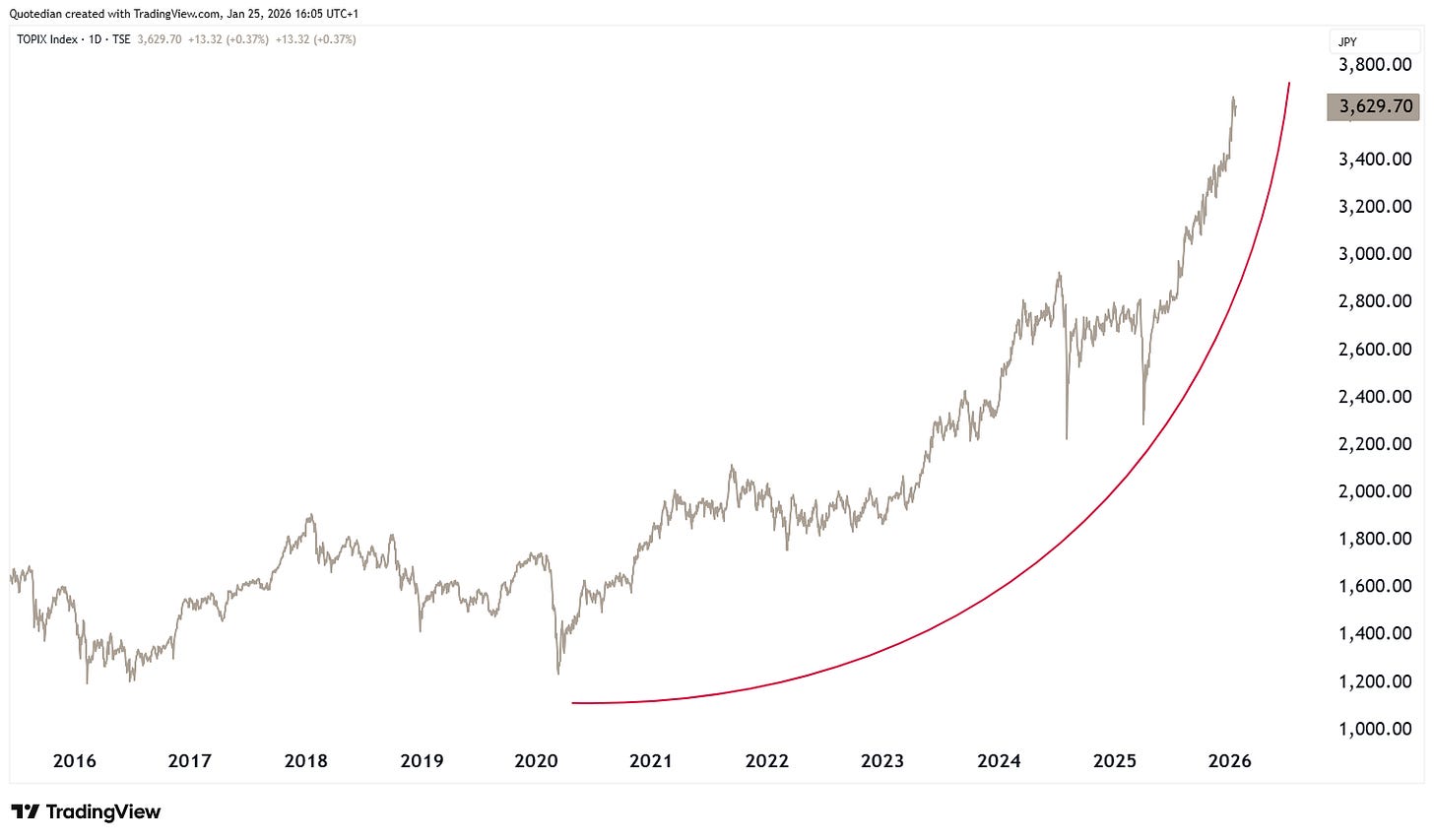

Let me finish the equity section with a chart on Japanese equities, which will serve as perfect segue into the fixed income section:

The TOPIX, like gold and silver, is starting to go parabolic. Now, remember this Quotedian’s quote of the week:

“A bubble is a bull market in which you don’t have a position.”

— Eddy Elfenbein

Hence, continuing with the Japan-narrative, until last Friday, JGB yields continued on their rip higher:

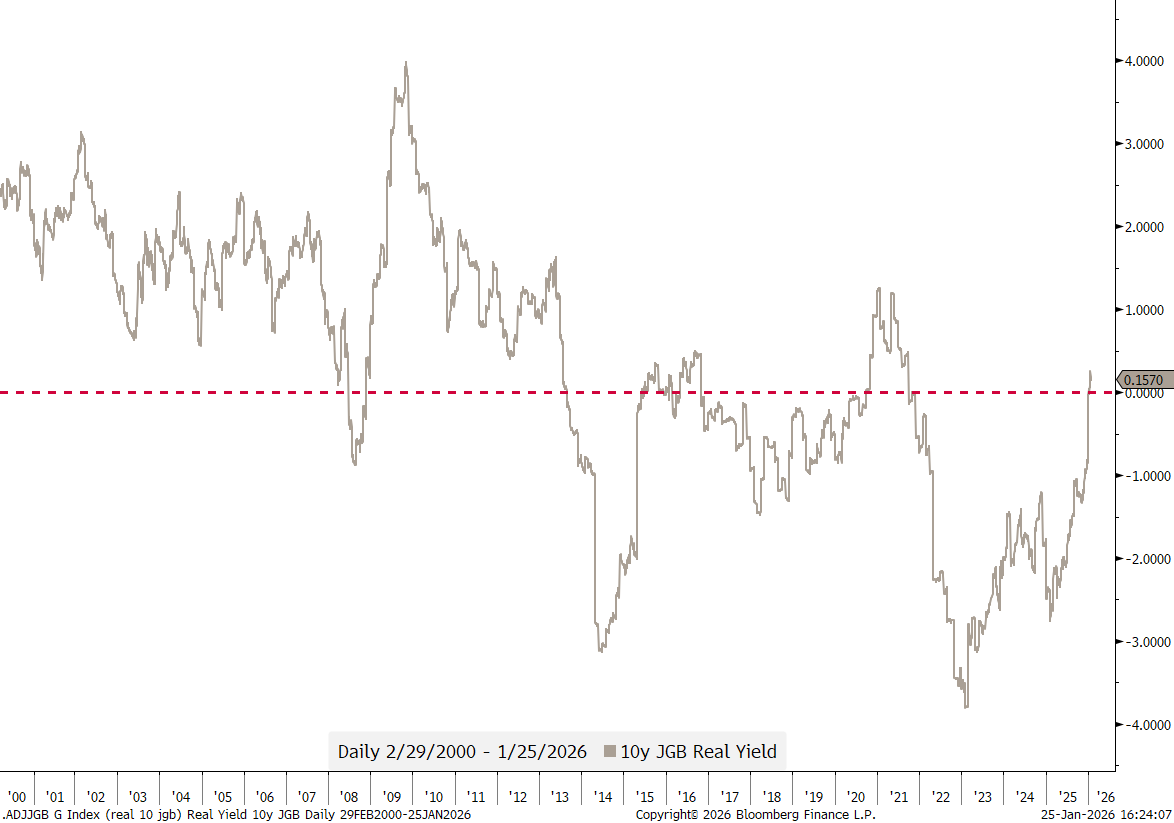

Now, whilst this makes for good headline, and we even dedicated last week’s Quotedian (click her) to the subject, the truth is that real-yields, whilst higher than a few years ago, are barely in positive territory:

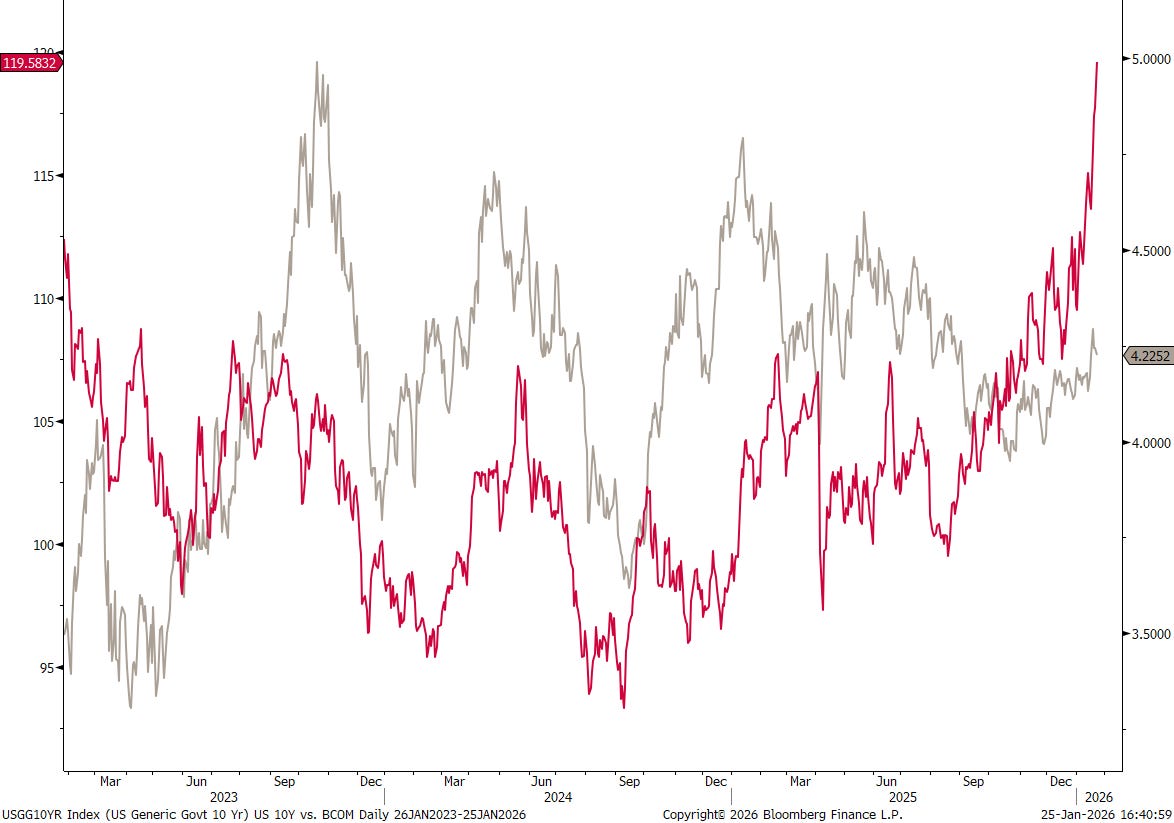

In the US, the 10-year yield, after a recent well-document breakout has been in consolidation mode:

According to commodities, yields should be higher:

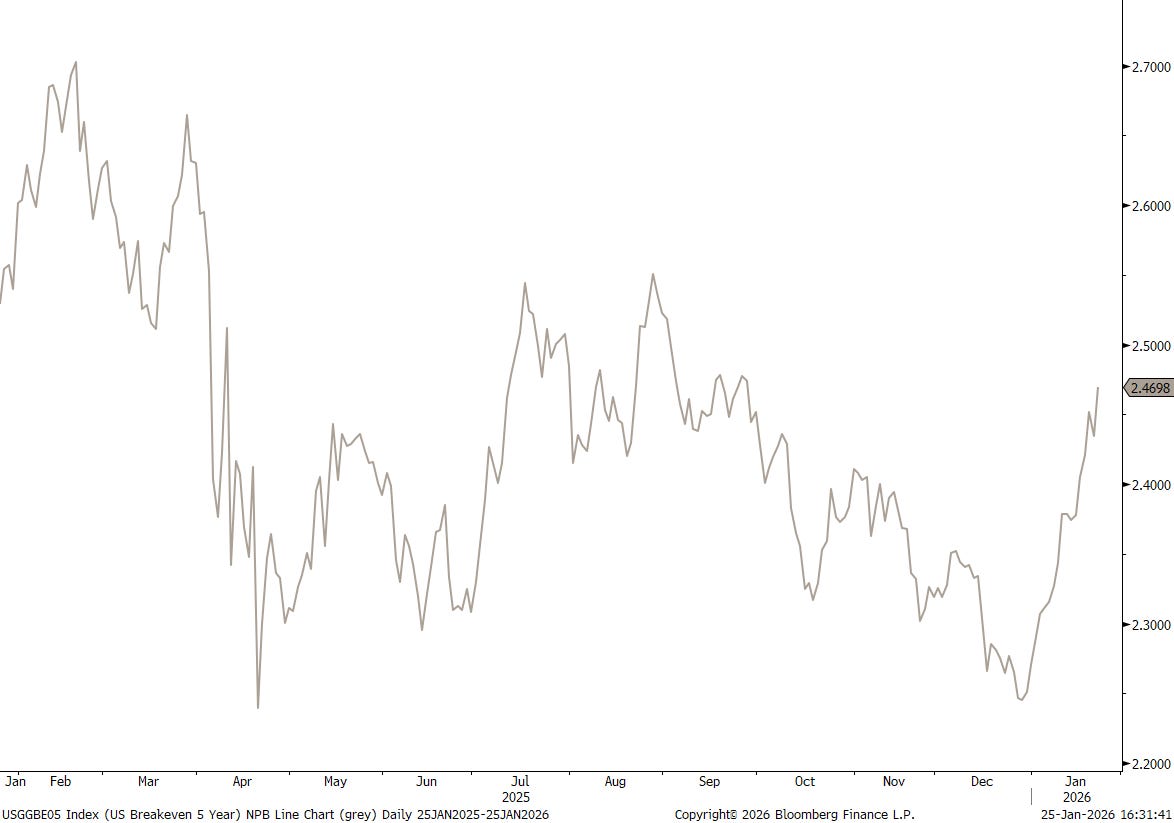

And inflation expectations (via Break-evens yields) have been accordingly shooting higher:

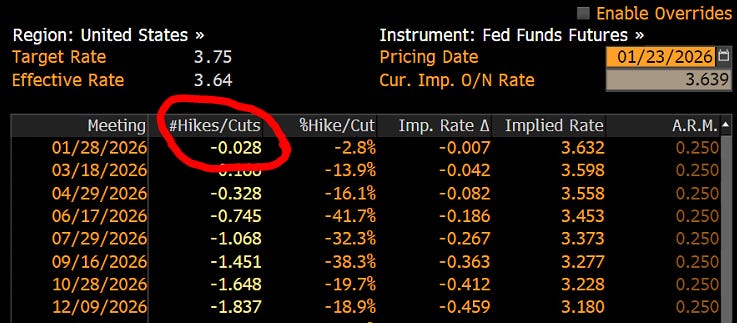

Given all this, it is unlikely the Fed will cut their key policy rate next Wednesday:

In any case, the Fed has become, more than ever, a price taker, not a price maker.

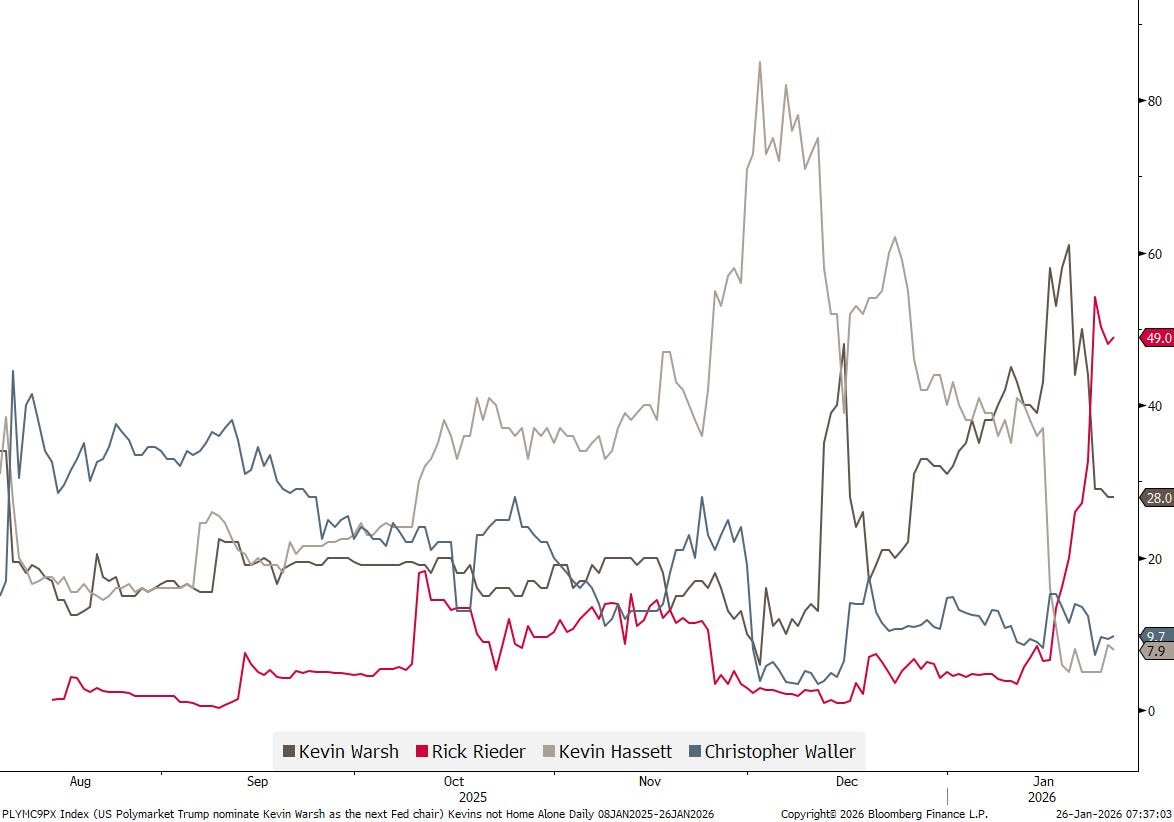

And talking of the Fed, suddenly the Kevins (Warsh & Hasset), long-time only contenders to become the next Chairman of the US central bank, are not Home Alone anymore. Chris Waller (blue line) and especially BlackRock’s head of Fixed Income Rick Rieder (red line) have entered the house race too:

In currency markets, as mentioned at the outset, the US Dollar is at danger of becoming the victim of bad irresponsible deliberate monetary and fiscal policy. The next leg down for the Greenback may have started last week:

The blood letting over the past few session has been vicious…

And now it is not only the Euro pushing higher versus the USD,

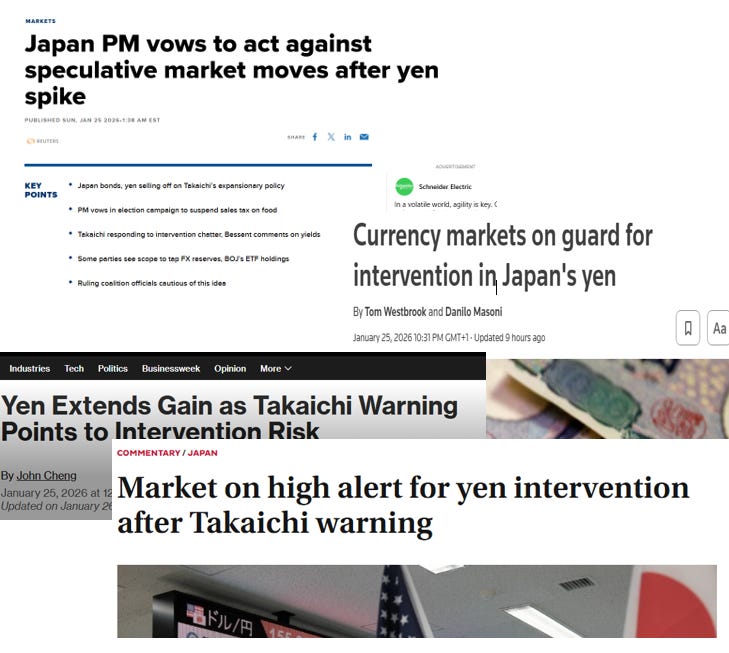

but rather the JPY as now joined in too,

as rumours about BoJ currency intervention, perhaps in coordination with the US Federal Reserve Bank, are increasing:

After all, it’s the talk of the town:

Safe haven currencies, such as the Swiss Franc,

or the Singapore Dollar,

having been on a tear, with the latter reaching a new all-time high (all-time low from a USD perspective). And mind you, even though the all-time low for the USD/CHF cross was 0.7066 in August of 2011, the lowest weekly close was at 0.7674, with today’s rate (0.7775) only a big figure away from that mark…

To finish on the currency side, here’s the chart of Bitcoin as representative of the crypto-realm:

Here, the currency has gone a bit risk-off over the past hours, but as long as 84k holds, we should be ok.

And now to commodities, which includes a wide area of underlyings, ranging from pork bellies and frozen orange juice (hat tip to Trading Places) to all kind of sweet and sour crude oils to, of course, precious metals.

As a whole, the commodity-complex is moving higher and an increasing momentum (i.e. speed). Here’s the Bloomberg Commodity Index (BCOM):

The latest trend acceleration is probably not least due to the oil chart suddenly looking much more constructive again:

Could that oil price tailwind possibly come from President Trump confirming that a US armada is on its way to the Persion Gulf?

Likely.

Is this the reason that Gold is above $5,000 this Monday morning. Amongst others, yes, also likely. Gold has now taken out the 3K, 4K, and 5K levels all in the SAME year!

Investing into one of the best performing equity indices, the S&P 500, is suddenly not so much fun anymore when measured in REAL money (i.e. Gold):

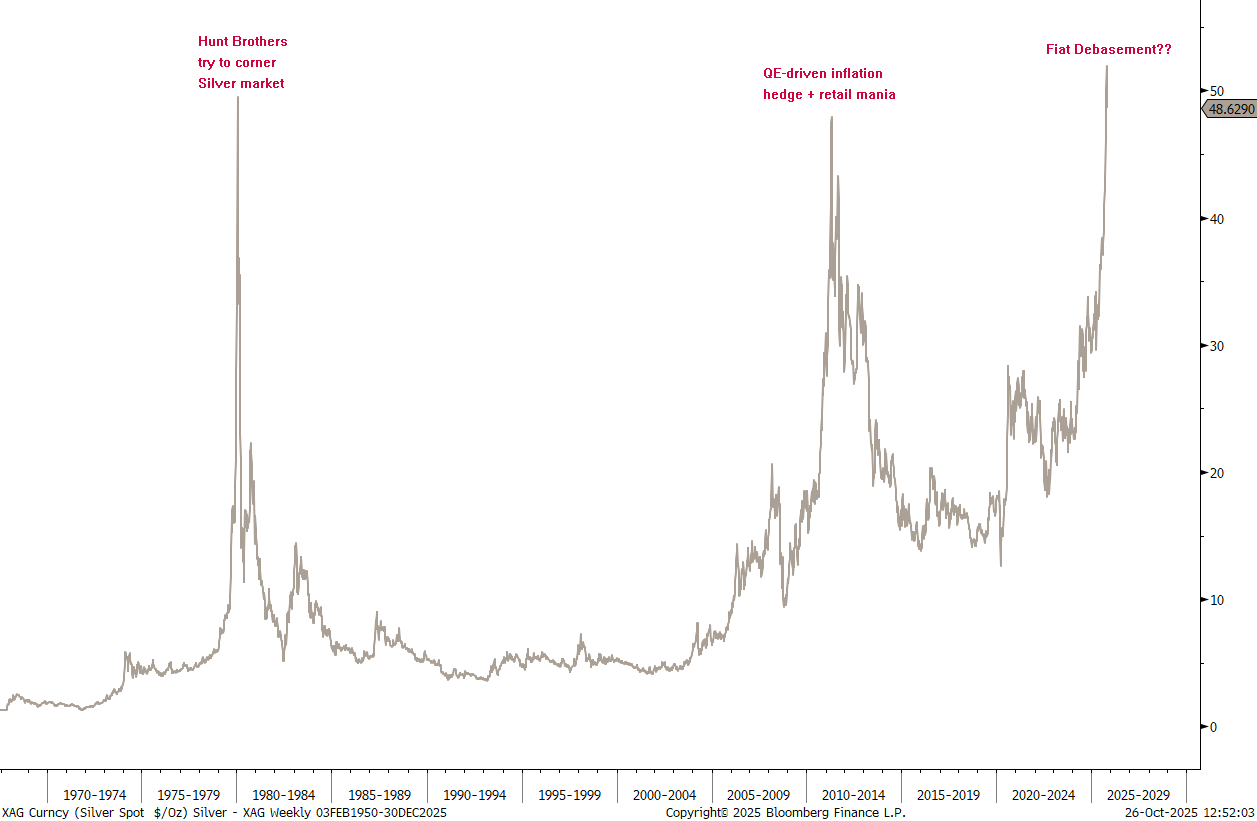

And talking of Gold relative to other ‘stuff’, I showed the following two Gold-to-Silver chart in the October 27th, 2025 Quotedian titled “A Silver Lining” (click here):

The forecast was that Silver will end in a blow-off top, as it always does. Silver was just around the USD50/oz mark then:

Here’s the updated version of the first chart:

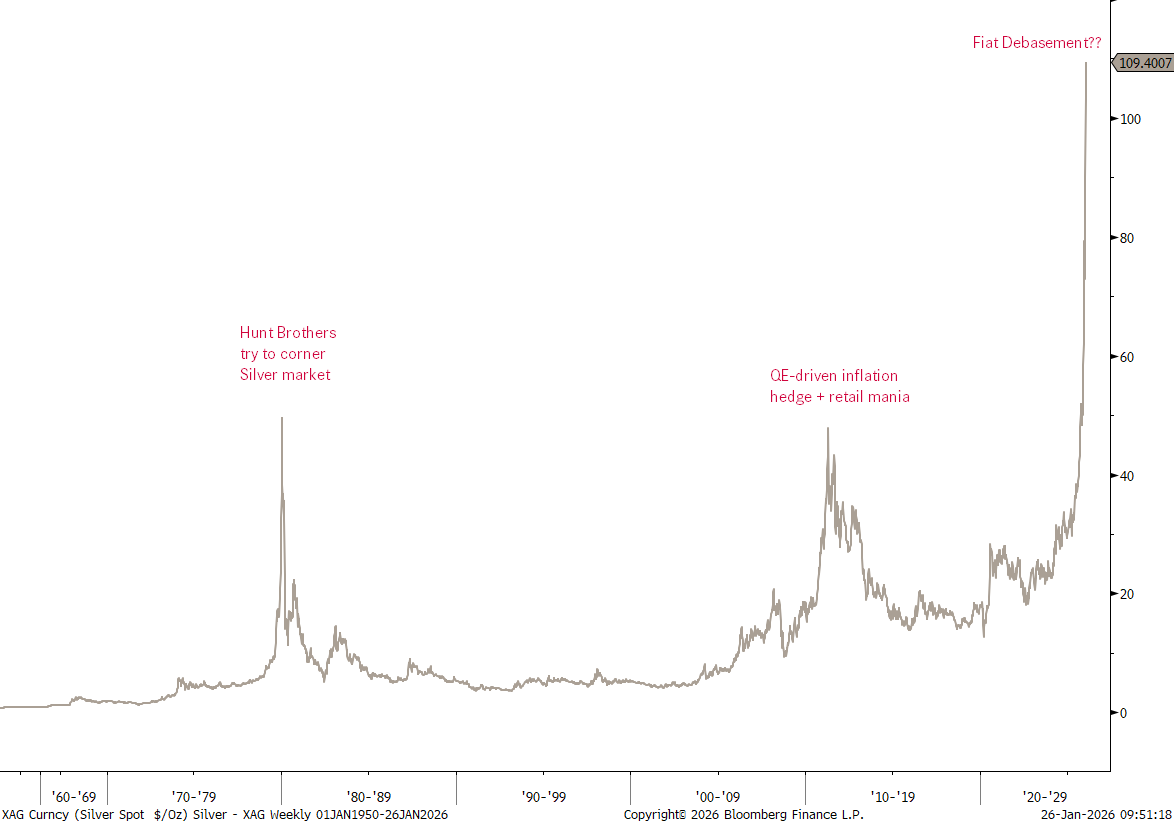

And here’s the updated second one:

WOW!

It took Silver 46 years to get back above 50, and then three months to double again from there …

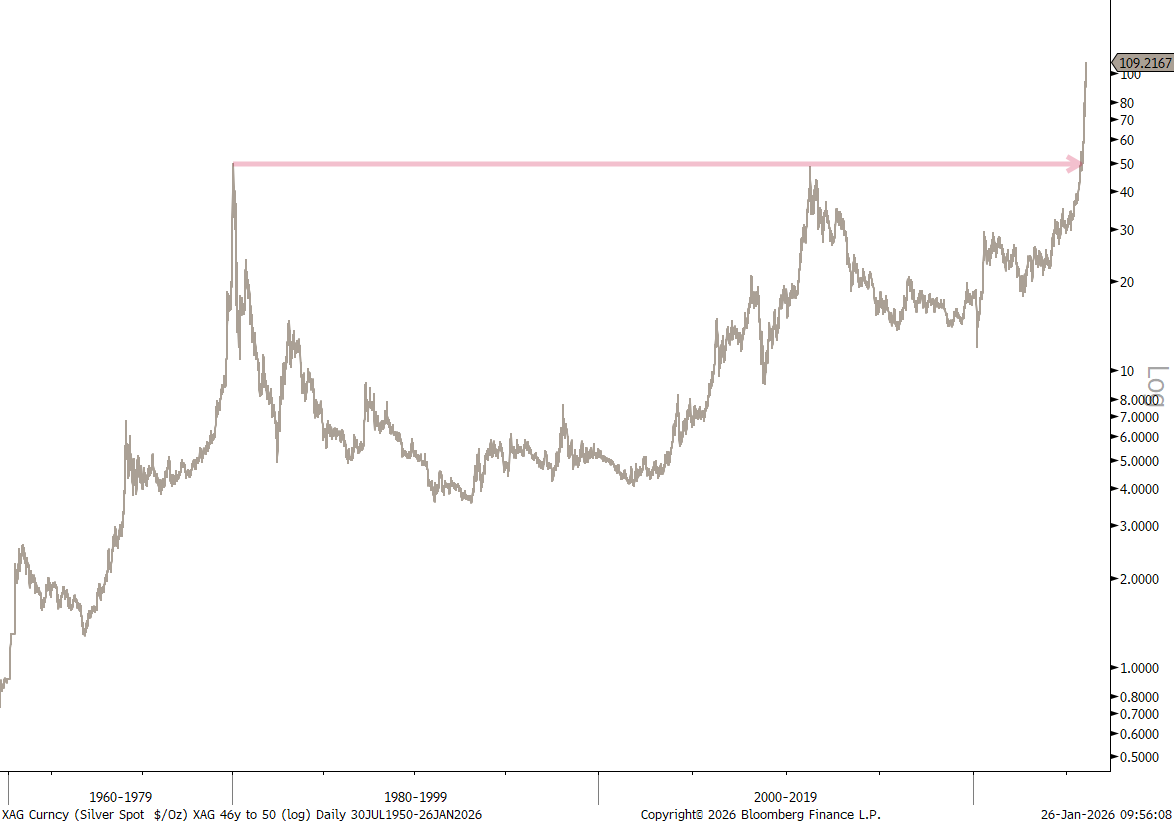

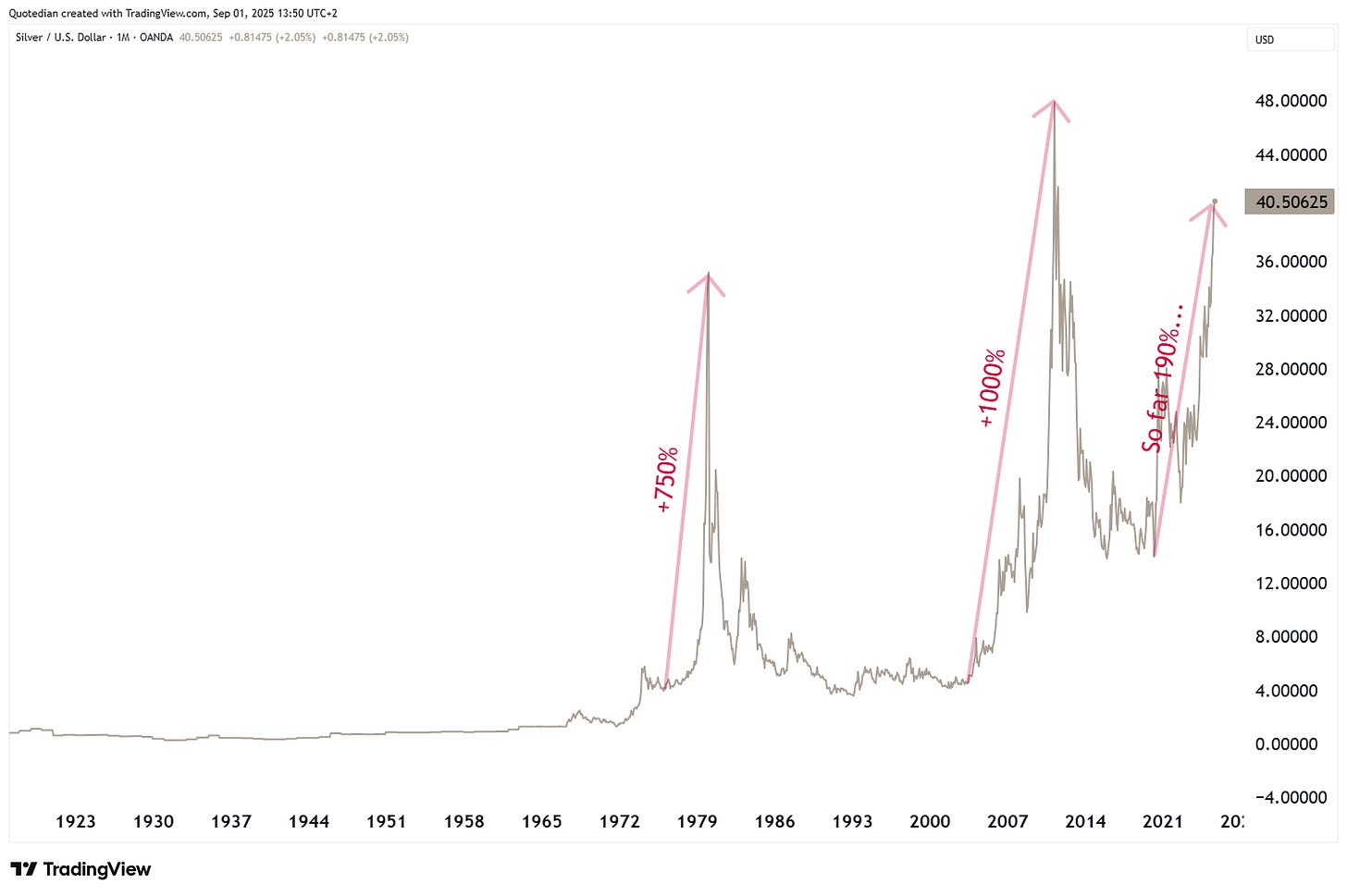

So, how much upside is still left in Silver? Here’s another chart I have shown and updated on several occasion, as for example in the September 1st, 2025 Quotedian dubbed “Shake It Off” (click here), with Silver at barely at $40 then.

Here’s an updated version:

Having been invested in Silver all the way along, I start calling it a day here. A move above $120 is likely, but what is not likely at all is that Silver will then stall and STAY at that higher level.

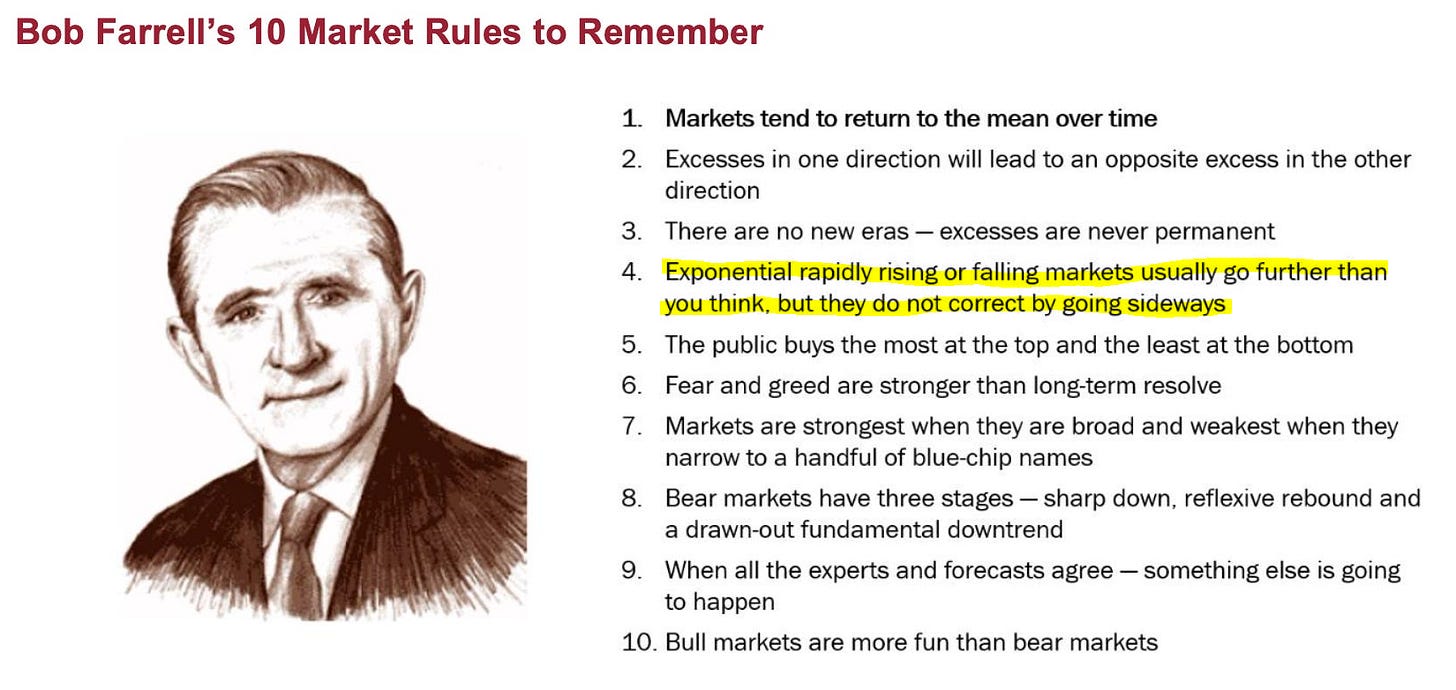

Or, as rule #4 of famed Technical Analyst Bob Farrell outlines:

That’s all for this week’s Quotedian, but make sure to remain updated throughout the week by subscribing to The QuiCQ (click here). My spidey senses are saying it could be another ‘exciting’ week for financial markets.

Best,

André

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by NPB Neue Privat Bank AG