Higher for Longer

The Quotedian - Vol VI, Issue 71 | Powered by NPB Neue Privat Bank AG

“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

— Henry Ford

So, apparently, this was an aggressive do-nothing by the FOMC last night. Indeed, as expected, this fine committee of select members of Federal Reserve Banks around the US did not hike key interest rates but rather signaled via the dart board dot plot, that one more hike can be expected for 2023:

Why the irony with the dart board comparison? Consider for example the 2025 forecast, ranging from 5.75% to 2.50%. We all know that forecasting is difficult, especially if it is about the future, so why bother? Or, also consider the track record of Dot Plot forecasting. Here’s the same Dot Plot from the December 2021 FOMC meeting, i.e. three months before the current hiking cycle started:

In any case, the message continued to be higher for longer during yesterday’s press conference and this is well-expressed in bond yield behaviour (see fixed income section).

Need somebody to help you cut through the bla bla?

Contact us at ahuwiler@npb-bank.ch

Enough CB bashing, let’s review what markets thought of the Fed action yesterday…

But first, let’s start the equity section with a quick follow-up on what we discussed in Tuesday’s Quotedian (An ARM and a leg). We defined that participating in IPOs provides ‘irregular’ excess returns at best. As a point in case, we got the Instacart IPO in the US on the very same day and after an initial 40% jump the stock’s hype faded and it ended up 13% ‘only’. And by yesterday’s closing, the stocks traded back at $30.10, a full 10 cents above IPO price…

But what is probably worse, and as the chart from NYU’s “Dean of Valuation” Aswath Damodaran outlines, only very few of the very earliest investors in fact made money over the IPO price:

Now, let’s say it all together: CAVEAT EMPTOR!

Ok, finally, to yesterday’s markets:

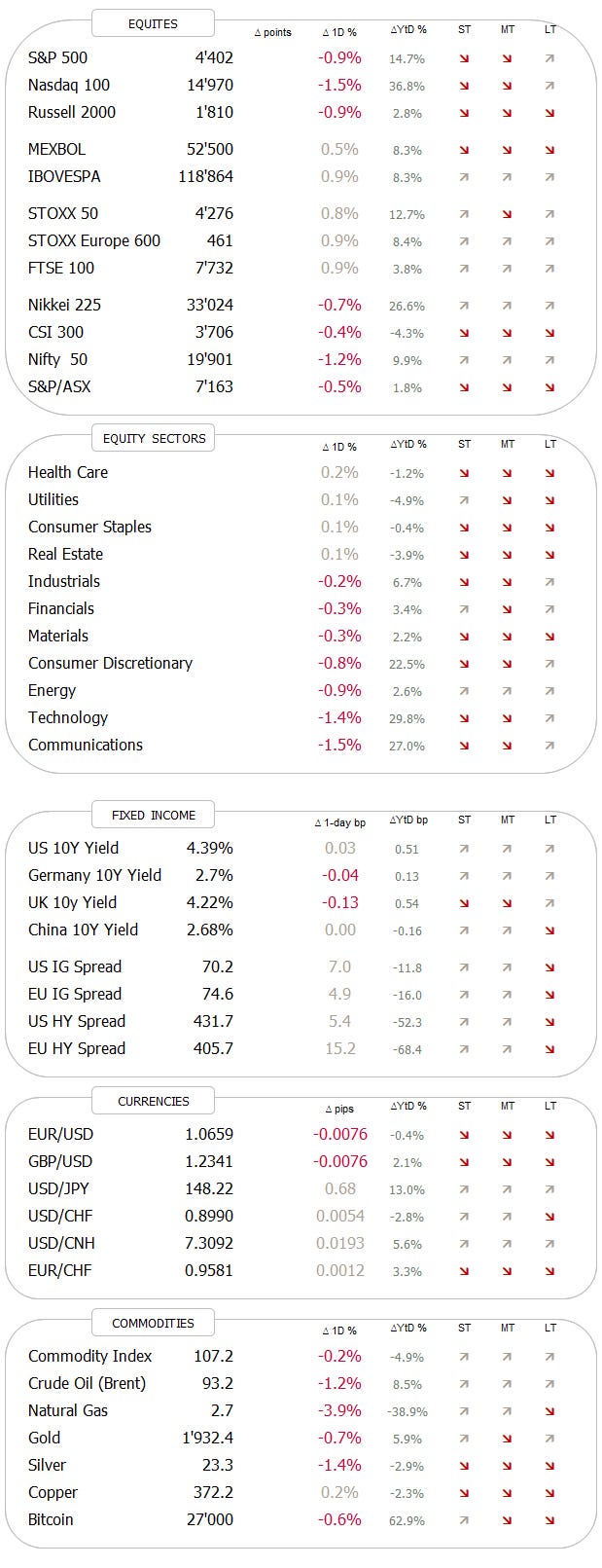

Whilst equity investors initially were quite ok with the no-hike decision, they really started hating to hear the “higher for longer” chanting from Fed Boss Powell during his press conference:

Stocks as measured by S&P 500 futures dropped more than one percent during the press conference and then continue to slide even after market close.

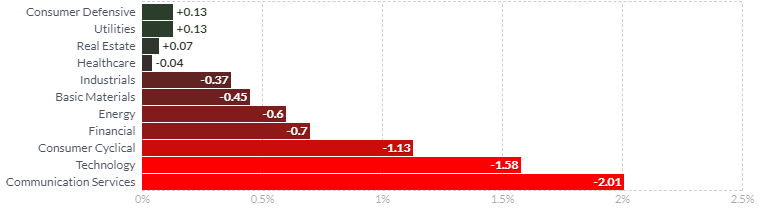

Still, four out of eleven sectors managed to eke out a gain, even though only marginally so:

The distribution of sector performance then also serves as a spoiler to what happenend on the bond yield side, with the most defensive sectors holding on to gains and the long-duration sectors, such as communication services, technology and consumer discretionaries the big losers.

Whilst the daily advancer to daily decliner ratio was an OKish 1:2, the market heat map is still decisively red, with the big swingers (aka The Magnificent Seven) noticably weaker:

Surprisingly enough, the S&P 500 is still trading within our upper and lower lines in the sand, though with yesterday’s down candle, the chart has moved to look top heavy again:

Whilst the S&P 500 was down just shy of one percent on the day yesterday, the Nasdaq, due to its longer duration nature, obviously got some more stick and closed down 1.5%:

The main support zone continues to be just below 14,800, however, substantial damage was down by falling out of the triangle as shown above.

European stocks, which were happily trading higher yesterday, should see their fortunes turn 180 degrees this early Thursday morning as indicated by futures trading.

As a side note, it will be interesting to see how UK’s FTSE 100 will trade over the coming days as a) a rate hike may be not a done deal today after yesterday’s surprise low CPI reading (6.7% vs 7.0% expected) and b) a reaction to the roll-back on some green policies by the country’s government last night.

Asian equity traders are falling over themselves to reduce risk this morning but look for yourself:

We have already spoilerized in the equity section above, but given Powell’s “higher for longer” attitude yesterday, it should come at now surprise that bond yields are traded firmer.

The intraday chart of the US 2-year treasury yield reveals a 15 basis point rise in one-day post FOMC - believe me, that is a huge move:

Not is it only a huge intraday move, but as the following chart shows, the 2-year yield therefore yesterday also hit a seventeen year high!

The bond bulls, i.e. those hoping for lower yields and higher bond prices will argue that, hence, we are now at exactly the same level where yields turned lower in 2006. To me, this sounds much like a second marriage, where hope triumphs over experience…

Unsurprisingly, the longer end of the course rose slightly less, leading to a flattening of the yield curve.

In the UK, where the BoE is due to announce their monetary policy today, the likelihood for a rate hike was sharply revised downward from 80% chance of a hike

to less than 50%

on the back of the aforementioned lower-than-expected inflation reading.

Unsurpringly, given the hawkish “do nothing” by the Fed, the Greenback advanced, with the Dollar Index (DXY) advancing as we had suggested a few Quotedians ago:

As the chart above shows, we are now at a really important resistance line from a technical point of view - above, the sky is the limit (nearly).

This translates as follows on to the EUR/USD chart:

A bit more leeway to the support zone at 1.05, but there this cross has to hold.

Finally, given the hawkishness in the US and the possible approaching end of the hiking cycle in the UK, a short GBP, long USD may be a good play?

Let’s do it below 1.2300!

Let’s skip commodities today, as this letter has grown too long already.

In that context then, time to hit the send button!

Happy Thursday and happy investing!

André

On Tuesday I had the privilege to attend one of the seminars organised by research powerhouse and asset manager Gavekal.

Founding member Charles Gave gave (no pun intended) one of his landmark speeches and trust me, it is simply better for your stomach if I do not further elaborate on his remarks.

Chief economist Will Denyer gave some fascinating insight as usual too, and the following slide from his deck is easily worth COTD status:

Stay tuned …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance