Hike! Hiike! Hiiike! Hiiiiiiiiiike!

The Quotedian - Vol VI, Issue 44 | Powered by NPB Neue Privat Bank AG

"Whenever the Fed hits the brakes, someone goes through the windshield"

— Old Wall Street Adage

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Quite the hiking festival yesterday, as first the Swiss National Bank (SNB) announced a 25 basis point “as expected” hike. Shortly after Norway’s Norge Bank announced a surprise hike of 50bp (versus 25bp) expected. And then at lunchtime, the Bank of England surprised markets with a 0.50% hike versus 0.25% - though admittedly this was only a surprise to non-Quotedian readers!

But, then, we got this headline:

The newly appointed finance minister of Turkey, Mehmet Simsek, who actually has the mission to bring the country’s monetary policy to a more conventional approach (Erdogan insisted on lowering interest rates in order to fight inflation over the past i-dont-know-how-many-years), followed through on this by hiking rates by 6.5% from 8.5% to 15% in one blast.

The worst about his? A hike to 20% was expected by market participants!!!!

The Turkish Lira applauded the decision with an immediate 4% drop (extending it to above 6% overnight),

to a new all-time lows

And, yes, of course, I am being a sarcastic and inglorious basterd when typing “applauded”.

And off we go to our usual rotation through the wonderful world of macro markets…

The good old Quotedian, now powered by NPB Neue Privat Bank AG

Need sound currency advise? Contact us at info@npb-bank.ch

Stocks were lower across the Globe yesterday (don’t believe me? check the Dashboard) except for tech stocks, where FOMO continues to rule.

But hey, wait Mr Quotedian, you will say, the S&P 500 was up too and that’s not only tech! To which I would counter: “Please check yesterday’s sector performance, with a special focus on the top three performers - all somewhat tech/long-duration heavy”:

Another evidence that even in the US it was rather a down than an update lays within the advancer-decliner ratio, which showed about two stocks down for every stock up.

Here’s an intraday chart of some of the more popular US indices:

Nevertheless, a VIX at a three-year low and below 13 does not suggest that market participants are expecting a deeper market correction - something I can agree with:

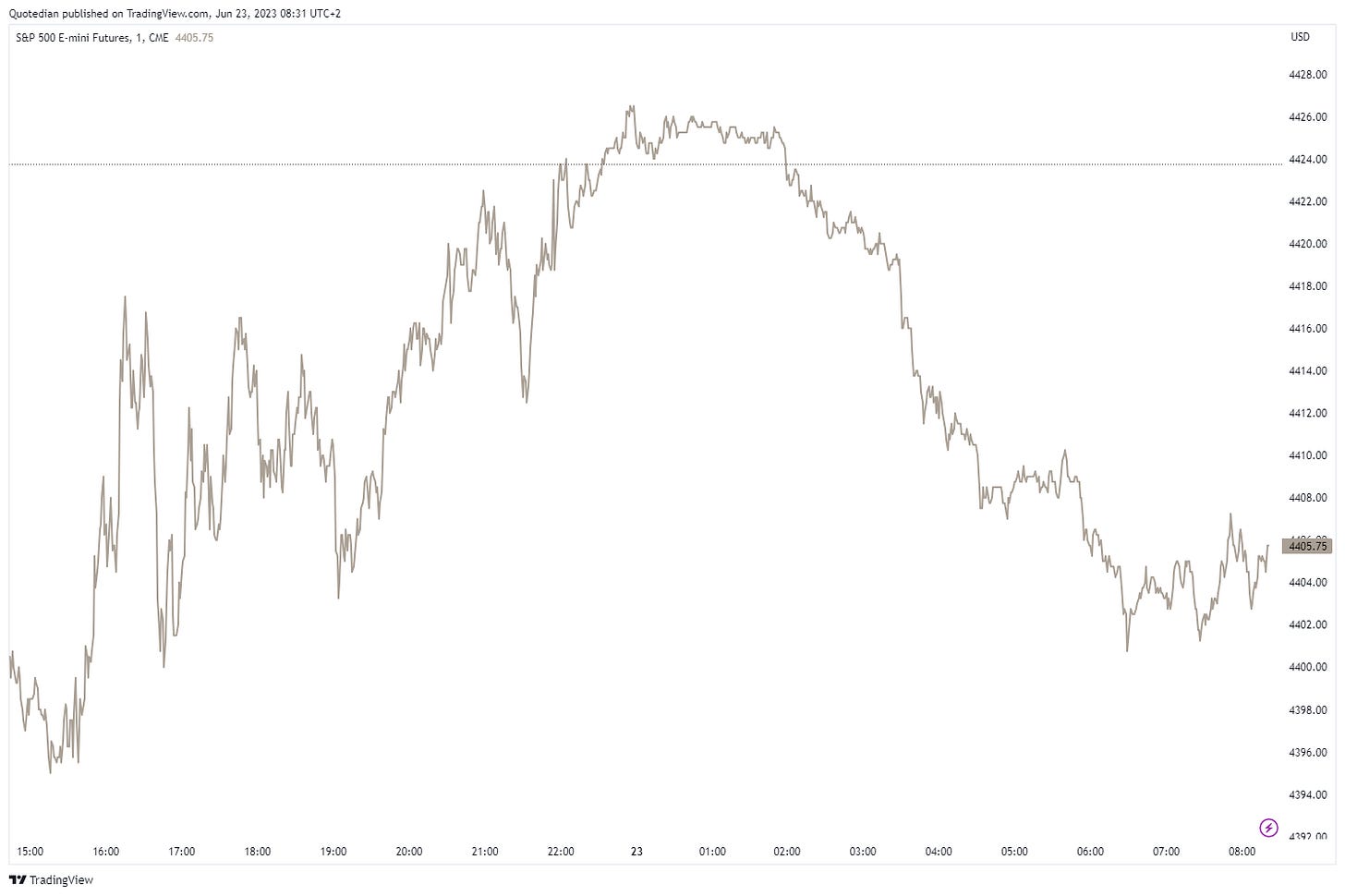

Asian markets, where Chinese mainland markets remain closed today, are a sea of red this morning, with no apparent catalyst, other than maybe US equity futures which started turning south shortly after (European) midnight:

European equity indices also suggest a weak opening of cash markets at 09:00 CET.

The resilience of tech (long-duration) stocks in yesterday’s session was all the more surprising, as yields around the globe shifted higher on the hiking activity described at the outset of today’s letter and generally further hawkish central bank talk. The entire US yield curve shifted about 7 basis points higher yesterday:

In Europe (using German rates as proxy) the yield curve inverted even further, close to be catching up with the US 100bp inversion:

Staying in Europe for a moment, Greece is holding elections this weekend, after a stalemate last month. It is interesting to observe that Italian (BBB) bonds now trade at a premium to Greek (BB+9) bonds:

Credit spreads meanwhile traded a bit wider yesterday, supporting the negative equity sentiment, but continue to fail to give a clear picture on the longer-term chart:

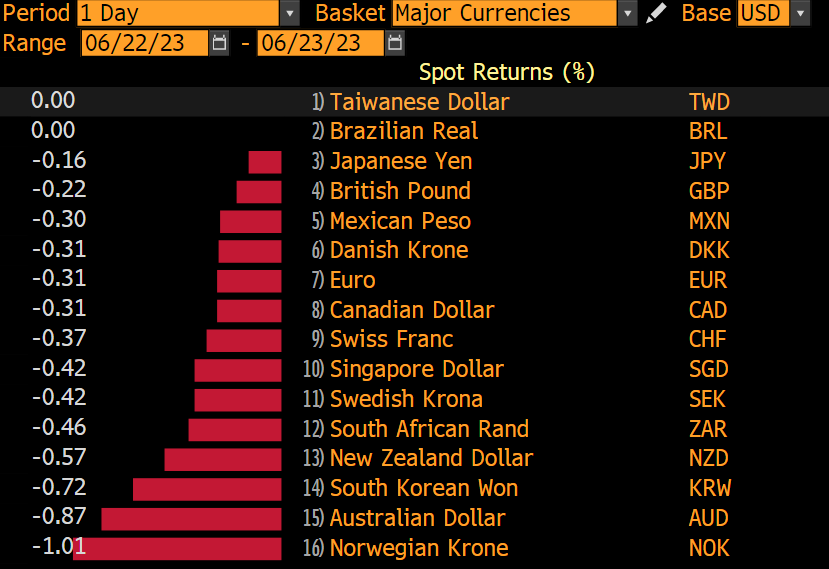

In currency markets, we already touched upon the biggest mover - the Turkish Lira.

The greenback itself had not only a good day versus the TRY, but versus all major currencies too:

Very early days, but could it be that the EUR/USD is trying to put a shoulder-head-shoulder reversal pattern in place?

It seems that investors are not only giving up on the structural inflation trade, but also on the commodity super-cycle narrative.

At least looking at oil (-4% yesterday),

and Gold (-1% yesterday)

one could come to such conclusion.

We’ll have a closer look at this topic in the Quotedian.

And, apropos next Quotedian, under our new agreed regime of daily Quotedians, the next issue will be Monday night/Tuesday morning.

Unless I get very itchy over the weekend, in which case you would have to bear with a special edition.

In either case - ENJOY YOUR WEEKEND

CHART OF THE DAY

Here’s one for the bulls:

Stay tuned…

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance