Hotel California

The Quotedian - Vol V, Issue 138

“You can check out any time you like, but you can never leave"

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Let’s start with a “life hack”. The average Quotedian takes anywhere between 5 and 6 minutes to read. The playtime of Eagle’s “Hotel California” is just above six minutes - so go and click on the link in the QOTD and enjoy one of everybody’s favourite rock ballads as you digest today’s Q!

On we go …

So what should we call yesterday’s session?

Looking at the following chart, I would probably go with #4:

Not only did S&P futures close below the previous cycle low (June 16th) on Tuesday, but they also undercut the absolute trading low on that day, probably triggering a ton of stop loss orders, to then turn on a pin’s head and rally nearly four percent into the closing bell. This is what it looks like on the intraday chart:

Seeing the following heat map will need little further explanation on how excellent the market breadth was:

In other words, if Apple, the largest weight hadn’t had a bad day, gains would have been even more sizeable. All eleven sectors were up on the day, and the ratio of stocks advancing versus stocks declining was a very constructive 10:1, also making for an important 90% up-volume thrust day.

Yesterday’s session has implications for investors and traders alike:

Investors can remain cautiously weighted, as it was avoided that stocks fell into the secular bear market zone (red) on our inverse traffic light chart:

For traders, there is a short-term trading opportunity on the long side, with a relatively tight stop loss below yesterday’s lows (~3% from the current level).

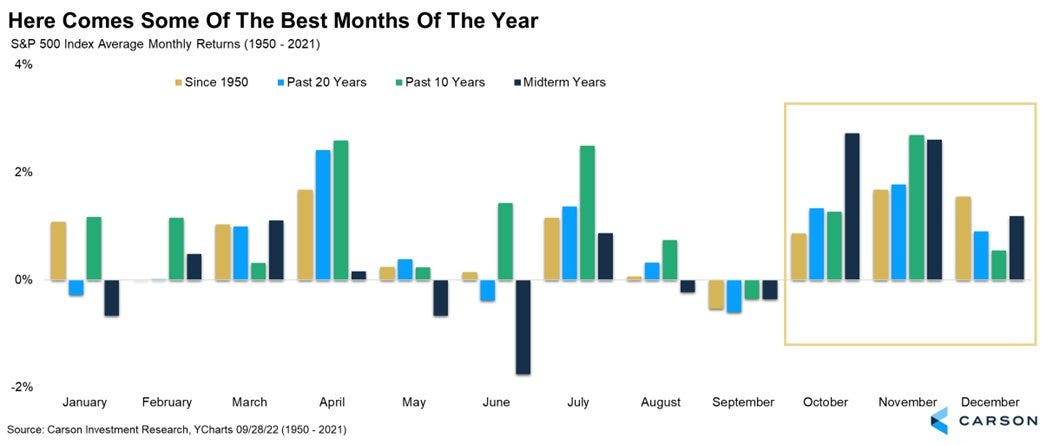

Not trying to fish for the bullish argument, but here’s the seasonal performance pattern for the S&P 500, which argues that October is not a bad month for stocks (ex-1987 maybe…) and actually is especially good in mid-term election years:

Similarly, for European equities (SXXP), the tag has changed from ‘Last Chance’ to ‘New Hope’:

Asian equity markets are nearly uniformly testing the upside this morning, with gains within the half to full percentage point range. Index futures are slightly up for European markets and flattish to down in the US, supposedly digesting yesterday’s hefty rally.

This brings us to fixed income markets and the other reason for today’s title and QOTD (or did you think I really just put up that song for entertainment purposes?!).

So here we go … some 15 years ago, an expedition full of central bankers, spearheaded by no other than the great Ben Bernanke, entered into a whole new phase of CB activity (aka Hotel California) by actively mingling with global markets. They partied hard and ever harder. Only this year they realised that the party (QE) was getting out of hand, especially as the bill (inflation) was getting too high. So, they did start to check out, one by one, neatly in line, waiting for their respective turns. But some of the first ones to check out (e.g. BoE) have now realised they can never really leave … Here’s a statement from the BoE yesterday (highlights mine):

"In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses. To achieve this, the Bank will carry out temporary purchases of long dated UK government bonds from September 28th. The purpose of these purchases will be to restore orderly market conditions. The purchases will be carried out on whatever scale is necessary to effect this outcome. The operation will be fully indemnified by HM Treasury."

WOW! Market intervention, QE and a whatever-it-takes statement all in one little paragraph! By the way, QT was supposed to start next week, but is now postponed into November, and replaced by a sprinkle (GBP65 bn) of QE.

“You can check out any time you like, but you can never leave"

Maybe the Bank of Japan (BoJ) was right all along by not even pretending they could check out … just saying.

So, what did the BoE-Pivot look like on the market place? Here’s the 10-year UK Gilt yield chart:

Woohooo! At least it seems to have had the desired effect - for now. Problem is, all this debt-financed fiscal stimulus and “whatever-it-takes” Treasury department intervention come at a price. Here’s the UK’s Credit Default Swap (CDS) rate:

Other markets saw a similar reversal in their yield trends, albeit to a lower extent. Here’s the 10-year US treasury as proxy and example:

Of course, a reversal here would fit well with the reversal trade on the equity side too. But maybe this is all just wishful thinking hoping for long-only investors …

Another interesting chart is the one of the iShares 20+ Year Treasury Bond ETF, one of the most popular treasury bond ETFs (AuM $27bn), which before yesterday’s bounce had just completed a nine-year-long round-trip:

Moving into currency markets, and taking into consideration the move on UK Gilts, it should come at no big surprise that the GBP/USD (aka Cable) rate also showed signs of reversal:

Admittedly, it does not look like a lot on the daily chart:

But zooming into an intraday chart of the past five sessions or so, we come to realize it was a 5% jump. Ladies and gentlemen, 5% in a G7 currency in two days is A LOT:

Again, as for bonds and equities, the turnaround was throughout the whole FX asset class, with many important (temporary?) reversals observed. Here’s the EUR/USD chart:

For now, the trend channel boundaries are continued to be respected and taking some profits on Euro shorts yesterday seems to have been a decent idea (Famous Last Words…)

Let’s cut short here, as the soundtrack is about to end, but just before we leave, here’s another argument in favour of a short-term market pivot yesterday:

CNBC has brought famed short seller and über-bear Jim Chanos out yesterday - that’s probably an even stronger contrarian buy signal than their “Markets in Turmoil” special reports …

Time to hit the send button - have a save Thursday!

André

CHART OF THE DAY

According to today’s COTD, if there is anything to be had from value investing, we should be shorting India here and go long one of the markets at the other end of the spectrum (probably ex-Turkey):

Any suggestions on which pair trade we should follow over the coming weeks to months? Short India, long Egypt, Hungary, Poland or Brazil? Leave your comment here:

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance

Hi André. How do you see bonds after observing the yield curve control from BoE, BoJ and ECB (indirectly via Anti-Fragmentation Tool)? Wouldn't you consider corporate bonds a better option?

Thank you for your work!