Known Unkown

Volume V, Issue 177

“There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don't know. But there are also unknown unknowns. There are things we don't know we don't know.”

— Donald Rumsfeld

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

After yesterday’s gargantuan letter, I’m working on a bit a tighter time schedule this morning, so let’s keep it short today, with longer-term observations left for Sunday’s letter. Hence, if you are not subscribed yet, make sure to do that right now, in order not to miss any future editions:

As usual, we start with equities, albeit they really deserved the least of our attention yesterday, as it was a quiet and close to boring session, not untypical after a big move as seen on Wednesday.

Of course, European stocks played catch-up to Wall Street’s strong performance the previous night, but US stocks themselves closed what we could call ‘flat’ without upsetting to many people.

The S&P 500 ended the day three points lower, with the ratio of advancing and declining stocks quite precisely split down the middle:

Sector performance was skewed a bit more to the negative side, but again, really nothing to write home about:

Of course, little has changed on the S&P’s daily chart - the construct remains in favour for further advance to our second target at around 4,300:

Another chart worth revisiting is the one of the Philadelphia Semiconductor Index, better known as the SOX index, which continues on its path to the 3,000-3,100 target zone we defined a few weeks ago after an inverted shoulder-head-shoulder buy signal got triggered.

A move above the 200-day moving average (blue line) will confirm we are still ‘on target’, and probably have positive longer-term implications for semiconductor stocks AND the entire market.

Whilst we normally do not discuss a lot of individual equities in this more cross-asset focused letter, a drop in Blackstone’s share price of over 7% is worthwhile some further scrutiny:

Even though the share recovered from intraday lows by session end, the stock price is close to its October lows and is underperforming the S&P by about twenty percent on a year-to-date basis. Here’s the reason:

Blackstone's (BX) $125 billion real estate fund for high net-worth individuals said it would limit redemptions after receiving a surge of requests from investors looking to liquidate into cash. The news sent the private equity firm's stock down as much as 8%.

The company met only 43% of redemption requests from investors in their Real Estate Income Trust (REIT) in November.

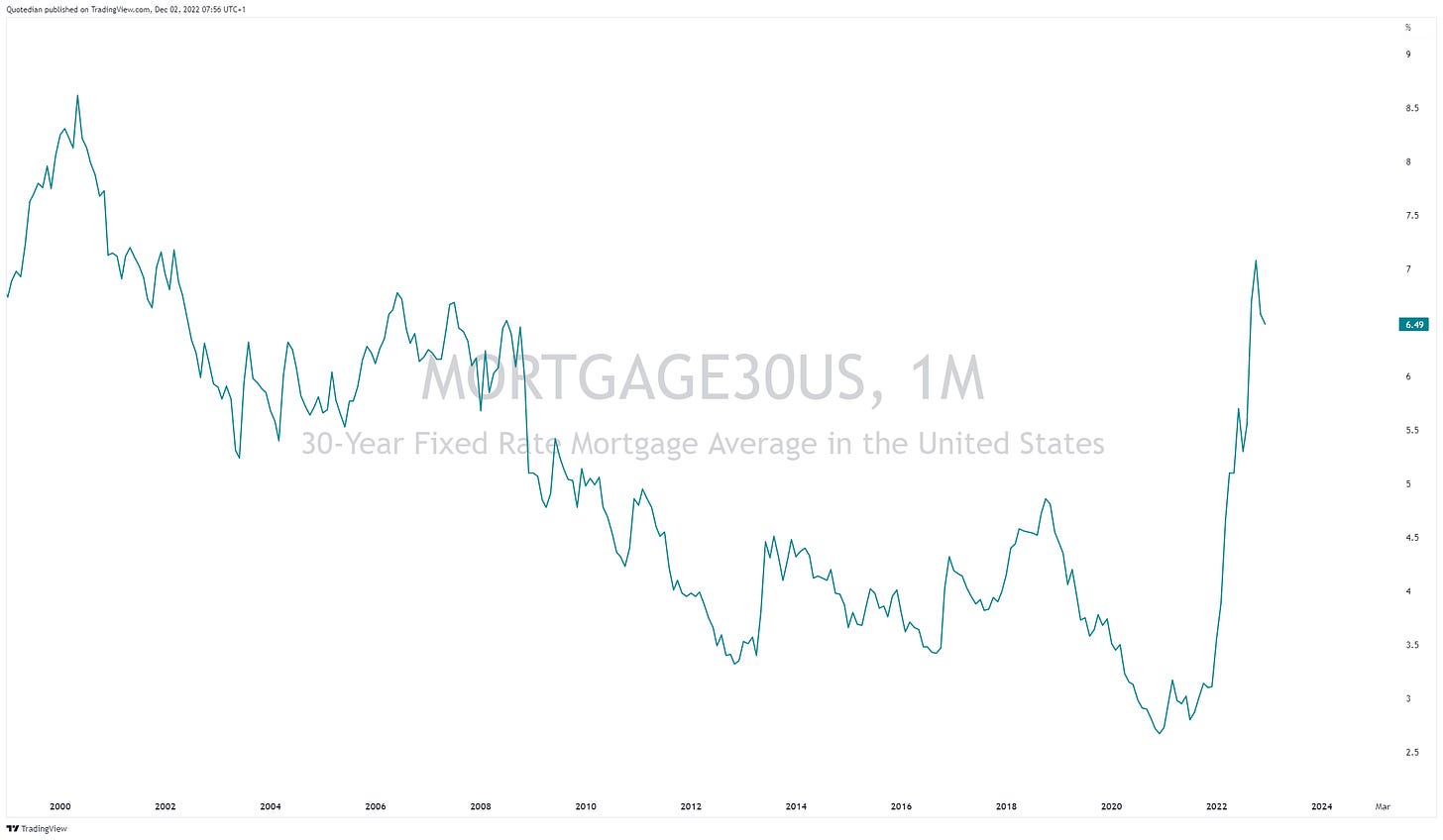

This is of course on the back of investors getting wary of the real estate sector, after borrowing costs have increased substantially this year. As a proxy, here the Freddie Mac 30-year average mortgage rate:

Of course, we do not worry about Blackstone (BX), but rather the entire ‘private debt’ sector, which we always have considered as an attractive alternative to traditional fixed income, but which has grown tremendously in size over the past few years during TINA’s hunt for yield.

It has been my feeling for a while now, that this may be one of the “known, unknown” themes for 2023. Stay tuned (and do your due diligence) …

Finishing off the equity section, we note that most Asian markets are printing red this morning, led by a one-and-half percent drop in Japan, where strength in the Yen is provoking weakness in the stock market.

European and US index future are in slightly negative territory as I type.

Fixed-income markets were substantially more interesting yesterday, where an ISM reading of below 50 (49.0) further confirmed the US economy is likely to slip into recession:

This pushed the US 10-year yield right down into our “must-hold” support zone,

and steepening the curve (10-2) another tad:

Credit spreads continue their compressing process,

naturally pushing up the HYG ETF in the process, where the rally now is becoming meaningful:

One final economic data caught my attention yesterday - the US savings rate as % of disposable income just hit its lowest reading since 2005 (which was the lowest since the statistic is being measured), suggesting that the COVID-savings have now been depleted:

Combine this with the fact that credit card debt has been on the rise (unfortunately I do not have the chart), and it becomes clear that the US consumer is unlikely to bail out the economy over the coming months…

The other big and important macro move (apart from the bid drop in yields) came in the form of a further weakening US Dollar.

The US Dollar Index (DXY) dropped below its 200-day moving average for a first time since June ‘21 - this seems meaningful:

Similarly, the EUR-USD cross has now clearly confirmed its intention to stay above that very same MA:

And the USD/JPY cross is working on it:

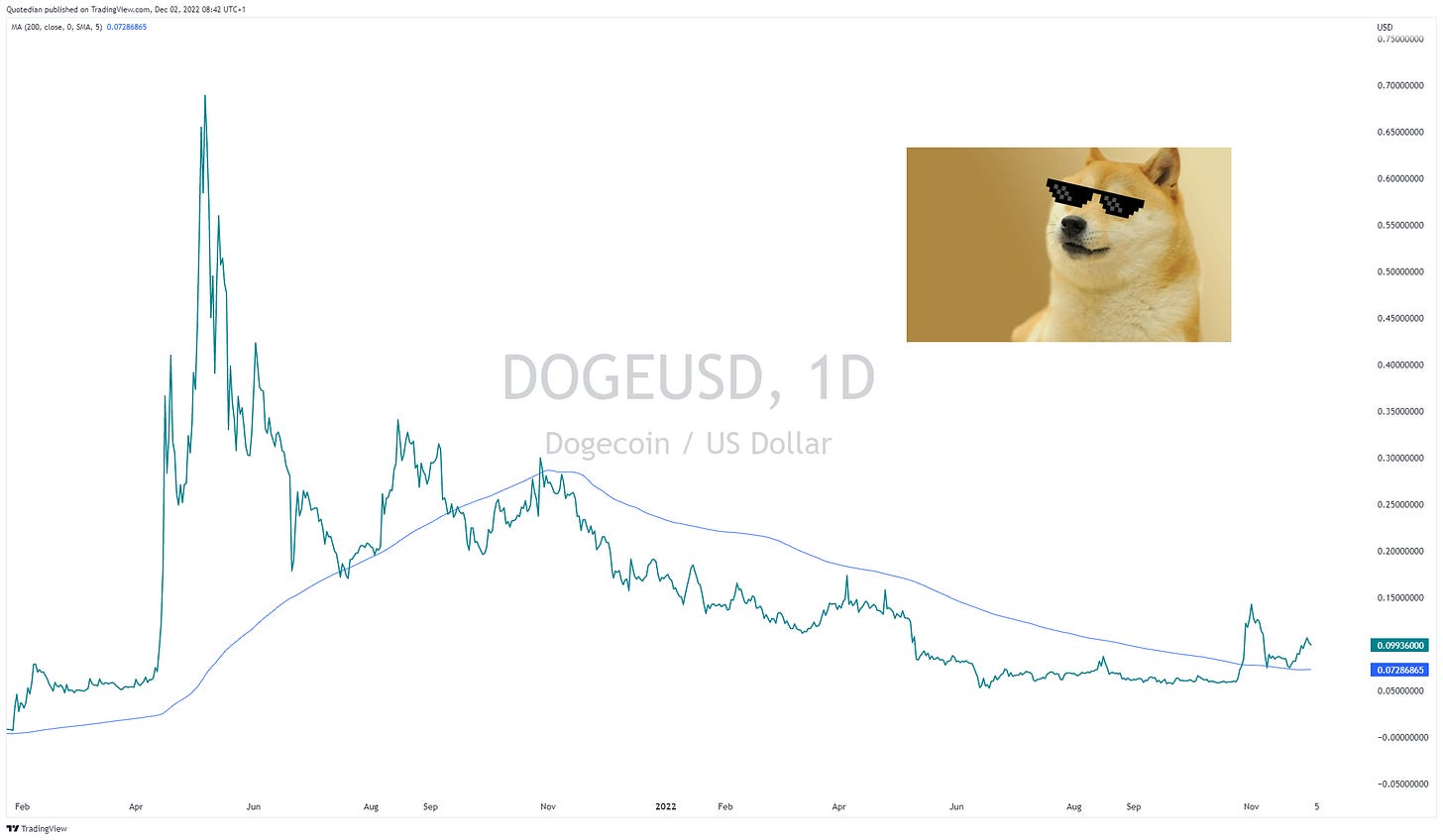

In the crypto space (no, no SBF attack today, even though the guy is giving interviews right now as if he just had single-handily won the World Cup Soccer tournament), remember that cryptocurrency ‘Dogecoin’ that was invited as a joke, a spoof? Well, I just check all major cryptos, and it is one of the very few that trades above its 200-day moving average:

Finishing off with commodities, just a quick look at the Gold chart, which is now very neatly following our script:

$1,800 seems a natural point of resistance now on our way to $1,900.

Time to hit the send button!

Have a great Friday and an even greater Weekend!

André

CHART OF THE DAY

The chart below is pretty ‘impressive’. Put together by our friends at Bloomberg, it shows how Britain will be affected by strikes every day in the run-up to Christmas. Workers in the rail network, buses, postal service, health sector and schools are among those staging walkouts in their quest for higher wages.

Not signs of a happy society and probably not isolated to the UK. Possibly one of the major topics for the rest of the decade?

Stay tuned …

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance