Le Roi Est Mort, Vive Le Roi!

The Quotedian - Vol VI, Issue 86 | Powered by NPB Neue Privat Bank AG

“The reports of my death are greatly exaggerated”

— Mark Twain

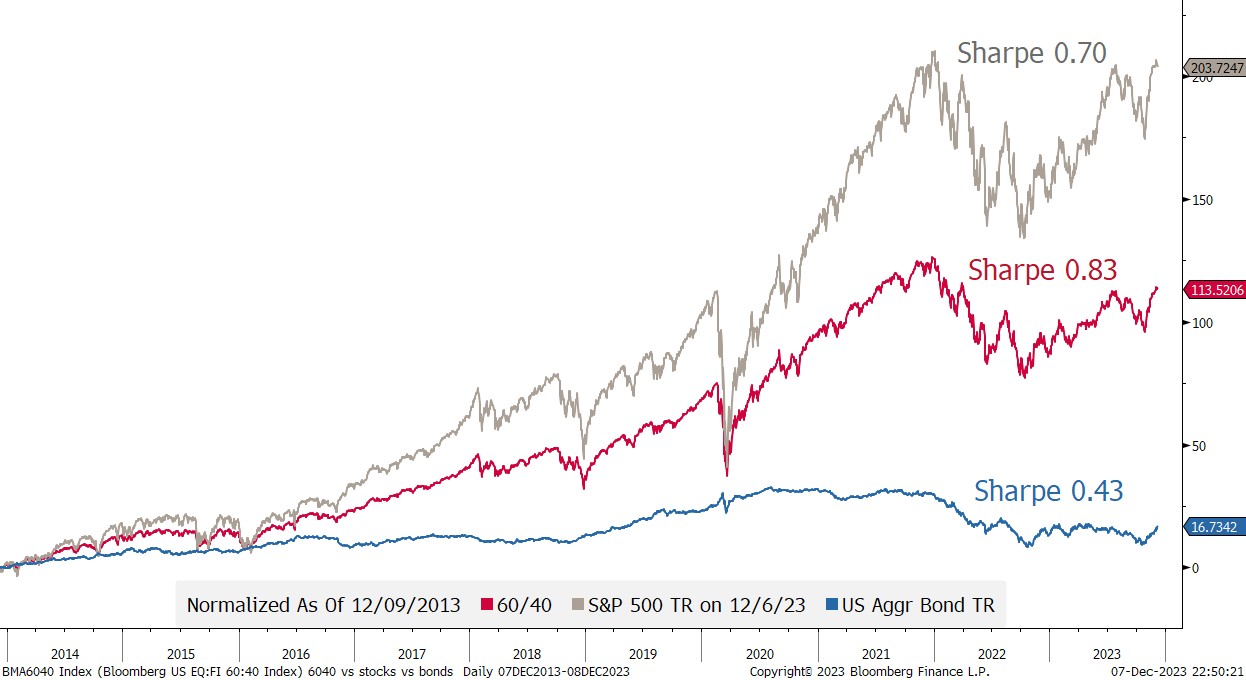

The 60/40 Allocation Strategy (60% allocated to stocks; 40% allocated to bonds) is a well-documented and well-accepted allocation for many investors. Simple to implement, it is supposed to take advantage of equity upside and provide diversification/hedging via rising bond prices as equities. And boy, did the strategy work well over the past 40 years or so.

Unfortunately, I only have data (courtesy Bloomberg) since the GFC, but the track record has been stunning since then:

Admittedly, 2018 provided a negative return, but believe me, with Volmageddon taking place in December of that year, other portfolios looked worse - much worse!

However, then 2022 came along and 60/40 stopped working:

Already here, the death of King 60/40 was widely discussed, and the chatter did not stop, even after a mixed to positive start to the current year for the strategy. The three back-to-back negative months in August, September and October seemed to be the final death knell for the strategy:

But along came November, and 60/40 blew everything else out of the water, especially in risk-adjusted terms:

Again, in risk-adjusted terms (e.g. Sharpe ratio), 60/40 continues to be second to none:

The King is dead, long live the king!

Without further ado, let’s move into our market observations, grouped as usually by asset classes.

Starting with equities, and looking at the almighty S&P 500 benchmark, we see there has been a tug-of-war going on between bulls and bears for eleven sessions now:

The low-risk trade here would be to go short, with a tight stop above the red dashed line.

BUT…

The market (as measured by the S&P 500) has now not seen a move over one percent in either direction and, as the old Wall Street adage goes: “NEVER SHORT A DULL MARKET”.

The Nasdaq already broke above its summer highs, as we had discussed in previous letters:

However, it has struggled to provide a clear lift-off and continues to hover just above the previous resistance now turned support.

US small-cap stocks, as measured by the Russell 2000, have moved into the upper half of their nearly 1 1/2-year range:

But one of the most surprising performances comes from no other than our one European equity market. Dovish comments by normally more hawkish ECB member Isabel Schnabel this week reaccelerated the uptrend:

This acceleration was enough to lift the STOXX 600 Europe index above a what seems to be a key resistance:

And, ladies and gentlemen, the narrower Euro STOXX 50 index closed at a new … drumroll … all-time high on Wednesday:

As did the index of a basket case of a country called Germany:

Even the SMI, one of Europe’s lagging markets this year is recovering:

Especially one of the index’s heavy-weights, Roche, has helped to push the index above the dotted trendline above, after they announced the takeover of obesity drug maker privately-held Carmot Therapeutics and simultaneously reported good trial results for one of their breast cancer treatments:

In Asia, the Japanese stocks so far failed to mimick US and European equity advances, maybe due to a strengthening of the Yen (more on this in the Yield and FX section):

But still, holding up well.

In India, total market cap reached USD 4 Trillion, closing in on Hong Kong’s $4.6 Trillion:

And then, to finish off (literally), there’s China:

As much as the trend was clear for rates over the past two years or so, it is so also now:

I would expect a pause as yield is breaching the uptrend line (dotted) but is also approaching the 200-day moving average (black, continuous line).

Could tomorrow’s NFP (non-farm payroll) number be the trigger for a short-term rise in rates?

In the meantime, an economic zone called Euro, yields seem to brace for a recession at best, maybe even disinflation/deflation.

All this, is quite contrary to what is happening in the land of the rising yields sun:

That last up-candle (7/12) came on the back of comments by Japan’s MoF and BoJ, which insinuate that the end of Yield Curve Control (YCC) may be closer upon us than expected.

This closing narrowing of the interest spread of Japanese yields to other currencies (below the Japan/US example) serves as a perfect segue into the currency section:

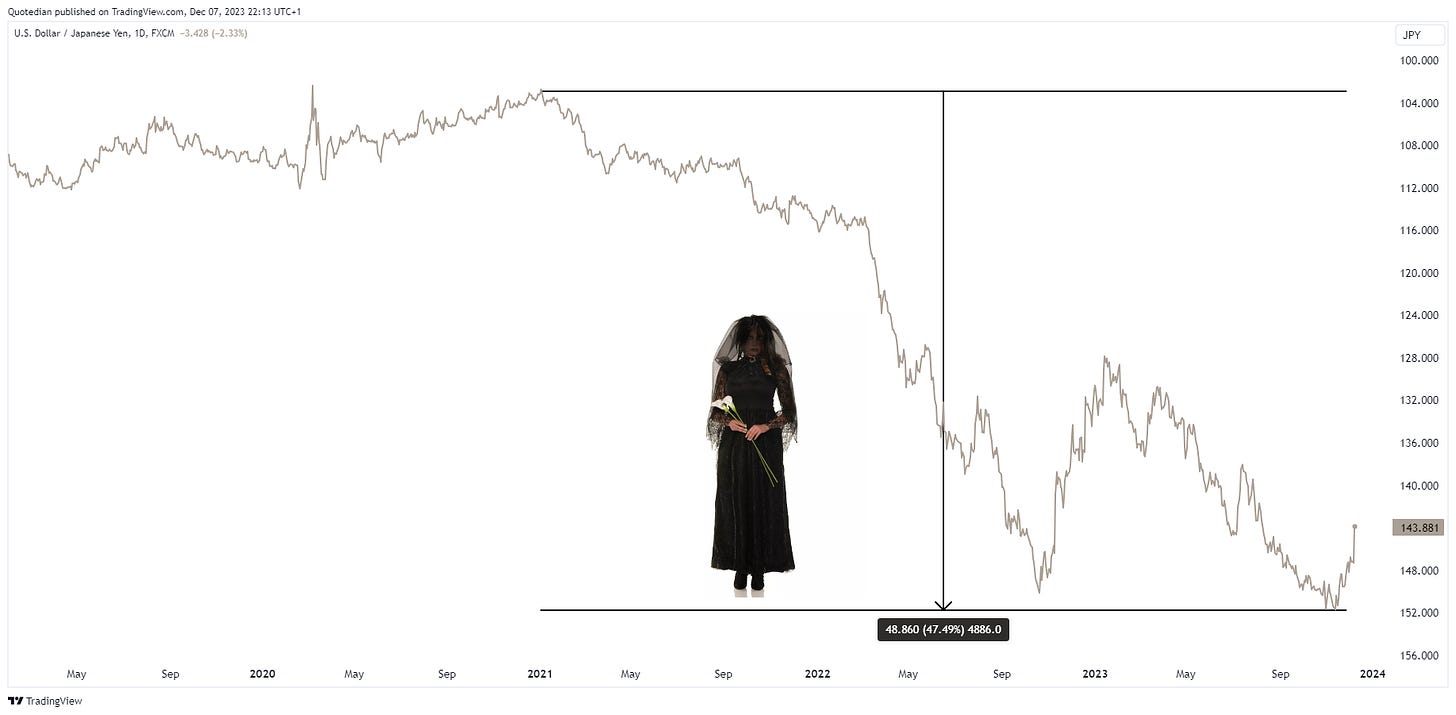

As mentioned above, the narrowing of the Yen-to-USD interest rate differential is starting to have an impact on FX markets. Here’s the USD/JPY chart:

Now, before I get excited about the upcoming Yen uptrend (and I will), let me put a disclaimer first:

Catching the falling knife of the Yen has been the Widow-Maker trade of the past two years:

No! Not that widow, this widow:

BUT…

Given that everybody and his Mrs Watanabe has been borrowing in Yen and subsequently shorting the currency to finance ______________ (fill in your favourite project here) over the past years, once this snowball gets really rolling …..

What else?

Nothing much.

Oh.

Hold on, there’s also Bitcoin, which just hit $44,000 for a year-to-date return of 170%:

Maybe I nearly forgot, because Bitcoin is more a commodity than a currency? Don’t agree? Then, what is Gold? Currency or Commodity?

Ha!

Let’s Poll:

With the poll out of the way, let’s first have a look at Gold in the commodity section:

The yellow metal briefly hit a new intraday all-time high at 2,135 during Tuesday’s Asian trading session, but it seems somebody was squeezed out there.

But there is no denial - as discussed previously, Gold held up tremendously well as real rates from -25 to above +2% over the past 2 years (more than two 2’s there) and now that real rates have started dropping, a breakout higher seems to be on the books.

Oil is in global recession territory and, (little clap on our collective back) about to reach our shoulder-head-shoulder price target:

Wondrous time and time again how these things work when they do - and not only in hindsight!

In other commodity news, Sugar, one of the best-performing commodities this year is collapsing, as lower oil prices are shifting ethanol production back to sugar production, reducing supply worries:

Aaand, that’s all for this issue. Today Friday, the focus is of course on the non-farm payroll number in the US and the range of guestimatets is wide as usual:

¨But, remember, the number does not matter as much as how the market reacts to the number!

Stay tuned…

André

Another King, coming back from the living dead … hhhmm… kings… is Bitcoin.

What?! Bitcoin a king? How dare I! A “thing” that king god Jamie Dimon of JPM-fame would close down immediately if he were government (he’s not) cannot possibly be called king!!!

An asset that has been up over 100% on average every year over the past ten years, on my humble account, can be called King any day and every day:

The King is dead, long live the king!

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance