Oh La La

The Quotedian - Vol VII, Issue 21 | Powered by NPB Neue Privat Bank AG

“Three things cannot be long hidden: the sun, the moon, and the truth.”

— Buddha

My prevailing belief for this year was that markets will “cheat” themselves higher until the US elections in November and from there we will have take is at comes. That ‘belief’ worked well so far, and being long/overweight risky assets has rewarded our clients handsomely so far this year.

I am somewhat more concerned about that belief now …

Buy protection when you can, not when you have to … Are you being correctly advised by your

Contact us at ahuwiler@npb-bank.ch

We have seen this movie before … a seemingly not so important issue

suddenly catches momentum and evolves into something potentially disrupting …

There is still a chance that all this sinks into an issue of nothingness and is washed away

but given that many of you are thinking right now: “WTF is he going on about?!” I truly belief that this has all the necessary components to become a major “issue”.

Yes, I am talking of France of course …

and I know you have not been paying attention.

Let’s go … or … on y va!

Did you know, that one G7 country saw its major benchmark index drop more than six percent last week?

Yes, France’s CAC 40 gave back all of its year-to-date gains in a little over a week:

The January gap has now been officially filled.

But whilst the situation in France is far from being dramatic or new, the markets’ reaction goes a long way to show positioning and the thin ice we have been skating on.

Two weeks ago we asked in The Quotedian (click here) whether the OAT-Bund spread was wide enough (see ‘Rates’ section below) after the debt downgrade by a major credit agency.

Bank stocks clearly did not like it and then started to hate it after the snap election called by Monsieur Macron a week later:

The three major bank stocks are down about 20% in less than a month.

And contagion risk is increasing. Here are the performances of some other, non-French European banks:

I do not want to be a Cassandra here, and my overall framework remains positive into November, but I do see dangers of an important disruption here.

It’s not just European banks that are puking. Here is the relative chart of US regional banks, now below the SVB March 2023 lows:

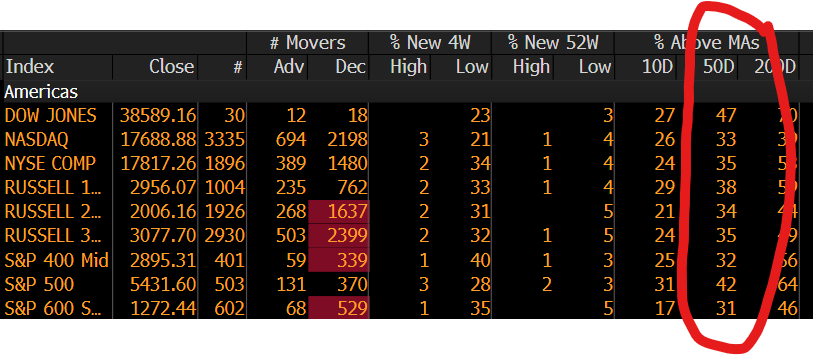

AND … as we highlighted in Friday’s QuiCQ (click here), breadth is narrowing at a worrisome pace. The following table shows that a majority of stocks are trading below their respective 50-day moving averages:

Nevertheless, the Nasdaq and the S&P 500 closed at weekly all-time highs last week. Here’s the weekly chart of the S&P 500:

HOWEVER, the NYSE accumulative advance-decline line (lower clip) hit a new multi-week low at the same time, illustrating how narrow this rally is getting:

Even within the tech sectors, anything outside AI is struggling:

And speaking of the Mag-7 (were we?), here’s an interesting chart from Bloomberg last week:

Let’s cut the equity section short here as there is some stuff to review on the fixed income side, but not without having our usual look at the top performing stocks year-to-date and how they have fared over the past five days.

Starting with Europe, we observe that some important mean reversion has taken place:

Whilst it comes at little surprise that the bank stocks are down given the “French Connection”, it is worrisome to observe the sell-off in defense stocks (Leonardo, Rheinmetall, Saab, others). This is a sign that the market is indeed worried about the EU’s future …

Now to the US list:

More continuation here than mean reversion - a manifesto to Momentum strategies continuing to work well. Check out the Chart-of-the-Day at the end of this document for more on this!

As mentioned further up, we wrote about the OAT-Bund spread two weeks ago, asking whether it was wide enough given the S&P debt downgrade of France. This is the chart of the spread we showed:

And this is the updated version of the same:

Benefit of hindsight, that was not a completely stupid question to ask…

Clearly, the market is worried about French finances, especially in the case of a sudden political regime slide to the far right. Here is how European yields have evolved over the past three months, courtesy of the fine folks at Gavekal:

So, what is the end game to this? Is the OAT-Bund spread widening to 80 bp enough? Is the sell-off in stocks over? Have bank stocks seen there lows?

My personal feeling this Monday morning is that the answer to above questions is a clear and resounding NO!

Simply not enough ilk has been spent on this yet, i.e. there has been no panic moment just yet. The ECB is eerily quiet, or maybe better said ignorant about the whole issue. My confidence runs high that Mr Market will come to put the central bank’s determination to test. 2012 anyone?

And speaking of the ECB, German yields have been falling as investors have rushed to buy “safe” assets:

But maybe long Danish government bonds (which are outside the Eurozone) and short OATs is the better strategy:

Another ‘victim’ of the French issue has been the Euro, which lost value against nearly everything:

For the time being major support at 1.0666 on the EUR/USD held:

The Swiss Franc is continued to be bought as Safe Haven currency and has now gained back two thirds of the entire move since beginning of this year:

In cryptocurrency-land, the breakout higher on Bitcoin has still not happened:

In the commodity space, Gold probably also found a “safe haven” bid:

To state the obvious, support at 2,280 looks crucial.

Copper has given back about half of its gains since February:

Which is in slight contrast to crude oil prices, which have been rising over the past few sessions:

That’s all for today - time for me to hit the send button, and yes, time for you to hit that like button!

Have a great week,

André

In the equity section we observed that Momentum as a strategy continues to work well - at least in the US market. The chart below shows the performance of the Invesco S&P 500 Momentum ETF (red) versus the Invesco S&P 500 Equal-Weight ETF (grey) and the SPDR S&P 500 ETF (blue) over the past year:

Until the next Momentum-Crash, that’s working well …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance