On Average

The Quotedian - Vol VI, Issue 22 | Powered by Neue Privat Bank AG

"Facts are stubborn things, but statistics are pliable."

— Mark Twain

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Yesterday’s session was the third consecutive snooze-fest for US equities. On a daily rate-of-change chart, this definitely feels like the quiet period of the year so far:

The trillion Dollar question (because, what’s a billion amongst friends anyway these days…) is of course, whether this is a) never short a dull market or b) the quiet before the storm? Hey, let’s do a poll on that right away:

Speaking of which, at NPB Neue Privat Bank we released our Q2 outlook yesterday. Find it here on LinkedIn for example or write me, to receive your own ‘personalised’ softcopy.

In newly released outlook, we highlight for example that we reduce our equity exposure to Neutral. This is not a bearish view, but rather taking profit on our well-timed equity upgrade in Q1 and a certain lack of conviction going into the next two quarters. Also, very importantly, remember the following from the daily disclaimer in The Quotedian:

I know you read the disclaimer every time, but just in case you missed that particular bullet point.

More seriously, The Quotedian has a much more tactical and sarcastic view on market happenings. For serious investment advice, go here (click on logo):

Back to the US equity session, which left us with following heat map:

Johnson&Johnson stands out like a sore thumb, as even though they beat expectations with their Q1 earnings, the company also stated that a key cancer study will take longer-than-expected to update:

Looking under the hood of yesterday’s session, two things stand out to me in terms of market breadth:

S&P Winners: 250 / S&P Losers: 251 - WOW, now that’s what I call a stalemate

The # of shares participating in the current rally (as measured by stocks above 50-day moving average) is below December and February peaks … not too healthy….

In the fixed-income space, interestingly enough, US 10-year yields have held well above their lower trend-channel support line and have even recovered above the 200-day moving average:

Is a test of the upper resistance line (~4%) on the books?

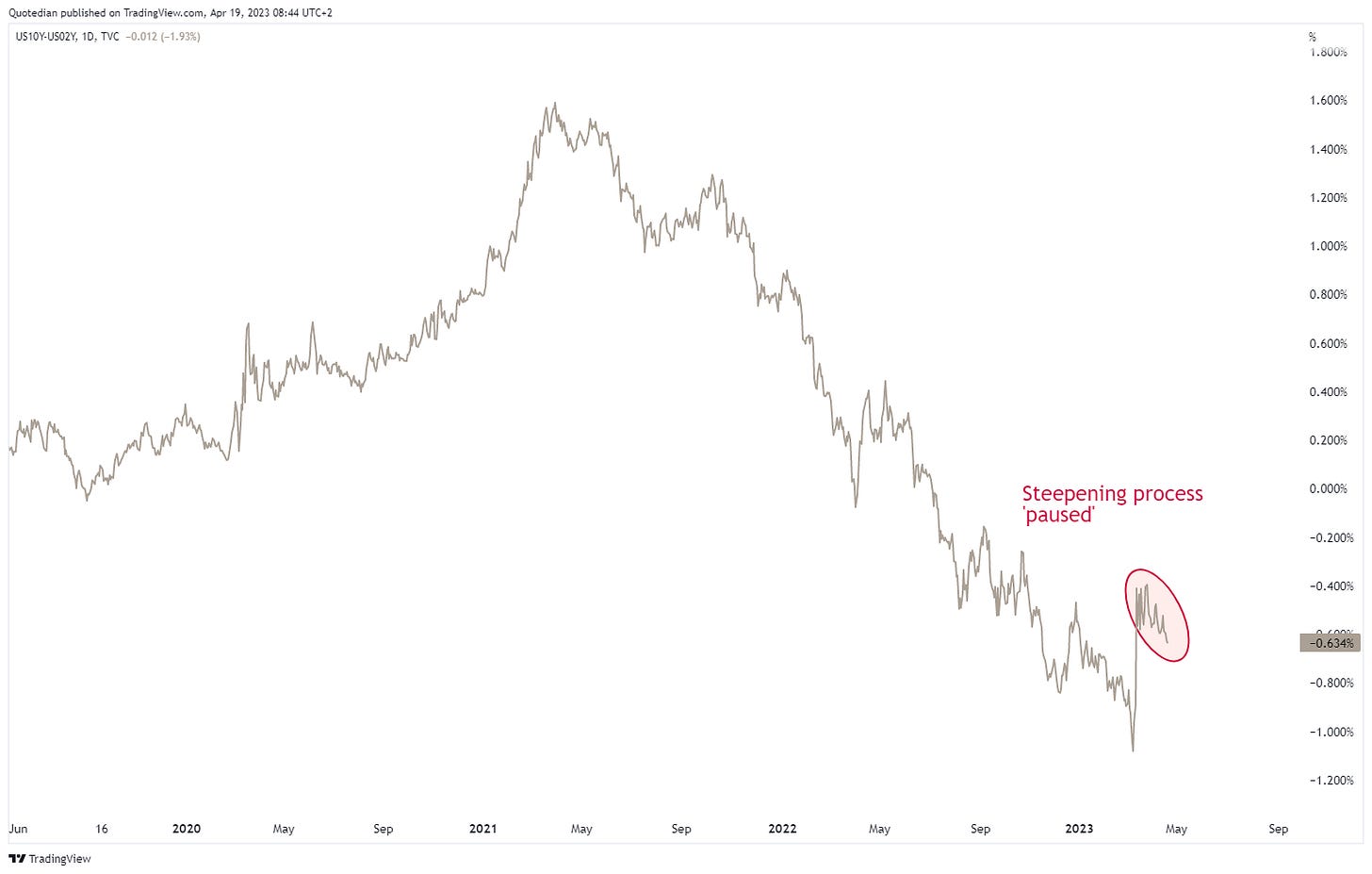

At the same time the steepening process of the curve (10y-2y) seems also to have stalled for now:

A steepening process that by the way never took place on the Fed’s favourite “slope of curve” measure (10y-3m):

European rates are marching higher again, as the market assumes that the ECB is far from done. Here’s the chart of the 2-year Bund yield first:

And here the market implied path of the ECB’s key interest rate, still implying three rate hikes into the end of the yeaer:

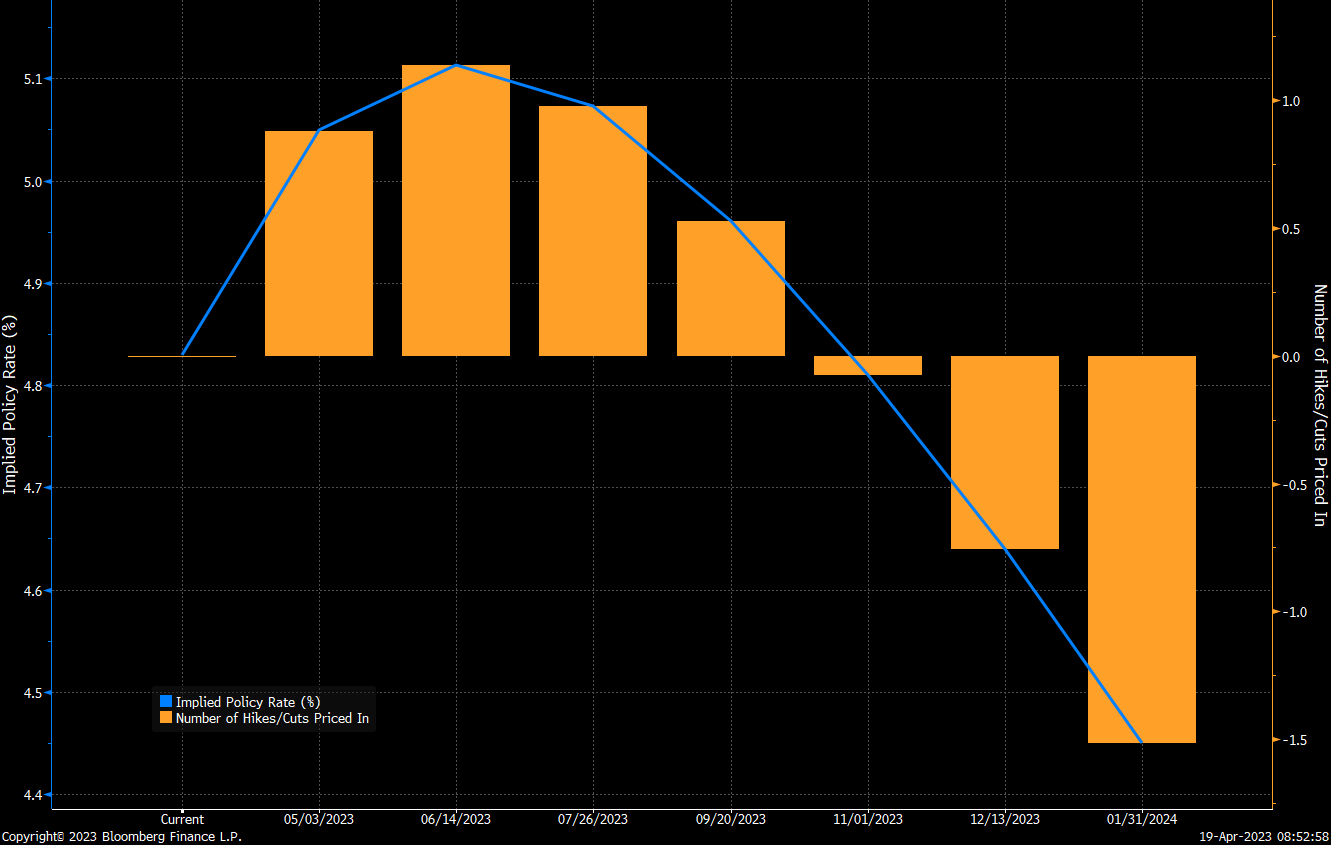

For comparison purposes, here's what the market thinks the Fed will do with their policy rate:

Not a lot going on at the currency front over the past few hours, with most action taking place in cryptocurrencies, as SEC boss Gary Gensler brushed off criticism during his first appearance before the GOP-controlled House Financial Services Committee. In short, takling the crypto-question and bringing at least some regulation to the table seems to be a net-postive for Bitcoin & Co:

Time to hit the send button. A technical issue kept me from issuing today’s Quotedian earlier. Hopefully better tomorrow.

Take care,

André

CHART OF THE DAY

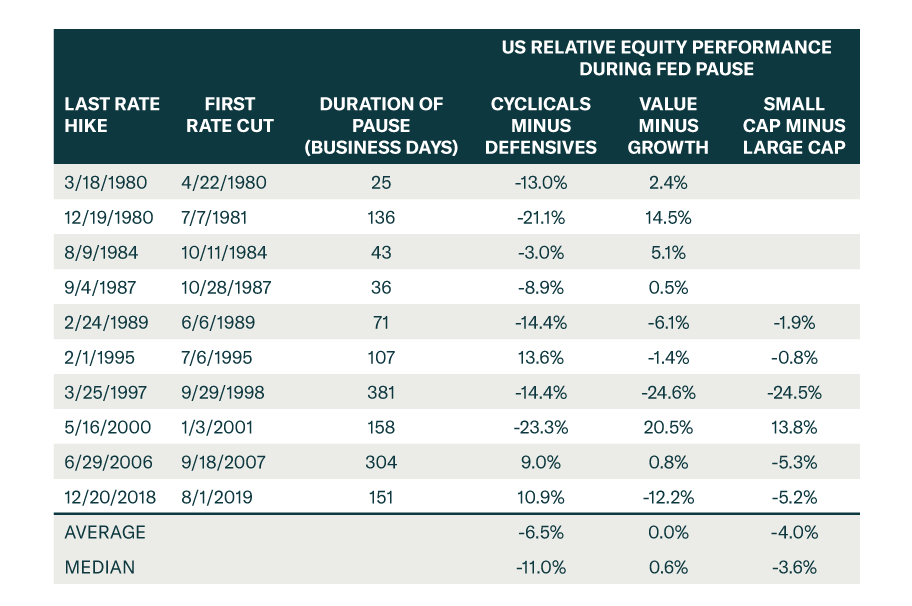

Here’s an interesting study from the fine folks at BCA Research.

This study analysis which equity style outperformed in previous periods where the Fed stopped hiking (something that is expected to happen after the next May 3rd FOMC meeting) until they start cutting again.

It seems that on average, defensive stocks outperformed cyclicals and small cap underperformed large cap. No clear winner in the Value versus Growth debate however.

So, all in all, on average, this study would propose the position your portfolio in defensive large cap stocks.

And now, please remember the analyst who had his head in the oven and his feet in the freezer, proclaiming that on average he felt just fine.

Thanks for reading The Quotedian! Subscribe for free to receive new posts the moment they are published.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance