Outrageous!

The Quotedian - Vol VI, Issue 90 | Powered by NPB Neue Privat Bank AG

“There are known knowns. These are things we know that we know. There are known unknowns. That is to say, there are things that we know we don't know. But there are also unknown unknowns. There are things we don't know we don't know.”

— Donald Rumsfeld

Normally, I like to have the title of The Quotedian I am about to start typing before I start typing - it just keeps me sticking (a bit) better to the red thread of the letter “du jour”.

Sometimes it is real a struggle to come up with fitting and engaging titles and other times, they seem to get written by themselves. Courtesy, the Federal Open Market Committee (aka FOMC) last week, I had a ton of alternative titles to today’s “Outrageous”.

For example:

What do they know we don’t?

Or:

The FOMC front runs the FOMC

Or:

Take it easy!

(with the 1979 ABBA hit “Does Your Mother Know” playing in the background)

And then here’s my absolute favourite:

Powell Burns Volcker

(probably funny only to odd sods such as me, but had to give it a shot anyway).

But, in the end, I stuck to “Outrageous”, because there’s only one proper opportunity during the year to use this title and that is during the LAST edition of The Quotedian (of the year), which you hold in your hands have in front of you on your screen today.

Outraged with your investment performance? We can help (and can also serve you Valerian tea whilst we help).

Contact us at ahuwiler@npb-bank.ch

So, why outrageous? It was originally Byron Wien* of Morgans Stanely fame, who started to put a list together of his top 10 surprises for the incoming year, where he defined a surprise as being the market assigning a less than 1/3 probability, but he actually thought there was a more than 50% chance of that surprise happening. His hit rate was not too shabby at all!

* researching for this letter I learnt that Byron actually passed away two months ago (read it here and here). RIP Legend!

It was a few years ago that Saxo Bank took that concept and created its list of “outrageous” predictions for the next year. Here is for example their list of outrageous surprises for 2024:

Simultaneously, a few years ago, your favourite market letter also started to gather outrageous predictions from its readership and it always was fun to observe what came out of this. After a few years of “forced” pause, we are launching this initiative again, hoping that the marketing department of Saxo Bank does not mind (after all, I plugged them here), we will re-launch our own list of outrageous predictions for 2024.

Here is how it goes - you can either

Leave your outrageous prediction in the Comments section by clicking on the button below

or, send me an email with your prediction to ahuwiler@npb-bank.ch

Knowing how much you like your anonymity, I assume most will opt for the latter method.

So, what could an outrageous prediction look like? Here are just some samples I dreamed up in less than five minutes to give you some guidance:

Bitcoin will hit $500,000

Bitcoin turns out to be a scam and trades down to $0.01

Neither the GOP nor the Dems but an independent party wins the US election

The SMI, rising to 20,000, nearly doubles

Japanese 10-year yields hit 5%

AI apps get declared illegal as deep fake cases mushroom

UBS is nationalized as CS-backpack turns out to be too toxic

Hence, we look for an outrageous prediction which is connected to the macro-, political or geopolitical world and may have a larger impact on financial markets. But if you prefer to predict that your local football club will win the Champions League final … fine by me.

Now, before continuing with the rest of the letter, which is quite boring anyway, stop for a few minutes, formulate your outrageous prediction and fire that email off to me. Yes. Now! Right now!!

Deadline 31.12.2023 - the best outrageous prediction which also more or less came to fruition, will receive an investment book of my choice!

Now on to today’s letter, which is all about reviewing the pollster results from last Tuesday’s (12th December) letter, titled “Superforecasters”.

The letter was all about forecasting what is going to happen in financial markets over the next 12 months, so, let’s check out what you have decided.

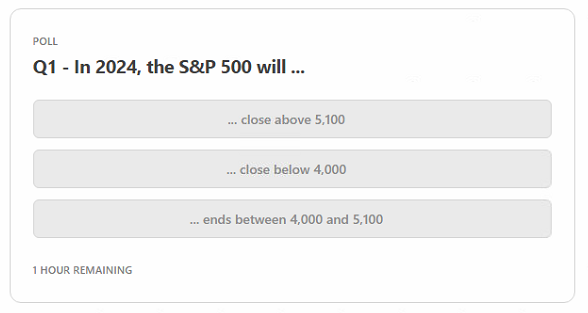

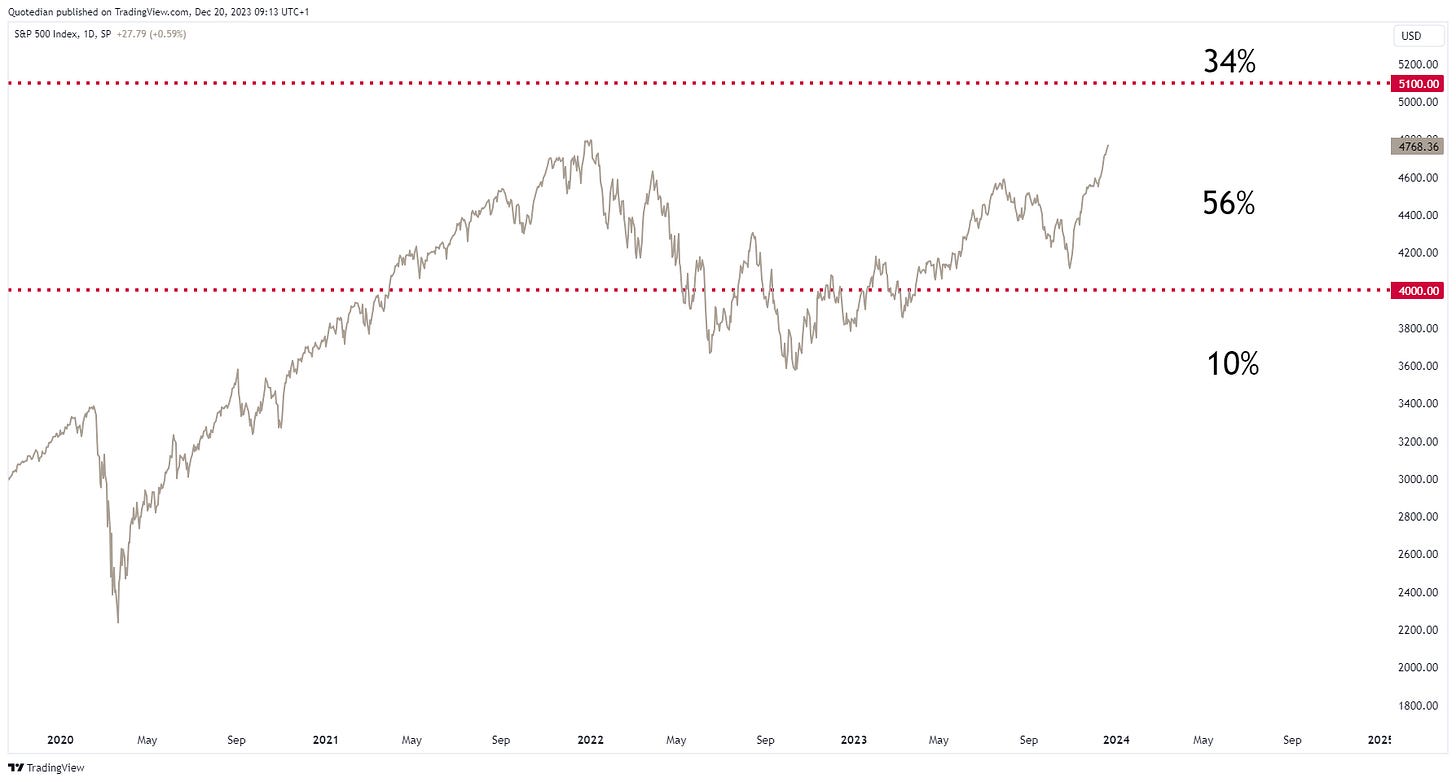

Our first question in the equity section was regarding the S&P 500:

Basically, I had set the upper (5,100) and lower (4,000) boundaries at roughly 7% distance from the then prevailing price level, as at least to the upside, 7% represents the average performance of stocks over the long run. Here’s how you voted:

I trust interpretation of the results is straight forward, but just in case …

More than half (56%) of you think that it will be relatively benign, single-digit return year for the S&P500

One third (34%) is wearing rosy glasses

And 10% are miserable pessimists :-)

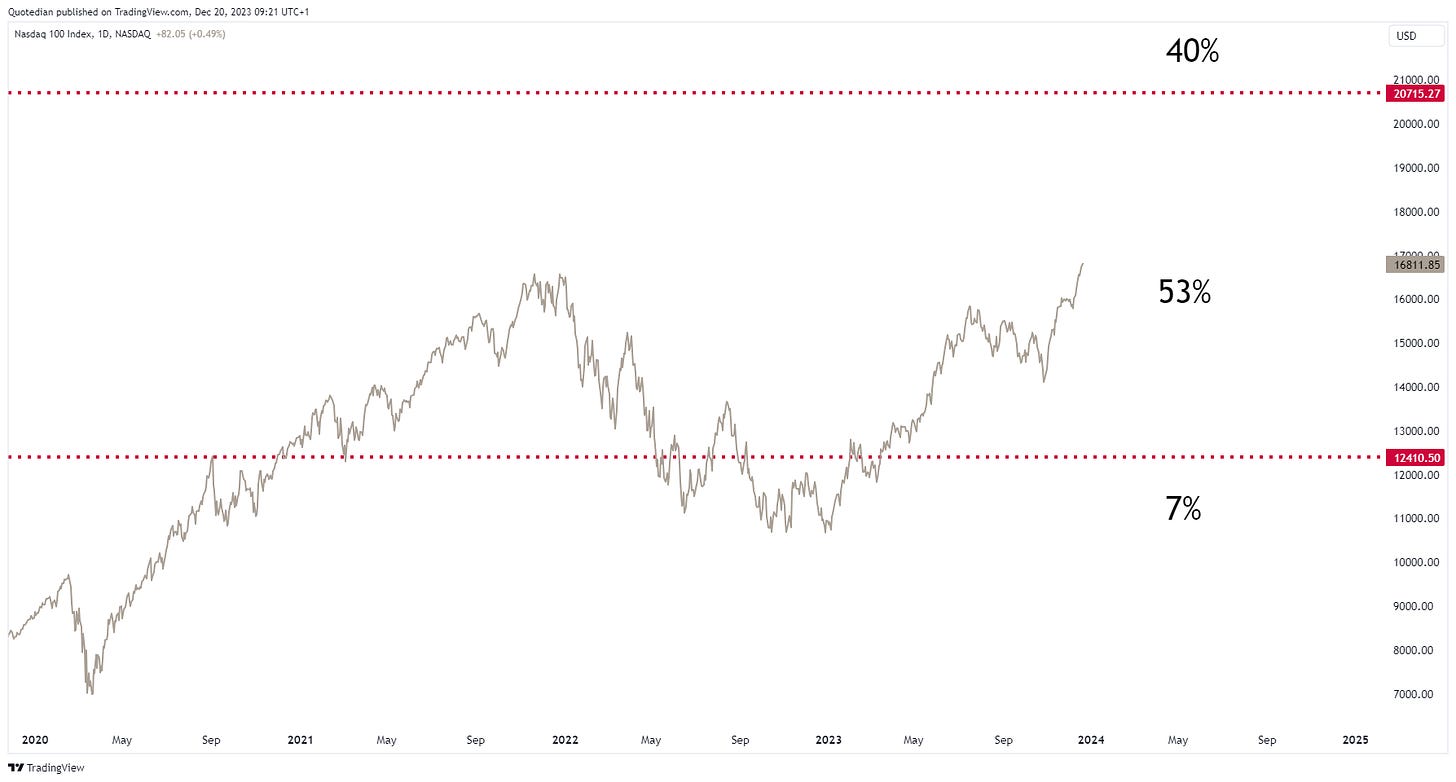

The next question then was about the Nasdaq and its fortunes in 2024:

This question was designed to see what you think will happen after the Nasdaq already had an 50% up year in 2023. Of course, the range between best and worst possible outcome is pretty wide, hence the outcome of your vote should come as no surprise:

Though admittedly, there are quite a few optimists (40%) among us, calling for another 25% rise in 2024!

On to question #3, where we raised the question whether small cap could outperform large cap in 2024, or if they were in for a fourth consecutive year of underperformance:

The question was based on the chart below, which shows the yearly performance spread between large cap (SPX) and small cap (RTY) stocks, where we note that small caps used to outperfrom from the year 2000 onwards, but suddenly faced a 180 degree regime change after 2013, where the norm for the past decade was for large cap to outperform:

Here’s what you voted:

Let’s push on …

The next questions, regarding whether European stocks will be able to outperform US peers,

it will come at little surprise that the vote was a bit clearer than on the pervious question, given that there has not been a regime change over nearly two decades:

I.e., 87% of you expect European stocks to underperform again in 2024. I ain’t going to hold against that bet!

Next up is a similarly frustrating question for the two remaining value investors around the globe:

Well, at least nearly one third of you are devoted value disciples:

And then finally, to wrap up the equity section, nominated for the best performing act in 2024 are:

S&P 500

STOXX 600

Nikkei 225

CSI 300

S&P BSE 500

All said.

Over in the rates section, we asked two economic questions relating to US data in 2024 to begin with. The first one was whether US unemployment would be higher or lower in a year’s time, with the current reading being 3.7% (November):

Your vote was pretty clear and makes a lot of intuitive sense:

The second, econmic-related question, was regarding consumer inflation and whether you would think it is higher or lower than it is today (3.1% in November):

Ah, close call! This probably pretty well reflects the debate going on between inflationistas and deflationistas in the market place.

Next, as we have asked about unemployment and inflation, it is a sheeeeeeeeer coincidence that these two actually overlap with the Fed’s dual mandate ;-)

So, why not ask where you think the fed fund rate will be at the end of 2024. Given that fed fund futures are already discounting six(!) rate cuts for next year,

your downwards bias does not come as a major surprise:

Ok, over to freely trading fixed income market benchmark rates. Your vote for the year end level for the US 10 year Treasury yield reveals that 3/4 of you are bullish on bonds in 2024:

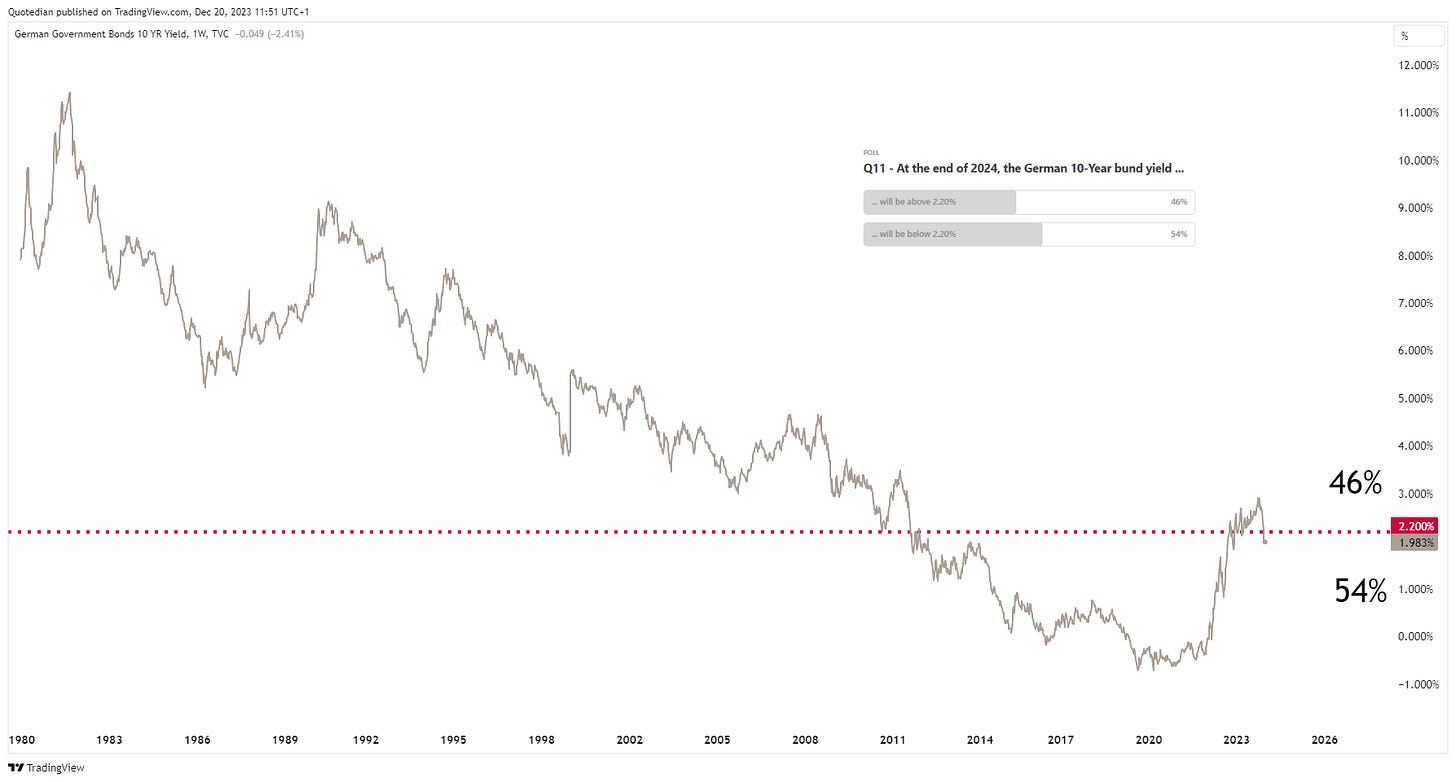

What about European rates? Where do you see the German 10-Year Bund yield as proxy for European interest rates by the end of next year?

Surprisingly, a much less clear outcome than on the US-rate vote!

Already heading into our currency forecasts, the first FX-related question was regarding the EUR/USD cross:

And, you very clearly voted, that:

Oh no.

Well, so be it. On then with the same question for the EUR/CHF currency pair. Higher or lower than now at the end of 2024:

Ah, finally some conviction! Probably no wonder though, as it has been a one—way story for 50 years …

And already to the last question in the FX section, where we asked your opinion about the USD/JPY rate in a years time. This cross has been in focus of many this year, not least to a nearly 20% drop in the Yen, before a pretty strong recovery as abandoning of NIRP (negative interest rate policy) at the BoJ has become a “something to talk about”. I gave you several levels/ranges to vote on, trying to pinpoint a bit better on how much exactly bullish or bearish you were on the Yen:

These were your votes:

Pretty evenly split, I’d say. My view? Without picking a definitive side, my gut feeling is that maybe both extreme outcomes got too little votes …

Ok, rushing towards wrap-up of this too long letter, we just posed one question regarding commodities. The question was which of the five main sub-categories would perform best:

It was a close head-to-head race between Energy and Precious Metal commodities, with the latter prevailing at the end.

Finally, I abused the COTD section last week to ask two bonus questions.

The first one was purely a cover up of the mistake I made at the beginning of the letter, having forgotten to ask as first question which asset class you expected to perform best in 2024.

And then, once I hit the send button, I realised how much of a really stupid question that was.

Some volatility-adjustment, sharpe ratio or z-score angle would have made sense to level the playing field, but, oh well, the beauty of benefit of hindsight.

In any case, here is what you voted:

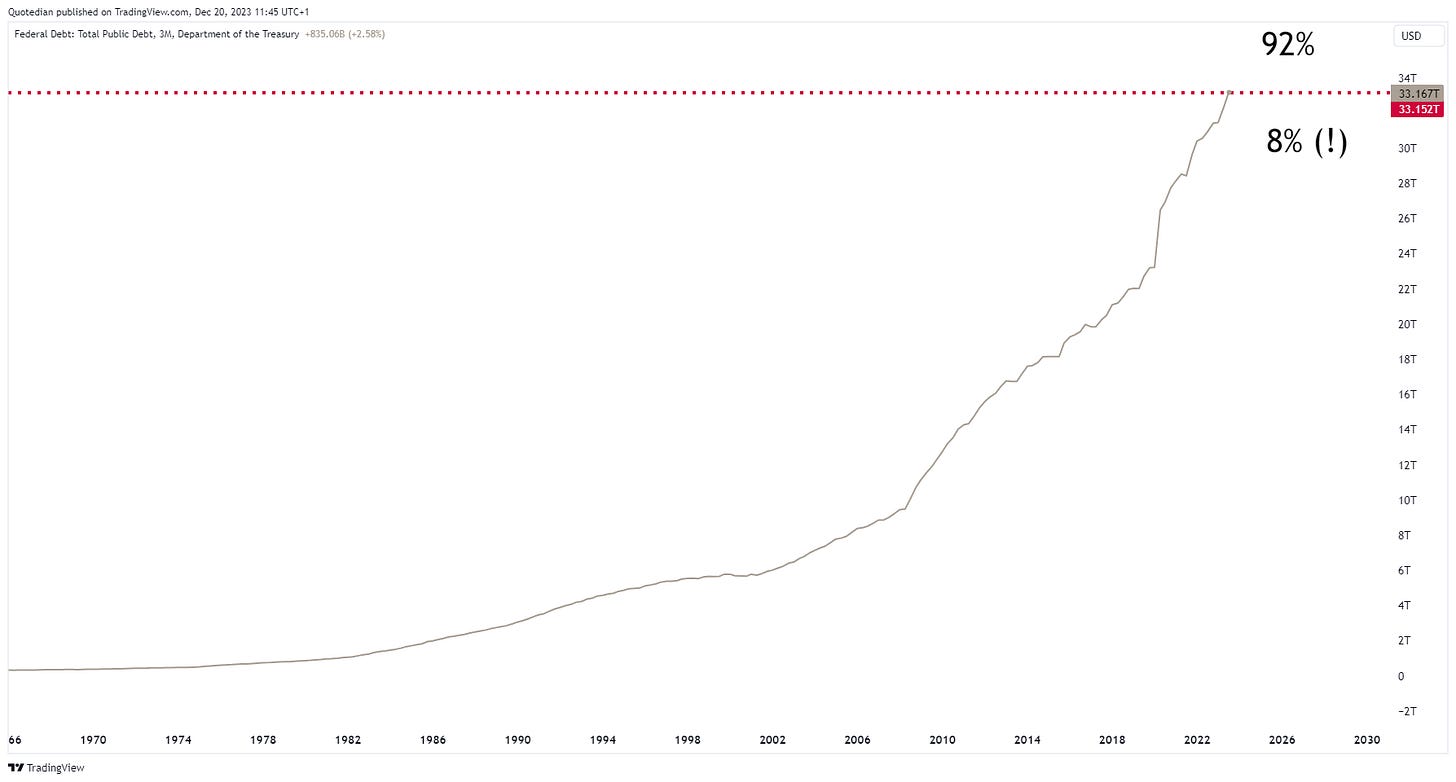

And finally, the last question on whether US Debt would be higher or lower in years time was of course an attempt to humorously end the letter.

Even so:

Ok, that’s all folks.

All that’s left is to which you and your families and happy and lovely festive season and may your best investment of 2023 be your worst in 2024.

André

P.S. Make sure to tune back in during the first week of January 2024 for our end of year review!

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

![Such a useful GIF [Fixed] : r/funny Such a useful GIF [Fixed] : r/funny](https://substackcdn.com/image/fetch/$s_!YATy!,w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5d10727d-50d6-402c-85f3-3a48129c99db_350x197.gif)

one outrageous prediction, Communist party oppens china to democracy