Shift Happens

Vol VIII, Issue 12 | Powered by NPB Neue Privat Bank AG

"We live in an age of great events and little men."

— Sir Winston Churchill

Enjoying The Quotedian but not yet signed up for The QuiCQ? What are you waiting for?!!

Just before we start this week’s shortened letter, let me do a quick survey. Your participation would be very welcome, even though not handsomely rewarded 😉.

The question is regarding the length of the Quotedian. Is it too long? Too short? Or just about right?

With that out of the way, and once again, I would appreciate your plentiful and honest participation, let’s get to today’s theme, which is about a cluster of seismic shifts happening in geopolitics, markets and our lives in general right now.

It would be too cheap to quote Vladimir Lenin saying,

“There are decades where nothing happens; and there are weeks where decades happen.”

once again.

But, it’s so bloody true recently.

We had events in the past which were clearly underestimated at the time of the happening, but had massive long-term impacts on markets, politics and/or civilizations as a whole.

Not going all the way back to Cleopatra, but listing some recent examples of the current Millenia, following comes to mind:

China joins WTO (2001)

Draghi “Whatever it takes” (2012)

COVID (2020)

More “ancient” examples would include the Fall of the Berlin Wall (1989) or Nixon closing the Gold Window (1971).

You get the drift.

Today, we have several of those massive events moving tectonic plates at an accelerating rate:

Examples include:

Trump topsy-turvying global politics

Germany abandoning the “Schuldenbremse”

Xi embracing Chinese entrepreneurs (again)

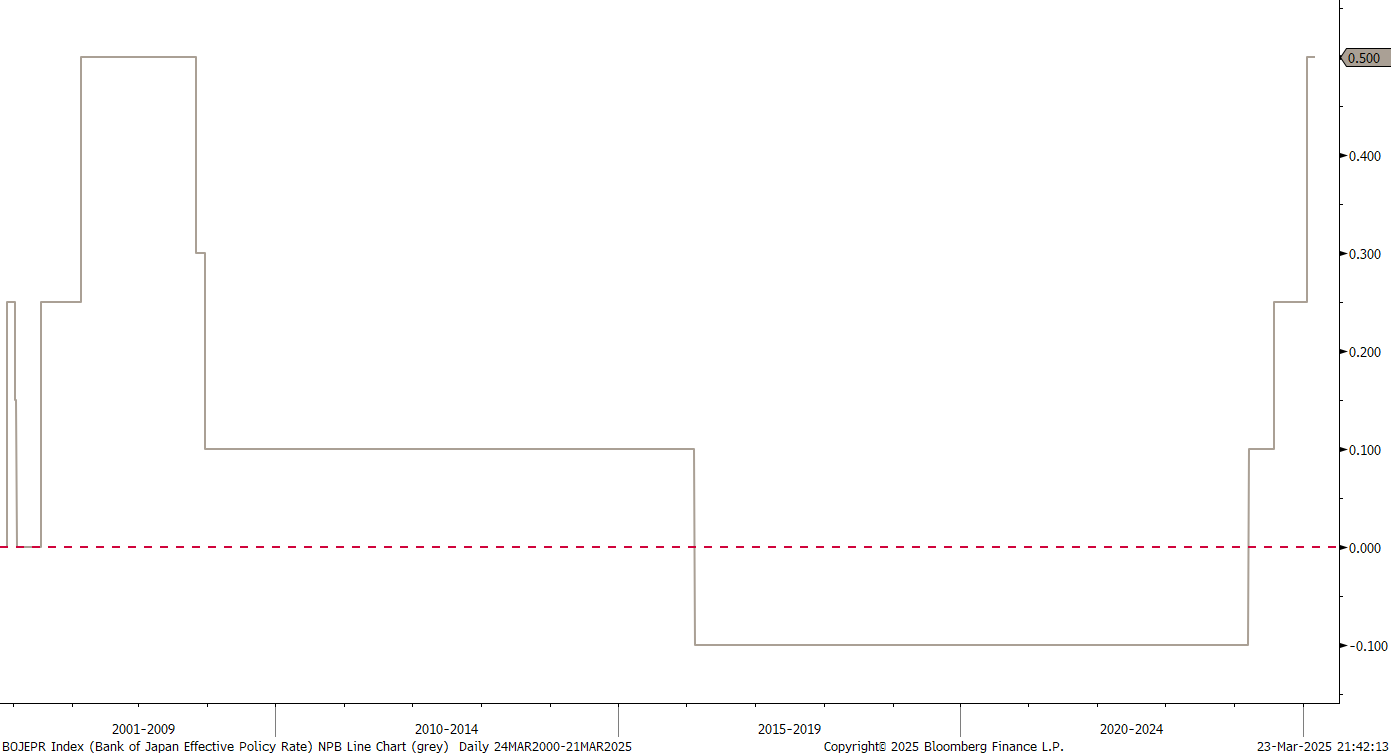

The Bank of Japan exiting negative rates nearly 10 years later

and many others…

Today’s letter takes a look at some of those shifts …let’s get the continents moving!

IMHO, Trump has been a heaven-sent gift for Europe. A very much-needed wake-up call. Consider this:

Mario Draghi, Captain America Europe in 2012, was literally begging for this to happen a few weeks ago:

A few weeks of Trump rattling the NATO cage was enough for Europe to realize that the global order is changing and it needs to get its proverbial finger out of its a…. do something.

Markets reacted, as BofA’s fund manager survey below (and relative market performance above) demonstrates:

Here’s another view, also courtesy of BofA, of that seismic change happening:

Now, we know that the European “outperformance” had a lot of false starts over the past …. uuhmm …. nearly 20 years:

But still, a further shift has the potential to be truly seismic:

Of course it is not only Europe versus US, but also Value versus Growth:

John Authers at Bloomberg offered the following chart this morning, showing that value has been on a tear in Japan, but not so in the US:

Staying in Japan one moment longer, we note another seismic shift that has taken place over the past years:

Japanese stocks, on average, now offer a substantially higher dividend yield than their US counterparts…

And now to some more tactical observations… The chart of the S&P 500 looks different than during previous corrections, not least due to the time of price spent below the 200-day moving average:

As Paul Tudor Jones famously quipped, and to which my 35 years of hands-on market experience fully subscribe:

"Nothing good happens below the 200-day moving average."

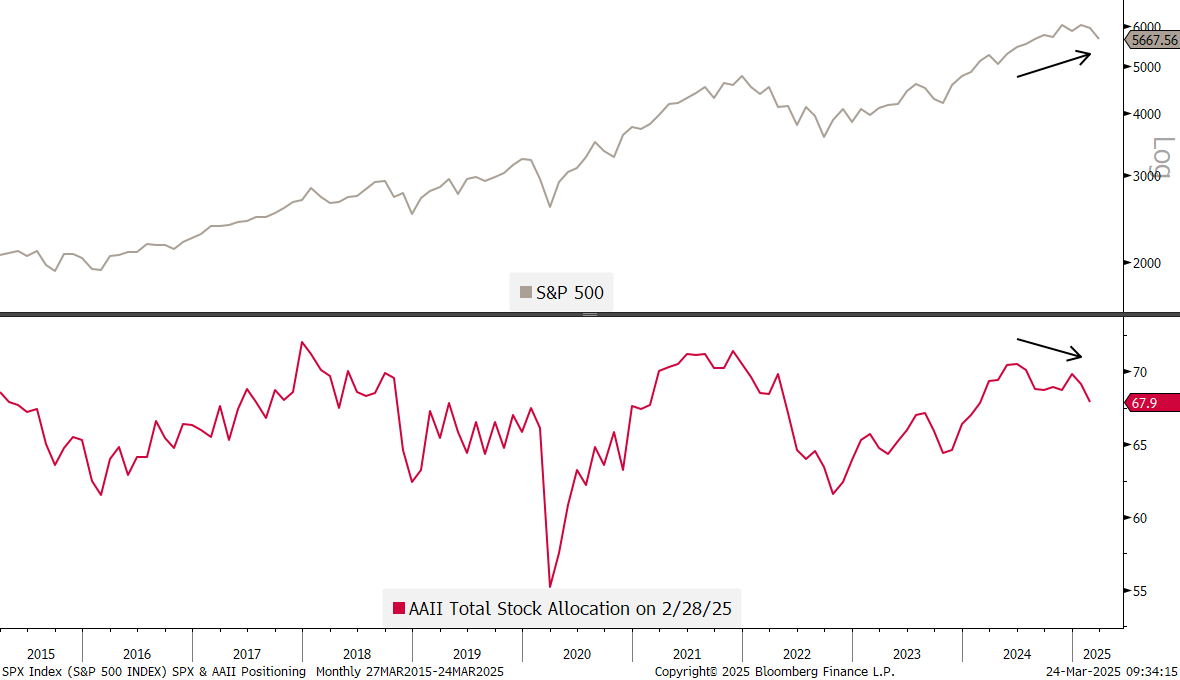

From a sentiment point of view, prices should rebound over the coming days to weeks, but a failure to do so would be a major tell.

For example, the last time the AAII bull-bear spread was this negative for such a long-time, it offered a major buying opportunity:

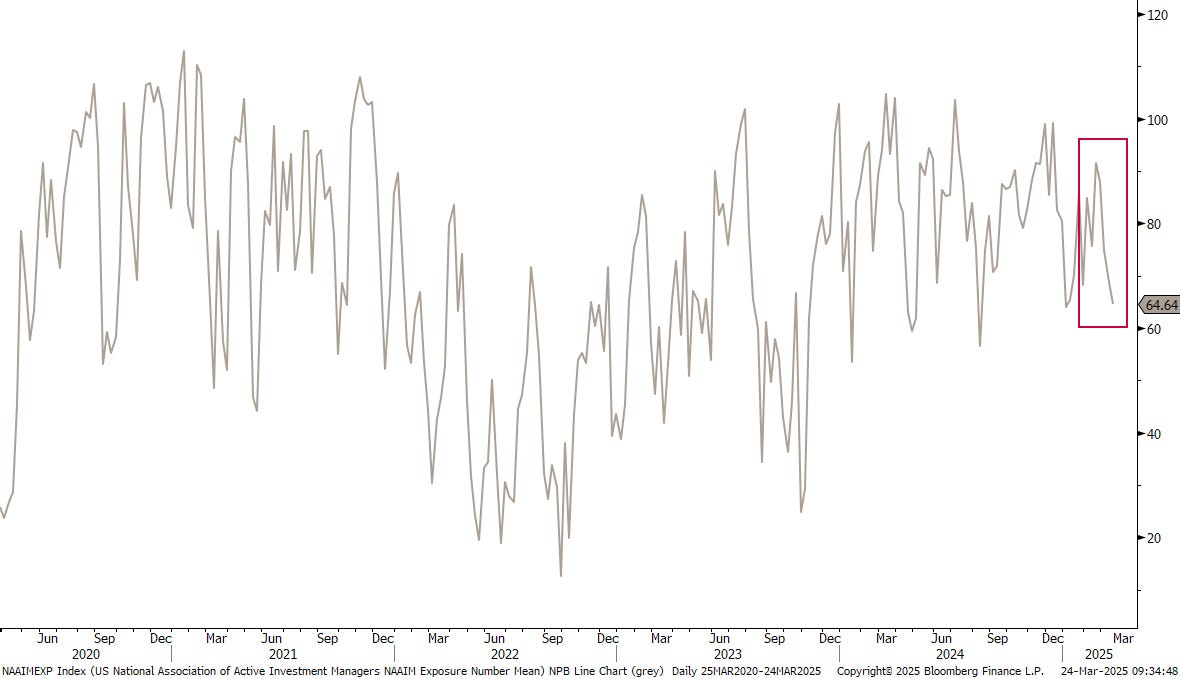

The NAAIM (National Association of Active Investment Managers) Exposure Index shows that member firms have been reducing their equity exposure at a fast pace over the past few weeks:

Equity exposure of retail investors (via AAII) remains relatively high, but has been diverging from the market’s price action over the past months:

A third seismic event we mentioned in our opening paragraph, was the recent BFF again meeting between China President Xi and Alibaba founder Jack Ma. Here’s a reminder of the timeline:

To me, this marks the official end to the multi-year crusade of President Xi versus tech billionaires that thought they are greater than Mother China. Chinese tech stocks think the same as I do:

Plenti of upside still in there...

Let’s turn to interest rates now to observe some seismic rattling going on there.

Starting with German 10-year yields for example, the last few weeks have definitely been an multiple-sigma event given the size of the move:

Clearly the market “smelled” the coming fiscal move out pretty early …

Another country with an 8.9 reading on the financial Richter scale is Japan, where the country is exiting a period of price stagnation and ultra-loose monetary policy that lasted over 20 years:

Japanese Government bonds (light grey) have long been front-running the BoJ’s monetary policy (red), and they themselves had been front-run by the more freely traded 10-year JPY swap rate (dark grey):

US yields have been in comparison a relatively quiet affair recently:

This is then also expressed in a low MOVE (VIX equivalent for Treasury bonds) reading:

Credit spreads have been widening in the most recent equity sell-off and hence must be closely observed for further signs of stress over the coming weeks:

Let’s start the currency section at not so a conventional place, but where a new seismic reading has just appeared. Turkey’s Lira plunged after Erdogan detained his top political rival:

Watch this space…

The US Dollar topped out on Trump’s inauguration day. Whilst a currency never trades in a vacuum and a higher EUR/USD rate can be explained via a weaker USD AND a stronger EUR, the weakness of the greenback versus nearly anything has been telling:

Bitcoin seems to have a bottom for now, though continues stuck in its downward sloping trend channel:

Only a move above 92k would give an “all clear” signal.

Trump’s tariffs on-and-off-and-on-and-offs are creating all kind of price skews not only fixed income and equity markets, but also in the commodity space.

Consider US steel prices for example:

More (possible) tariffs on ‘foreign’ steel is pushing domestic prices higher (more demand).

Copper prices are also on a tear, having closed at a new all-time high on Friday and trading even higher today:

This raises the question: Is there catch-up potential in copper miners?

But the one metal we of course have to talk about is Gold! USD3,048.88 is the “official” all-time closing high set last Wednesday:

Thinking of it, that was another major shift over 50 years ago, when then President Nixon said the following (emphasis mine):

“I have directed Secretary Connally to suspend temporarily the convertibility of the dollar into gold or other reserve assets, except in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States.”

Since that fateful national television address by Nixon on a Sunday evening back in 1971, gold has now handsomely beaten the very hard to beat S&P 500:

This of course makes us immediately remember another famous quote, this time by legendary economist Milton Friedman:

“Nothing is so permanent as a temporary government program.”

In any case

With this, let us end this week’s letter and find out over the coming days if the bulls can indeed gain the overhand again.

See you same time, same place, next week. And don’t say I didn’t warn you."

In reality, you need no other Disclaimer than the one above, but just in case:

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Investing real money can be costly; don’t do stupid shit

Leave politics at the door—markets don’t care.

Past performance is hopefully no indication of future performance

The views expressed in this document may differ from the views published by Neue Private Bank AG