THE Pivot

The Quotedian - Vol VI, Issue 89 | Powered by NPB Neue Privat Bank AG

“What stands in the way becomes the way.”

— Marcus Aurelius

Admittedly, this issue of The Quotedian was not planned, but last night’s event and ensuing market movements warrant a short, ad-hoc edition of everybody’s favourite newsletter.

In any case, I will also abuse this intro to quickly remind you to make sure you saw yesterday’s letter, available here: SUPERFORECASTERS

There are 15 + 2 quick and easy polls in the letter and the more readers participate the more fun and more meaningful it will be. Hence, go vote!

And talking of voting …

Here’s what happened yesterday (European) evening/night:

As we all know (and discussed), yesterday was the final FOMC (Federal Reserve Open Market Committee) meeting of the year. As you may remember, about a year ago, the chatter was all about when the Fed would Pivot, i.e. change their restrictive monetary policy. However, along the year, the Fed’s message became a loud and clear “higher for longer” (interest rates).

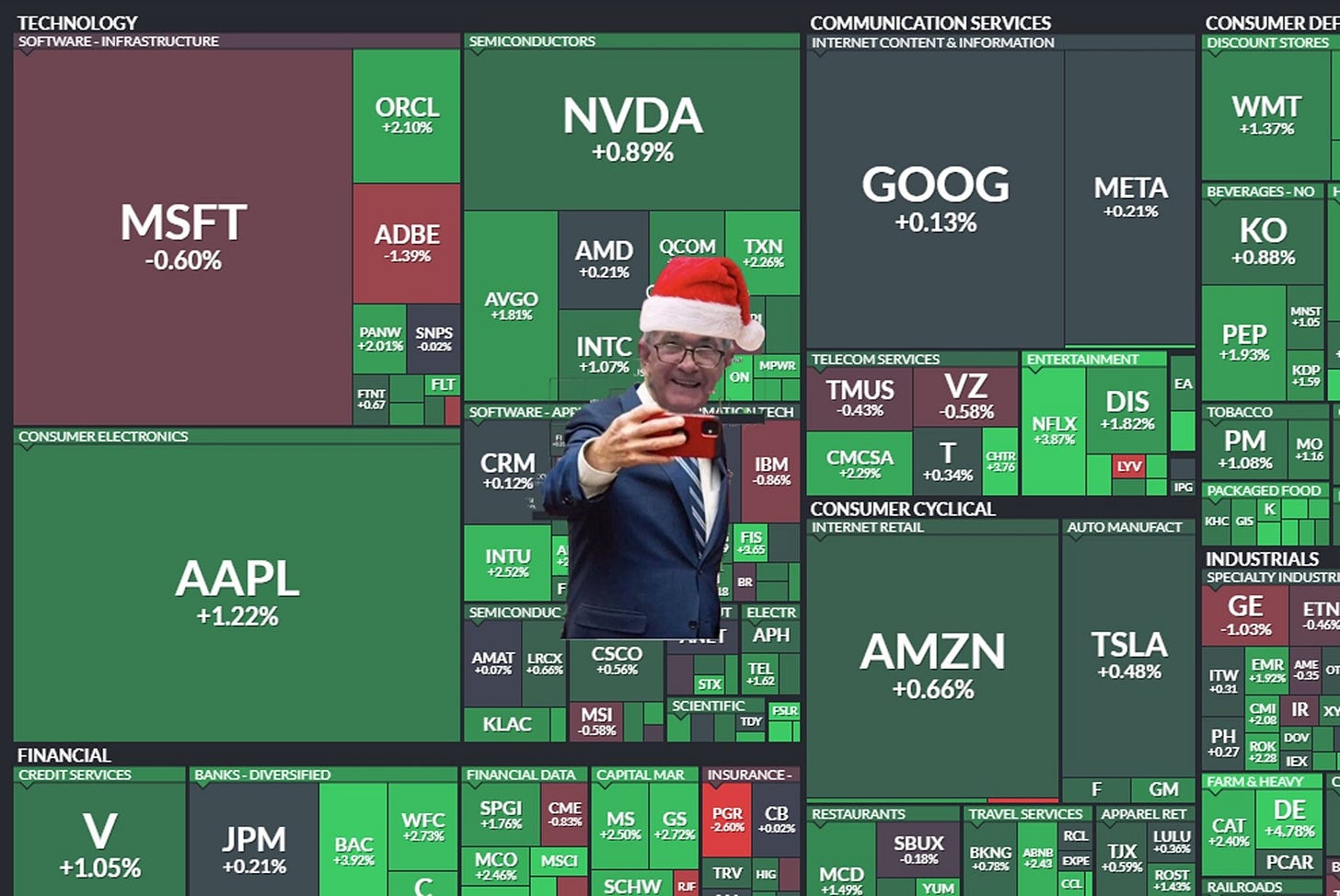

And after the recent easing of financial conditions via higher share prices and lower bond yields, not few were expecting to see this version of the x-mas Powell:

But then, last night, the Fed provided the ULTIMATE Pivot, as my self-made Crocodile Dundee Meme at the top of this letter tries to illustrate:

Only 8 FOMC members expected upside inflation risks (versus 14 in September)

The Dot Plot three months ago, showed that 10 members thought the fed funds rate would still be above 5% by the end of 2024. Now only three think that. The median estimate has dropped by a full 50 basis points, and there is one outlier who thinks that it will drop below 4%.

The ensuing press conference by Powell doubled down on dovishness

So, instead of the Grinch who stole Christmas, we got this version of Powell last night:

Market reaction was vehement … let’s check a few of them!

As the dashboard above shows, the S&P and Nasdaq rallied more than one percent, but the real stars of the session included:

Small-Cap stocks (Russell 2000 +3.5%):

Non-Profitable Tech (+5.7%):

Most Shorted (+7.1%):

Especially the latter indicates how much panic ensued amongst short sellers!

But also the good old Dow (DJI) got some “red carpet”, by hitting a new all-time high:

So, two things we can conclude:

Drawdown for the Dow is now 0.0%

The bear market did INDEED end in October of 2022 …

Aahh, the beauty of the benefit of hindsight!

Anyway, at the end, and to wrap up this short equity section, we got this:

In rates, let’s look at just three charts to some up the session:

2-Year Treasury Yields:

10-Year Treasury Yields:

And the combination of both as a spread (10-2):

That’s a meaningful re-steepening there. Expect the inversion to end over the next few weeks, with all the attached implications, discussed many times in this space.

In the FX space, it will come as no surprise, that the US Dollar had a mediocre session:

Just one chart here of the USD/JPY, because my call for a lower greenback versus the Yen is right, but for the wrong reason:

In the commodity section, just one chart - the one of Gold:

Up 2.5% yesterday, nearly 3% including this morning’s advance. Is Gold up due to a weaker Dollar, or, maybe, god-forbid, increasing inflation expectations after the dovish Fed Pivot? Probably, both…

No COTD today, but let me finish with this thought:

Why did the Fed provide this strong pivot yesterday?

Do they see a much weaker economy ahead? Perhaps.

Did Powell just want to be nice before xmas? Perhaps.

OR…

Did the Presidential Election race of 2024 just begin?!

Knowing Powell is no big friend of one particular Republican candidate …

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance