This SOXX!

The Quotedian - Vol VI, Issue 83 | Powered by NPB Neue Privat Bank AG

“We suffer more often in imagination than in reality.”

— Seneca

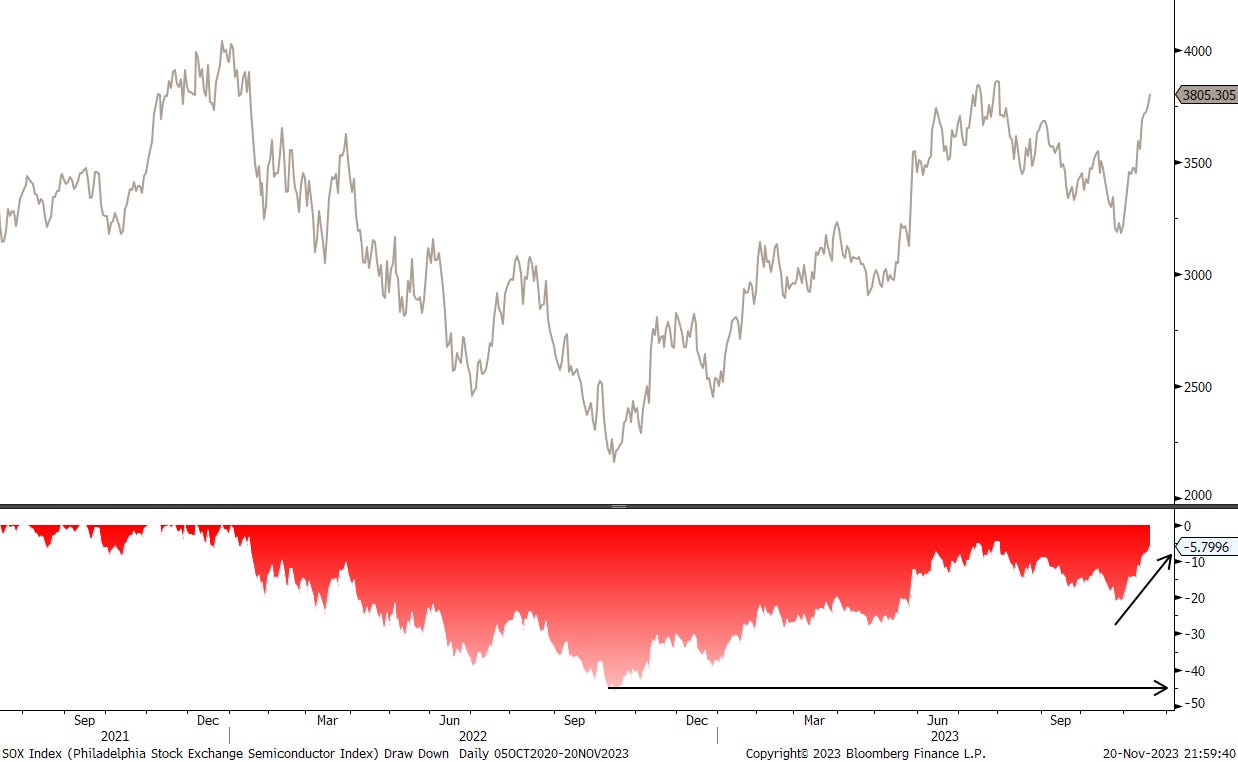

SOXX is the ticker of the iShares Semiconductor ETF, which track the Philadelphia Semiconductors Index, better known as the SOX index. Both had a fantastic rally in excess of 75% since the October 2022 bottom and are now about one percent away from taking out the July highs, and only 5% away from a new all-time high (ATH):

On a drawdown chart this looks as follows:

Will the SOX Index, and hence the SOXX ETF, reach a new all-time high? My best guess would be that yes, and probably before year end. (And I just broke the rule of “you can give a price target and a time frame, but never both together!”).

Here’s the cheat code:

The slightly narrower (25 i.o. 30 stocks) VanEck Semiconductor ETF has already reached a new ATH over the past few days and continues to go from strength to strength.

Want to construct a portfolio via ETFs? We can help!

Contact us at ahuwiler@npb-bank.ch

After this introduction, let’s get started with our usual deliberations.

Stocks continue their year-end festival and despite starting to look slightly overextended on a short-term time frame (daily RSI >70), the path of least resistance continues to be to the upside. Not a lot should change regarding this during a shortened and probably low-volume festive week (Thanksgiving) in the US. Here’s the S&P 500:

The drawdown since the December 2021 ATH is now less than six percent, though admittedly it took the index nearly two years to recover to the current extent:

If we include dividends, i.e. use the S&P 500 Total Return index, the full recovery is nearly complete:

Admittedly, when using an equal-weight version of the index, more work still lays ahead:

But as I showed last week, more and more stocks are joining in on the rally, for example by hitting new 52 week highs. This is Monday’s statistic on new 52W highs on the S&P 500:

Which brings us back to the equal-weight S&P 500, where the index popped above its 200-day moving average again, confirming the broadening participation in this rally:

In the Nasdaq 100, a full 17% of all members hit a new 52-week high yesterday. And no new low:

Here’s a chart of that same index:

Small cap stocks (Russell 2000) rebounded earlier this month where they had to, but now have stalled at the 200-day moving average. Still a lot of work to do there:

Checking in on Europe for a moment, we note that breadth is also constantly improving:

Climbing above the 200-day moving average would be a major win for the STOXX 600 Europe index:

The narrower Euro STOXX 50 index has already managed to do just that:

Due to time constraints, I have not added the economic and earnings calendar in this edition, however, I can tell you here that AI-Superstar NVidia (NVDA) is reporting tonight after the US closing bell. Yesterday, it reached a new all-time high:

Will the company live up to the hype … once again? Stay tuned!

And talking hype … the market is giving a lot of credit to Argentina’s new government. The MERVAL benchmark index for the country popped 7.11%,

whilst the Global X MSCI Argentina ETF exploded over 12% higher:

The second largest position in that ETF is YPF, which was renationalized by the Argentinean government under Cristina Fernández de Kirchner in 2012:

Should you still buy a stocks after it rushed 40% higher in a day? Maybe not immediately, but the long-term chart would suggest further potential upside if indeed something is changing in what once was one of the richest countries on earth:

Moving over into the fixed-income world, we note that it has got (slightly) quieter there over the past few sessions:

The immediate trend remains undoubtfully down for yields, with 4.25% probably a first target for the Tens.

The yield curve inverted further again, as the longer end of the curve came under pressure,

after a very decent auction of 20-years Treasury bonds:

The lesser stress of higher yields is also manifesting itself in the form of a dropping MOVE index, the bond’s world equivalent to the VIX:

The market gives now a zero % chance for a December rate hike by the Fed and expects the Fed Fund rate to be below 4% by 2025:

In Europe, the yield on the 10-year German Bund is threatening to fall below its 200-day moving average for a first time since December 2021:

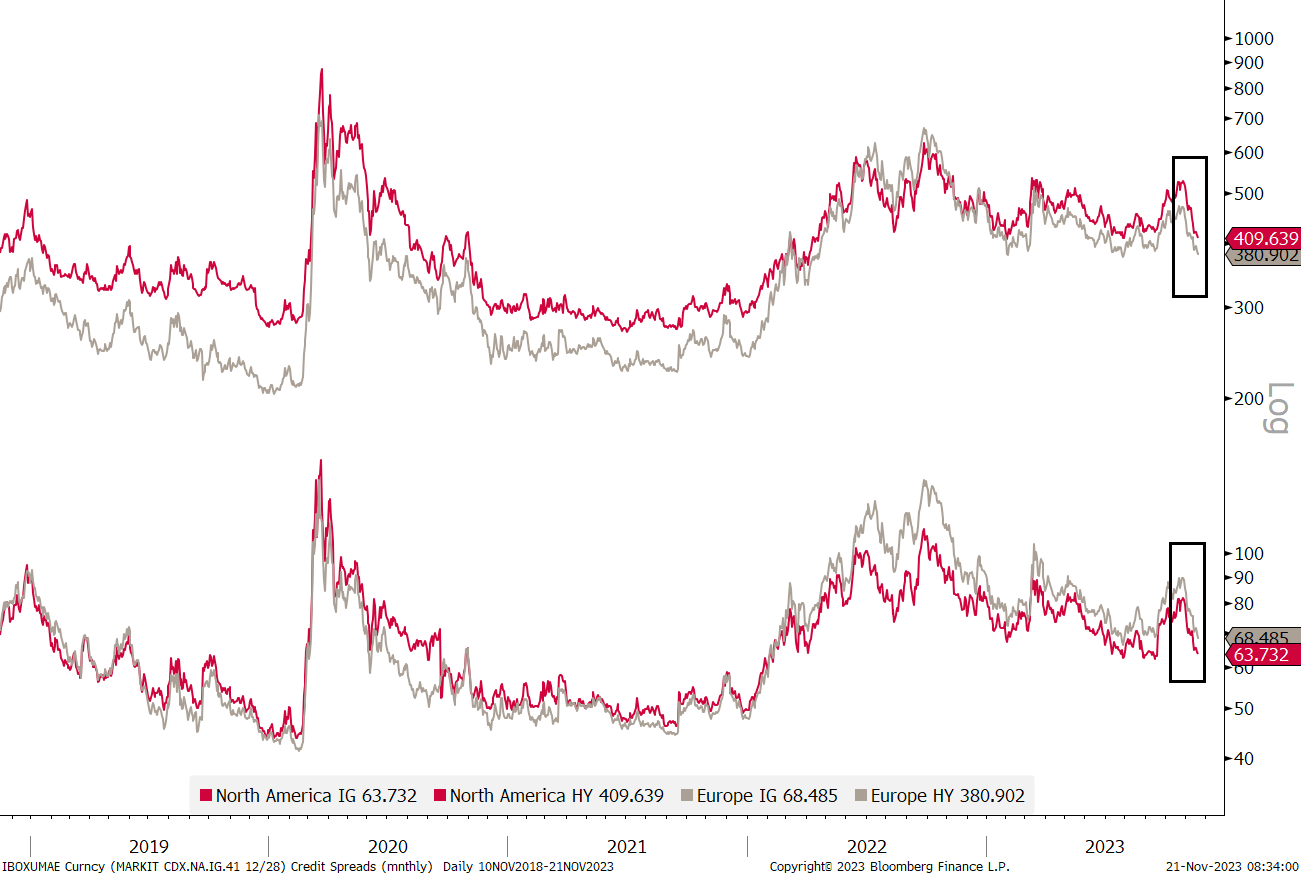

Credit spreads have been tightening on the back of the equity rally:

In the currency complex, the Greenback has been weakening against all other major currencies since the beginning of the month, helping the risk-on mood of the market:

The Dixie (DXY - US Dollar Index) dropped below the 200-day moving average on Friday and yesterday Monday extended on those losses:

The Dixie is made up by two thirds of the Euro and the Japanese Yen, and whilst the former is showing (of course) some major advances,

the real show is happening on the USD/JPY cross, where unwinding of the Big (Yen) Short may have started:

And finally, in the commodity space, have a close look at Gold over the coming sessions. After successfully holding above its 200-day moving average (circle), a potentially very bullish pattern is playing out:

Go long on a close above $2,006/oz.

Oil has recovered from a recent low, but continues to trade below its 200-day moving average:

And one commodity I have been mentioning for a while now, but which I am sure only the fewest of us are invested in, is Uranium:

Continue to ignore at your own peril…

That’s all for today. If all goes well we’ ll be back later this week, though a lack of market action during this Thanksgiving week may have a major impact on my laziness…

André

I am usually more of trend follower/momentum- more than a mean reversion-guy, but the current set-up in XBI (SPDR Biotech ETF) looks tempting:

May try to bottom fish with tight stop below the red dashed line?

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

The views expressed in this document may differ from the views published by Neue Private Bank AG

Past performance is hopefully no indication of future performance

The biotech chart seems very interesting (I have zero idea about biotech). Btw, is there a big correlation between the rise of Argentinean stocks and the decrease of the Argentian peso vs the USD?