Ugly Awards

The Quotedian - Vol V, Issue 147

"The stock market is the creation of man that has most humbled him."

— Alan Shaw

DASHBOARD

AGENDA

CROSS-ASSET DELIBERATIONS

Welcome to the Sunday edition of The Quotedian, where we take advantage of markets being closed, catch a breath and a beer (or whatever your favourite poison is) and have a closer look at the week just gone by.

And how fortunate we are, to be living through the age of the “Rebirth of Macro”, as central banks are trying to pull away from the mess they have created over the past two decades.

I have been writing The Quotedian on and off and in different forms for well over a decade now (anyone on the list to remember “Strai[gh]t Views” or “Daily Compass”?), and I cannot remember a time where there is so much to observe on a daily basis. And we mostly just cover macro, ignoring company-level news nearly completely. Unfortunately, it also means that sometime I may omit some important issues, as they get lost in the heat of the daily investment battle. My apologies, therefore, but I also encourage you to use the Comment section should you think something should be discussed:

Having said that, whilst there is tons to write about, it is bloody difficult to come to any conclusion that may hold true more than a couple of hours, let alone days. Of course, this does not mean you should stop reading this fantastic daily investment blog in front of you right now (completely unbiased opinion), but more important than ever, you need a plan and stick to that plan. And also, of course, listen to the trees to find your way through the investment forest, as for the two main asset classes, the tune has not changed since the beginning of the year (geez, I sound nearly poetic today!). You can find the prevailing tune every day in the dashboard above, but let me copy/paste it for you here:

But enough blah-blah, let’s get on with the weekly review starting with equities. Here’s the 5-day performance of some of the most closely followed international equity indices:

A few things stick out from this table:

European equities outperformed their US counterpart his week, and whilst I would not dare to call for an outright outperformance of EZ over US stocks given all the rubbish that is going on here, stocks in Europe may be at a level where they are so cheap that they are able to hold water against the more expensive US market.

Hong Kong shares are getting massacred again:

Brazilian stocks are giving back the gains from the “Lula”-rally:

Now, let me also insert quickly a daily chart of equity volatility (VIX):

Fragmentation and elevated volatility - equally signs of a dysfunctional market but also of opportunity…

I haven’t mentioned Friday’s session yet, which was very much the mirror picture of Thursday. The brilliant folks at Bespoke Investment Group had a good chart on this:

Looking at the market carpet for the whole week, it is interesting to see that there is actually quite a lot of green and that it is mainly the S&P 500 heavy-weights that are pulling the index lower:

We had discussed this phenomenon earlier in the week here.

Turning only very briefly to equity sectors, at a global level, we observe the following weekly performance statistics:

Health care and consumer staples outperformed, whilst the longer duration consumer discretionary and technology sectors got hit once more. I’ll leave the sector discussion here as is, but encourage you to check today’s COTD for some further ‘inspiration’.

And then there are fixed-income markets …

It’s just ugly, ugly, ugly.

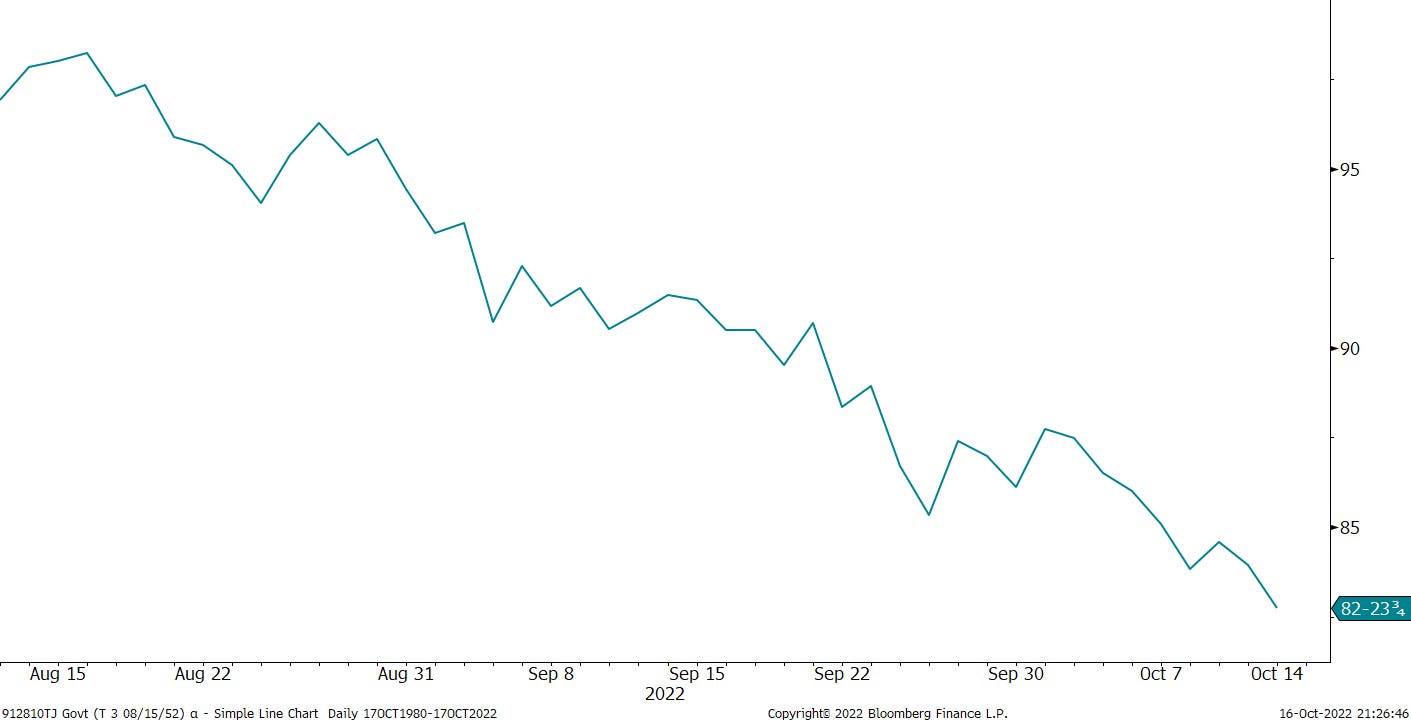

Here are the contenders for the ugliness award - Fixed Income Markets - in no specific order:

A 30-year US treasury bond launched at par on the 15th August, i.e. just two months ago, now is to be had at 82 and change:

US 10-year treasuries are facing their worst drawdown. Ever. With a difference.

And finally, if you were one of the poor souls who thought it was a good idea to buy a 100-year Austrian government bond with a coupon of below 1% in the summer of 2020, I sure hope you took your profit in December of the same year:

And looking at Friday’s session, where the US 10-year Treasury bond pierced through major resistance, is not exactly improving the outlook for the entire asset class:

I have much more to say on this, but we’re making good progress, so let’s not get sidetracked. However, stay tuned … 😉

Looking at foreign exchange market performances, it was another winning week for the US Dollar, but for a few exceptions:

Standing out is the positive performance of the British Peso Sterling, where government changes are now as common as they are in Italy (and I probably just insulted my Italian friends). In any case, the Pound is not behaving like a healthy currency:

Also standing out then, the Australian Dollar and the Japanese Yen. Regarding the latter, remember there was an FX intervention and remember what we discussed Mr Market will do after an FX intervention? Exactly, test the resolve!

Finally, in commodity markets, the Dollar strength and some profit-taking after the OPEC+ output cut decision last week led to a generally lower commodity complex this week:

In German, there is this saying: “Wie gewonnen, so zeronnen”, which more or less the equivalent of “easy come, easy go”, but just the much better description of the last two in the price of Silver:

As usual, I had much more to say or observe, but time has really come to hit the Send button.

Be good, tomorrow is Monday.

André

CHART OF THE DAY

I know, I know … I have expressed my “love” for energy stocks many time for a long period, but, IMHO, they just continue to be one of the easist longs out there. Undervaluation, dividend and an emerging uptrend are all tremendous tailwinds to the sector, as much as my Esg friends may hate fossil fuels.

Here’s the chart of the XLE (SPDR Energy Select Sector ETF) versus the XLK (SPDR Technology Select Sector ETF).

Thanks for reading The Quotedian! Subscribe for free to receive new posts and support my work.

DISCLAIMER

Everything in this document is for educational purposes only (FEPO)

Nothing in this document should be considered investment advice

Past performance is hopefully no indication of future performance